SGX

摘要: SGX, full name Singapore Exchange Limited , is a multi-asset broker registered in Singapore, providing securities and derivatives trading, as well as one-stop integrated services such as listing, trading, clearing, settlement, depository and data.

Risk Warning

Trading online involves significant risks and you could lose all of your invested capital. It is not suitable for all traders or investors. Please ensure you understand the risks involved and note that the information contained in this article is for general information only.

| Aspect | Information |

| Registered Country/Area | Singapore |

| Founded year | 2-5 years ago (specific founding year not mentioned) |

| Company Name | Singapore Exchange Limited |

| Regulation | Not subject to valid regulation at the moment |

| Minimum Deposit | 10 shares |

| Maximum Leverage | Up to 7x (with Daily Leverage Certificates) |

| Spreads | Securities: 0.005%-0.05%; Derivatives: 0.001%-0.05% |

| Trading Platforms | SGX Mobile App, Securities Investor Portal (CDP), SGXNet, and more (multiple platforms) |

| Tradable assets | Stocks, REITs, ETFs, Structured Warrants, DLCs, Equity Index, FX & Rates, Commodities |

| Account Types | Individual Account, Joint-Alternate Account |

| Demo Account | Not mentioned |

| Islamic Account | Not mentioned |

| Customer Support | Phone: +65 6535 7511, Email: askSGX@SGX.com, Social media presence (WeChat, Telegram, Twitter, Facebook, YouTube, LinkedIn), Multiple office locations |

| Payment Methods | Bank transfer, cheque, PayNow |

| Educational Tools | Insights, real-time price feeds, delayed price feeds, news and corporate actions, post-trade data feeds, data services for listed companies, reference data feeds, historical data, “In Focus” section (market updates) |

Basic Information and Regulations

SGX, full name Singapore Exchange Limited , is a multi-asset broker registered in Singapore, providing securities and derivatives trading, as well as one-stop integrated services such as listing, trading, clearing, settlement, depository and data. These products are subject to market fluctuations, and their values and trading volumes change over time. SGX also offers leverage through Daily Leverage Certificates (DLCs) and charges spreads and commissions on securities and derivatives trades.

SGX offers different account types, including individual and joint-alternate accounts, and allows for online deposits and withdrawals with associated fees. They provide multiple trading platforms and educational tools to assist users in accessing market information. Customer support is available through various channels, but there have been user reviews highlighting concerns related to fund withdrawals, reliability, and potential fraudulent activities.

Here is the homepage of the brokers official website:

Regulation

As for the regulatory situation, no effective regulatory information has been found so far. that's why SGX The supervision status on wikifx is listed as “Not yet supervised” and only received a low score of 1.41/10.

NOTE: Screenshot dated January 10, 2023. WikiFX is a dynamic score, which will track the dynamic real-time score of traders. The score captured at the current time does not represent the past and future scores.

Pros and Cons

SGX, or Singapore Exchange Limited, offers a diverse range of investment products and provides up to 7x leverage with SGX DLCs. It also boasts low spreads and commissions, along with access to insights and real-time data. However, it faces challenges such as a lack of valid regulation, the absence of popular trading platforms like MT4, the potential for additional fees, and concerns related to mixed customer reviews and support.

| Pros | Cons |

| Diverse range of investment products | Lack of valid regulation |

| Up to 7x leverage with SGX DLCs | No popular trading platforms available, such as MT4 |

| Low spreads and commissions | Additional fees may apply |

| Multiple trading and data platforms | Potential complexity and learning curve |

| Access to insights and real-time data | Mixed reviews and customer support concerns |

Business Scope

Stocks: SGX features various stocks, including DBS, UOB, OCBC Bank, SIA, and Singtel, among others. These stocks are actively traded, with fluctuating values and trading volumes. For instance, DBS has a current value of 33.230 with a trading volume of 996.5K.

REITs (Real Estate Investment Trusts): SGX hosts REITs like CapLand IntCom T, CapLand Ascendas REIT, Mapletree Log Tr, Suntec Reit, and Keppel DC Reit. These REITs represent diverse real estate portfolios and exhibit changes in their unit prices and trading volumes. For example, CapLand IntCom T is valued at 1.830 with a trading volume of 6,976.7K.

ETFs (Exchange-Traded Funds): SGX offers ETFs like Lion-OCBC Sec HSTECH S$, STI ETF, LION-PHILLIP S-REIT, and NikkoAM-STC Asia REIT. These funds track various indices and commodities, with their unit prices and trading volumes subject to market dynamics. For instance, Lion-OCBC Sec HSTECH S$ is priced at 0.654 with a trading volume of 1,241.8K.

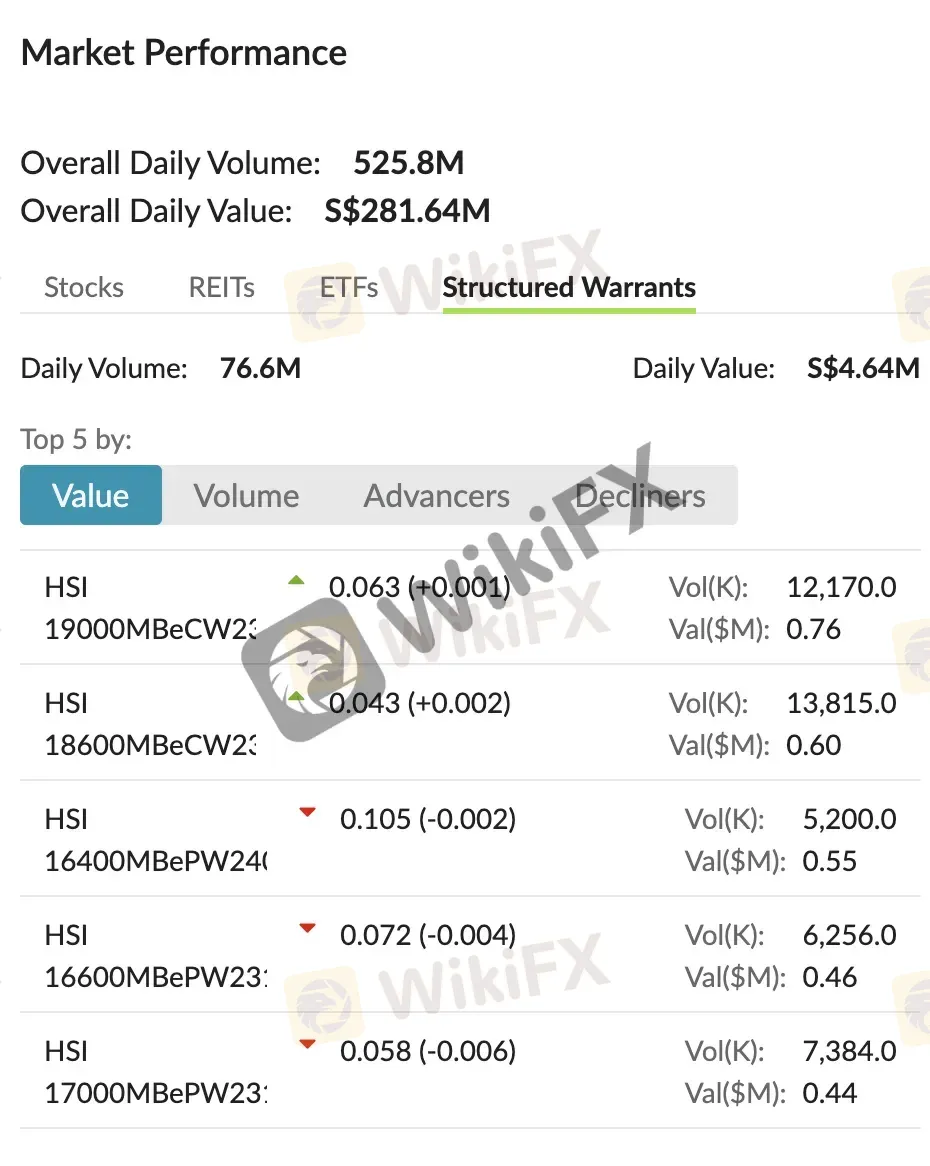

Structured Warrants: SGX also facilitates trading in structured warrants such as HSI 19000MBeCW231129 and HSI 18600MBeCW231030. These warrants can provide leverage and are characterized by changing prices and trading volumes. For instance, HSI 19000MBeCW231129 is valued at 0.063 with a trading volume of 12,170.0K.

Market Instruments

Indices: SGX provides a range of indices for tracking market performance. The Straits Times Index (STI), for instance, is a capitalization-weighted index that monitors the top 30 companies listed on SGX. Additionally, indices like the iEdge-UOB APAC Yield Focus Green REIT Index, FTSE ST Consumer Goods & Services Index, iEdge SG All Healthcare Index, and iEdge S-REIT Leaders Index SGD are also available.

Stocks: SGX offers a selection of individual stocks for trading, including DBS, UOB, OCBC Bank, Singtel, and SIA. These stocks are subject to market fluctuations, with their respective prices updated regularly.

REITs (Real Estate Investment Trusts): SGX hosts various REITs, such as CapLand IntCom T, CapLand Ascendas REIT, Mapletree Log Tr, and Suntec Reit. These REITs represent diverse real estate portfolios, and their unit prices can change based on market conditions.

ETFs (Exchange-Traded Funds): SGX provides ETFs like Lion-OCBC Sec HSTECH S$, STI ETF, LION-PHILLIP S-REIT, NikkoAM-STC Asia REIT, and Nikko AM STI ETF. These funds track different indices and commodities, offering investors a way to diversify their portfolios.

Structured Warrants (SWs): SGX features structured warrants like HSI 19000MBeCW231129 and HSI 18600MBeCW231030. These warrants may provide leverage and can experience changes in their prices over time.

DLCs (Daily Leverage Certificates): SGX offers DLCs like HSTECH 5xLongSG240424, Alibaba 5xLongSG250904, and Tencent 5xLongSG231220. These certificates aim to provide amplified exposure to underlying assets and may exhibit price fluctuations.

Equity Index: SGX offers equity index futures, including the FTSE China A50 Index Futures Oct 23 and Nikkei 225 Index Futures Dec 23, which allow investors to speculate on the future direction of these indices.

FX & Rates: SGX provides futures contracts related to foreign exchange rates, such as INR/USD Futures Oct 23, USD/CNH Futures Dec 23, KRW/USD Futures Oct 23, and USD/SGD Futures Dec 23.

Commodities: SGX offers futures contracts related to commodities like TSI Iron Ore CFR China (62% Fines) Futures Oct 23, TSI FOB AUS Premium Coking Coal Futures Oct 23, TSR20 Rubber Futures Dec 23, and USEP Monthly Base Load Electricity Futures Sep 23, catering to investors interested in commodities trading.

| Pros | Cons |

| Diverse range of market instruments, including indices, stocks, REITs, ETFs, structured warrants, DLCs, equity index futures, FX & rates, and commodities | Potential market fluctuations affecting investments |

| Opportunity to diversify portfolios with various asset classes | Lack of specific mention regarding regulatory oversight |

| Access to speculation on future market directions | Market-dependent price changes may pose risks for investors |

Account Types

Individual Account: This account type is for individuals who are at least 18 years old and not undischarged bankrupts.

Joint-Alternate Account: This account type is for two individuals who want to jointly manage an account. Either individual can give instructions to CDP, the depository for SGX securities.

Leverage

SGX Daily Leverage Certificates (DLCs) offer leverage of up to 7x on major Asian indices. This means that investors can gain exposure to the price movement of an index with a fraction of the capital required to buy the underlying shares.

Spreads & Commissions

SGX Securities and Derivatives have spreads and commissions of 0.005%-0.05% and 0.001%-0.05% respectively. For example, a securities trade of S$10,000 would have a spread of S$0.50-S$5.00 and a commission of S$5.00-S$50.00. A derivatives trade of S$10,000 would have a spread of S$0.10-S$5.00 and a commission of S$0.10-S$5.00. Additional fees, such as clearing fees and regulatory fees, may apply.

Deposit & Withdrawal

SGX Securities and Derivatives can be deposited into or withdrawn from your CDP account online through the CDP website or mobile app. The minimum deposit amount is 10 shares. There is a withdrawal fee of S$10 per withdrawal. The following payment methods are accepted for deposits and withdrawals: bank transfer, cheque, and PayNow. For example, to deposit 100 shares of LSS into your CDP account via bank transfer, you would need to pay a deposit fee of $10. To withdraw 100 shares of LSS from your CDP account via PayNow, you would also need to pay a withdrawal fee of S$10. Processing times for deposits and withdrawals may vary depending on the payment method used.

| Pros | Cons |

| Online deposit and withdrawal options | Withdrawal fee of S$10 per withdrawal |

| Minimum deposit amount of 10 shares | Limited payment methods (bank transfer, cheque, PayNow) |

| Processing times may vary by method |

Trading Platforms

SGX Mobile App: This mobile app provides live market updates for easy access to market information.

Securities Investor Portal (CDP): A user-friendly portal offering access to CDP Internet and educational tools, supporting individual investors in their decision-making.

SGXNet: A secure platform for listed issuers to upload corporate announcements and requests.

REACH-ST: The securities trading engine that provides high-speed and reliable access for trading members.

NPTS: The securities settlement and depository system.

SGX Bond Pro: An institution-only electronic bond trading platform connecting buyers and sellers of Asian bonds, offering multiple trading protocols.

Titan OTC: An over-the-counter (OTC) trade registration platform across various asset classes.

Titan Platforms: An integrated trading, trade registration, and clearing platform for derivatives products.

SGX Data Direct: A one-stop online platform for interactions with SGX related to Market Data services.

Exchange Notes: Provides access to a comprehensive history of datasets for subscribing SGX-ST members.

Members Portal: A web platform for participants to submit applications for SGX Memberships to SGX RegCo.

RegCo Submission: A web platform for issuers or their professional advisors to submit regulatory applications to SGX RegCo.

Data Submission: A web platform for trading or clearing members to securely submit regulatory files to SGX RegCo.

| Pros | Cons |

| Diverse range of trading platforms for various needs | Potential complexity and learning curve |

| User-friendly interface with educational tools on Securities Investor Portal (CDP) | Absence of popular trading platforms like MT4 |

| Access to live market updates and comprehensive datasets on SGX Mobile App and others | Limited information on the ease of use and reliability of platforms |

Customer Support

Tel: +65 6535 7511;

Email: ask SGX @ SGX .com;

Social Media: WeChat, Telegram, Twitter, Facebook, YouTube and LinkedIn;

Address:

2 shenton way, #02-02 SGX centre 1 singapore 068804;

Unit 09-12, Level 33, China World Trade Centre, Tower A No. 1 Jian Guo Men Wai Avenue, Chaoyang District Beijing 100004, China;

155 North Wacker Drive, Suite 4250 Chicago, IL 60606, USA;

Unit 12B, 12/F No. 33 Des Voeux Road Central Hong Kong;

38 St Mary Axe London EC3A 8BH;

9th Floor Platina (Regus) G Block, Bandra Kurla Complex, Bandra (East) Mumbai – 400 051, India.

Educational Tools

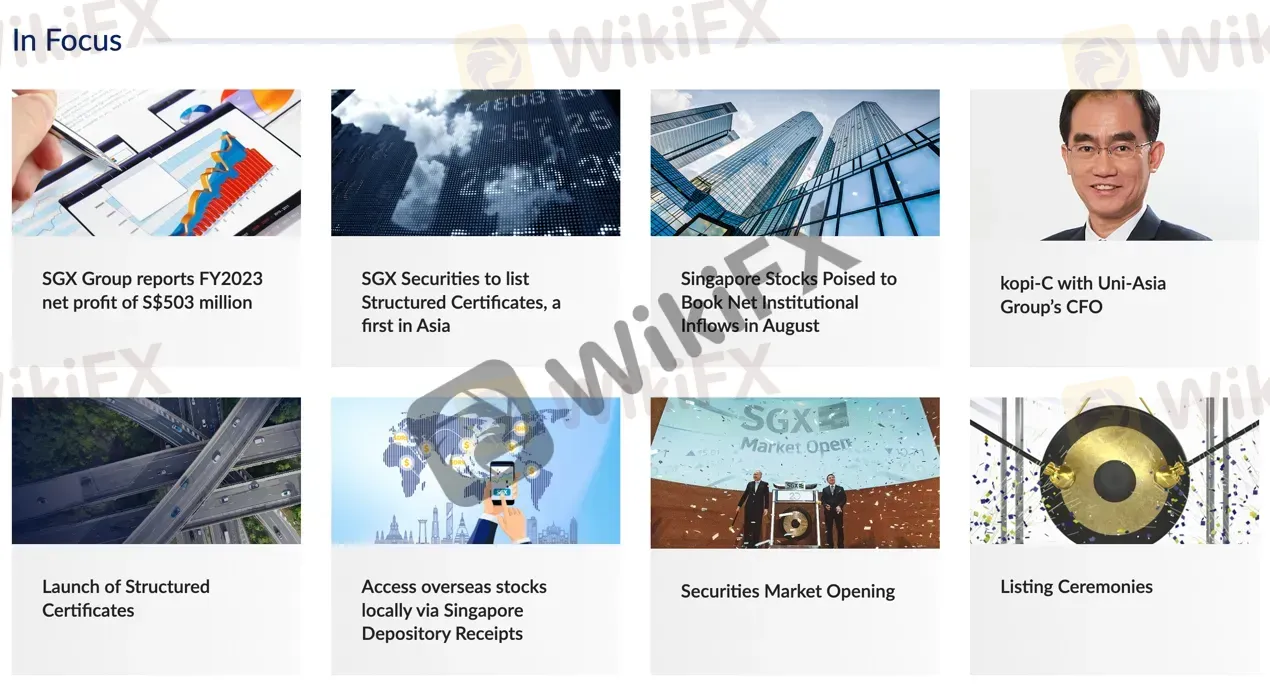

SGX offers educational tools and resources that include insights and information. Their “In Focus” section provides updates on topics such as SGX Group's financial performance, listings, and market trends. Additionally, they offer real-time price feeds, delayed price feeds, news and corporate actions, post-trade data feeds, data services for listed companies, reference data feeds, and historical data to help users access relevant market information and stay informed.

Reviews

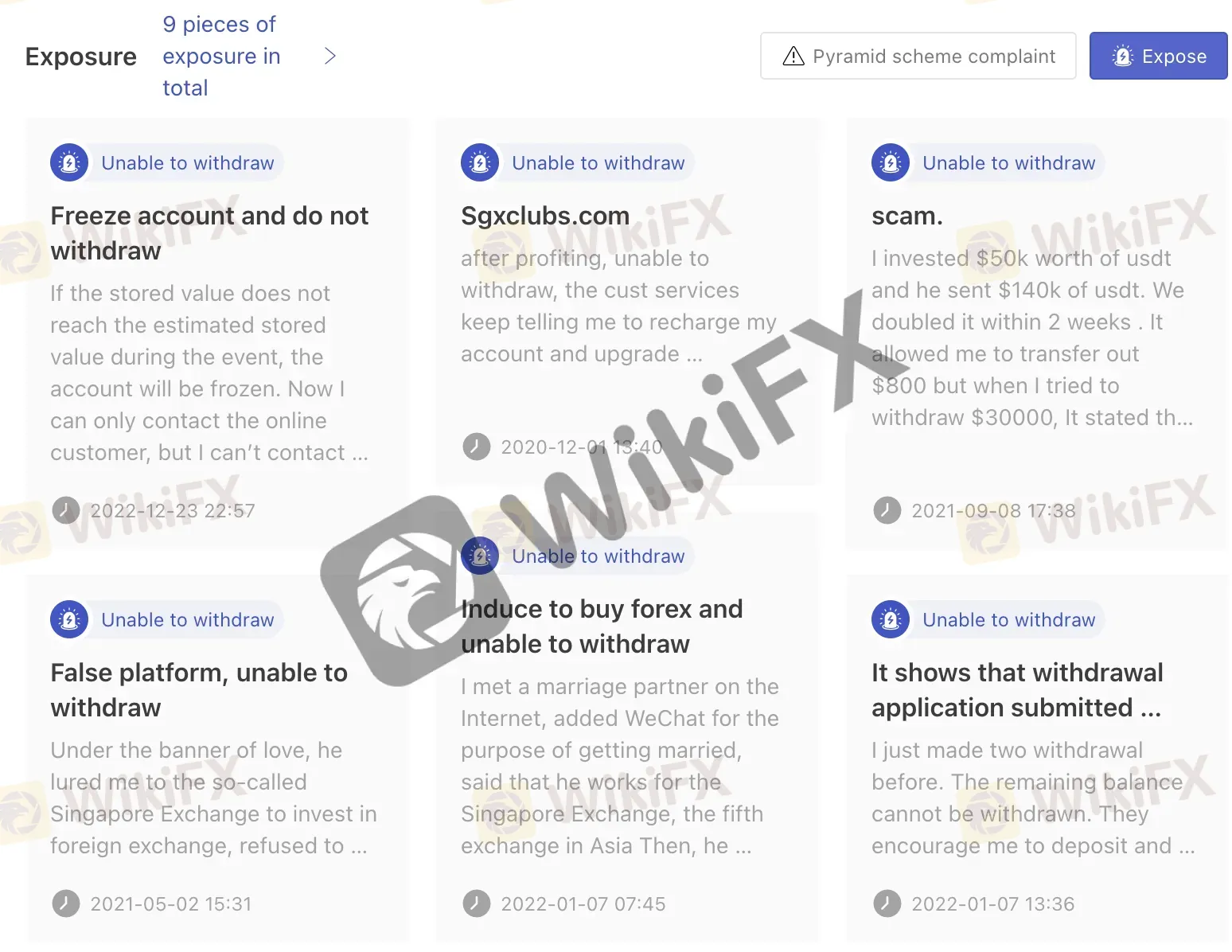

Reviews of SGX on WikiFX highlight various concerns and issues. Some users reported difficulties with withdrawing funds, citing frozen accounts and unresponsive customer service. Others mentioned being lured into investments under false pretenses and encountering obstacles when trying to withdraw profits. There are also instances of users alleging scams and fraudulent activities, where they were persuaded to deposit more money with promises of high returns but faced challenges when attempting to withdraw their funds. Additionally, there are recent exposures related to withdrawal issues and reliability concerns. These reviews suggest a range of problems and challenges faced by users of SGX.

Conclusion

In conclusion, SGX, or Singapore Exchange Limited, presents both advantages and disadvantages. On the positive side, SGX offers a variety of products and services, including stocks, REITs, ETFs, structured warrants, and more, providing investors with options for diversification. Additionally, the availability of leverage through SGX Daily Leverage Certificates can potentially enhance investment opportunities. However, it's crucial to exercise caution and be aware of the associated risks, as SGX is not currently subject to valid regulation. Reviews and complaints on platforms like WikiFX have raised concerns about difficulties with fund withdrawals, unresponsive customer service, and potential scams, underscoring the need for vigilance and due diligence when considering SGX as a trading platform.

FAQs

| Q 1: | SGXIs it regulated? |

| A 1: | No valid regulatory information has been found so far. |

| Q 2: | SGXIs it friendly to newbies? |

| A 2: | It is not recommended for anyone to trade with unregulated or opaque brokers. |

相關閱讀

理解能力的高低,決定你在投資市場的成敗

投資市場,就像是一片無邊無際的大海,浪潮起伏不定。有些人能在驚濤駭浪中穩穩駕馭航船,而有些人卻在風暴來臨時束手無策...

Valetax受模里西斯FSC監管、低點差、高槓桿,獲97%用戶好評

愛因斯坦曾說過:「複利是世界第八大奇蹟。」因此,在長期財務規劃的旅程中,如果能夠選擇一個可靠的合作夥伴,不僅能夠讓資產持續增值,更能在市場波動中保持穩定,實現財務自由的目標。因此,一直以來外匯天眼致力於收集全球美股、期貨、外匯券商資訊,幫助投資人辨別平台優劣,避開潛在風險。今天,我們要帶大家一起查詢Valetax這家交易商。

LION獅子國際遭投資人實名爆料!惡意喊單導致大幅虧損,指控用戶違約拒絕出金

最近在一些外匯社群中,我們看到一些投資人指出LION獅子國際這家券商已經淪落到靠詐欺用戶賺黑心錢的地步,與幾年前意氣風發的模樣截然不同。這家曾經受到許多交易者推崇的平台,如今究竟怎麼了呢?下面就讓我們了解詳情。

市場解析:OANDA安達曾以傳承自豪,如今成為 FTMO 收購戰利品

30 年的市場聲譽仍不足以在競爭激烈的零售交易行業中立足。FTMO 獲得了專業知識、監管批准與牌照,或將改變市場既有規則。

天眼交易商

熱點資訊

市場解析:OANDA安達曾以傳承自豪,如今成為 FTMO 收購戰利品

外匯牌價怎麼看?

LION獅子國際遭投資人實名爆料!惡意喊單導致大幅虧損,指控用戶違約拒絕出金

Valetax受模里西斯FSC監管、低點差、高槓桿,獲97%用戶好評

1/20-2/2外匯詐騙高風險平台曝光

Emar Markets安全疑慮大!遭馬來西亞SC示警,多位投資人爆料無法出金

Magic Compass寶匯是否值得信賴?全面解讀平台監管資訊、交易環境、用戶評價、營運概況

匯率計算