YZZ CAPITAL

Lời nói đầu:YZZ CAPITAL, established in 2010 and headquartered in the United States, is a dynamic brokerage that offers a wide array of trading instruments, including over 500 assets such as CFDs on Forex, commodities, metals, energies, and more. Despite its extensive offerings and innovative trading tools, YZZ CAPITAL operates without formal regulatory oversight as it claims to be registered under the NFA, but holds an unauthorized status. This situation presents considerable risks, notably in terms of fund security and operational transparency, which are critical for clients to consider when choosing to trade with YZZ CAPITAL.

| YZZ CAPITAL | Basic Information |

| Company Name | YZZ CAPITAL |

| Founded | 2010 |

| Headquarters | United States |

| Regulations | NFA (Unauthorized) |

| Tradable Assets | Forex, commodities, bonds, metals, energies, shares, indices |

| Account Types | Cent Account, Pro Account, Premium Account |

| Minimum Deposit | Not specified |

| Maximum Leverage | Up to 1:100 |

| Spreads | As low as 0.0 pips for major forex pairs; varies across other instruments |

| Commission | Ranges from $0.0005 to $0.85 per share/contract depending on the instrument |

| Deposit Methods | Not specified |

| Trading Platforms | Proprietary YZZ CAPITAL Trading App |

| Customer Support | Email support at support@yzzcapital.com, office located in One World Trade Center |

| Education Resources | Not specified |

| Bonus Offerings | Not specified |

Overview of YZZ CAPITAL

YZZ CAPITAL, founded in 2010 and based in the United States, offers an extensive portfolio of over 500 trading instruments, including forex, commodities, bonds, metals, energies, shares, and indices. Despite its wide range of offerings and advanced proprietary trading app, YZZ CAPITAL operates without proper authorization from the NFA, making it unregulated. This status is a significant concern as it affects the firm's transparency and the security of client funds. The company's trading conditions are appealing with various spreads and options for zero commissions on some accounts, facilitated by their user-friendly trading platform.

Is YZZ CAPITAL Legit?

YZZ Capital claims to be regulated by the NFA in the United States with license number 0563502. However, it is important to note that the regulatory status is currently listed as abnormal, and the official status is Unauthorized. This indicates that YZZ Capital operates without proper authorization, which poses significant risks to traders and investors. Potential clients should exercise caution and thoroughly assess the risks involved when considering engagement with an unauthorized broker.

Pros and Cons

YZZ CAPITAL stands out for offering a comprehensive suite of more than 500 trading instruments ranging from forex to energies and indices. The brokerage enhances user experience with its proprietary trading app, known for its advanced features and intuitive interface. Additionally, YZZ CAPITAL attracts traders with competitive spreads and the availability of zero commissions on certain accounts. However, the brokerage's significant downside is its unregulated status, as it operates without official authorization from the NFA, introducing substantial risks related to the security of funds and overall transparency. This lack of regulation also restricts clients' options for dispute resolution, which is a critical consideration for potential investors.

| Pros | Cons |

|

|

|

|

|

|

Trading Instruments

YZZ Capital offers a broad spectrum of over 500 trading instruments, which include CFDs on Forex, commodities, bonds, metals, energies, shares, and indices. This extensive range allows for significant diversification opportunities for traders looking to engage in multiple markets.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Commodities | Crypto | CFD | Indices | Stock | ETF |

| YZZ CAPITAL | Yes | Yes | No | Yes | Yes | Yes | No |

| RoboForex | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| IC Markets | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Exness | Yes | Yes | Yes | Yes | Yes | Yes | No |

Account Types

YZZ Capital provides three distinct account types catering to various trader needs:

1. Cent Account: Features trading in cents with zero commissions and is swap-free, making it suitable for those starting with smaller volumes.

2. Pro Account: Offers low spreads and a leverage of 1:100, with zero commissions, targeting more experienced traders seeking cost-effective trading conditions.

Premium Account: Provides zero commissions and a leverage of 1:100, designed for serious traders looking for high leverage with no additional costs.

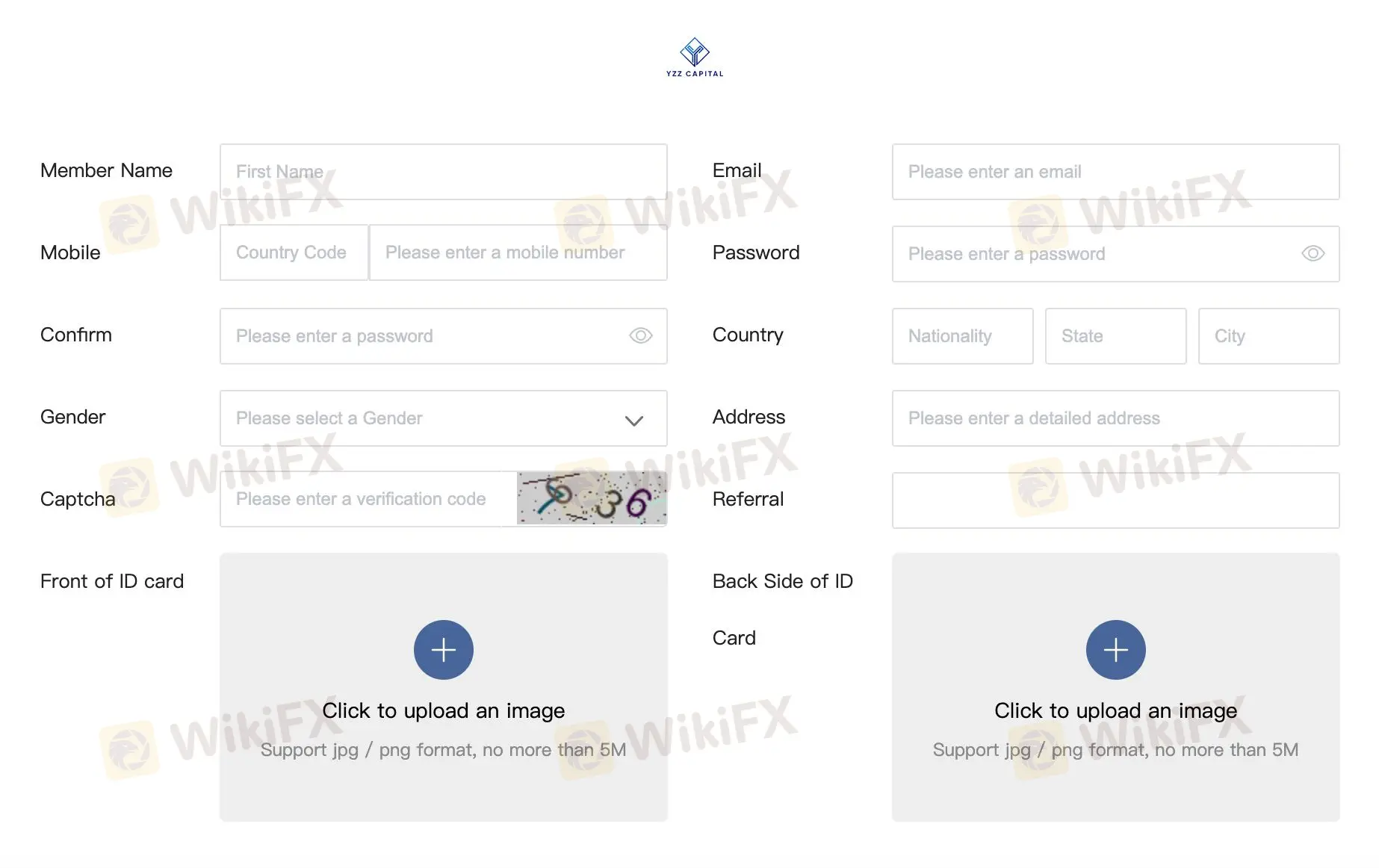

How to Open an Account

To open an account with YZZ CAPITAL, follow these steps.

Visit the YZZ CAPITAL website. Look for the “Register” button on the homepage and click on it.

Sign up on websites registration page.

Receive your personal account login from an automated email

Log in

Proceed to deposit funds to your account

Download the platform and start trading

Leverage

YZZ Capital offers leverage options up to 1:100 for its Pro and Premium account types, providing traders with the potential to increase their trading exposure significantly relative to their initial investments.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | YZZ CAPITAL | FxPro | IC Markets | RoboForex |

| Maximum Leverage | 1:100 | 1:200 | 1:500 | 1:2000 |

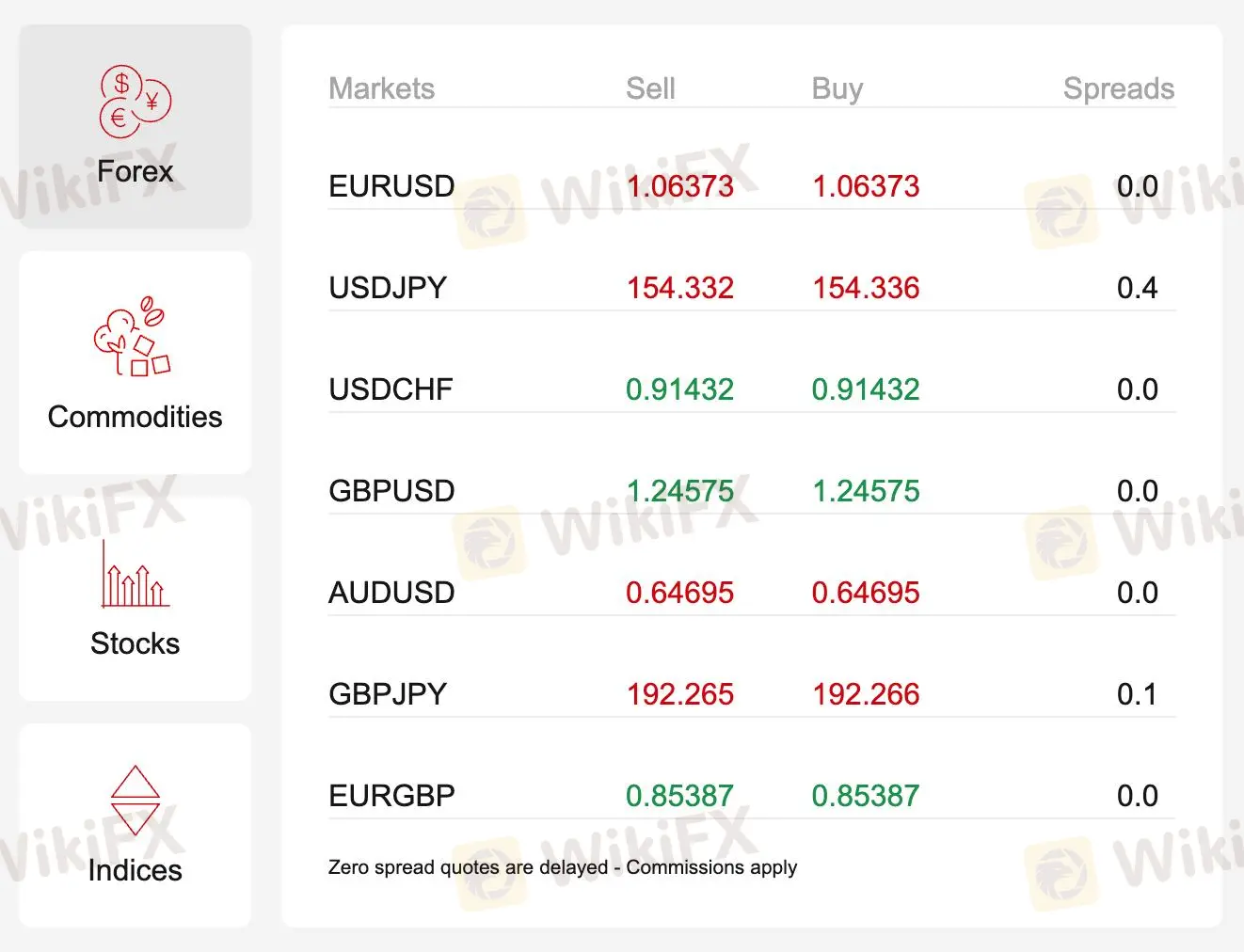

Spreads and Commissions

YZZ Capital offers highly competitive spreads and commission structures across various markets:

Forex: Spreads are exceptionally low, often reaching 0.0 pips for major pairs like EURUSD, USDCHF, and GBPUSD, with other major pairs like USDJPY and GBPJPY having slightly higher but still minimal spreads.

Commodities: Spreads vary depending on the commodity, with Oil having a spread of 0.11, Gold at 0.32, and others like Silver and Copper also maintaining low spreads.

Stocks: Spreads on stocks are relatively narrow, with examples like Apple at 0.24, Amazon at 0.1, and slightly wider spreads on stocks like Alibaba and Goldman Sachs.

Indices: The spreads on indices are also competitive, with indices like the USA30 having a spread of 2.9, and others like the FRA40 and UK100 having spreads under 3.0.

Trading Platforms

YZZ Capital offers a proprietary mobile trading app designed to meet the specific needs of its traders. Recognized with an award from Capital Finance for Best Forex Trading App, this platform features a modern and intuitive interface. It allows traders to manage multiple accounts from one wallet, customize their trading experience, and access a detailed history of each trade. The app supports trading across hundreds of instruments, making it versatile for trading on-the-go.

Customer Support

YZZ Capital provides customer support through multiple channels. Their main office is located on the 77th floor of One World Trade Center, 285 Fulton St, New York, NY 10007, United States. For direct assistance, clients can reach out via email at support@yzzcapital.com, ensuring accessible and responsive support for their inquiries and issues.

Conclusion

YZZ CAPITAL offers an attractive trading environment with its broad range of instruments and state-of-the-art trading technology. However, the lack of regulatory authorization introduces significant risks, including questions about the security of funds and the overall reliability of the broker. Traders considering YZZ CAPITAL must weigh the technological and trading benefits against the potential financial and legal risks due to the unregulated status of the brokerage.

FAQs

Q: What types of financial instruments can I trade with YZZ CAPITAL?

A: YZZ CAPITAL provides access to a broad selection, including Forex, commodities, stocks, bonds, and various indices.

Q: Does YZZ CAPITAL charge any commissions on trades?

A: YZZ CAPITAL offers zero commission trading on some accounts, although fees may vary based on the type of account and trading instruments.

Q: What are the risks of trading with an unregulated broker like YZZ CAPITAL?

A: Trading with an unregulated broker increases the risk of financial insecurity, potential disputes remaining unresolved, and general operational transparency issues.

Q: How can I contact YZZ CAPITAL for support?

A: You can contact YZZ CAPITAL via email at support@yzzcapital.com or visit their office located in One World Trade Center, New York.

Q: What trading platforms does YZZ CAPITAL offer?

A: YZZ CAPITAL offers a proprietary mobile trading app that has been recognized for its user-friendly interface and advanced trading features.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then.

Người môi giới liên quan

Broker WikiFX

FP Markets

AvaTrade

Pepperstone

FOREX.com

TMGM

Neex

FP Markets

AvaTrade

Pepperstone

FOREX.com

TMGM

Neex

Broker WikiFX

FP Markets

AvaTrade

Pepperstone

FOREX.com

TMGM

Neex

FP Markets

AvaTrade

Pepperstone

FOREX.com

TMGM

Neex

Tin hot

Pi Network: Dự báo về giá đồng Pi trong tháng 03/2025

Cộng đồng sáng tạo WikiFX: Cùng Pi Network chinh phục thị trường

Robot Forex: Bí quyết tự động hóa giao dịch Forex hiệu quả với WikiFX

Entry là gì? Vì sao Entry trong Forex thuận xu hướng vẫn thua?

Cập nhật Pi Network mới nhất: Những lo ngại tăng cao về đội ngũ cốt lõi của Pi

Tin tức tổng hợp - Một quỹ đầu tư bị chỉ trích vì giam tiền trader hơn 1 năm

Đà Nẵng phát lệnh truy nã đặc biệt một nghi phạm trong vụ Mr. Pips Phó Đức Nam

WikiFX Review sàn Forex MHMarkets 2025: Chương trình đối tác hấp dẫn từ sàn quốc tế

Thông báo Cập nhật ứng dụng WikiFX phiên bản 3.6.4

Pi Network: Hàng loạt Pioneers rơi vào thế bí

Tính tỷ giá hối đoái