T.RowePrice-Some important Details about This Broker

摘要:T. Rowe Price offers a comprehensive range of investment products to individual investors, financial advisors, institutions, and consultants, including stocks, fixed income, multi-asset strategies, private equity, private credit, target-date funds, and impact investing. Although the official website mentions authorization by the Luxembourg Financial Supervisory Authority, the actual regulatory jurisdiction is currently limited to Hong Kong. Key information such as account types, fee structures, and deposit/withdrawal procedures is not publicly disclosed. Investors should thoroughly verify the legitimacy and transparency of the platform before making any decisions.

| T.RowePriceReview Summary | |

| Founded | 1995 |

| Registered Country/Region | United States |

| Regulation | SFC |

| Products & Services | Fund, Equity, Fixed income, Multi-asset, Private equity, Private credit, Target date solutions, and Impact investing |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Phone: + 1-410-345-2000 |

| Social Media: LinkedIn | |

| Address: 1307 Point Street, Baltimore, MD 21231 United States | |

T.RowePrice Information

T. Rowe Price offers a comprehensive range of investment products to individual investors, financial advisors, institutions, and consultants, including stocks, fixed income, multi-asset strategies, private equity, private credit, target-date funds, and impact investing. Although the official website mentions authorization by the Luxembourg Financial Supervisory Authority, the actual regulatory jurisdiction is currently limited to Hong Kong. Key information such as account types, fee structures, and deposit/withdrawal procedures is not publicly disclosed. Investors should thoroughly verify the legitimacy and transparency of the platform before making any decisions.

Pros & Cons

| Pros | Cons |

| Regulated by SFC | Lack of transparency |

| Multiple services and products | |

| Customer support in 28 languages | |

| Long operation history |

Is T.RowePrice Legit?

Although T. Rowe Price claims to be authorized and regulated by the Luxembourg Financial Supervisory Authority. It is regulated by the Securities and Futures Commission of Hong Kong, with license number AVY670.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| China (Hong Kong) | Securities and Futures Commission of Hong Kong (SFC) | Regulated | T. Rowe Price Hong Kong Limited | Dealing in futures contracts | AVY670 |

Products & Services

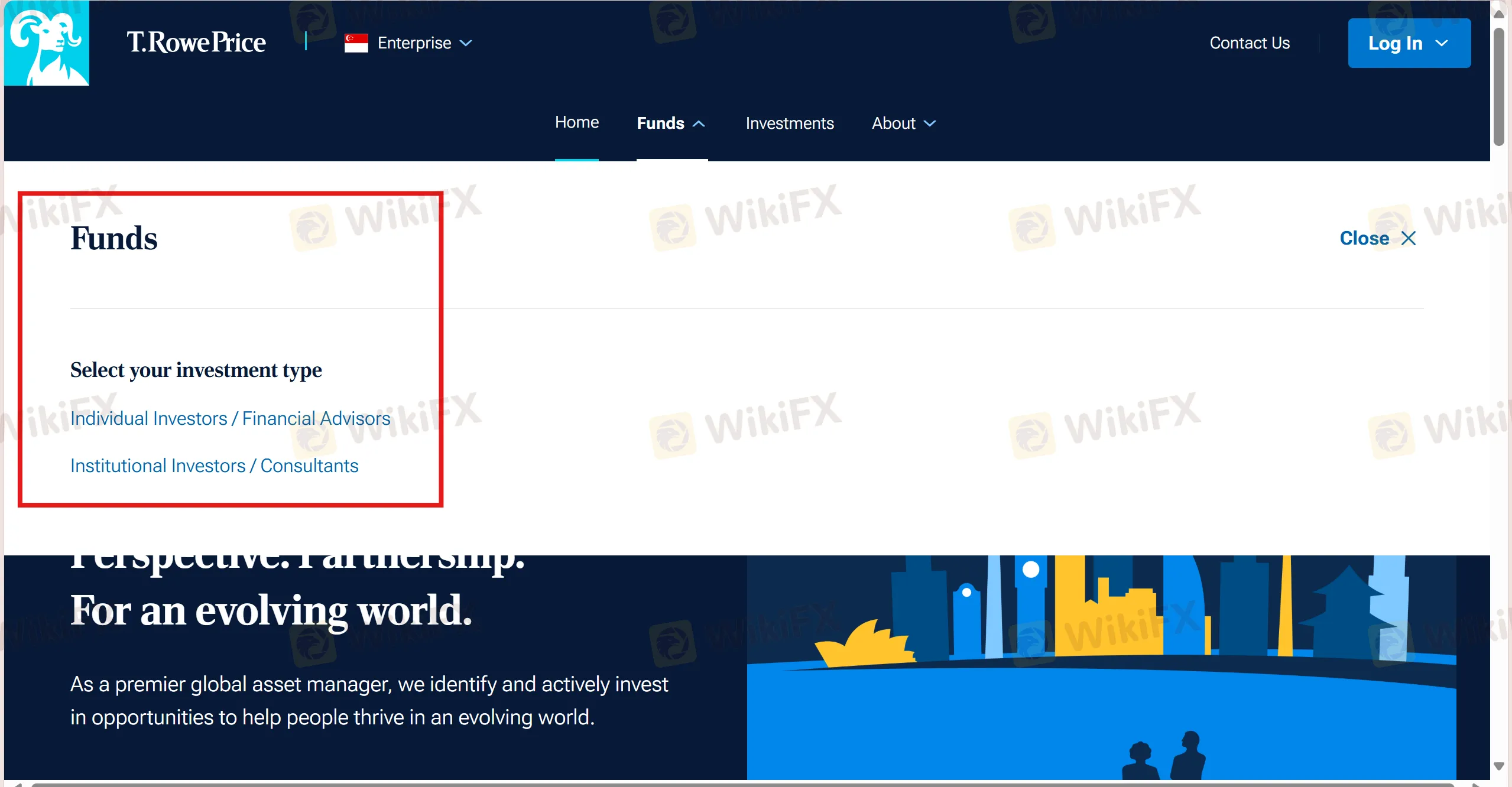

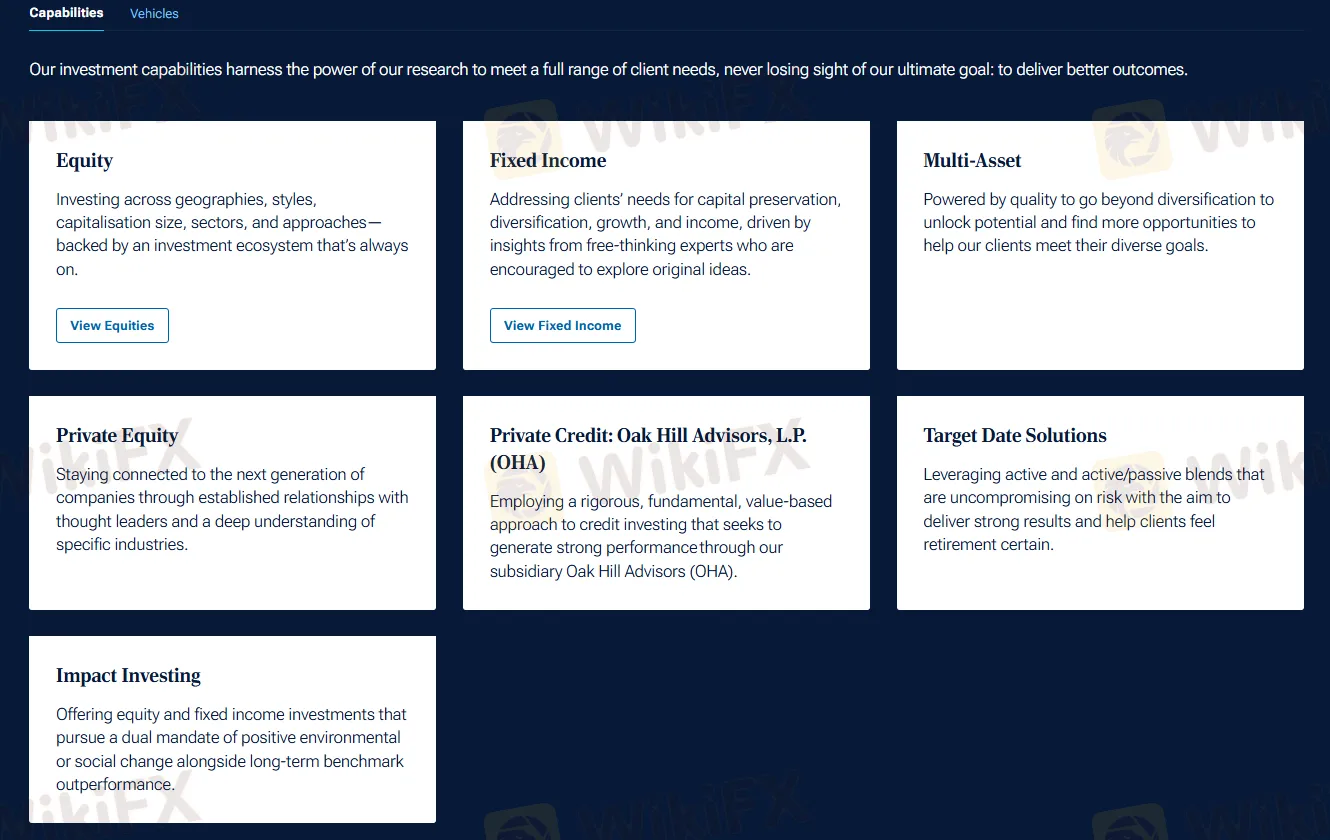

T. Rowe Price offers a comprehensive range of investment products and services, catering to individual investors, financial advisors, institutional investors, and consultants, with invesment services available for equity, fixed income, multi-asset, private equity, private credit (Oak Hill Advisors, L.P. (OHA)), target date solutions, and impact investing.

| Products & Services | Available | |

| Fund | Individual Investors | ✔ |

| Financial Advisors | ✔ | |

| Institutional Investors | ✔ | |

| Consultants | ✔ | |

| Investments | Equity | ✔ |

| Fixed Income | ✔ | |

| Multi-Asset | ✔ | |

| Private Equity | ✔ | |

| Private Credit: Oak Hill Advisors, L.P. (OHA) | ✔ | |

| Target Date Solutions | ✔ | |

| Impact Investing | ✔ | |

天眼交易商

热点资讯

SkyLine Guide 2026 泰国 —— 正式启动评委团组建工作!

WikiFX Elite Club Focus|Lê Minh Phương,信任是无形的桥梁

MT4卡成PPT,做T延迟被吊打?不允许还有人不知道这个YYDS!毫秒定输赢的Battle,别让“慢半拍”干趴你的钱包!

“想也有罪” Bridge Markets平台以“试图违规”为由任意扣留客户资金

WikiFX Elite Club Focus|吉米(Jimmy),信任是最珍贵的资产

Wikifx社区迎新春 一键接福,积分🐎到活动

汇率计算