Kita Nippon

摘要:Kita Nippon is an abbreviation for Kita Nippon Bank, Ltd., a banking institution based in Japan. It provides an array of financial instruments and services to its customers. For individuals, offerings include deposits, loans, insurance, investment trusts, and instant direct debit services etc. For its corporate clientele, Kita Nippon provides financing, payment services, management support, alongside support for business succession, mergers and acquisitions, and human resources. It’s noteworthy that Kita Nippon currently holds a revoked license from the Financial Services Agency (FSA) with number 8400001001882.

| Kita Nippon Review Summary in 6 Points | |

| Founded | 1942 |

| Registered Country/Region | Japan |

| Regulation | FSA revoked |

| Financial Instruments & Services | Individual customers: Deposit, loans, insurance, investment trust, instant direct debit service, Debit/credit card etc. |

| Corporate customers: Financing, payment services, management support, Business succession & M&A, Human resources support | |

| Trading Platform | Mobile App |

| Customer Support | Address, Phone, FAQ, inquiry form |

What is Kita Nippon?

Kita Nippon is an abbreviation for Kita Nippon Bank, Ltd., a banking institution based in Japan. It provides an array of financial instruments and services to its customers. For individuals, offerings include deposits, loans, insurance, investment trusts, and instant direct debit services etc. For its corporate clientele, Kita Nippon provides financing, payment services, management support, alongside support for business succession, mergers and acquisitions, and human resources. Its noteworthy that Kita Nippon currently holds a revoked license from the Financial Services Agency (FSA) with number 8400001001882.

In our upcoming article, we will present a comprehensive and well-structured evaluation of the bank's services and offerings. We encourage interested readers to delve further into the article for valuable insights. In conclusion, we will provide a concise summary that highlights the distinct characteristics of the bank for a clear understanding.

Pros & Cons

| Pros | Cons |

| • Wide array of instruments and services | • FSA revoked |

| • Many years industrys experience |

Pros:

Wide Array of Instruments and Services: Kita Nippon offers a comprehensive suite of instruments and services, allowing clients varied investment options, thus maximizing their potential for returns.

Many Years Industrys Experience: With its long-standing presence in the financial industry since 1942, Kita Nippon's collective years of experience is a testament to its understanding of market dynamics and client needs.

Cons:

FSA Revoked: Kita Nippon is under FSA revoked regulatory status, which raises concerns about its credibility and adherence to industry standards. This discourages interested investors due to the increased perceived risk.

Is Kita Nippon Safe or Scam?

When considering the safety of a bank like Kita Nippon or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a financial company:

Regulatory sight: Kita Nippon possesses a revoked license from the Financial Services Agency (FSA), bearing the license number 8400001001882 which should be seen as a red flag.

User feedback: To get a deeper understanding of the bank, it is suggested that traders explore reviews and feedbacks from existing clients. These shared insights and experiences from users can be accessed on reputable websites and discussion platforms.

Security measures: Kita Nippon has established a privacy policy as a vital protective framework that regulates the collection, usage, and safeguarding of clients' personal data, ensuring user privacy and supports the lawful management of data.

In the end, choosing whether or not to engage in trading with Kita Nippon is an individual decision. It is advised that you carefully balance the risks and returns before committing to any actual trading activities.

Financial Instruments & Services

Kita Nippon Bank provides a comprehensive suite of financial products and services for varying needs of their individual and corporate clients.

For individual clients, the bank has diverse offerings. These include Deposits for savings, a range of Loans for different financial needs, and numerous Insurance products for financial protection and future planning such as Individual Annuity Insurance, Whole Life Insurance, Student Financial Insurance, Individual Defined Contribution Pension Plan (iDeCo), and Dedicated Savings for Educational Funds. They also offer an Investment Trust for wealth growth, Instant Direct Debit Service for convenient transactions, and Debit/Credit Cards for flexible finances.

For corporate clients, the bank provides Financing options including a variety of business loan products suitable for corporations and sole proprietors. In addition to that, Convenient Payment Services like Biznet and FB services offer quick fund management, while Densai Net offers a new way of payment that replaces traditional billing. Further, Management Support services provide guidance for corporate sales and introduce collaborating business partners. Kita Nippon Bank also supports Business Succession & M&A initiatives for the growth and development of business and offers comprehensive Human Resources Support through recruitment consulting and asset formation seminars for employees to address organizational challenges.

How to Open an Account?

For opening an account, visit the nearest bank branch with required official identification documents, a seal for transactions, and cash for initial deposit. If a family member initiates the procedure, they need to carry official documents to confirm both their and the account holder's identity.

Trading Platforms

Kita Nippon Bank brings banking convenience at the fingertips of their customers with a user-friendly mobile application, available for both iOS and Android smartphones.

The application allows customers to handle their transactions and oversee their finances seamlessly from the comfort of their homes or on-the-go. It encapsulates a range of functionalities ensuring a comprehensive banking experience, all under one application.

Notably, while the application itself is available to customers at no extra cost, any communication charges associated with downloading and using the application, due to the use of internet services or mobile data, are borne by the customers themselves.

Customer Service

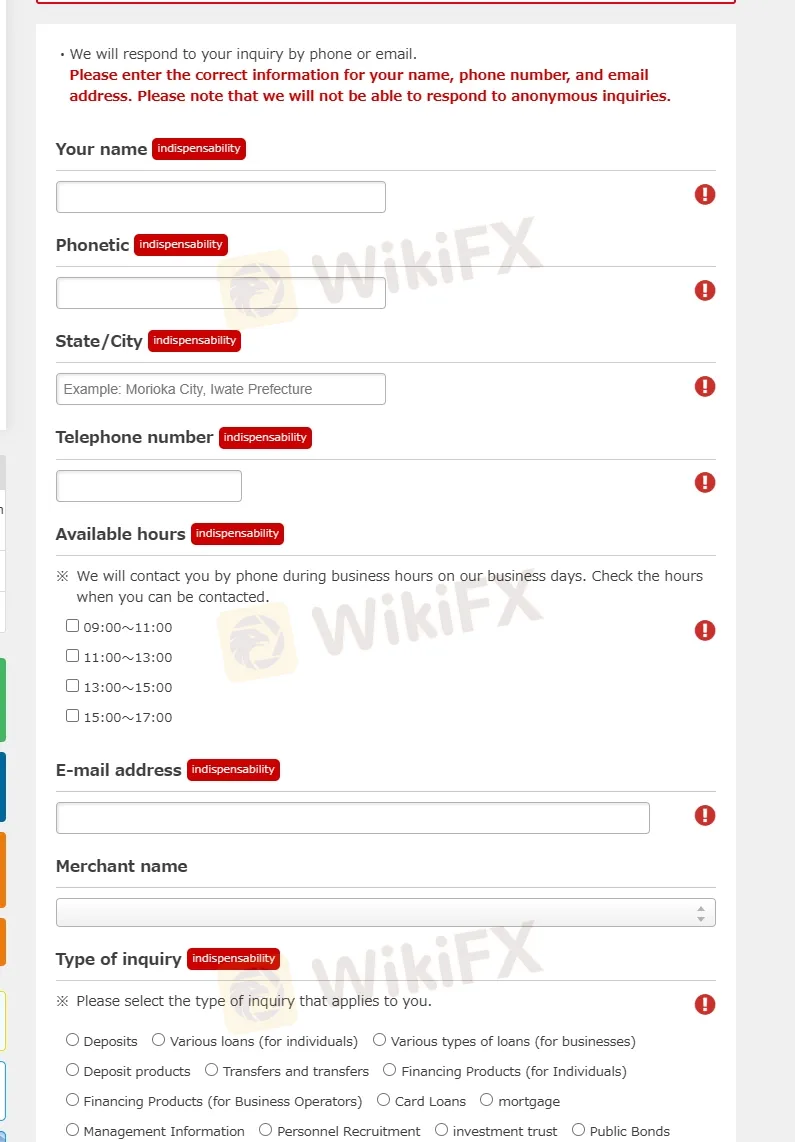

The bank's customer support includes physical address for visitation, phone line for direct communication, FAQ section for general inquiries and an inquiry form for detailed queries and assistance.

ADDRESS: 1-6-7 Chuo-dori, Morioka City, Iwate Prefecture.

Telephone number: 019-653-1111.

For more details about hotline for different products and services from different department or ATM addresses, you can directly visit https://www.kitagin.co.jp/inquiry/ to seek for the exact one you need.

Conclusion

In summary, Kita Nippon, a Japanese bank, offers a full suite of services, from deposit accounts to loans to investment services, tailoring the needs to both individual and corporate clients. However, its status as having its regulatory accreditation revoked by the FSA should cause interested investors to question its credibility and commitment to industry best practices.

Therefore, if you are considering to start to trade with Kita Nippon, you should seek for the most recent information directly from the bank before making any investment decisions or choose other financial institutions that demonstrate a stronger adherence to regulatory standards and professional conduct.

Frequently Asked Questions (FAQs)

| Q 1: | Is Kita Nippon regulated? |

| A 1: | No. The bank holds a revoked license from the FSA with license number 8400001001882. |

| Q 2: | Is Kita Nippon a good financial instution for beginners? |

| A 2: | No, its a good financial instution for beginners because of its revoked FSA regulatory status. |

| Q 3: | What kind of trading platform does Kita Nippon offer? |

| A 3: | Kita Nippon offers proprietary trading application available on both iOS and Android devices. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

天眼交易商

热点资讯

监管变动预警:一个陷入疯狂,六个疑似跑路

超级CPI预警:当数据核弹引爆时,如何让交易商比你更慌?

华人外汇圈再现“杀猪盘”,大批“东方”鲜韭正被送往「赛博屠宰场」

日本加密货币政策大变革:税收降至20%,比特币储备计划受阻

华尔街拉响警报:美国经济衰退风险攀升,贸易战成“达摩克利斯之剑”

汇率计算