SYS

摘要:SYS, founded in Hong Kong in 2018, offers a wide range of trading assets, including equities, derivatives, fixed income, and funds. Boasting a user-friendly interface and competitive commission rates, SYS appeals to traders looking for accessible and economically viable trading options. With a minimum deposit requirement of $100 tailored to accommodate a wide range of investors, SYS facilitates entry into the financial markets with ease. Nevertheless, the absence of regulatory oversight exposes traders to inherent risks. Issues regarding investor protection, transparency, and vulnerability to fraudulent activities loom over the platform's operations. The lack of regulatory supervision underscores the importance of due diligence and cautious decision-making for traders navigating the unregulated landscape of SYS.

| Aspect | Information |

| Company Name | SYS |

| Registered Country/Area | Hong Kong |

| Founded year | 2018 |

| Regulation | Not regulated |

| Market Instruments | Equities, derivatives, fixed income, funds |

| Account Types | Standard account |

| Minimum Deposit | $100 |

| Maximum Leverage | Up to 1:30 |

| Commissions | Range from $0.005 to $0.02 per share |

| Trading Platforms | Proprietary trading platform |

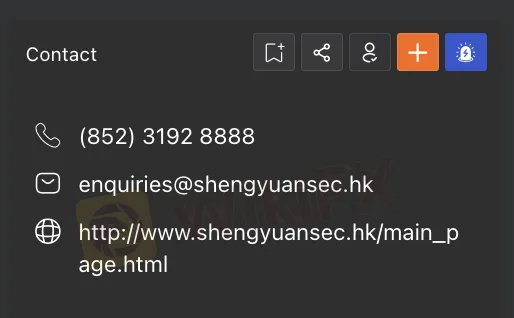

| Customer Support | Phone: (852) 3192 8888 |

| Deposit & Withdrawal | Email: enquiries@shengyuansec.hk |

Overview of SYS

SYS, founded in Hong Kong in 2018, offers a wide range of trading assets, including equities, derivatives, fixed income, and funds.

Boasting a user-friendly interface and competitive commission rates, SYS appeals to traders looking for accessible and economically viable trading options. With a minimum deposit requirement of $100 tailored to accommodate a wide range of investors, SYS facilitates entry into the financial markets with ease.

Nevertheless, the absence of regulatory oversight exposes traders to inherent risks. Issues regarding investor protection, transparency, and vulnerability to fraudulent activities loom over the platform's operations. The lack of regulatory supervision underscores the importance of due diligence and cautious decision-making for traders navigating the unregulated landscape of SYS.

Is SYS legit or a scam?

SYS is flagged as a suspicious clone by the Securities and Futures Commission (SFC) of Hong Kong, licensed for dealing in futures contracts under license number AVO470.

This regulatory designation by a reputable authority like the SFC signifies a heightened level of scrutiny and caution for traders. The status of being a suspicious clone raises questions about the platform's legitimacy and compliance with regulatory standards. Traders may hesitate to engage with SYS due to uncertainties surrounding its regulatory status, fearing potential risks related to fund security, market manipulation, and lack of investor protection. This regulatory uncertainty underscores the importance for traders to conduct thorough due diligence and exercise caution when considering trading on the platform.

Pros and Cons

| Pros | Cons |

| Low minimum deposit($100) | Unreliable customer support |

| Variety of payment methods | Limited regulatory oversight |

| Accessible leverage options up to 1:30 | Potential for fraudulent activity |

| User-friendly trading platform | Lack of transparency in operations |

| Wide range of trading assets including equities, derivatives, fixed income and fund | |

| Competitive commission rates ranging from $0.005 to $0.02 per share |

Pros:

Low minimum deposit ($100): The platform offers a low initial deposit requirement, making it accessible to traders with varying capital levels. This affordability lowers the barrier to entry for new traders, enabling them to start trading with minimal financial commitment.

Variety of payment methods: SYS supports multiple payment methods, including bank transfers and credit cards, providing traders with flexibility and convenience in funding their accounts. This variety allows traders to choose the payment option that best suits their preferences and circumstances

Accessible leverage options up to 1:30: SYS offers leverage options of up to 1:30, allowing traders to amplify their trading positions with a relatively smaller amount of capital. This accessibility to leverage enhances traders' ability to maximize potential returns on their investments.

User-friendly trading platform: The platform features a user-friendly interface, making it easy for traders to navigate and execute trades efficiently. Intuitive design and comprehensive features enhance the trading experience, particularly for novice traders who may be less familiar with complex trading platforms.

Wide range of trading assets: SYS provides a wide selection of trading assets, including equities, derivatives, fixed income, and funds. This breadth of offerings allows traders to diversify their portfolios and capitalize on various market opportunities across different asset classes.

Competitive commission rates ranging from $0.005 to $0.02 per share: The platform offers competitive commission rates for trades executed, with rates ranging from $0.005 to $0.02 per share. These cost-effective commission structures help traders minimize trading expenses, ultimately improving their profitability.

Cons:

Unreliable customer support: Traders have reported instances of unreliable customer support, including difficulties in reaching representatives and unresolved issues. This lack of responsiveness and effectiveness in addressing inquiries detracts from the overall user experience and can lead to frustration among traders.

Limited regulatory oversight: SYS operates without regulatory oversight, exposing traders to potential risks related to investor protection, transparency, and market integrity. The absence of regulatory supervision leaves traders vulnerable to fraudulent activities and other abuses, eroding trust in the platform and compromising the safety of their investments.

Potential for fraudulent activity: The lack of regulatory oversight increases the risk of fraudulent activity on the platform, including scams, manipulation, and misappropriation of funds. Traders should exercise caution and conduct thorough due diligence when engaging with SYS to mitigate the risk of falling victim to fraudulent schemes.

Lack of transparency in operations: The platform's operations may lack transparency, with limited visibility into key aspects such as order execution, pricing, and trade settlement. This lack of transparency can undermine traders' confidence in the fairness and reliability of the platform, leading to questions about the integrity of their trades.

Market Instruments

SYS offers access to a variety of trading assets across traditional and modern investment landscapes. Their roster includes:

Equities:

A broad range of Hong Kong and Mainland Chinese stocks, serving both domestic and international investors.

Participation in Initial Public Offerings (IPOs) for new listings on various Hong Kong and Mainland China exchanges.

Derivatives:

Futures contracts on various underlying assets such as commodities, currencies, and indices.

Options contracts offering hedging and speculative opportunities based on underlying equities, indices, and foreign exchange.

Fixed Income:

Bonds issued by governments and corporations, providing fixed income streams and varying risk profiles.

Structured products combining elements of different assets to offer tailor-made investment solutions.

Investment Funds:

Access to a wide range of mutual funds and unit trusts managed by various fund houses, covering various asset classes and investment strategies.

Additional offerings:

Margin financing and securities lending to leverage portfolio positions and generate income.

Corporate finance advisory services for businesses seeking capital raising or mergers and acquisitions

Account Types

The Standard Account offered by SYS provides traders with a straightforward trading experience.

With leverage capped at 1:30, this account type offers a balance between risk management and trading flexibility. Traders can execute trades with ease, benefiting from competitive commissions ranging from $0.005 to $0.02 per share.

The minimum initial deposit requirement of $100 AUD or equivalent ensures accessibility for a wide range of traders, including those with smaller capital. This account type is suitable for traders seeking a basic trading environment with standard features and cost-effective commission structures.

| Features | Standard Account |

| Leverage | 1:30 |

| Commission | $0.005 - $0.02 per share. |

| Min. Initial Deposit | $100 AUD or equivalent |

How to Open an Account?

Opening an account with SYS involves the following concrete steps:

Visit the Website: Begin by visiting the SYS website and locating the “Open Account” or “Register” button.

2. Complete Registration: Fill out the registration form with accurate personal information, including your full name, email address, contact details, and any other required information.

3. Submit Documentation: Upload supporting documents as required, such as a government-issued ID (e.g., passport or driver's license) and proof of address (e.g., utility bill or bank statement).

4. Fund Your Account: Once your account is verified, proceed to fund your trading account. SYS typically requires a minimum initial deposit, which may vary depending on the chosen account type.

5. Start Trading: Upon successful deposit, your SYS trading account will be activated, granting you access to the platform's trading features and functionalities. You can now start exploring the available trading assets, analyzing market trends, and executing trades according to your investment strategy.

Leverage

SYS offers a maximum leverage of 1:30 to traders.

This leverage ratio allows traders to control larger positions in the market with a relatively smaller amount of capital. While leverage can amplify potential profits, it also increases the level of risk, as losses can be magnified accordingly. Therefore, traders should exercise caution and employ risk management strategies when utilizing leverage in their trading activities on the SYS platform.

Spreads & Commissions

SYS charges commissions ranging from $0.005 to $0.02 per share for trades executed within the Standard Account.

This commission structure applies to each share traded and may vary depending on factors such as trading volume and market conditions. While the commissions are relatively low compared to other platforms, traders should consider these costs when planning their trading strategies.

The minimum initial deposit requirement of $100 AUD or equivalent ensures accessibility for traders of varying capital levels. Overall, the commission structure of SYS's Standard Account offers transparency and cost-effectiveness, enabling traders to make informed decisions while managing their trading expenses.

Trading Platform

SYS offers its clients a proprietary trading platform for accessing various financial instruments.

Features:

Multi-asset: Supports trading of equities, derivatives, fixed income, and investment funds.

Real-time market data: Provides live quotes, charts, and news feeds for various instruments.

Order placement: Allows for various order types (market, limit, stop-loss, etc.) and order management tools.

Technical analysis: Offers basic charting tools and technical indicators for market analysis.

Account management: Access to account overview, trading history, and fund management functions.

Deposit & Withdrawal

SYS accepts bank transfers and credit card payments as deposit methods. Traders can fund their accounts conveniently using these widely accepted payment options.

The minimum deposit requirement for SYS is $100 AUD or equivalent, ensuring accessibility for traders with varying capital levels. This minimum deposit threshold establishes a baseline investment level for users to initiate their trading activities on the platform.

Overall, the availability of bank transfers and credit card payments, along with the reasonable minimum deposit requirement, enhances accessibility and flexibility for traders using the SYS platform.

Customer Support

SYS provides customer support through phone and email channels, reachable at (852) 3192 8888 and enquiries@shengyuansec.hk.

However, users report dissatisfaction with the support services, citing difficulties in reaching representatives and unresolved issues. The lack of responsiveness and effectiveness in addressing inquiries leaves traders feeling frustrated and dissatisfied. Additionally, there are complaints about the unprofessional conduct of customer support staff, further exacerbating the negative perception of SYS.

Overall, the inadequate customer support infrastructure undermines traders' confidence in the platform and contributes to a negative trading experience.

Exposure

Users exposed to SYS, a clone firm, report being cheated out of approximately 190 million units without the ability to withdraw funds.

Notably, individuals associated with SYS exhibit a mainland accent. This situation casts a shadow of doubt over the platform's integrity and legitimacy, causing traders to question the safety of their investments and the reliability of the trading environment. The inability to withdraw funds compounds the issue, leaving traders feeling defrauded and frustrated.

The prevalence of mainland accents among SYS personnel further exacerbates dissatisfactions, suggesting potential fraudulent activity within the organization. As a result, traders are wary of engaging with SYS, highlighting the detrimental impact of such exposure on the platform's reputation and traders' confidence.

Conclusion

In conclusion, SYS, founded in Hong Kong in 2018, presents a range of advantages and disadvantages for traders. On the positive side, the platform offers accessibility and cost-effective trading solutions, with low minimum deposit requirements and competitive commission rates. Additionally, SYS provides a wide range of market instruments, including equities, derivatives, fixed income, and funds.

However, operating without regulatory oversight poses significant risks for traders, including issues about investor protection and susceptibility to fraudulent activities. The lack of regulatory supervision also contributes to a lack of transparency in operations, undermining traders' confidence in the platform. Additionally, the absence of specified account types, minimum deposit requirements, and maximum leverage ratios may limit traders' ability to tailor their trading experience to their individual needs.

FAQs

Q: What trading assets are available on SYS?

A: Equities, derivatives, fixed income, and funds.

Q: Is SYS regulated?

A: No, SYS operates without regulatory oversight.

Q: How can I contact customer support at SYS?

A: You can reach customer support via phone at (852) 3192 8888 or email at enquiries@shengyuansec.hk.

Q: What is the minimum deposit required to open an account with SYS?

A: The minimum deposit requirement is $100.

Q: What is the maximum leverage offered by SYS?

A: The maximum leverage offered is up to 1:30.

天眼交易商

热点资讯

干货分享!外汇天眼汇市生存指南:风暴翻盘,财富突围

WikiEXPO成为利伯兰官方合作伙伴,共同推动全球金融交易领域创新与健康发展

监管变动预警:盈透证券(IB)被两地撤销牌照

汇率计算