MIDF外匯交易平臺怎麽樣,正規靠譜嗎?

摘要:MIDF is a financial institution in Malaysia, offering a broad spectrum of investment and banking services. This firm provides diverse solutions for both individual and corporate clients, focusing on areas such as investment banking, stockbroking, and asset management.

Overview of MIDF

MIDF is a financial institution in Malaysia, offering a broad spectrum of investment and banking services. This firm provides diverse solutions for both individual and corporate clients, focusing on areas such as investment banking, stockbroking, and asset management.

Pros and Cons

| Pros | Cons |

| Established presence in the Malaysian financial market | No valid regulatory certificates |

| Diverse investment banking and stockbroking services | Limited information available on the public website about specific services |

| Offers both web and mobile trading platforms | Primarily focused on the Malaysian market |

| Access to local market expertise and research |

Is MIDF Legit?

MIDF operates without regulation from any recognized financial authority. Engaging with an unregulated broker like MIDF carries substantial risks, and investors should be aware of the potential consequences before depositing funds.

What Can I Trade on MIDF?

When you open a brokerage account with MIDF, you've got plenty of options for investing. The bank's primary focus is on shares traded on Bursa Malaysia. Plenty of shares listed on the Main Market and ACE Market are available. Retail clients can trade stocks and ETFs listed on the New York Stock Exchange and Nasdaq. For clients interested in fixed-income securities, MIDF Investment Bank offers access to Malaysian government securities, corporate bonds, and sukuk.

If you are looking for solutions to drive your business forward or seeking corporate advisory, you'll find a broad spectrum in MIDF. MIDF offers financing facilities for SMEs and mid-tier businesses. For asset management, various trusts and fund management products are also available.

| Tradable Instruments | Supported |

| Equities | ✔ |

| ETFs | ✔ |

| Fixed-income | ✔ |

| Forex | ❌ |

| Metals | ❌ |

| Bonds | ❌ |

| Crypto | ❌ |

MIDF Fees

Unlike some brokerages, which offer fee-free stock and ETF trade, MIDF takes a different approach. It provides a flat rate of 0.12% of the transaction value and a minimum fee of USD 1.99. Additional transaction charges include a stamp duty of RM1.50 for every RM1,000, an SEC clearing fee of 0.00051% of the total sales value, and a custodian fee paid by MIDF.

Overall, MIDF is on the pricier end for US Stocks and ETF trading compared to other brokerages.

Account Types

MIDF offers two live account types (conventional account and Shariah-compliant account) and a demo account.

You can open a MIDF Invest account conveniently through the mobile app or web platform. The account opening process requires minimal information, including the NRIC for verification purposes. Conventional and Shariah-compliant account are both available. You can deposit through online bank transfer once your account is approved.

Trading Platform

MIDF provides an advanced platform applying to different devices, including desktop, android and IOS. Professional-grade charting tools and in-depth analysis are both available on this platform. Whether you're a beginner or an experienced investor, it has been designed to help you make wiser investment decisions.

| Trading Platform | Supported | Available Devices | Suitable for |

| Mobile App | ✔ | IOS and Android | Novice and experienced investor |

| Web Trader | ✔ | Novice and experienced investor | |

| MT5 | ❌ | ||

| MT4 | ❌ |

Deposit and Withdrawal

Any transfers from a registered bank account to an RM Cash Account will be reflected immediately. Users can also transfer cash between their RM and USD cash accounts using a simple transfer process. It takes approximately T+2 business days for currency conversion.

The process of withdrawals depend on the availability of MYR (Malaysian Ringgit). If a conversion from USD to MYR is needed, it generally takes T+4 business days. However, if the funds are already in MYR, the process is shortened to T+2 business days.

There is a minimum deposit amount of RM30,000.

Deposit Options

| Deposit Options | Min. Deposit | Fees | Processing Time |

| Wire Transfer | RM30,000 | N/A | Instant |

Withdrawal Options

| Withdrawal Options | Min. Withdrawal | Fees | Processing Time |

| Wire Transfer | N/A | N/A | Conversion from USD to MYR:T+4 business days;already in MYR:T+2 business days |

Customer Support Options

If there's something you need to do that you can't manage online or through the mobile app, you can always reach out to customer support. You have multiple choices: including email (enquiry@midf.com.my), phone support (+03-2173 8888), and social media channels (Facebook, Youtube, and Twitter).

| Contact Options | Details |

| Phone | +03-2173 8888 |

| enquiry@midf.com.my | |

| Support Ticket System | N/A |

| Online Chat | No |

| Social Media | Facebook, Youtube, and Twitter |

| Supported Language | N/A |

| Website Language | English |

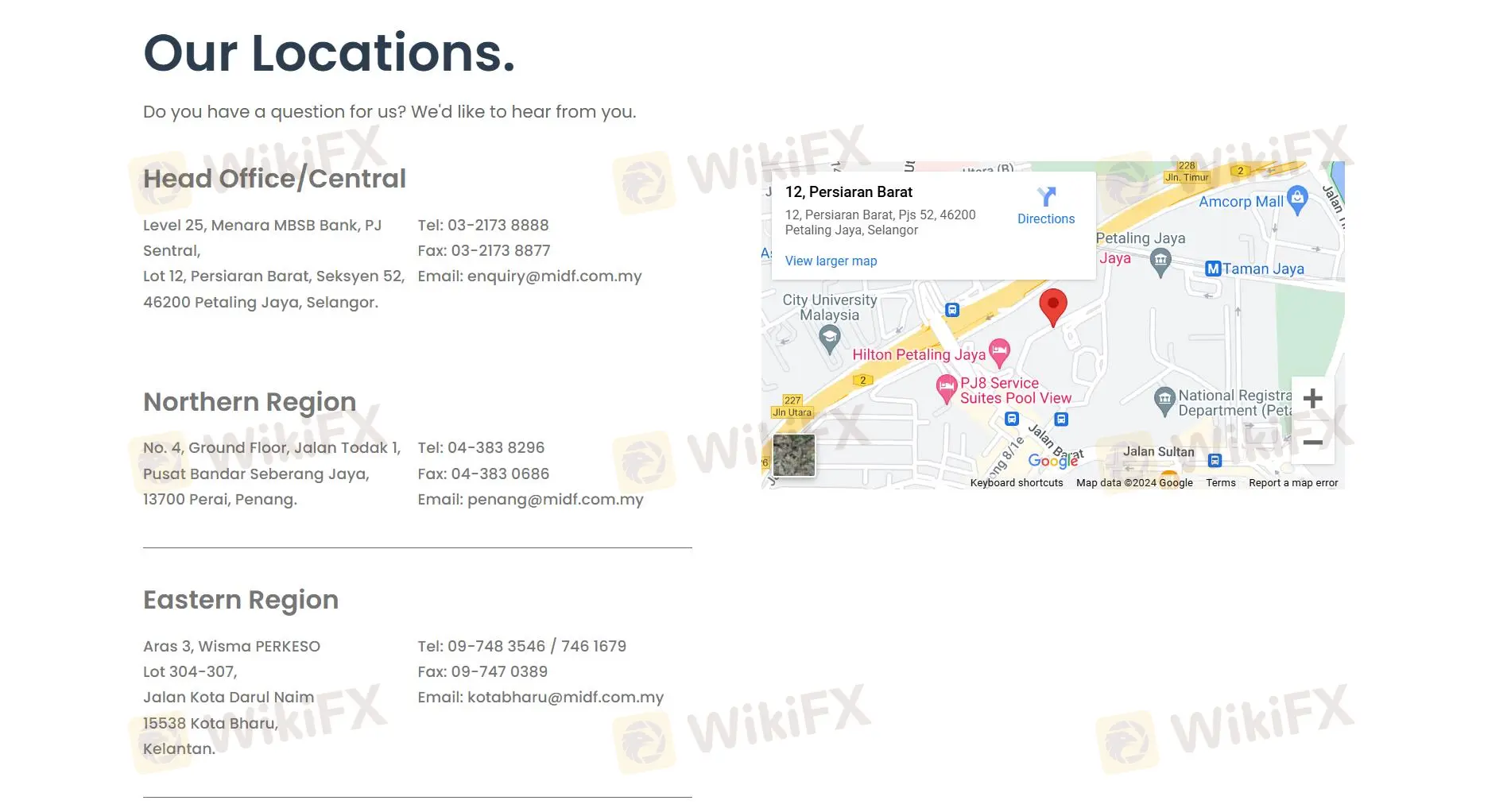

| Physical Address | Level 25, Menara MBSB Bank, PJ Sentral, Lot 12, Persiaran Barat, Seksyen 52, 46200 Petaling Jaya, Selangor. |

The Bottom Line

You can find a user-friendly online & mobile platform and a diverse range of financing solutions for business in MIDF, a stockbroking and investment banking. MIDF could be a good option if you focus on the Malaysian market. However, regulatory hurdles and costs are major downsides. Before choosing a brokerage, remember to consider risks and keep a close eye on fees.

FAQs

Is MIDF safe?

MIDF is not regulated by any reputable financial authority. Before choosing a brokerage, remember to consider the risk involved.

Is MIDF good for beginners?

MIDF is a great platform for beginners with its easy-to-navigate platform and excellent customer support.

What trading platforms are available for MIDF Investment Bank clients?

MIDF Investment Bank offers online and mobile trading platforms.

Risk Warning

Online trading involves considerable risk, so it may not be suitable for every client. Please make sure that you totally understand the risks involved and notice that the information above provided in this review may be subject to alteration owing to the constant updating of the company's services and policies.

熱點資訊

交易到底難在哪?

為何不同的外匯經紀商有不同的價格?

印尼投資人控Mabicon設局詐財!假網友誘導投資,出金遭拖延刁難

亨達國際金融平台分析:受澳洲ASIC與瓦努阿圖VFSC監管,營運實力是否穩健?

NPBFX陷交易糾紛爭議!用戶控獎金承諾跳票、交易帳戶被清空,平台說詞難服眾

台灣經紀商群益期貨評價如何?立即查看平台監管資訊、天眼實勘、展業狀況

Swissquote 加入 TradingView,為圖表交易者提供超過 400 種差價合約與外匯交易接入

新興券商CG FinTech風險揭露:公司地址造假、交易環境不理想、成立時間短暫,疑似詐騙黑平台

風險平台Alpex Trading持續爆雷!用戶獲利出金遭拖延,申訴石沉大海無下文

Fusion Markets持有澳洲ASIC全牌照,這家外匯券商究竟是否安全?平台優勢、潛在風險一次看

匯率計算