Garanti BBVA

摘要: Garanti BBVA is a leading comprehensive financial institution in Turkey, affiliated with the Spanish BBVA Group. Combining local service experience with international financial perspectives, it provides full-category financial solutions for individual and corporate clients.

| Garanti BBVA Review Summary | |

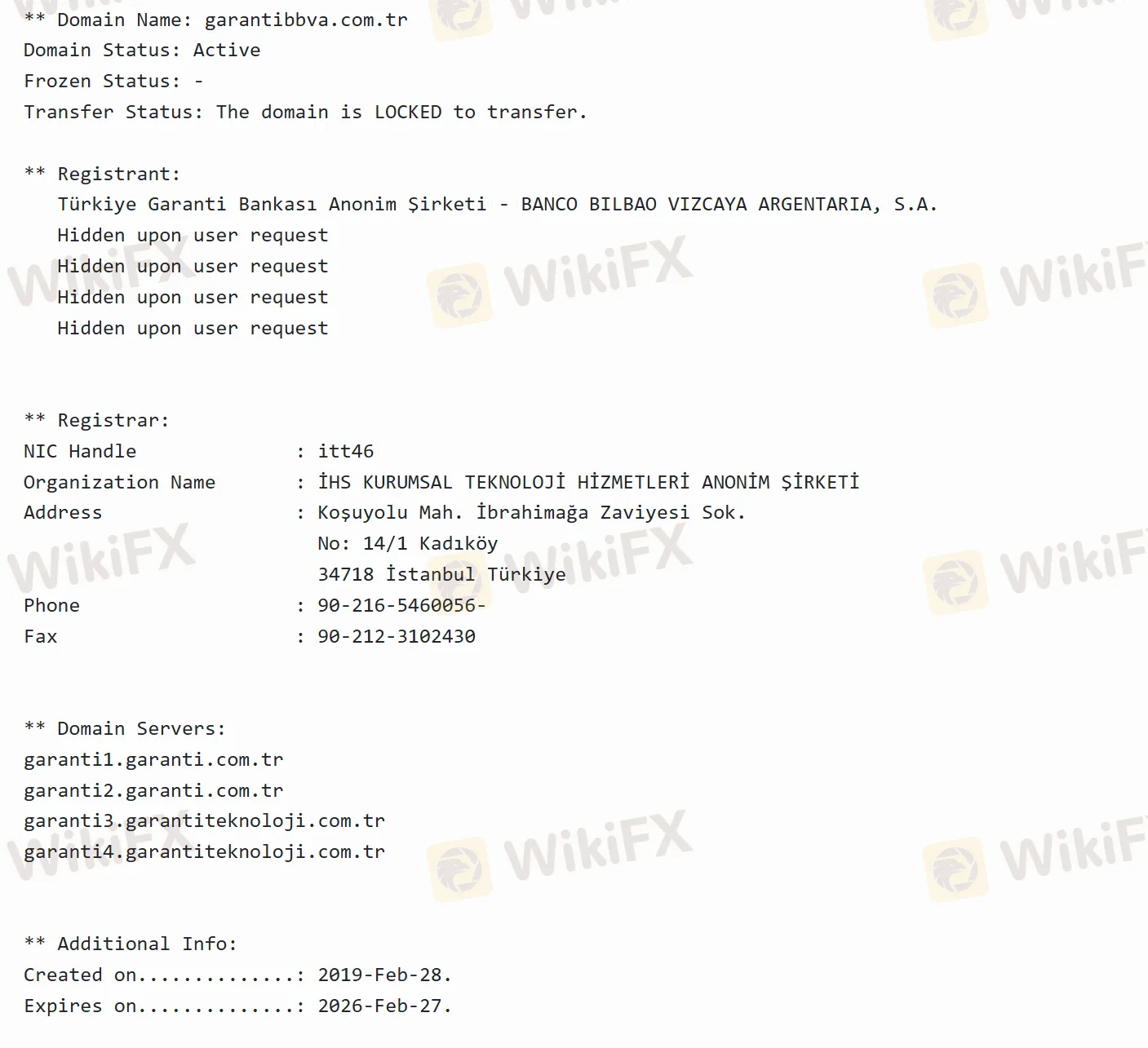

| Founded | 2019 |

| Registered Country/Region | Turkey |

| Regulation | No regulation |

| Trading Products | Investment Funds, Derivatives, Stocks |

| Trading Platform | Garanti BBVA eTrader |

| Customer Support | Facebook, Twitter, Instagram, YouTube, LinkedIn |

Garanti BBVA Information

Garanti BBVA is a leading comprehensive financial institution in Turkey, affiliated with the Spanish BBVA Group. Combining local service experience with international financial perspectives, it provides full-category financial solutions for individual and corporate clients.

Its business covers deposits, loans, investments, insurance, pensions, payment services, private banking, and other fields, and has a collaborative service system of digital channels (mobile banking, internet banking) and offline branch networks (including exclusive private banking outlets).

Pros and Cons

| Pros | Cons |

| Diversified services offerred | No regulation |

| Multiple account types | Limited trading products |

| Common payment methods | Low fee transparency |

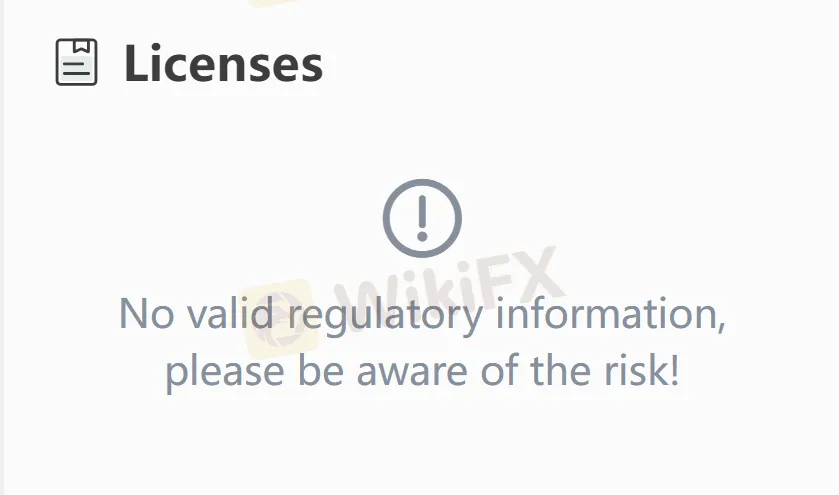

Is Garanti BBVA Legit?

Garanti BBVA is not supervised by any regulatory authority, even though it claims to have complete financial licensing qualifications.

What Can I Trade on Garanti BBVA?

| Trading Products | Supported |

| Investment Funds | ✔ |

| Derivatives | ✔ |

| Stocks | ✔ |

| Forex | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

| Category | Account Type | Features |

| Savings Accounts | e-Savings Account | Flexible withdrawals |

| NET Account | Clear maturity returns | |

| Cumulative Gold Account | Monthly gold (systematic gold investment) | |

| Time Deposit Accounts | TL/Foreign Exchange Time Deposits | Fixed-term deposits in Turkish Lira or foreign currencies |

| Interim Interest Yield Time Deposits | Installment interest payments | |

| Investment Accounts | Custodial Accounts | For fund subscriptions & stock trading; requires separate opening & risk assessment |

| Credit & Payment Accounts | Loan Accounts | Universal purpose loans, mortgage loans, auto loans, overdraft accounts (with installment function) |

| Card Accounts | Credit cards (e.g., Bonus Platinum, Miles & Smiles) & debit cards (Paracard Bonus series), supporting spending, transfers, and cash withdrawals | |

| Exclusive Service Accounts | Private Banking Accounts | Requires asset thresholds; offers customized wealth management, dedicated account managers, and premium services |

| Special Group Accounts | YUVAM (for non-resident Turkish citizens), Bonus Genç (student credit cards) |

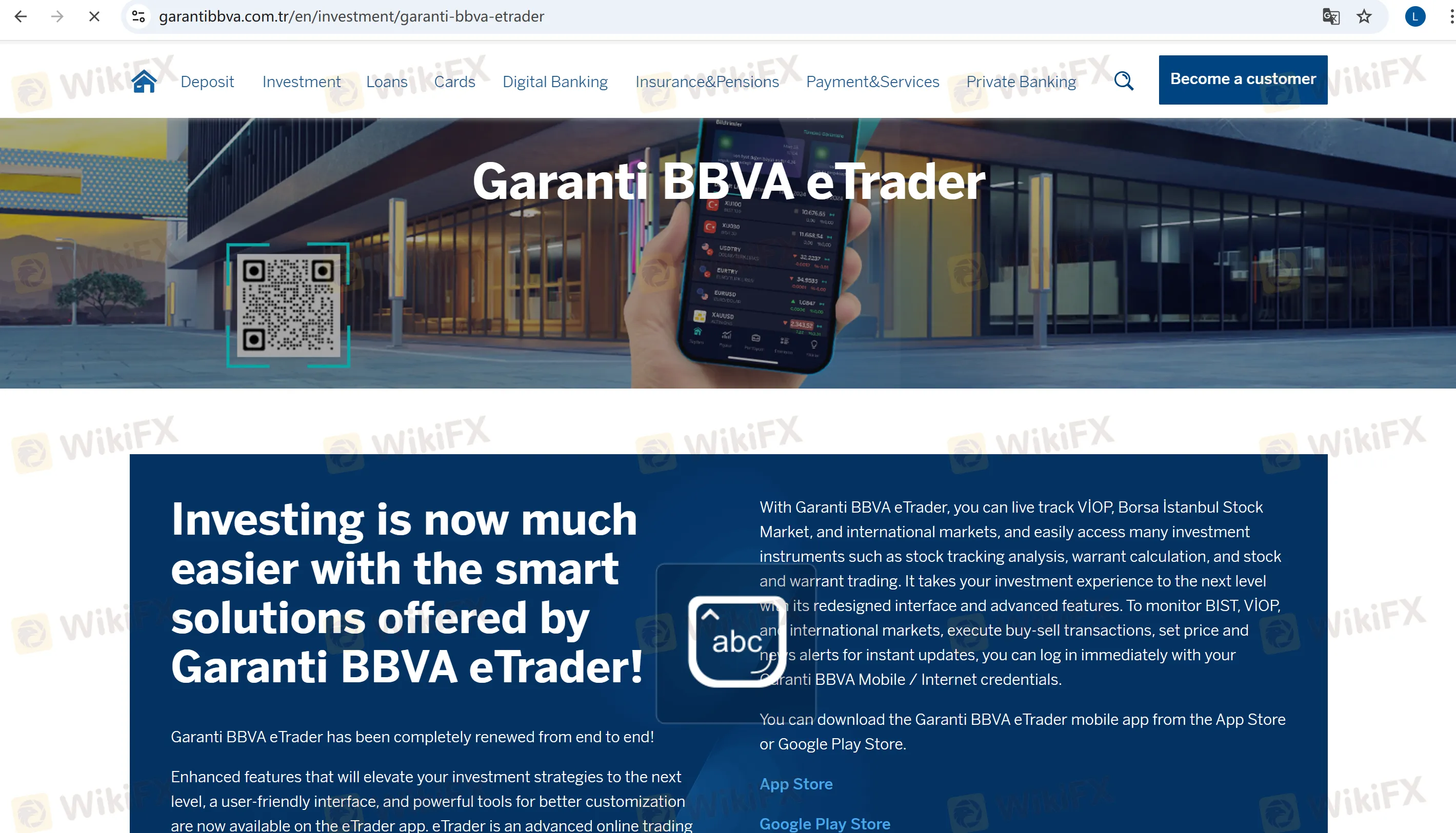

Trading Platform

| Trading Platform | Supported | Available Devices |

| Garanti BBVA eTrader | ✔ | Web, iOS, Android |

Deposit and Withdrawal

| Deposit Methods | Details |

| Offline Channels | Cash deposits at branch counters, ATM deposits (supports Paracard/BV credit cards) |

| Online Channels | Transfers via internet/mobile banking (domestic/international telegraphic transfers), Western Union receipt, third-party payment platform top-ups (limited to supported accounts) |

| Withdrawal Methods | Details |

| Cash | ATMs (supports overseas UnionPay/MasterCard withdrawals; fees may apply), counter withdrawals |

| Transfer | To other personal accounts, international telegraphic transfers (requires SWIFT code), Western Union payments |

天眼交易商

热点资讯

预测交易,正在成为传统外汇平台的新宠

蹭“MT5”名气玩套路 这个平台的两个美国“牌照”均可查,但备案不等于牌照!

黄金锁仓也会爆仓?金荣中国平台黄金价差13.64美元合理吗?

汇率计算