Celox外匯交易平臺怎麽樣,正規靠譜嗎?

摘要: Celox is anunregulated broker registered in Saint Vincent and the Grenadines. The tradable instruments with a maximum leverage of 1:200 include forex, cryptocurrencies, indices, shares, commodities, and CDFs. The broker also provides 24/5 client support and free commission. Celox is still risky due to its unregulated status and negative reviews about difficulty withdrawing money.

| CeloxReview Summary | |

| Founded | 2024-05-31 |

| Registered Country/Region | Saint Vincent and the Grenadines |

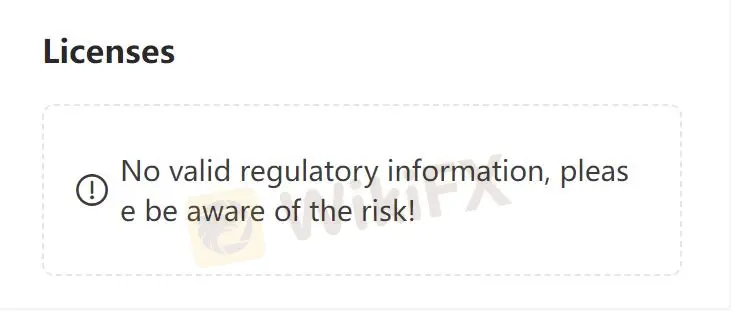

| Regulation | Unregulated |

| Market Instruments | CFDs/Forex/Cryptocurrencies/Indices/Shares/Commodities |

| Demo Account | ❌ |

| Leverage | Up to 1:200 |

| Spread | Low spreads |

| Trading Platform | Desktop Trader/Web Trader/Mobile Trader |

| Min Deposit | / |

| Customer Support | Phone: +44 2035141442 |

| Email: support@celox.live | |

| Online chat | |

| Social Media: Facebook, Instagram, Twitter, LinkedIn | |

Celox Information

Celox is anunregulated broker registered in Saint Vincent and the Grenadines. The tradable instruments with a maximum leverage of 1:200 include forex, cryptocurrencies, indices, shares, commodities, and CDFs. The broker also provides 24/5 client support and free commission. Celox is still risky due to its unregulated status and negative reviews about difficulty withdrawing money.

Pros and Cons

| Pros | Cons |

| 24/5 customer support | Unregulated |

| Leverage up to 1:200 | MT4/MT5 unavailable |

| Various tradable instruments | Demo account unavailable |

| Commission free | Inaccessible official website |

| Negative reviews about difficulty withdrawing money |

Is Celox Legit?

Celox is not regulated, making it less safe than regulated brokers.

What Can I Trade on Celox?

Traders can choose different investment directions because the broker provides forex, cryptocurrencies, indices, shares, commodities, and CDFs.

| Tradable Instruments | Supported |

| CFDs | ✔ |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Shares | ✔ |

Celox Fees

The commission is 0 and no hidden fees. The broker provides low spreads.

Leverage

The maximum leverage is 1:200, meaning that profits and losses are magnified 200 times.

Trading Platform

Celox provides Desktop Trader, Web Trader, and Mobile Trader. Traders can choose a convenient platform to invest.

| Trading Platform | Supported |

| Desktop Trader | ✔ |

| Web Trader | ✔ |

| Mobile Trader | ✔ |

Deposit and Withdrawal

The broker provides multiple payment methods, including Visa, Mastercard, Maestro, Wire Transfer, Bitcoin. However, due to the official website being inaccessible, transfer processing times and associated fees are unknown.

Customer Support Options

Celox provides 24/5 customer support; traders can contact the broker via phone and email.

Traders can also communicate via Facebook, Instagram, Twitter, and LinkedIn.

| Contact Options | Details |

| Phone | +44 2035141442 |

| support@celox.live | |

| Online Chat | ✔ |

| Social Media | Facebook, Instagram, Twitter, LinkedIn |

| Supported Language | English/Russian |

| Website Language | English/Russian |

| Physical Address | / |

熱點資訊

外匯儲備是怎麼來的?

ATFX Connect 聘請 FXCM 高管 Mohammed Khan 擔任首席營運官 (COO)

詐騙預警:AISTOCK登黑平台排行榜,無監管牌照、網站短期註冊,極具投資風險

揭露仿冒IG假交友詐騙套路:誆稱黃金波段交易輕鬆賺,指控涉嫌洗錢逼繳保證金

ConneXar Capital天眼評分低卻好評如潮?網軍留言洗版、牌照疑雲重重,存在極大詐騙風險

PU Prime 宣布即將進行 MT4、MT5 伺服器升級

WikiFX App 3.6.4版本上線公告

3/3-3/9最新外匯詐騙風險平台曝光

Pepperstone激石是否適合新手投資人使用?監管情形、交易環境、數據表現一次看

匯率計算