EasyTrade-Overview of Minimum Deposit, Spreads & Leverage

摘要:EasyTrade is an unregulated forex and CFD broker, against which there is a recent warning by the Bulgarian Financial Supervision Commission (FSC) and a court order to block the access to the website form the territory of Bulgaria. EasyTrade says to be owned and operated by the Estonian Grau International OU and regulated by an organization called The International Financial Services Commission (IFSC). Have in mind, however, that IFSC is nothing more than an anonymous website without legitimacy whatsoever.

| Registered Country | Australia |

| Regulation | No license |

| Establishment | 2-5 years |

| Minimum Spreads | From 0.0 pips |

| Maximum Leverage | 1:500 |

| Account Types | Standard, Raw accounts |

| Minimum Deposit | N/A |

| Trading assets | N/A |

| Customer support | Telephone: +61 3 8373 4800Email: support@etfxi.com |

General Information

EasyTrade is an

Regulation

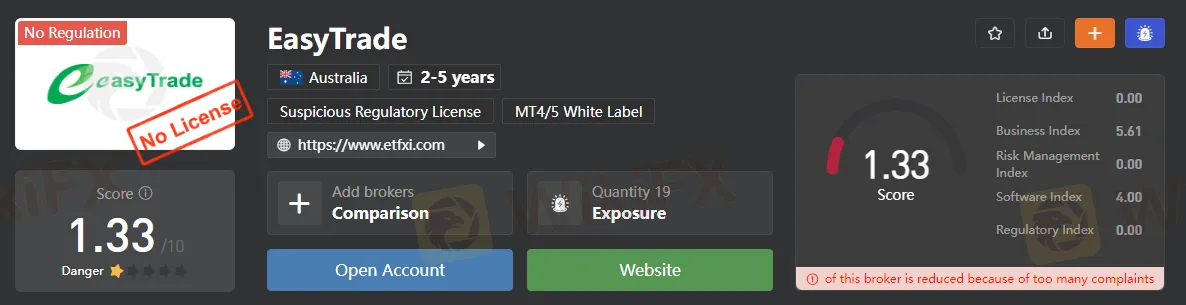

When it comes to regulation, EasyTrade let us know, for it does not hold any license to support its operation. Here we can see that EasyTrade only gets a very low score of 1.33/10 (The Screenshot was taken on 02/09/2023).

Market Instruments

EasyTrade says to be offering CFDs with “more than 1000 financial assets”, including forex pairs, stocks, commodities, indices and major crypto coins like Litecoin, Ethereum, Dash and Bitcoin and Ripple.

Minimum Deposit

EasyTrade offers quite a few trading accounts, with the minimum initial deposit for a basic account is $250. Although this is the reasonable amount, traders are not advised to register real trading accounts here given the fact that EasyTrade is not subject to any regulation.

Leverage

While a leverage up to 1:400 may actually be a negative for unexperienced traders, some professional ones like having the ability to use high leverage ratios like this. It gives them the opportunity to open much larger trades, while depositing small sums.

Spreads & Commissions

Spreads, however disappoint – as tested with a demo account the benchmark EURUSD spread was fixed at 4 pips, which is roughly three times higher than the levels traders usually expect with a standard account.

Trading Platform Available

EasyTrade uses a web based trading platform, which is overly simplified and lacks lots of features, supported by well-known platforms like the MetaTrader4 (MT4). For example, this platform has no technical analysis indicators, nor the automated trading option via EAs.

Deposit & Withdrawal

EasyTrade accepts all kinds of payment methods including major cards like VISA and MasterCard, e-wallets including PaySafe, Neteller, Skrill, WebMoney, QIWI, Yandex and AstroPay, as well as bank wire. There is a minimum 30 USD withdraw fee, monthly maintenance fee and a profit clearance fee, all of which, we should note are highly unusual.

Customer Support

Clients with any inquiry can get in touch with EasyTrade through email and telephone.

Here is the detailed contact information:

Telephone: +61 3 8373 4800

Email: support@etfxi.com

Pros & Cons

| Pros | Cons |

| Generous leverage up to 1:400 | No regulation |

| Weak trading platform | |

| Poor customer support | |

| High minimum deposit requirement |

Frequently Asked Questions

What trading platform does EasyTrade offer?

EasyTrade offers a web-based trading platform.

What is the maximum trading leverage offered by EasyTrade?

The maximum trading leverage offered by InvestMarket is up to 1:500.

How can I contact EasyTrade?

EasyTrade can be reached through telephone or email.

天眼交易商

热点资讯

监管变动预警:一个陷入疯狂,六个疑似跑路

超级CPI预警:当数据核弹引爆时,如何让交易商比你更慌?

华人外汇圈再现“杀猪盘”,大批“东方”鲜韭正被送往「赛博屠宰场」

日本加密货币政策大变革:税收降至20%,比特币储备计划受阻

华尔街拉响警报:美国经济衰退风险攀升,贸易战成“达摩克利斯之剑”

汇率计算