2025-02-21 18:47

业内USD performance against major currencies post-rate

#FedRateCutAffectsDollarTrend

USD Performance Against Major Currencies Post-Rate Cut

The performance of the U.S. dollar (USD) after a Fed rate cut is influenced by several factors, including the magnitude of the rate cut, the economic context, market expectations, and the monetary policies of other central banks. Below, we’ll explore how the USD tends to perform against major currencies (EUR, JPY, GBP, CAD, and AUD) in the aftermath of a Fed rate cut.

1. USD vs. Euro (EUR/USD)

a. Immediate Reaction:

• USD Weakening: The Euro (EUR) is often one of the primary beneficiaries when the Fed cuts rates. This is because a rate cut typically makes U.S. assets less attractive due to lower yields. As a result, traders may sell USD and buy EUR.

• Trend: If the rate cut signals a prolonged dovish stance by the Fed, the EUR/USD pair could see sustained upward movement, as traders anticipate continued weakness in the USD.

Example:

• 2019: The Fed cut rates multiple times in 2019, and the EUR/USD exchange rate tended to rise as the USD weakened in response to the cuts, especially as the market anticipated further cuts.

b. Long-Term Effects:

• Over the longer term, the USD may weaken further if the rate cuts are accompanied by signals of economic slowdown, or if the Fed hints at future dovish policies. In contrast, if the European Central Bank (ECB) is also dovish, the impact on EUR/USD might be less pronounced.

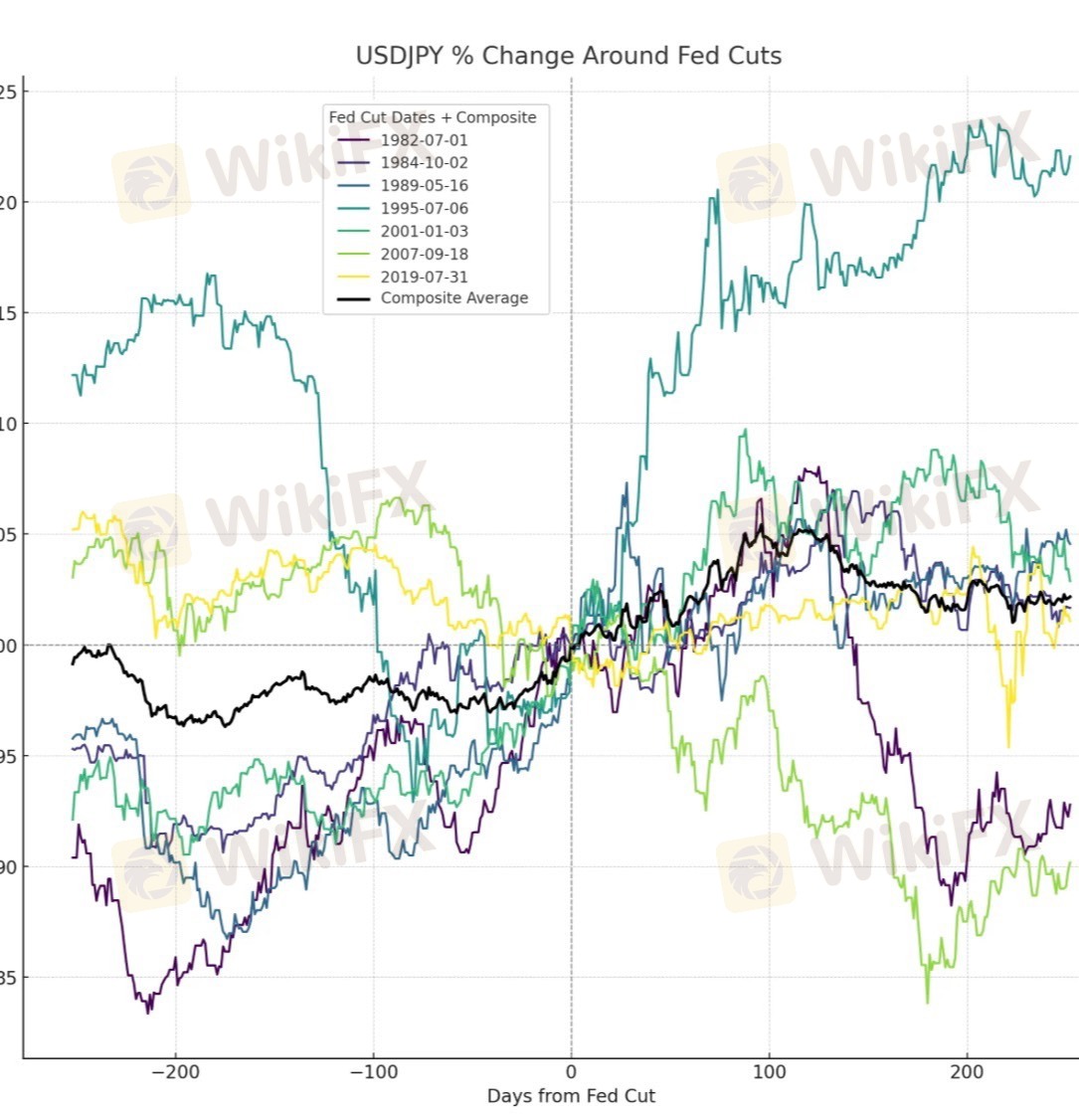

2. USD vs. Japanese Yen (USD/JPY)

a. Immediate Reaction:

• USD Weakening vs. JPY: The Japanese yen (JPY) is traditionally seen as a safe-haven currency. If the Fed cuts rates due to economic concerns or a potential slowdown, the market could view this as a risk-off signal, which may lead traders to flock to the yen. In this case, the USD/JPY pair would likely decline (USD weaker against JPY).

b. Risk Sentiment and Safe-Haven Flows:

• The yen tends to perform well during times of global economic uncertainty, so if the rate cut is seen as a response to weak economic data or recession fears, the USD/JPY pair may fall sharply, reflecting a flight to safety.

Example:

• During periods of global risk aversion (e.g., 2020 during the COVID-19 pandemic), the USD/JPY pair fell as traders sought safe-haven assets like the JPY, despite rate cuts from the Fed.

3. USD vs. British Pound (GBP/USD)

a. Immediate Reaction:

• GBP Strengthening: The British pound (GBP) often responds positively to a Fed rate cut if traders view the cut as a sign of weakness in the U.S. economy. The GBP/USD pair may rise as traders sell USD in favor of the pound.

• Relative Monetary Policy: The performance of the GBP against the USD also depends on the monetary policy stance of the Bank of England (BoE). If the BoE is expected to be more hawkish (i.e., keeping interest rates stable or even increasing them), the GBP/USD pair could rise more sharply after a rate cut from the Fed.

Example:

• In 2016, following the Brexit vote, the USD initially gained against the pound, but in the months after the Fed’s rate cuts, the GBP/USD pair started to recover, driven by the Fed’s dovish stance and improving UK economic data.

4. USD vs. Canadian Dollar (USD/CAD)

a. Immediate Reaction:

• USD Weakening vs. CAD: The Canadian dollar (CAD) is often influenced by the price of oil, as Canada is a major oil exporter. However, a rate cut by the Fed can also make the USD less attractive, leading to a weaker USD and a stronger CAD in the short term, especially if oil prices are stable or rising.

• Interest Rate Differentials: The Bank of Canada (BoC) policy also plays a significant role. If the BoC holds rates steady or is less dovish than the Fed, the USD/CAD pair may fall post-rate cut, reflecting an interest rate differential in favor of the CAD.

Example:

• After the Fed rate cuts in 2019, the USD/CAD pair weakened as the Fed’s dovish outlook prompted a stronger CAD in comparison. If oil prices were stable or rising, the CAD would also be supported, making the USD/CAD rate drop.

5. USD vs. Australian Dollar (USD/AUD)

a. Immediate Reaction:

• USD Weakening vs. AUD: The Australian dollar (AUD) is closely tied to global commodity prices (especially iron ore, coal, and gold), but it can also benefit from rate cuts in the U.S. if they signal economic weakness. As the USD weakens, the AUD tends to strengthen, particularly if the Fed’s actions lower yields on U.S. assets and push traders toward higher-yielding currencies.

b. Commodity Prices and Risk Appetite:

• A rate cut that signals an economic slowdown can push traders toward higher-risk assets, including the AUD. If the global economic outlook remains strong and commodity prices rise, the AUD could outperform the USD.

Example:

• After the Fed rate cuts in 2020 during the COVID-19 pandemic, the USD/AUD pair initially saw significant fluctuations. The Fed’s rate cuts, combined with rising commodity prices, caused a weaker USD and stronger AUD in the medium term.

6. General Trends in USD Post-Ra

赞 0

FX1172222260

交易者

热门讨论

业内

哎,现在明白不赌就是赢啊

行情分析

美元/加元技术面

技术指标

外汇技术分析之波浪理论

业内

[活動]論交易,贏取200元話費補貼

技术指标

EZ.Fury Kite是基于趋势指标MA进行判断

技术指标

指标派是什么?

集市分类

平台

展会

IB

招聘

EA

业内

行情

指标

USD performance against major currencies post-rate

印度 | 2025-02-21 18:47

印度 | 2025-02-21 18:47#FedRateCutAffectsDollarTrend

USD Performance Against Major Currencies Post-Rate Cut

The performance of the U.S. dollar (USD) after a Fed rate cut is influenced by several factors, including the magnitude of the rate cut, the economic context, market expectations, and the monetary policies of other central banks. Below, we’ll explore how the USD tends to perform against major currencies (EUR, JPY, GBP, CAD, and AUD) in the aftermath of a Fed rate cut.

1. USD vs. Euro (EUR/USD)

a. Immediate Reaction:

• USD Weakening: The Euro (EUR) is often one of the primary beneficiaries when the Fed cuts rates. This is because a rate cut typically makes U.S. assets less attractive due to lower yields. As a result, traders may sell USD and buy EUR.

• Trend: If the rate cut signals a prolonged dovish stance by the Fed, the EUR/USD pair could see sustained upward movement, as traders anticipate continued weakness in the USD.

Example:

• 2019: The Fed cut rates multiple times in 2019, and the EUR/USD exchange rate tended to rise as the USD weakened in response to the cuts, especially as the market anticipated further cuts.

b. Long-Term Effects:

• Over the longer term, the USD may weaken further if the rate cuts are accompanied by signals of economic slowdown, or if the Fed hints at future dovish policies. In contrast, if the European Central Bank (ECB) is also dovish, the impact on EUR/USD might be less pronounced.

2. USD vs. Japanese Yen (USD/JPY)

a. Immediate Reaction:

• USD Weakening vs. JPY: The Japanese yen (JPY) is traditionally seen as a safe-haven currency. If the Fed cuts rates due to economic concerns or a potential slowdown, the market could view this as a risk-off signal, which may lead traders to flock to the yen. In this case, the USD/JPY pair would likely decline (USD weaker against JPY).

b. Risk Sentiment and Safe-Haven Flows:

• The yen tends to perform well during times of global economic uncertainty, so if the rate cut is seen as a response to weak economic data or recession fears, the USD/JPY pair may fall sharply, reflecting a flight to safety.

Example:

• During periods of global risk aversion (e.g., 2020 during the COVID-19 pandemic), the USD/JPY pair fell as traders sought safe-haven assets like the JPY, despite rate cuts from the Fed.

3. USD vs. British Pound (GBP/USD)

a. Immediate Reaction:

• GBP Strengthening: The British pound (GBP) often responds positively to a Fed rate cut if traders view the cut as a sign of weakness in the U.S. economy. The GBP/USD pair may rise as traders sell USD in favor of the pound.

• Relative Monetary Policy: The performance of the GBP against the USD also depends on the monetary policy stance of the Bank of England (BoE). If the BoE is expected to be more hawkish (i.e., keeping interest rates stable or even increasing them), the GBP/USD pair could rise more sharply after a rate cut from the Fed.

Example:

• In 2016, following the Brexit vote, the USD initially gained against the pound, but in the months after the Fed’s rate cuts, the GBP/USD pair started to recover, driven by the Fed’s dovish stance and improving UK economic data.

4. USD vs. Canadian Dollar (USD/CAD)

a. Immediate Reaction:

• USD Weakening vs. CAD: The Canadian dollar (CAD) is often influenced by the price of oil, as Canada is a major oil exporter. However, a rate cut by the Fed can also make the USD less attractive, leading to a weaker USD and a stronger CAD in the short term, especially if oil prices are stable or rising.

• Interest Rate Differentials: The Bank of Canada (BoC) policy also plays a significant role. If the BoC holds rates steady or is less dovish than the Fed, the USD/CAD pair may fall post-rate cut, reflecting an interest rate differential in favor of the CAD.

Example:

• After the Fed rate cuts in 2019, the USD/CAD pair weakened as the Fed’s dovish outlook prompted a stronger CAD in comparison. If oil prices were stable or rising, the CAD would also be supported, making the USD/CAD rate drop.

5. USD vs. Australian Dollar (USD/AUD)

a. Immediate Reaction:

• USD Weakening vs. AUD: The Australian dollar (AUD) is closely tied to global commodity prices (especially iron ore, coal, and gold), but it can also benefit from rate cuts in the U.S. if they signal economic weakness. As the USD weakens, the AUD tends to strengthen, particularly if the Fed’s actions lower yields on U.S. assets and push traders toward higher-yielding currencies.

b. Commodity Prices and Risk Appetite:

• A rate cut that signals an economic slowdown can push traders toward higher-risk assets, including the AUD. If the global economic outlook remains strong and commodity prices rise, the AUD could outperform the USD.

Example:

• After the Fed rate cuts in 2020 during the COVID-19 pandemic, the USD/AUD pair initially saw significant fluctuations. The Fed’s rate cuts, combined with rising commodity prices, caused a weaker USD and stronger AUD in the medium term.

6. General Trends in USD Post-Ra

赞 0

我也要评论

提问

0条评论

还没人评论,赶紧抢占沙发

提问

还没人评论,赶紧抢占沙发