Lotas Capital

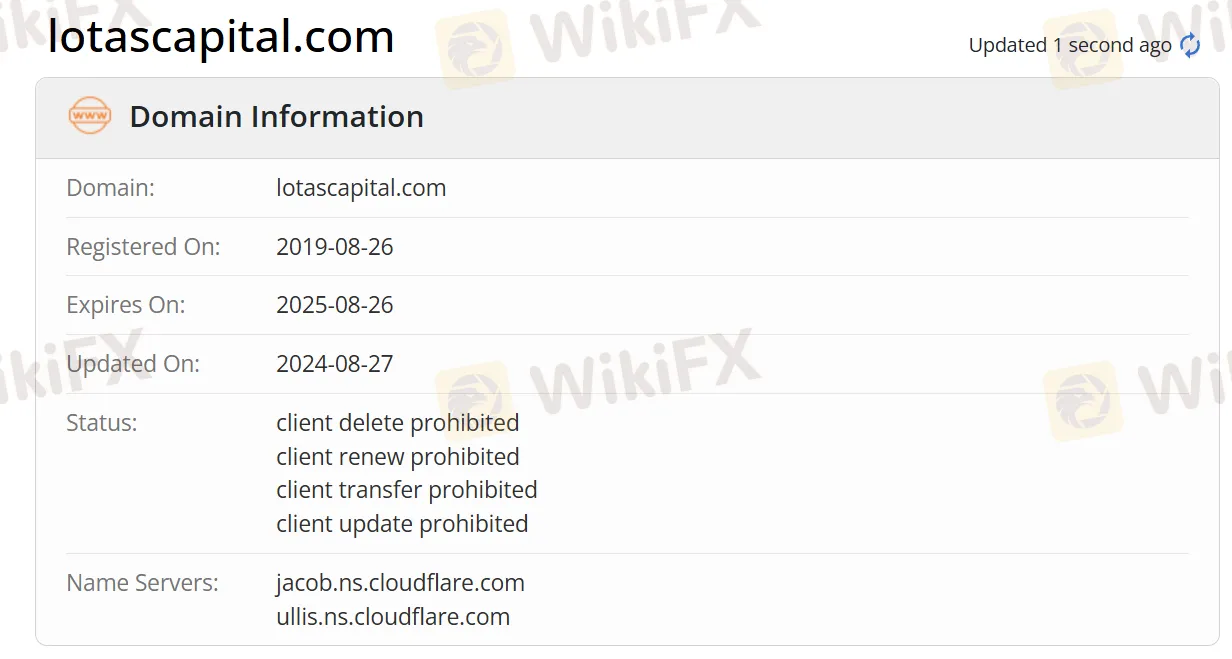

摘要:Lotas Capital offers a diverse portfolio of 106 products, including currency pairs, CFDs, stocks, and cryptocurrencies. Lotas Capital supports trading on the MT5 platform, which can be used on a variety of devices. However, this company is not regulated, which means potential risks cannot be ignored.

| Lotas CapitalReview Summary | |

| Founded | 2017 |

| Registered Country/Region | Saint Lucia |

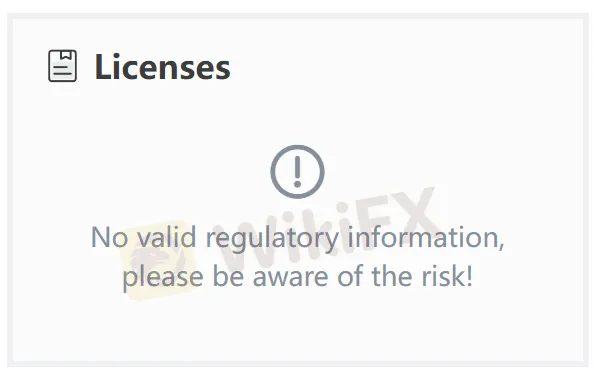

| Regulation | No Regulation |

| Market Instruments | Currency pairs, CFDs, stocks, and cryptocurrencies |

| Demo Account | / |

| Leverage | Up to 1:400 |

| Spread | From 1.8 pips |

| Trading Platform | MT5 |

| Minimum Deposit | / |

| Customer Support | Contact form |

| Email: info@lotascapital.com | |

| Phone: 44 7537 166150 | |

| Address: P.B. 1257 2 Pozitano Str., fl. 5, 1000 Sofia Center, Sofia, Bulgaria | |

| Regional Restrictions | Turkey, USA, Canada, Iran, Myanmar, North Korea, Russia |

Lotas Capital Information

Lotas Capital offers a diverse portfolio of 106 products, including currency pairs, CFDs, stocks, and cryptocurrencies. Lotas Capital supports trading on the MT5 platform, which can be used on a variety of devices. However, this company is not regulated, which means potential risks cannot be ignored.

Pros & Cons

| Pros | Cons |

| A variety of financial products | No regulation |

| Five types of accounts offered | Lack of transparency |

| MT5 supported | Regional restriction |

Is Lotas Capital Legit?

Lotas Capital is not regulated, and traders are advised to exercise caution when trading and use funds prudently.

What Can I Trade on Lotas Capital?

Lotas Capital offers a variety of tradable financial instruments, including Forex, Metals, Commodities, Stocks , and Cryptocurrencies.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

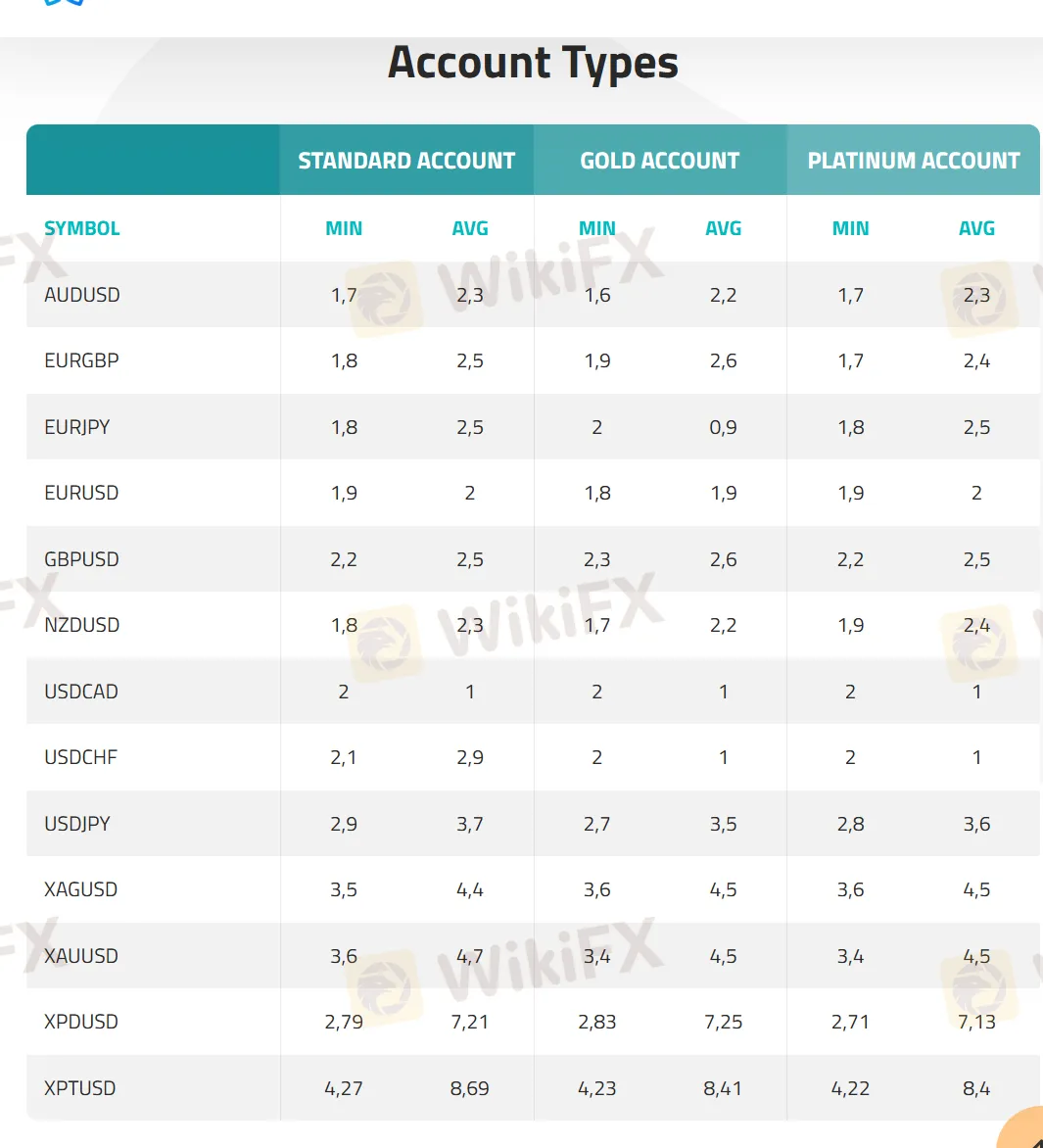

Account Types

Lotas Capital offers three types of real accounts: Standard, Gold, Platinum, ECN, and Swap-Free Account. Each account type has different features.

| Account Type | Spread (EUR/USD) | Leverage | Commission |

| Standard Account | From 1.9 pips | 1:200 | / |

| Gold Account | From 1.8 pips | 1:200 | / |

| Platinum Account | From 1.9 pips | 1:200/1:400 | / |

| ECN Account | Raw spread | 1:200 | $6 per lot |

| Swap-Free Account | Low spread | / | / |

Leverage

For most of the accounts, the leverage is 1:200. For Platinum Account, the leverage can be 1:200 or 1:400. Customers need to consider carefully before opening an account, since high leverage is likely to bring high potential risks.

Trading Platform

Lotas Capital supports trading on the MT5 platform, which can be used on a variety of devices.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Desktop, Mobile, Web | Experienced traders |

| MT4 | ❌ | / | Beginners |

天眼交易商

热点资讯

澳洲ASIC动真格了,外汇CFD行业大整顿,大佬平台连夜整改!

监管风险预警:这些经纪商监管信息变更,牌照被撤销或套牌、无证经营

YK换壳登场:共同基金冒充外汇经纪商,HTFX旧套路或再现

汇率计算