GX

摘要:GX, the trading name of GS Brokers Capital Inc., is a brokerage company registered in the United Kingdom and currently does not maintain functional website, that's why we can only gather all the information in this article from Internet.

Note: GX's official website - https://www.gxbrokers.com/ is currently inaccessible normally.

| GX Review Summary | |

| Founded | / |

| Registered Country/Region | United Kingdom |

| Regulation | No regulation |

| Market Instruments | 2,100+, forex, CFDs, stocks and commodities |

| Demo Account | ❌ |

| Spread | From 0.2 pips (Forex) |

| From 0.4 pips (CFDs) | |

| Leverage | Up to 1:500 |

| Trading Platform | / |

| Min Deposit | USD 200 |

| Customer Support | Email: tradetoolspro@company.com |

| Address: 38 Ropery Rd Gateshead NE8 2HP United Kingdom | |

GX Information

GX, the trading name of GS Brokers Capital Inc., is a brokerage company registered in the United Kingdom and currently does not maintain functional website, that's why we can only gather all the information in this article from Internet.

The company offers trading services in CFDs, stocks and commodities. Minimum dpeosit is a little high at USD 200, with a tight spread from 0.2 pips.

However, it cannot be negleceted that the broker currently operates without any valid regulation, which indicates possible less compliance to industry and customer protection.

What's worse, there are two complaints on WIkiFX about withdrawal issues, indicating unpleasant customer experience with this broker.

Pros and Cons

| Pros | Cons |

| Wide range of tradable assets | Inaccessible website |

| Tight starting spreads | No regulation |

| No demo accounts | |

| High minimum deposit | |

| WikiFX exposures about withdrawal issues |

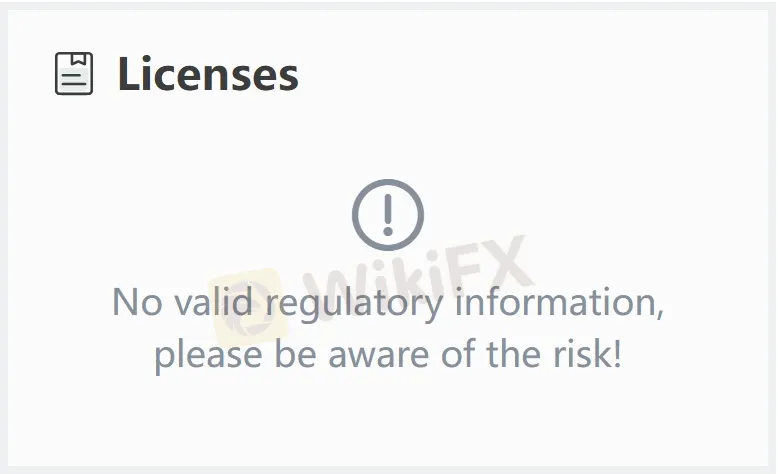

Is GX Legit?

Regulation is a crucial aspect of evaluating the legitimacy and reliability of a brokerage firm, and in the case of GX, the broker operates without any valid regulatory oversight. The absence of a regulatory framework raises huge concerns regarding the broker's adherence to industry standards, financial transparency, and the protection of client interests.

What Can I Trade on GX?

GX claims to offer access to 2,100+ tradable assets to trade, including Forex, CFDs, stocks and commodities.

| Tradable Instruments | Supported |

| Forex | ✔ |

| CFDs | ✔ |

| Stocks | ✔ |

| Commodities | ✔ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type/Fees

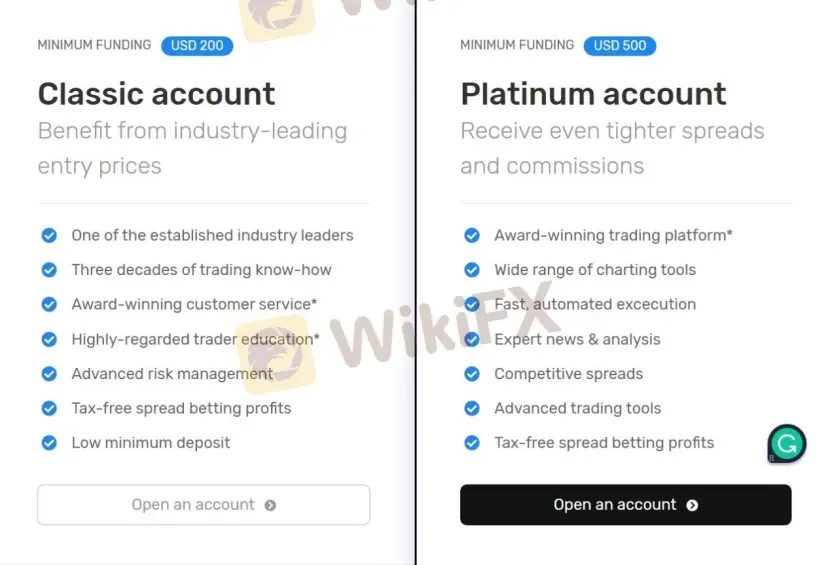

GX claims to offer two types of trading accounts, namely Classic and Platinum, with minimum initial deposit requirements of $200 and $500 respectively. In comparison, licensed brokers allow setting up a starter account with a minimum deposit of $100 or even less.

| Account Type | Min Deposit |

| Classic | USD 200 |

| Platinum | USD 500 |

While spread and commission vary depending on the trading asset. For example, the spread is as low as 0.2 pips on forex, and from 0.4 pips on the CFDs. The commission is from $3 on US stocks and $1.25 per lot on commodities.

| Asset Class | Spread | Commission |

| Forex | From 0.2 pips | / |

| CFDs | From 0.4 pips | / |

| US stocks | / | From $3 |

| Commodities | / | From $1.25 per lot |

Leverage

The leverage provided by GX is capped at 1:500. Nevertheless, you should keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

相关阅读

FOMO周五:比特币过山车继续

又是时候了,乡亲们;周末。随着周末的结束,是时候再次回顾本周的高潮和低谷、成功和失败了。今早与交易员聊天,大多数图表观察家和屏幕监查者都在谈论的一个重大举措似乎是比特币的暴跌。“爱它还是恨它”加密图标本周进一步下跌了16%,延续了最近的跌幅。比特币从本月早些时候的历史高点下跌了近20%。那么,让我们来看看是什么原因导致了这一举动,就像以往一样,如果你抓住了这一举动?做得好!如果没有?总有下个星期。

FOMO周五:比特币崩盘

当我们进入周末的时候,是时候盘点一下本周的赢家和输家了。像往常一样,这意味着周五下午不是庆祝就是后悔。本周,在与众多交易员交谈时,很明显,大家关注的焦点是比特币的抛售。鉴于人们对加密货币涨势的关注,本周逾17%的抛售成为一大话题。有趣的是,所有的加密评论家和比特币否认者都完全享受数字货币遭受挫折的任何时候,所以即使是那些错过这一举措的人也能够享受它。无论如何,让我们看看发生了什么,为什么这是一个伟大的交易。

Daily Market Recap - Bitcoin continues to attract attention

Denigrated by its opponents for its volatility and speculative nature, Bitcoin, which keeps breaking records, can have its uses within a multi-asset portfolio, says Robeco.

Daily Market Recap - Bitcoin Reaches All Time High Above 50,000 USD

Bitcoin, the world's largest cryptocurrency, has been booming since the end of 2020, with BTCUSD showing no signs of slowing down on the charts.

热点资讯

WTI 随着美国库存增加而下滑至接近 72.50 美元

加拿大央行行长麦克勒姆:关税威胁对加元的影响大于利率差异

加拿大乔利表示对关税谈判“谨慎乐观”

美元/加元在美国GDP公布前以温和的正面偏向交易于1.4400以上

德国第四季度初步GDP环比收缩0.2%,预期为-0.1%

纽元/美元在关税不确定性中回升至0.5650以上

白银价格预测:在各国央行鸽派信号的推动下,白银/美元升至接近31.00美元

快讯:欧洲央行如预期在1月将关键利率下调25个基点

美国第四季度GDP年率为2.3%,低于预期的2.6%

澳元/美元持平,美国GDP数据不及预期

汇率计算