FBS-Some Important Details about This Broker

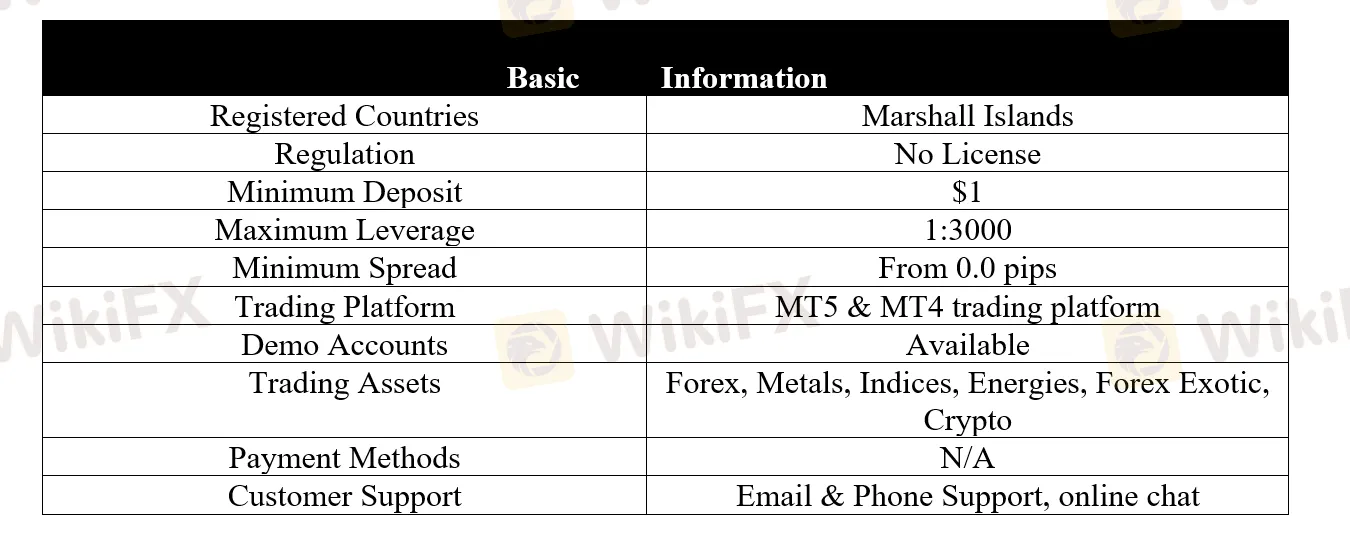

摘要:Registered in Marshall Islands, FBS is a forex broker providing access to a massive financial market, Forex, Shares, Cryptocurrencies, Indices. With the FBS platform, investors can get access to six trading accounts: Cent, Micro, Standard, Zero-Spread, ECN and Crypto, with the minimum deposit to invest with this broker starting at $1. FBS is the trading name operated by Mitsui Markets Ltd, and this broker is not subject to any regulation, please be aware of the risk.

Risk Warning: This FBS is a brand name operated by Mitsui Markets Ltd, an offshore company under no regulation, and this broker is pretending the legit FBS (https://fbs.com/), using its official website to misunderstand investors. please be aware of the potential scam.

General Information

Registered in Marshall Islands, FBS is a forex broker providing access to a massive financial market, Forex, Shares, Cryptocurrencies, Indices. With the FBS platform, investors can get access to six trading accounts: Cent, Micro, Standard, Zero-Spread, ECN and Crypto, with the minimum deposit to invest with this broker starting at $1.

FBS is the trading name operated by Mitsui Markets Ltd, and this broker is not subject to any regulation, please be aware of the risk.

Market Instruments

With the FBS platform, five classes of trading instruments including Forex, Metals, Indices, Energies, Crypto are all available through this brokerage platform.

Account Types

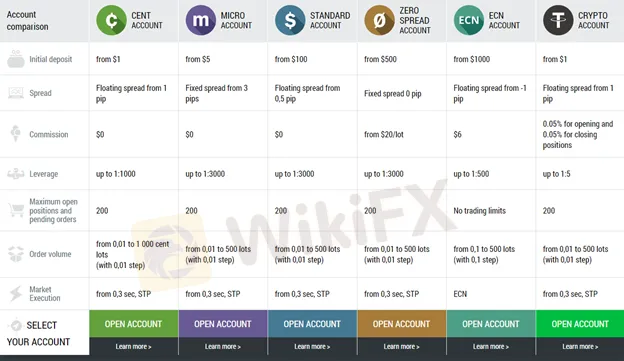

This FBS provides six types of trading accounts for both retail and professional traders. The Cent account is suitable for beginners, and only $1 is enough. The Standard account is suitable for all types of traders, with the minimum deposit starting at $100. The Zero-Spread and ECN accounts are designed for professional traders and scalpers who pursue raw spreads and low commissions, requiring an initial deposit of $500, and $1,000, respectively. Lastly, the Crypto account, asks for an initial deposit of $1.

How to open an account with FBS?

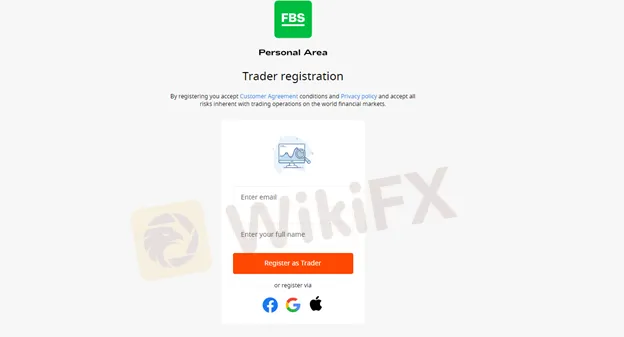

Opening an account with FBS is an easy and simple process:

1. Click the “OPEN ACCOUNT” link, and fill up some required details on the popping-up page.

2. Upload your personal data for this company to verify your details.

3. Choose the preferable payment methods, fund your account and start to trade with this forex broker.

Leverage

When it comes to leverage, this unregulated FBS allows its clients to use leverage of up to 1:3000, higher than the levels regarded appropriate by many regulators, with the maximum leverage for major forex up to 1:30 in Europe and Australia, and 1:50 in Canada and U.S.

Since leverage can magnify gains as well as losses, it can also cause serious fund losses, especially to inexperienced traders. Therefore, it is wise for beginners to choose the smaller size no more than 1:10 until they gain more trading experience.

Spreads & Commissions

Spreads and commissions are tightly associated with account types. The Cent, Micro and Standard accounts provides a zero-commission trading environment, with spreads from 1 pip, 3 pips, and 0.5 pips, respectively. The Zero-spread account charges fixed spread at 0 pips, with a commission from $20 per lot. The ECN account provides floating spreads from 1 pips, with a commission of $6. As for the Crypto account, the spread start from 1 pips, with the commission charged at 0.05% for opening and 0.05% for closing positions.

Payment Methods

The minimum deposit is $1, and this FBS allows its clients to make a deposit and withdrawal through VISA, NETELLER, STICPAY, SKRILL, and Perfect Money.

Customer Support

This FBS leaves no contact information for clients to get in touch with them.

However, you can follow this broker on Twitter, Facebook, Instagram.

Risk Warning

Trading leveraged products such as forex, cryptocurrencies and derivatives may not be suitable for all investors as they carry a high degree of risk to your capital. Please ensure that your fully understand the risks involved, taking into account your investments objectives and level of experience.

The information presented in this article is intended solely for reference purposes.

相关交易商

天眼交易商

热点资讯

华人外汇圈再现“杀猪盘”,大批“东方”鲜韭正被送往「赛博屠宰场」

大马老商痛失30万令吉!加密货币投资骗局再升级,高回报诱饵下的陷阱

大通金融(MultiBank Exchange Group)全面测评

日本加密货币政策大变革:税收降至20%,比特币储备计划受阻

投资被骗就找这个人 诈骗第一站【专职取款人】

华尔街拉响警报:美国经济衰退风险攀升,贸易战成“达摩克利斯之剑”

经纪商阻止您提款的隐秘手段

大平台也删交易日志 谁是汇圈终极Boss?

WikiFX App 3.6.4版本上线公告

新加坡富二代卷入3.06亿美元加密货币盗窃案 夜店挥霍66.5万,名包赠佳人

汇率计算