EXMA TRADING

摘要:EXMA TRADING, a trading name of EXMA TRADING LLC, is allegedly a forex broker registered in Saint Vincent and the Grenadines that claims to provide its clients with various tradable financial instruments with flexible leverage up to 1:500 and floating spreads from 0.0 pips on the MT4 and MT5 trading platforms via three different live account types, as well as 24/7 customer support service.

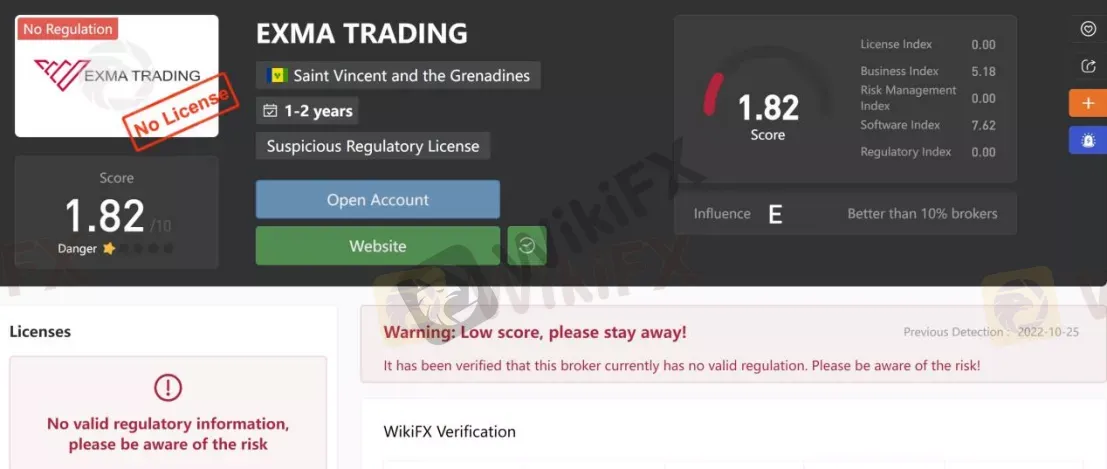

General Information & Regulation

EXMA TRADING, a trading name of EXMA TRADING LLC, is allegedly a forex broker registered in Saint Vincent and the Grenadines that claims to provide its clients with various tradable financial instruments with flexible leverage up to 1:500 and floating spreads from 0.0 pips on the MT4 and MT5 trading platforms via three different live account types, as well as 24/7 customer support service. Here is the home page of this brokers official site:

However, as for regulation, it has been verified that EXMA TRADING does not fall under any valid regulations. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.82/10. Please be aware of the risk.

Market Instruments

EXMA TRADING advertises that it offers access to 1,250+ markets, including forex, metals, indices, cryptocurrencies, stocks and commodities.

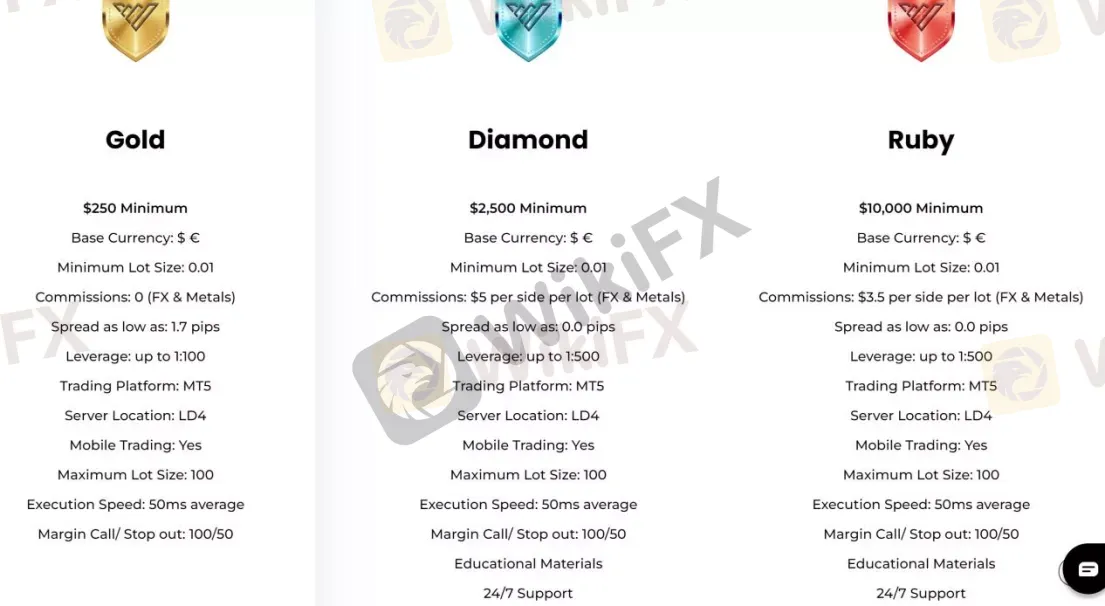

Account Types

Apart from free demo accounts, EXMA TRADING claims to offer three types of live trading accounts, namely Gold, Diamond and Ruby. The minimum initial deposit is $250 for the old account, while the other two account types have much higher minimum initial capital requirements of $2,500 and $10,000 respectively. In comparison, licensed brokers allow setting up a starter account with a minimum deposit of $100 or even less.

Leverage

The leverage provided by EXMA TRADING is adjusted based on account types. For instance, clients on the Gold account can experience a leverage of 1:100, while the Diamond and Ruby account can enjoy a higher leverage of 1:500. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

All spreads with EXMA TRADING are a floating type and scaled with the accounts offered. Specifically, the spread on the Gold account starts from 1.7 pips, while the Diamond and Ruby account members can enjoy tighter spreads from 0.0 pips. As for the commission on forex and metals, there is no commission charged on the Gold account, while the Diamond and Ruby account have to pay a commission of $5 and $3.5 per side per lot respectively.

Trading Platform Available

The platform available for trading at EXMA TRADING is one of the most notable and preferred trading platforms the market offers - MT4 and MT5 for Desktop, Mobile Apps and WebTrader. MT4 & MT5 are highly praised by traders and brokers alike due to their ease of use and great functionality. Both of them offer top-notch charting and flexible customization options. They are especially popular for their automated trading bots, a.k.a. Expert Advisors.

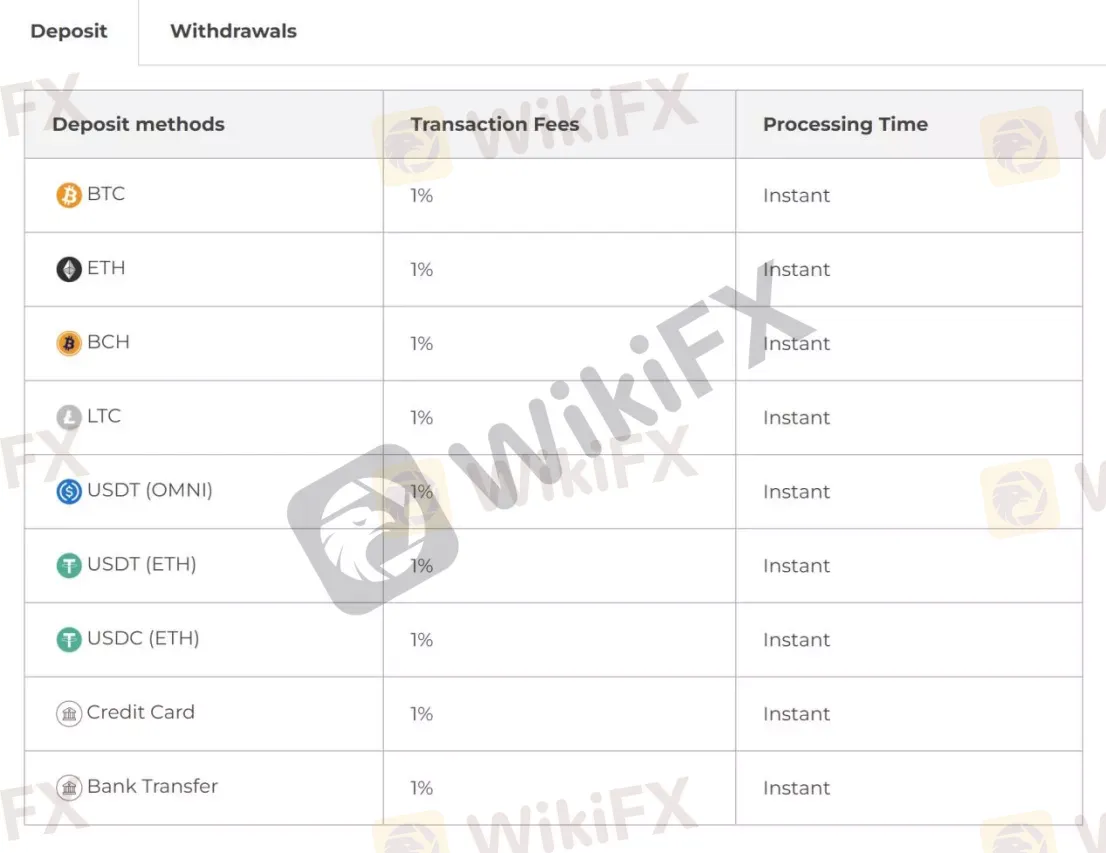

Deposit & Withdrawal

EXMA TRADING says to work with numerous means of deposit and withdrawal choices, consisting of credit card and bank transfers, as well as multiple cryptocurrencies. The minimum initial deposit requirement is $250. All deposits and withdrawals are said to be charged a 1% transaction fee, and they can be processed instantly.

Customer Support

EXMA TRADINGs customer support can be reached by telephone: +44 2045252031, email: support@exma-trading.com or live chat. Company address: First Floor, First St. Vincent Bank Ltd Building, James Street, Kings-town, St. Vincent, and the Grenadines.

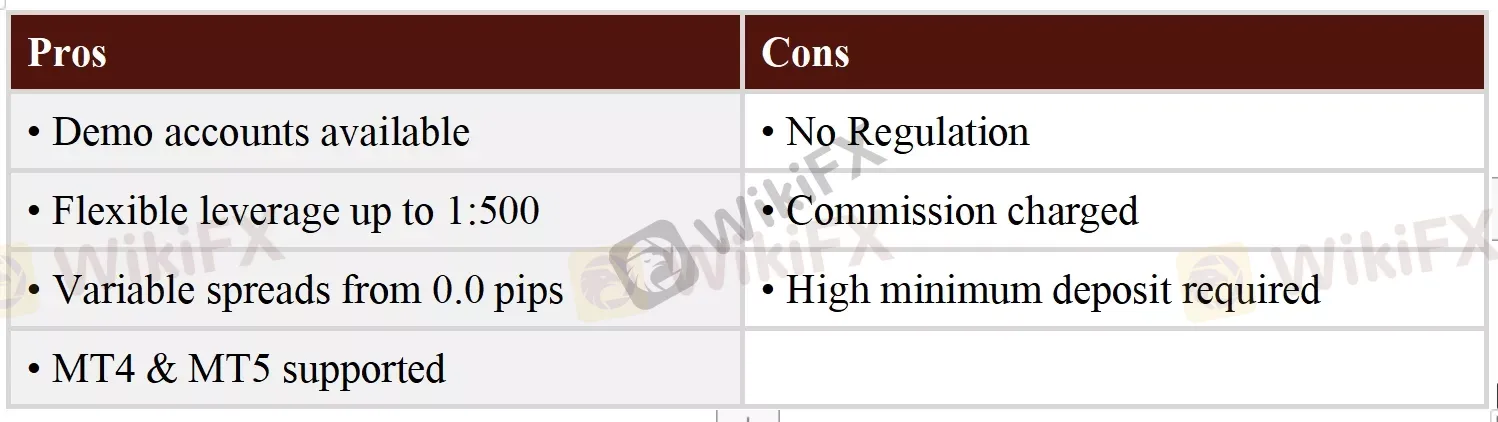

Pros & Cons

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

相关阅读

FOMO周五:比特币过山车继续

又是时候了,乡亲们;周末。随着周末的结束,是时候再次回顾本周的高潮和低谷、成功和失败了。今早与交易员聊天,大多数图表观察家和屏幕监查者都在谈论的一个重大举措似乎是比特币的暴跌。“爱它还是恨它”加密图标本周进一步下跌了16%,延续了最近的跌幅。比特币从本月早些时候的历史高点下跌了近20%。那么,让我们来看看是什么原因导致了这一举动,就像以往一样,如果你抓住了这一举动?做得好!如果没有?总有下个星期。

FOMO周五:比特币崩盘

当我们进入周末的时候,是时候盘点一下本周的赢家和输家了。像往常一样,这意味着周五下午不是庆祝就是后悔。本周,在与众多交易员交谈时,很明显,大家关注的焦点是比特币的抛售。鉴于人们对加密货币涨势的关注,本周逾17%的抛售成为一大话题。有趣的是,所有的加密评论家和比特币否认者都完全享受数字货币遭受挫折的任何时候,所以即使是那些错过这一举措的人也能够享受它。无论如何,让我们看看发生了什么,为什么这是一个伟大的交易。

Daily Market Recap - Bitcoin continues to attract attention

Denigrated by its opponents for its volatility and speculative nature, Bitcoin, which keeps breaking records, can have its uses within a multi-asset portfolio, says Robeco.

Daily Market Recap - Bitcoin Reaches All Time High Above 50,000 USD

Bitcoin, the world's largest cryptocurrency, has been booming since the end of 2020, with BTCUSD showing no signs of slowing down on the charts.

天眼交易商

热点资讯

特朗普加密货币峰会引爆市场,监管松动下加密资产迎来新机遇?

TriumphFX外汇投资骗局:马来西亚72宗报案,损失超2370万令吉!

The Funded Trader 深陷延迟出金困境:客户积怨加剧

TradingView图表工具登陆印度NCDEX:商品交易迎来专业化升级

汇市江湖现实版《活着》 受害者血书「领峰贵金属欺诈观后感」

杀猪盘把银行干倒闭 CEO被骗4710万美元 判24年监禁

朝鲜“Lazarus”黑客组织揭秘:加密史上最大盗窃案背后的国家级威胁

币安上线GoPlus Security (GPS) 代币:安全至上的新风向标

玩不起?做油盈利5万刀出金被拒!“报价出错”是谁的遮羞布?

汇率计算