Trust Traders -Some important Details about This Broker

摘要:Trust Traders presents itself as a forex broker based in Samoa providing investment services to both individual and corporate investors using a professional ECN-based model, as well as leverage up to 1:500, tight spreads and PAMM service.

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Founded Year | 1-2 years |

| Company Name | Trust Trade Finance |

| Regulation | No valid regulatory information |

| Minimum Deposit | Varies depending on the investment plan |

| Maximum Leverage | Not specified |

| Spreads | Not specified |

| Trading Platforms | Not specified |

| Tradable Assets | Cryptocurrencies, stocks, ETFs, currencies, indices, commodities |

| Investment Plans | Basic, Standard, Advanced investment plans |

| Services | Multi-asset trading and investment platform, cryptocurrency wallet, on-chain cryptocurrency exchange |

| Customer Support | Email support@trusttradefi.com |

General Information

Trust Trade Finance is a trading and investment platform based in the United Kingdom. It offers a wide range of investment opportunities across various financial markets, including cryptocurrencies, stocks, ETFs, currencies, indices, and commodities. The platform provides three investment plans, namely Basic, Standard, and Advanced, each with different minimum investment requirements, durations, and potential returns. Investors have the flexibility to access their profits at any time and can also choose to reinvest their capital.

However, it is important to note that Trust Trade Finance operates without valid regulation, which raises concerns about its legitimacy and credibility. The lack of regulatory oversight increases the potential risks associated with investing through this platform. Additionally, the company's website provides limited information, and there are no specified details regarding leverage, spreads, trading platforms, payment methods, or educational tools.

While Trust Trade Finance presents investment opportunities, caution is advised when considering involvement with an unregulated entity. Thorough research, professional advice, and careful consideration of the associated risks are recommended before engaging in any financial activities through Trust Trade Finance.

Pros and Cons

Trust Trade Finance offers a diverse range of investment opportunities across multiple financial markets, providing investors with the potential to diversify their portfolios and benefit from market fluctuations. The availability of three investment plans allows for flexibility in choosing the one that aligns with individual investment goals. Additionally, the option to access profits at any time and the ability to reinvest capital provide investors with some degree of control over their investments.

However, it is crucial to consider the potential risks associated with Trust Trade Finance. The lack of regulatory oversight raises concerns about the legitimacy and credibility of the platform, which may deter some cautious investors. The absence of detailed information regarding leverage, spreads, trading platforms, payment methods, and educational tools also limits transparency and may affect the overall user experience. It is important to exercise caution, conduct thorough research, and seek professional advice before engaging with Trust Trade Finance or any unregulated financial entity.

| Pros | Cons |

| Diverse range of investment opportunities. | Lack of regulation raises concerns about legitimacy and credibility. |

| Multiple investment plans with potential returns. | Limited information provided on leverage, spreads, trading platforms, payment methods, and educational tools. |

| Access to multiple asset classes including cryptocurrencies, stocks, ETFs, currencies, indices, and commodities | Potential risks associated with engaging with an unregulated entity. |

Is Trust Trade Finance Legit?

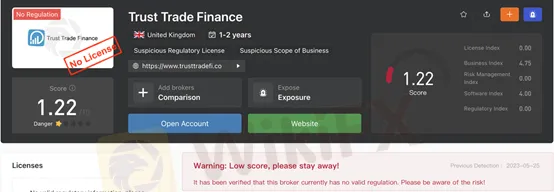

Trust Trade Finance is a company based in the United Kingdom that operates in the field of trade finance. However, it is important to note that the provided information indicates that Trust Trade Finance is not regulated. The regulatory status of a financial institution is crucial as it ensures that the company adheres to certain standards, guidelines, and legal requirements, which helps protect the interests of clients and promotes transparency and accountability.

The lack of regulation raises concerns about the legitimacy and credibility of Trust Trade Finance. The suspicious regulatory license, suspicious scope of business, and the absence of valid regulatory information indicate a high potential risk associated with this company.

Investment Plans

Trust Trade Finance offers three investment plans: Basic, Standard, and Advanced. Each plan has its own features and requirements.

BASIC

The Basic plan requires a minimum investment of $1,000. It offers a daily return of 16.5% and runs for a duration of seven days. The maximum deposit allowed in this plan is $5,000. Investors can expect a 15.5% return on investment (ROI) to access their profits at any time. The plan also allows for recurring capital investment, meaning investors can reinvest their profits. For example, if an investor puts in $1,000, they would receive a ROI of $155, resulting in a total of $1,155 after seven days.

STANDARD

The Standard plan starts with a $6,000 investment. It offers a daily return of 6% and has a longer duration of 30 days. Investors can deposit up to $19,000 in this plan. The ROI for this plan is 80%. Similar to the Basic plan, investors have the option to access their profits at any time and reinvest their capital. For instance, if an investor invests $6,000, they would receive a ROI of $4,800, resulting in a total of $10,800 after 30 days.

ADVANCED

The Advanced plan requires a minimum investment of $20,000. It offers a daily return of 6.5% and runs for 40 days. Investors can deposit up to $1,000,000 in this plan. The ROI for this plan is 160%. Investors have the same privileges as the other plans, including the ability to access profits and reinvest capital. If an investor puts in $20,000, they would receive a ROI of $32,000, resulting in a total of $52,000 after 40 days.

It is important to note that these investment plans are described based on the information provided. However, given the lack of regulation and the associated risks highlighted earlier, caution should be exercised when considering any investment opportunities. Thorough research and professional advice are recommended before making any financial decisions.

| Pros | Cons |

| Multiple investment plans with varying durations and ROIs | Lack of regulation raises concerns about legitimacy and safety |

| Diversification options across different investment plans | Limited information provided on plan details and risks |

| Potential for attractive returns on investment | Potential risks associated with engaging with an unregulated entity |

Service and Features

Trust Trade Finance offers a range of services and features to its clients. The main features include:

1. Multi-Asset Trading and Investment Platform: Trust Trade Finance provides a platform that allows users to trade and invest in multiple assets. This includes cryptocurrencies, stocks, ETFs, currencies, indices, and commodities. The platform aims to cater to diverse investment preferences and strategies.

2. Cryptocurrency Wallet: Trust Trade Finance offers a cryptocurrency wallet for users to store their digital assets.

3. On-Chain Cryptocurrency Exchange: The platform includes an on-chain cryptocurrency exchange, allowing users to trade cryptocurrencies directly on the platform.

One aspect of Trust Trade Finance is the provision of free insurance coverage purchased from Lloyd's of London. This insurance offers coverage of up to 1,000,000 GBP/USD/EUR/AUD, depending on the region.

| Pros | Cons |

| Multi-Asset Trading and Investment Platform | Lack of regulatory oversight raises concerns about legitimacy and credibility. |

| Cryptocurrency Wallet | Limited information on certain aspects such as leverage, spreads, and payment methods. |

| On-Chain Cryptocurrency Exchange | Potential risks associated with engaging with an unregulated entity. |

| Free Insurance Coverage from Lloyd's of London | Limited transparency and information on the platform. |

Customer Support

Trust Trade Finance provides customer support to assist its clients with their inquiries and concerns. The provided contact information includes an email address, support@trusttradefi.com, which clients can use to reach out to the company's support team. The company's website, trusttradefi.com, serves as a platform where clients can access information about the services offered and potentially find additional support resources.

The location of Trust Trade Finance is mentioned as London, United Kingdom. However, it is important to note that the lack of regulatory information and the potential risks associated with the company, as mentioned earlier, should be taken into consideration when assessing the reliability and effectiveness of their customer support.

Clients who require assistance or have questions regarding their investments, trading activities, account management, or any other related matters can reach out to Trust Trade Finance through the provided email address. It is recommended to clearly communicate your concerns and provide any relevant details to ensure a prompt and accurate response from their customer support team.

Conclusion

In conclusion, Trust Trade Finance is a trade finance company based in the United Kingdom that offers investment opportunities across various financial markets, including cryptocurrencies, stocks, ETFs, currencies, indices, and commodities. However, it is important to note that Trust Trade Finance lacks regulation, which raises concerns about its legitimacy and credibility. The absence of valid regulatory information and the associated risks pose potential dangers to investors. Additionally, while the company provides investment plans with potential returns, the high potential risk and lack of regulation should be carefully considered before engaging with Trust Trade Finance. Caution, thorough research, and seeking professional advice are strongly advised when dealing with unregulated entities in the financial industry.

FAQs

Q: Is Trust Trade Finance a regulated company?

A: No, Trust Trade Finance is not regulated according to the available information. It operates without valid regulatory oversight.

Q: What investment plans does Trust Trade Finance offer?

A: Trust Trade Finance offers three investment plans: Basic, Standard, and Advanced. Each plan has different minimum investment requirements, durations, and potential returns.

Q: Can I access my profits at any time with Trust Trade Finance?

A: Yes, you have the flexibility to access your profits at any time with Trust Trade Finance. The investment plans allow for the withdrawal of funds and the option to reinvest capital.

Q: Does Trust Trade Finance provide insurance coverage?

A: Yes, Trust Trade Finance offers free insurance coverage purchased from Lloyd's of London. The coverage amount depends on the region and can go up to 1,000,000 GBP/USD/EUR/AUD.

Q: What assets can I trade on Trust Trade Finance?

A: Trust Trade Finance provides opportunities to trade a variety of assets, including cryptocurrencies, stocks, ETFs, currencies, indices, and commodities.

Q: How can I contact customer support at Trust Trade Finance?

A: You can reach Trust Trade Finance's customer support team by emailing them at support@trusttradefi.com. They are available to assist with any inquiries or concerns you may have.

Q: Where is Trust Trade Finance based?

A: Trust Trade Finance is based in London, United Kingdom, according to the provided information.

天眼交易商

热点资讯

外汇天眼雷达红灯!关税利刃出鞘,美国CPI联袂“恐怖数据”续力春节档期,黑平台正摩拳擦掌…

监管变动预警:盈透证券(IB)被两地撤销牌照

干货分享!外汇天眼汇市生存指南:风暴翻盘,财富突围

WikiEXPO成为利伯兰官方合作伙伴,共同推动全球金融交易领域创新与健康发展

EBC全球百万美金交易大赛Ⅱ

汇率计算