2025-01-31 22:55

业内Understanding Forex Market Time Zone

#firstdealofthenewyearFateema

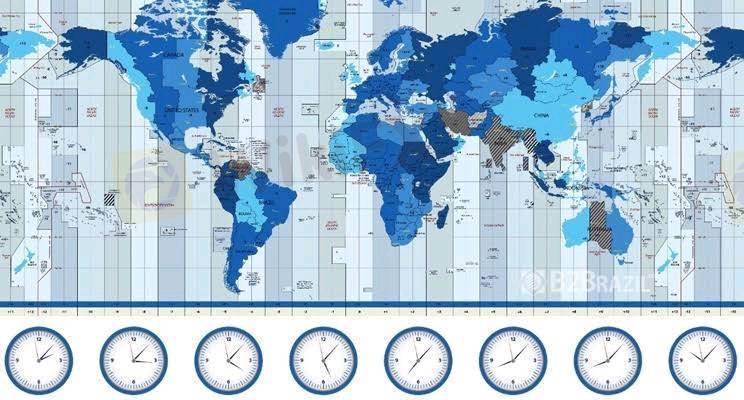

The forex market operates 24 hours a day, five days a week, across different time zones. This continuous operation allows traders to participate in the market at almost any time. Below is a breakdown of the major forex trading sessions and their corresponding time zones:

1. Sydney Session (Asia-Pacific)

*. Time Zone: GMT +10 (AEST) / GMT +11 (AEDT during daylight saving time).

*. Trading Hours: 10:00 PM – 7:00 AM GMT.

*. Key Currencies: AUD, NZD, JPY.

*. Characteristics:

a) The session is relatively quiet compared to others.

b) Focus on AUD and NZD pairs due to their connection to the Australian and New Zealand economies.

2. Tokyo Session (Asian)

*. Time Zone: GMT +9 (JST).

*. Trading Hours: 12:00 AM – 9:00 AM GMT.

*. Key Currencies: JPY, AUD, NZD.

*. Characteristics:

a) Increased volatility, especially during the overlap with the Sydney session.

b) JPY pairs (e.g., USD/JPY, EUR/JPY) are actively traded.

c) Liquidity is moderate, with a focus on Asian markets.

3. London Session (European)

*. Time Zone: GMT +0 (GMT) / GMT +1 (BST during daylight saving time).

*. Trading Hours: 8:00 AM – 5:00 PM GMT.

*. Key Currencies: EUR, GBP, CHF.

* Characteristics:

a) The most liquid and volatile session, accounting for the majority of forex trading volume.

b) Major economic data releases from Europe (e.g., UK, Germany, France) often occur during this session.

c) Overlaps with the New York session, creating the most active trading period.

4. New York Session (North American)

*. Time Zone: GMT -5 (EST) / GMT -4 (EDT during daylight saving time).

*. Trading Hours: 1:00 PM – 10:00 PM GMT.

*. Key Currencies: USD, CAD, MXN.

*. Characteristics:

a) High liquidity, especially during the overlap with the London session (1:00 PM – 5:00 PM GMT).

b) USD pairs (e.g., EUR/USD, GBP/USD) are heavily traded.

c) Major U.S. economic data (e.g., Non-Farm Payrolls, CPI) is released during this session.

5. Overlapping Sessions

*. London & New York Overlap (1:00 PM – 5:00 PM GMT):

a) The most active trading period, with high liquidity and volatility.

b) Ideal for day traders looking for quick opportunities.

*. Sydney & Tokyo Overlap (12:00 AM – 7:00 AM GMT):

a) Moderate activity, with a focus on JPY, AUD, and NZD pairs.

6. Weekend Closure

*. The forex market closes on Friday at 10:00 PM GMT (New York session) and reopens on Sunday at 10:00 PM GMT (Sydney session).

*. During weekends, the market is closed, and no trading occurs.

key Note

a) Best Times to Trade: The London and New York sessions (especially during their overlap) offer the highest liquidity and volatility.

b) Quiet Times: The Sydney session and late New York session are typically quieter, with fewer trading opportunities.

c) Time Zone Adjustments: Be mindful of daylight saving time changes, as trading hours may shift slightly during the year.

By understanding the forex market time zones, you can plan your trading activities to align with the most active and liquid periods, increasing your chances of success.

赞 0

Palomaeuro

交易者

热门讨论

业内

哎,现在明白不赌就是赢啊

行情分析

美元/加元技术面

技术指标

外汇技术分析之波浪理论

业内

[活動]論交易,贏取200元話費補貼

技术指标

EZ.Fury Kite是基于趋势指标MA进行判断

技术指标

指标派是什么?

集市分类

平台

展会

IB

招聘

EA

业内

行情

指标

Understanding Forex Market Time Zone

尼日利亚 | 2025-01-31 22:55

尼日利亚 | 2025-01-31 22:55#firstdealofthenewyearFateema

The forex market operates 24 hours a day, five days a week, across different time zones. This continuous operation allows traders to participate in the market at almost any time. Below is a breakdown of the major forex trading sessions and their corresponding time zones:

1. Sydney Session (Asia-Pacific)

*. Time Zone: GMT +10 (AEST) / GMT +11 (AEDT during daylight saving time).

*. Trading Hours: 10:00 PM – 7:00 AM GMT.

*. Key Currencies: AUD, NZD, JPY.

*. Characteristics:

a) The session is relatively quiet compared to others.

b) Focus on AUD and NZD pairs due to their connection to the Australian and New Zealand economies.

2. Tokyo Session (Asian)

*. Time Zone: GMT +9 (JST).

*. Trading Hours: 12:00 AM – 9:00 AM GMT.

*. Key Currencies: JPY, AUD, NZD.

*. Characteristics:

a) Increased volatility, especially during the overlap with the Sydney session.

b) JPY pairs (e.g., USD/JPY, EUR/JPY) are actively traded.

c) Liquidity is moderate, with a focus on Asian markets.

3. London Session (European)

*. Time Zone: GMT +0 (GMT) / GMT +1 (BST during daylight saving time).

*. Trading Hours: 8:00 AM – 5:00 PM GMT.

*. Key Currencies: EUR, GBP, CHF.

* Characteristics:

a) The most liquid and volatile session, accounting for the majority of forex trading volume.

b) Major economic data releases from Europe (e.g., UK, Germany, France) often occur during this session.

c) Overlaps with the New York session, creating the most active trading period.

4. New York Session (North American)

*. Time Zone: GMT -5 (EST) / GMT -4 (EDT during daylight saving time).

*. Trading Hours: 1:00 PM – 10:00 PM GMT.

*. Key Currencies: USD, CAD, MXN.

*. Characteristics:

a) High liquidity, especially during the overlap with the London session (1:00 PM – 5:00 PM GMT).

b) USD pairs (e.g., EUR/USD, GBP/USD) are heavily traded.

c) Major U.S. economic data (e.g., Non-Farm Payrolls, CPI) is released during this session.

5. Overlapping Sessions

*. London & New York Overlap (1:00 PM – 5:00 PM GMT):

a) The most active trading period, with high liquidity and volatility.

b) Ideal for day traders looking for quick opportunities.

*. Sydney & Tokyo Overlap (12:00 AM – 7:00 AM GMT):

a) Moderate activity, with a focus on JPY, AUD, and NZD pairs.

6. Weekend Closure

*. The forex market closes on Friday at 10:00 PM GMT (New York session) and reopens on Sunday at 10:00 PM GMT (Sydney session).

*. During weekends, the market is closed, and no trading occurs.

key Note

a) Best Times to Trade: The London and New York sessions (especially during their overlap) offer the highest liquidity and volatility.

b) Quiet Times: The Sydney session and late New York session are typically quieter, with fewer trading opportunities.

c) Time Zone Adjustments: Be mindful of daylight saving time changes, as trading hours may shift slightly during the year.

By understanding the forex market time zones, you can plan your trading activities to align with the most active and liquid periods, increasing your chances of success.

赞 0

我也要评论

提问

0条评论

还没人评论,赶紧抢占沙发

提问

还没人评论,赶紧抢占沙发