2024-11-09 07:41

業內Events in focus (AEDT):

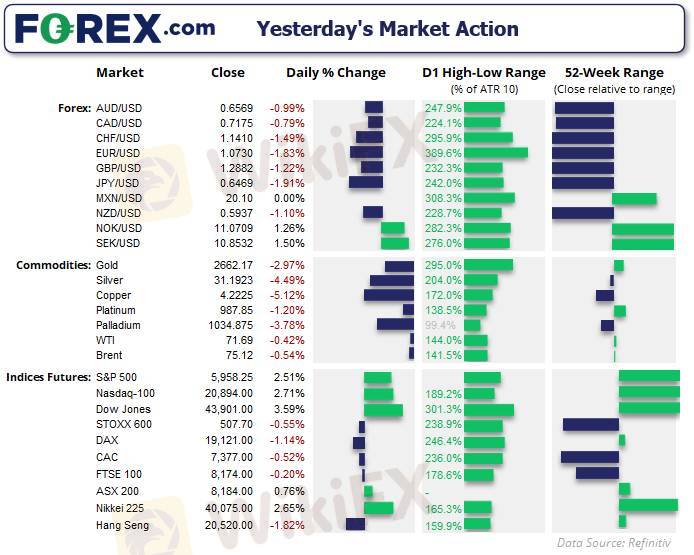

Today’s Asian calendar is relatively full, although none of it could be considered top tier data as we’re still absorbing the turbulence from yesterday’s election. But we do have two central bank meetings with a combined 50bp of cuts likely in the pipeline.

A 25bp cut from the BOE seems practically a given, but thanks to the recent UK budget it remains up in their air as to whether the central bank will want to signal further cuts today. If they don’t GBP/USD could regain some bullish traction but it is unlikely to fully recoup its losses from yesterday. A sympathy bounce perhaps? Whereas a dovish cut could see GBP/USD bears have another crack at probing the 200-day SMA around the 1.28 handle.

A 25bp cut is also expected, with Fed fund futures implying a 99.5% probability of such a move. It will be interesting to see if the Fed strikes a more cautious tone with Trump lined up for a return in January. Although Another viable option is to provide a dovish cut today and cement a 25bp cut for December, to get any cuts done and dusted before we see what the new administration brings.

贊 0

CSK

交易者

熱門討論

業內

哎,现在明白不赌就是赢啊

行情分析

美元/加元技术面

技術指標

外汇技术分析之波浪理论

業內

[活動]論交易,贏取200元話費補貼

技術指標

EZ.Fury Kite是基于趋势指标MA进行判断

技術指標

指标派是什么?

市集分類

平臺

展會

代理商

招聘

EA

業內

行情

指標

Events in focus (AEDT):

| 2024-11-09 07:41

| 2024-11-09 07:41Today’s Asian calendar is relatively full, although none of it could be considered top tier data as we’re still absorbing the turbulence from yesterday’s election. But we do have two central bank meetings with a combined 50bp of cuts likely in the pipeline.

A 25bp cut from the BOE seems practically a given, but thanks to the recent UK budget it remains up in their air as to whether the central bank will want to signal further cuts today. If they don’t GBP/USD could regain some bullish traction but it is unlikely to fully recoup its losses from yesterday. A sympathy bounce perhaps? Whereas a dovish cut could see GBP/USD bears have another crack at probing the 200-day SMA around the 1.28 handle.

A 25bp cut is also expected, with Fed fund futures implying a 99.5% probability of such a move. It will be interesting to see if the Fed strikes a more cautious tone with Trump lined up for a return in January. Although Another viable option is to provide a dovish cut today and cement a 25bp cut for December, to get any cuts done and dusted before we see what the new administration brings.

贊 0

我也要評論

提問

0條評論

還沒人評論,趕緊搶佔沙發

提問

還沒人評論,趕緊搶佔沙發