FTMO PipsPRO

摘要:FTMO PipsPRO is an unregulated trading platform based in the United Kingdom. While it offers different account types with varying minimum deposits, ranging from £1,000 to £50,000, it operates without regulatory oversight. This lack of regulation can pose significant risks to traders, including limited investor protection and transparency. Unfortunately, crucial details such as spreads and available trading platforms remain undisclosed.

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Company Name | FTMO PipsPRO |

| Regulation | Unregulated |

| Minimum Deposit | STARTER: £1000, SILVER: £5000, GOLD: £10,000, PLATINUM: £50,000 |

| Maximum Leverage | Varies by instrument (Up to 5000X for certain assets) |

| Spreads | Information not provided |

| Trading Platforms | Information not provided |

| Tradable Assets | Cryptocurrencies, Stock Indices, Forex, Energies, Individual Stocks, Options, ETFs |

| Account Types | STARTER, SILVER, GOLD, PLATINUM (with compounding returns) |

| Customer Support | Limited customer support options, primarily via email |

| Payment Methods | Cryptocurrency deposits (Bitcoin and Ethereum) |

| Educational Tools | None |

Overview

FTMO PipsPRO is an unregulated trading platform based in the United Kingdom. While it offers different account types with varying minimum deposits, ranging from £1,000 to £50,000, it operates without regulatory oversight. This lack of regulation can pose significant risks to traders, including limited investor protection and transparency. Unfortunately, crucial details such as spreads and available trading platforms remain undisclosed.

Traders considering FTMO PipsPRO should be cautious, as the platform's website is reported as being down, and there are allegations of it being associated with scams. Additionally, educational resources are notably absent, which may hinder traders seeking to enhance their knowledge and skills. Furthermore, the limited customer support options, primarily via email, can leave traders feeling unsupported in urgent situations.

In light of these concerns, traders are strongly advised to exercise extreme caution and consider alternative, regulated brokers with more transparent and trustworthy practices.

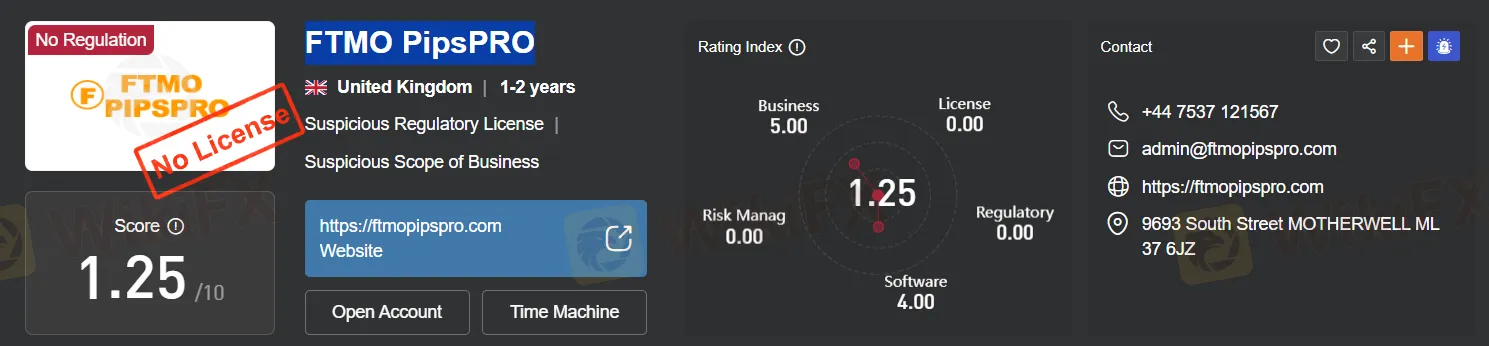

Regulation

FTMO PipsPRO is an unregulated broker, which means it operates without oversight or supervision by a financial regulatory authority. This lack of regulation can pose risks for traders, as there may be limited investor protection and transparency regarding the broker's operations and practices. Traders considering FTMO PipsPRO or similar unregulated brokers should exercise caution, conduct thorough research, and carefully assess the risks associated with trading with a brokerage firm that lacks regulatory oversight. It's important to understand that the choice of a broker should align with one's risk tolerance and trading preferences, with regulated brokers generally offering a higher level of security and accountability.

Pros and Cons

FTMO PipsPRO presents a mixed bag of advantages and disadvantages for traders. While it offers diverse market instruments and leverage options, its unregulated status and lack of educational resources raise concerns. Here's a breakdown of the pros and cons:

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

FTMO PipsPRO provides traders with a broad selection of market instruments and leverage options, making it appealing to those seeking diversified trading opportunities and potentially high returns. However, its unregulated status raises concerns about investor protection and transparency. The platform's lack of educational resources may hinder traders looking to enhance their skills. Additionally, there are reports of scam allegations, and the limited customer support options further compound uncertainties. Traders considering FTMO PipsPRO should proceed with caution and conduct thorough due diligence.

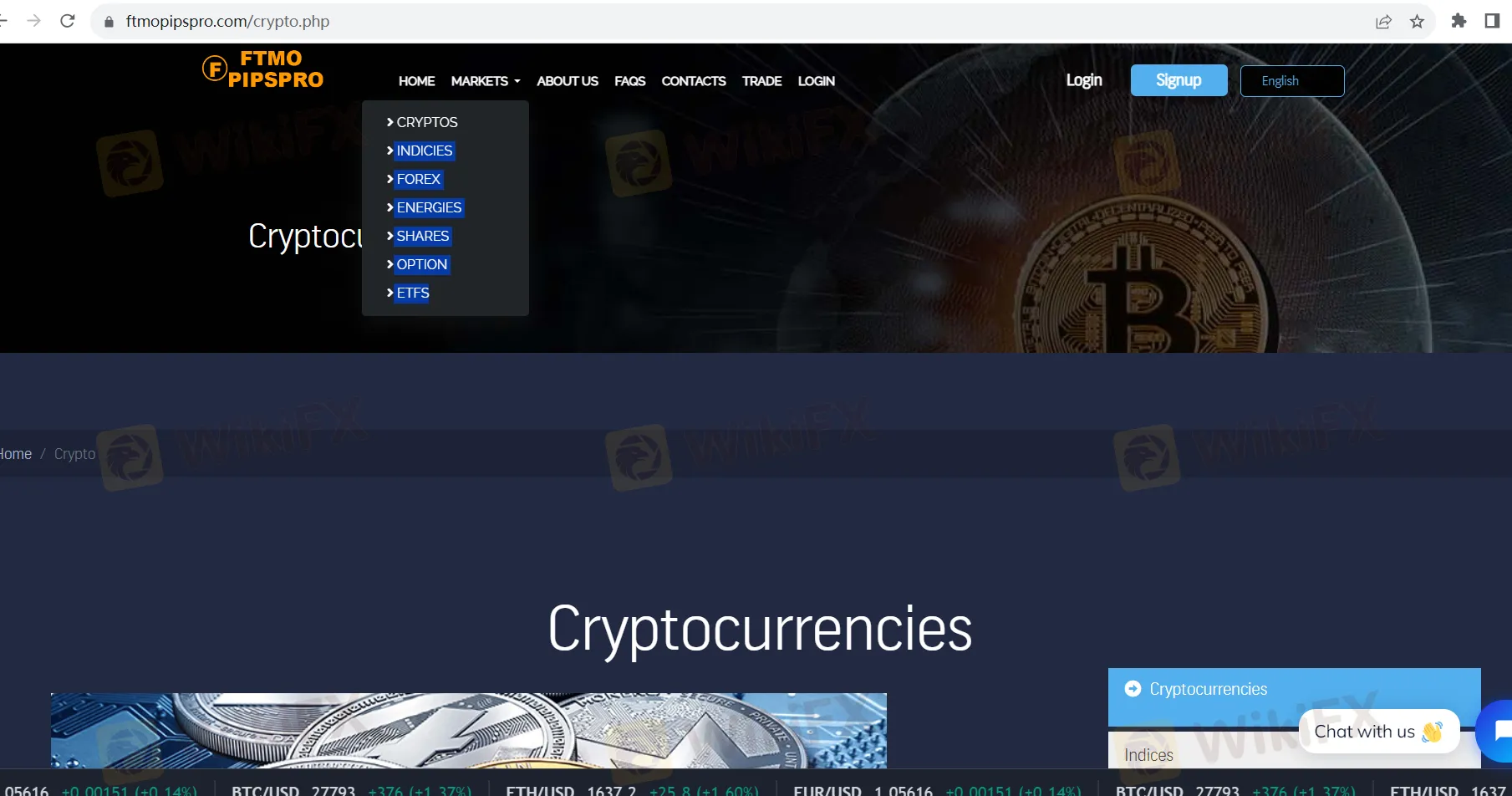

Market Instruments

FTMO PipsPRO offers a diverse range of market instruments for traders and investors, providing opportunities to participate in various financial markets. Here's a breakdown of the market instruments available through FTMO PipsPRO:

Cryptos (Cryptocurrencies): FTMO PipsPRO allows traders to access the cryptocurrency market, which includes popular digital assets like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC). Cryptocurrency trading offers the potential for high volatility and significant price movements, attracting both short-term and long-term traders.

Indices (Stock Indices): Traders can engage in index trading through FTMO PipsPRO, with access to major stock indices like the S&P 500, Dow Jones Industrial Average (DJIA), and NASDAQ Composite. Index trading provides exposure to the overall performance of a specific market or industry.

Forex (Foreign Exchange): FTMO PipsPRO provides access to the forex market, allowing traders to trade currency pairs from around the world. Major, minor, and exotic currency pairs are available for trading, offering diverse opportunities for currency speculators.

Energies (Commodity Futures): FTMO PipsPRO offers trading in energy commodities, including crude oil (WTI and Brent) and natural gas. Energy markets are influenced by global supply and demand dynamics, making them appealing to traders seeking exposure to the energy sector.

Shares (Stocks): Traders can invest in a wide range of individual company shares through FTMO PipsPRO. This allows for participation in the equity markets and the potential to benefit from company-specific developments and performance.

Options (Options Contracts): While FTMO PipsPRO primarily focuses on spot and futures trading, some platforms may provide options trading capabilities, allowing traders to use options contracts for various hedging or speculative purposes.

ETFs (Exchange-Traded Funds): Exchange-traded funds are also available for traders and investors who prefer a diversified approach. ETFs track various underlying assets, including stocks, bonds, commodities, and more, offering a simple way to gain exposure to specific market segments.

FTMO PipsPRO's comprehensive suite of market instruments caters to a wide range of trading strategies and risk appetites, making it possible for traders to diversify their portfolios and adapt to changing market conditions. However, it's crucial for traders to conduct thorough research, understand the associated risks, and adhere to a well-defined trading plan when engaging in any of these market instruments. Additionally, considering the unregulated nature of FTMO PipsPRO, traders should exercise due diligence and caution before trading with the platform.

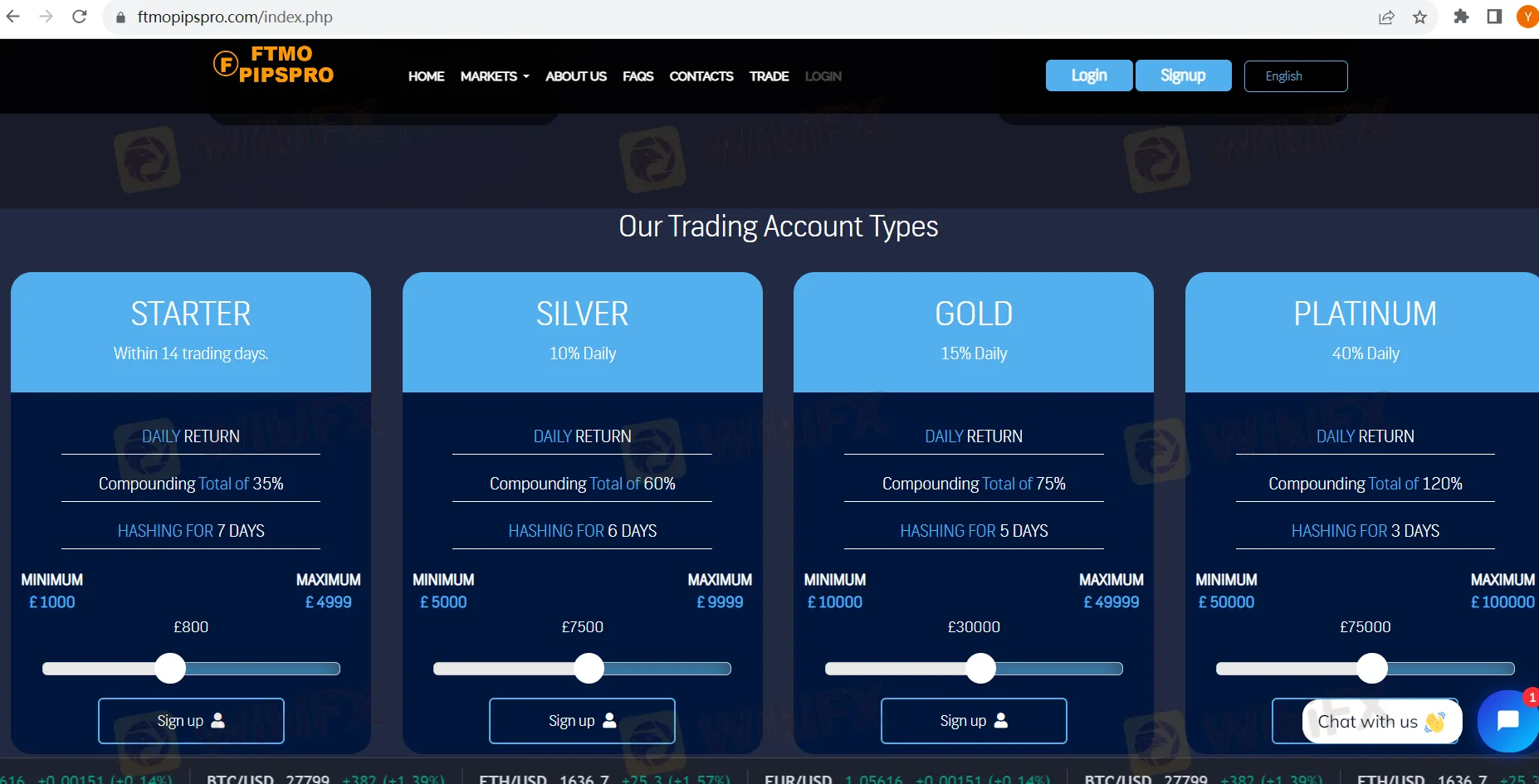

Account Types

FTMO PipsPRO offers a range of trading account types, each tailored to different investor preferences and financial objectives. These account tiers are designed to provide varying levels of daily returns, compounding strategies, and investment thresholds.

Firstly, the STARTER Account is an option for those looking to begin their trading journey, offering a daily return based on a compounding total of 35%. This account appears to involve a “hashing” activity that spans over 7 days, though the exact nature of this activity is not explicitly defined. To join, investors need to make a minimum investment of £1000, with a maximum limit set at £4999.

Stepping up, the SILVER Account presents traders with a daily return of 10%, compounded to reach a total of 60%. Like the STARTER account, it includes a “hashing” component, which lasts for 6 days. To be eligible for the SILVER Account, investors must commit a minimum investment of £5000 and can invest up to £9999.

For those seeking even greater returns, the GOLD Account offers a daily return of 15%, compounding to a total of 75%. It features a shorter hashing duration of 5 days. To access this tier, investors need to invest a minimum of £10,000, with a maximum investment cap of £49,999.

At the pinnacle, the PLATINUM Account offers an exceptional daily return of 40%, compounded to a total of 120%. The hashing period for this account is relatively brief, spanning 3 days. To enter the PLATINUM tier, investors must commit a substantial minimum investment of £50,000, with a maximum investment limit set at £100,000.

It's essential for prospective investors to approach these accounts with careful consideration. While they present potentially attractive returns, the reference to “hashing” and the lack of detail raise questions about the nature of the investment activities involved. Additionally, it's important to bear in mind that investment opportunities promising exceedingly high returns often come with elevated levels of risk. Therefore, conducting thorough research and understanding all terms, conditions, and risks associated with these accounts is paramount before considering any investments.

Leverage

This broker offers a wide range of leverages for different trading instruments, allowing traders to amplify their positions and potentially increase both profits and losses. The maximum trading leverage offered by this broker varies depending on the specific instrument being traded. Here's a breakdown of the maximum trading leverage available for the mentioned instruments:

Bitcoin (BTC): The maximum trading leverage for Bitcoin is up to 100X. This means that traders can control a position size up to 100 times the amount of their initial investment, significantly amplifying the potential gains or losses from Bitcoin trading.

Ethereum (ETH): Ethereum also offers a maximum trading leverage of up to 100X, allowing traders to control a position size that is 100 times their initial investment.

Litecoin (LTC): Similar to Bitcoin and Ethereum, Litecoin offers a maximum trading leverage of up to 100X.

Ripple (XRP): Ripple, or XRP, follows the same pattern with a maximum trading leverage of up to 100X.

EOS: EOS, like the other cryptocurrencies listed, provides a maximum trading leverage of up to 100X.

EURUSD: For the EURUSD currency pair, the broker offers a maximum trading leverage of up to 1000X. This is notably higher than the leverage available for cryptocurrencies.

S&P 500: The S&P 500 index, which represents a basket of US stocks, offers a maximum trading leverage of up to 100X.

GOLD: Gold trading on this platform provides a substantial maximum trading leverage of up to 5000X, making it one of the highest-leverage instruments offered.

CRUDE OIL: Similar to the S&P 500, crude oil trading also offers a maximum trading leverage of up to 100X.

JAPAN: Trading related to Japanese markets, such as the Nikkei 225 index or Japanese yen pairs, offers a maximum trading leverage of up to 5000X, again featuring some of the highest leverage levels available.

It's important to emphasize that while high leverage can magnify potential profits, it also significantly increases the risk of substantial losses. Traders should exercise caution and have a clear risk management strategy in place when using high leverage, as it can lead to rapid and substantial capital depletion in volatile markets. Furthermore, regulatory bodies in various countries have imposed restrictions on leverage for retail traders to protect them from excessive risk, so traders should be aware of and comply with relevant regulations in their jurisdiction.

Spreads and Commissions

FTMO's PipsPRO program offers traders the chance to secure trading capital but lacks transparency regarding spreads and commissions.

Spreads, the difference between buying and selling prices, and commissions, trading fees, aren't clearly detailed on the program's website or materials. This lack of transparency can make it challenging for traders to understand the cost structure and implications of their trades.

To gain clarity, traders should contact FTMO's customer support and carefully review the program's terms and conditions. It's crucial to have a clear understanding of these aspects before participating in the program to make informed trading decisions.

Deposit & Withdrawal

FTMO PipsPRO, according to its website, appears to offer only Bitcoin and Ethereum as deposit methods. While we cannot independently verify this information without an account, it's essential to note that this limited choice of cryptocurrency deposit options has raised suspicions within the trading community.

The concern stems from the fact that some unscrupulous brokers prefer cryptocurrency deposits because they are irreversible. Once you send your funds in crypto, it's challenging to initiate a chargeback or reverse the transaction if you encounter issues with the broker. In such cases, prevention is the best form of protection, and the safest course of action is to exercise caution and consider alternative brokers with more conventional deposit methods.

Trading Platforms

FTMO PipsPRO requires identity verification before granting access, a common industry practice. However, it lacks the option for a demo account before verification. Sending personal documents to unverified brokers is risky, as it can expose you to identity theft and misuse.

Unfortunately, we couldn't evaluate FTMO PipsPRO's trading platform. Consider brokers offering MetaTrader 4 (MT4) or MetaTrader 5 (MT5) for robust trading features, including indicators, Expert Advisors, VPS, and more, along with a reputable track record.

Customer Support

FTMO PipsPRO's customer support is notably lacking in accessibility and transparency, with only an email address provided for inquiries and a somewhat vague physical address. The absence of more direct and immediate support options like live chat or a dedicated phone line may leave traders feeling unsupported in urgent situations, raising concerns about the platform's commitment to assisting its users effectively.

Educational Resources

FTMO PipsPRO appears to offer limited or no educational resources for traders. This lack of educational materials and resources can be a drawback for traders who rely on such resources to enhance their knowledge and skills in the financial markets.

Summary

FTMO PipsPRO raises several red flags for traders. It operates without regulation, posing potential risks due to limited investor protection and transparency. The investment accounts, while promising attractive returns, lack clarity about the underlying “hashing” activity, and high-return promises often come with elevated risk levels. Additionally, the platform's limited customer support options and lack of educational resources raise concerns about trader support and development. Moreover, there are reports labeling it as a scam, adding to the skepticism surrounding FTMO PipsPRO. Traders are strongly advised to exercise extreme caution and consider alternatives with more transparent and regulated practices.

FAQs

Q1: Is FTMO PipsPRO a regulated broker?

A1: No, FTMO PipsPRO is an unregulated broker, which means it operates without oversight or supervision by a financial regulatory authority.

Q2: What market instruments can I trade with FTMO PipsPRO?

A2: FTMO PipsPRO offers a range of market instruments, including cryptocurrencies, stock indices, forex pairs, energy commodities, individual company shares, options contracts, and exchange-traded funds (ETFs).

Q3: What are the maximum trading leverages available with FTMO PipsPRO?

A3: The maximum trading leverage varies depending on the instrument, ranging from 100X for cryptocurrencies to 5000X for specific assets like gold and Japanese market-related instruments.

Q4: Does FTMO PipsPRO offer educational resources for traders?

A4: No, FTMO PipsPRO does not appear to provide educational resources, which may be a limitation for traders seeking learning materials and support.

Q5: Are there reports of FTMO PipsPRO being associated with scams?

A5: Yes, there have been reports labeling FTMO PipsPRO as a scam. Traders should exercise extreme caution and conduct thorough research before engaging with this platform or similar unregulated brokers.

天眼交易商

热点资讯

监管变动预警:一个陷入疯狂,六个疑似跑路

超级CPI预警:当数据核弹引爆时,如何让交易商比你更慌?

华人外汇圈再现“杀猪盘”,大批“东方”鲜韭正被送往「赛博屠宰场」

日本加密货币政策大变革:税收降至20%,比特币储备计划受阻

华尔街拉响警报:美国经济衰退风险攀升,贸易战成“达摩克利斯之剑”

汇率计算