Icahn Enterprises

摘要:Icahn Enterprises FX, a subsidiary of Icahn Enterprises LP, offers trading services in the financial markets. Operating under the leadership of Mr. Carl Icahn, the company is headquartered in Milton Towers, Sunny Isles Beach, Florida. Founded on February 17, 1987, Icahn Enterprises FX provides access to a 1000+ currencies. With competitive spreads and a user-friendly mobile trading platform, it attracts traders seeking convenience and cost-effective trading options. However, the platform's lack of regulatory oversight may pose challenges for some traders, necessitating careful consideration before engaging with the platform.

| Aspect | Information |

| Company Name | Icahn Enterprises FX |

| Registered Country/Area | United States |

| Founded Year | 1987 |

| Regulation | Unregulated |

| Market Instruments | Forex |

| Account Types | N/A |

| Minimum Deposit | 4,000 yen |

| Maximum Leverage | N/A |

| Spreads | Competitive (e.g., USD/JPY: 0.2 pips) |

| Trading Platforms | Icahn Enterprises FX Trading Platform |

| Customer Support | +1 781 575 4223 |

Overview of Icahn Enterprises FX

Icahn Enterprises FX, a subsidiary of Icahn Enterprises LP, offers trading services in the financial markets. Operating under the leadership of Mr. Carl Icahn, the company is headquartered in Milton Towers, Sunny Isles Beach, Florida. Founded on February 17, 1987, Icahn Enterprises FX provides access to a 1000+ currencies.

With competitive spreads and a user-friendly mobile trading platform, it attracts traders seeking convenience and cost-effective trading options. However, the platform's lack of regulatory oversight may pose challenges for some traders.

Regulatory Status

Icahn Enterprises FX operates without regulation, rendering it unauthorized for trading activities.

Pros and Cons

| Pros | Cons |

| Competitive spreads (e.g., USD/JPY: 0.2 pips, JPY/GBP: 1.0 pips) | Limited range of trading assets |

| Mobile phone trading platform available | Lack of regulatory oversight |

| 1000 currencies available | User exposure about unresponsive to complaints |

Market Instruments

Icahn Enterprises FX provides a comprehensive selection of forex trading assets, empowering users with precise control over position management.

By offering trading in currency increments rather than the standard, traders can optimize their strategies. For instance, trading USD/JPY typically requires a margin at a ratio. However, with currency increments, the margin reduces, facilitating smaller transactions.

Spreads & Commissions

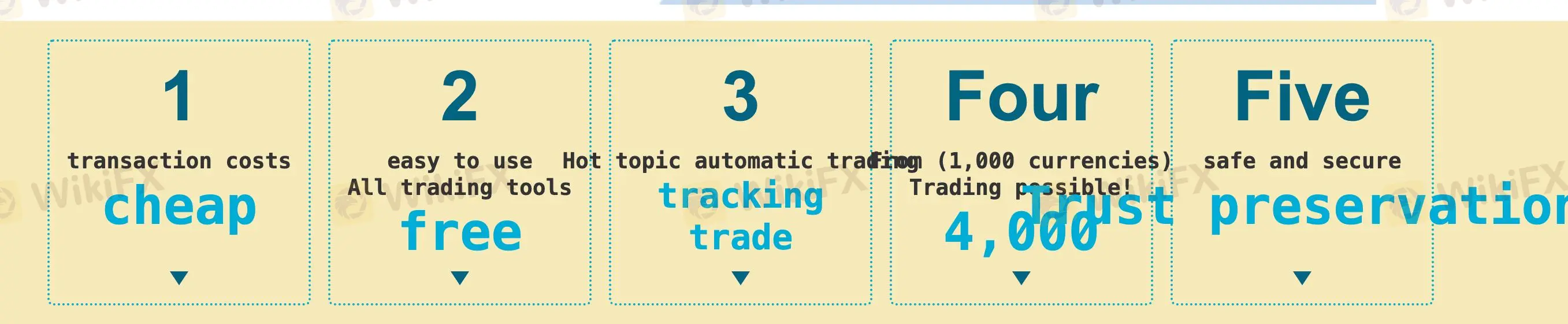

At Icahn Enterprises FX, transaction costs are notably low, with spreads ranking among the narrowest in the industry. For instance, the spread for USD/JPY stands at 0.2 pips, while for JPY/GBP, it is 1.0 pip.

Trading Platform

Icahn Enterprises FX offers a proprietary trading platform known as the Icahn Enterprises FX Trading Platform.

This platform is compatible with iOS, Android, and Mac operating systems, providing flexibility for users across different devices.

The Android version of the platform is highlighted for its trading speed and competitive advantage, featuring one-touch trading, customizable screen layouts, access to trading history data, advanced drawing tools, and over 30 indicators for market analysis and account management.

An offline mode is available, allowing users to access price and graph data even without an internet connection. The platform is available for free download from the respective app stores.

Deposit & Withdrawal

Enterprises FX Transactions offer a flexible minimum deposit requirement, starting from 4,000 yen.

This allows traders to initiate transactions with a relatively small amount, facilitating entry into the market for beginners or those seeking to minimize risk. With the option to trade in 1,000 currency increments rather than the conventional 10,000, traders gain enhanced control over position management. For instance, trading 10,000 USD/JPY with a 1 dollar = 100 yen ratio typically requires a 40,000 yen margin. However, with the ability to trade in 1,000 currencies, the margin reduces to 4,000 yen, enabling traders to engage in transactions with smaller amounts.

Moreover, the platform permits up to 10 positions with varying rates for each 1,000 currencies.

Customer Support

Icahn Enterprises FX offers a single customer support channel via phone to assist users with inquiries and risks. Their dedicated support team can be reached via phone at +1 781 575 4223, providing prompt assistance and guidance.

Exposure

User reviews of Icahn Enterprises FX reveal a significant level of dissatisfaction and distrust among some users.

One reviewer alleges the company's failure to deliver promised profits and accuses them of being unresponsive to complaints.

Such negative experiences can erode trust in the platform and discourage potential traders from engaging with it. The exposure of such reviews can also tarnish the platform's reputation, potentially leading to decreased user activity and participation.

Conclusion

Icahn Enterprises FX, a subsidiary of Icahn Enterprises LP, offers trading services primarily in forex markets with over 1000 currency options. The platform attracts traders with its competitive spreads and user-friendly mobile trading platform. However, the absence of regulatory oversight poses risks for traders, necessitating caution.

FAQs

What is the minimum deposit required to start trading with Icahn Enterprises FX?

The minimum deposit is 4,000 yen, allowing traders to begin trading with a relatively small investment.

How can I contact customer support at Icahn Enterprises FX?

You can reach customer support via phone at +1 781 575 4223, email, or live chat for prompt assistance.

What trading instruments are available on Icahn Enterprises FX?

Icahn Enterprises FX offers forex trading with over 1000 currency options, providing diversified trading opportunities.