Maxx Empire

摘要:Maxx Empire is a brokerage company registered in Australia. The broker's official website has been closed, so traders cannot obtain more security information.

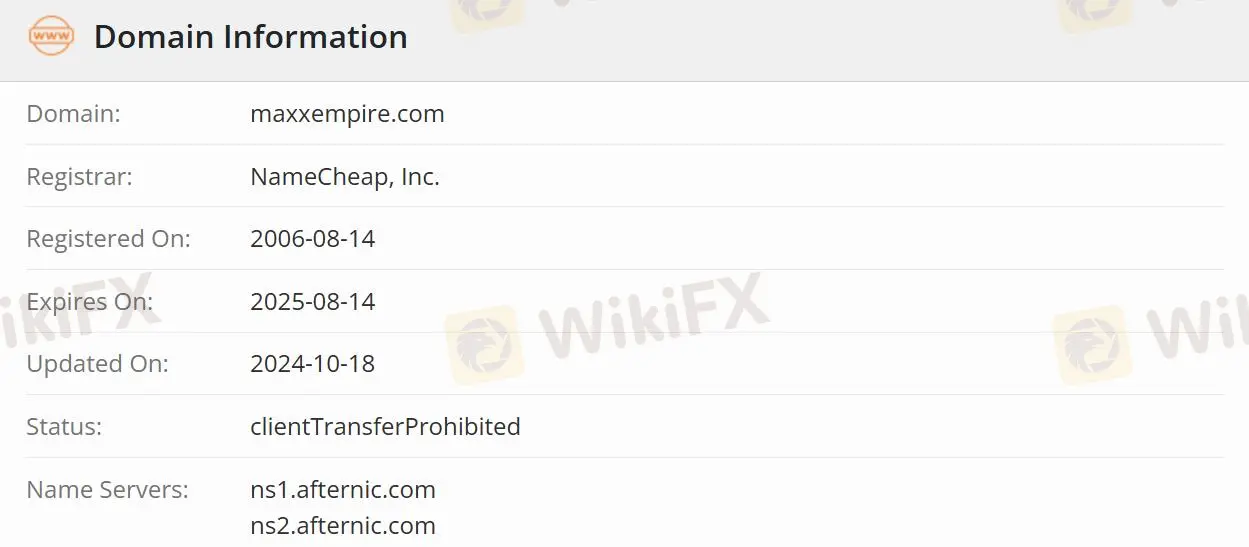

Note: Maxx Empire's official website: https://www.maxxempire.com/en/ is currently inaccessible normally.

Maxx Empire Information

Maxx Empire is a brokerage company registered in Australia. The broker's official website has been closed, so traders cannot obtain more security information.

Is Maxx Empire Legit?

| Australia Securities & lnvestment Commission(ASIC) |

| Current Status | Suspicious Clone |

| Regulated by | Australia |

| License Type | Appointed Representative(AR) |

| License No. | 001279178 |

| Licensed Institution | Huiyuan Capital Pty Ltd |

Maxx Empire is authorized and regulated by the Australia Securities & lnvestment Commission(ASIC), current status is Suspicious Clone, which will increase trading non-compliance and reduce traders investment security. Caution is advised when dealing with the Maxx Empire.

Downsides of Maxx Empire

- Unavailable Website

Maxx Empire's official website is currently inaccessible, raising concerns about its reliability and accessibility.

- Lack of Transparency

Since Maxx Empire does not explain more transaction information, especially regarding fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

The ASIC regulates the Maxx Empire. However, the Suspicious Clone status is less safe than a regulated one.

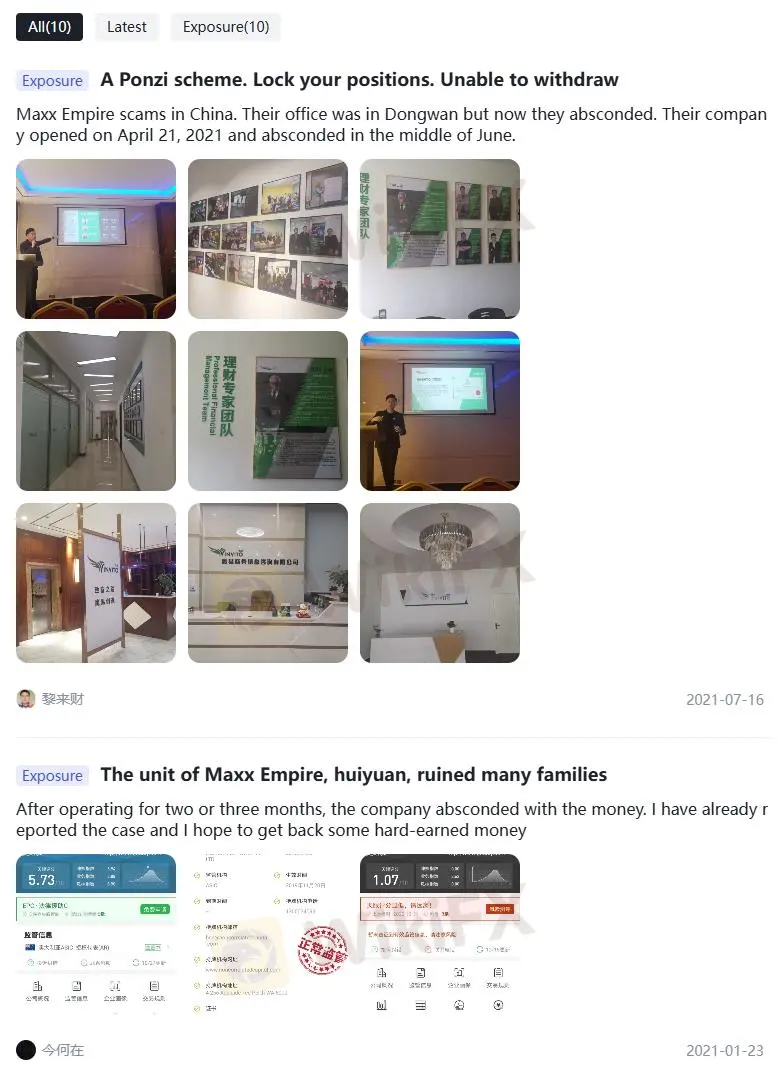

- Withdrawal Difficulty

According to a report on WikiFX, a user encountered significant difficulties with fund withdrawals and suspected scams. The issue remained unresolved despite the request being pending for a long time.

Negative Maxx Empire Reviews on WikiFX

On WikiFX, “Exposure” is posted as a word of mouth received from users.

Traders must review information and assess risks before trading on unregulated platforms. Please consult our platform for related details. Report fraudulent brokers in our Exposure section and our team will work to resolve any issues you encounter.

As of now, there are 10 pieces of Maxx Empire exposure.

Exposure. Cannot withdraw & Scams

| Classification | Unable to Withdraw/Scams |

| Date | 2020-2021 |

| Post Country | Hong Kong, China |

You may visit: https://www.wikifx.com/en/comments/detail/202107163722456069.html

https://www.wikifx.com/en/comments/detail/202005209012415533.html.

Conclusion

Maxx Empire Since the official website cannot be opened, traders cannot get more information about security services. In addition, the Suspicious Clone status indicates that this brokers trading risks are high. Traders can learn more about other brokers through WikiFX. Information improves transaction security.

天眼交易商

热点资讯

新手外汇交易者常见误区

美元/加元在1.4300以上盘整;上行潜力似乎有限

英镑/美元持稳于1.2500以下;较弱的美元起到顺风作用

今日外汇:美元回落,黄金创下新高,市场等待美国数据

美联储坚持鹰派言论,根据FXS美联储情绪指数

纽元/美元价格预测:在0.5700附近创下新的每周高点

美国1月ADP私营部门就业人数增加18.3万,预期为15万

白银价格预测:在美国ADP就业数据向好后,白银/美元放弃涨幅

金价因避险情绪刷新历史新高

由于数据喜忧参半,美元承压影响市场情绪

汇率计算