2025-01-29 17:05

業內Swing Trading Strategies

#firstdealofthenewyearFateema

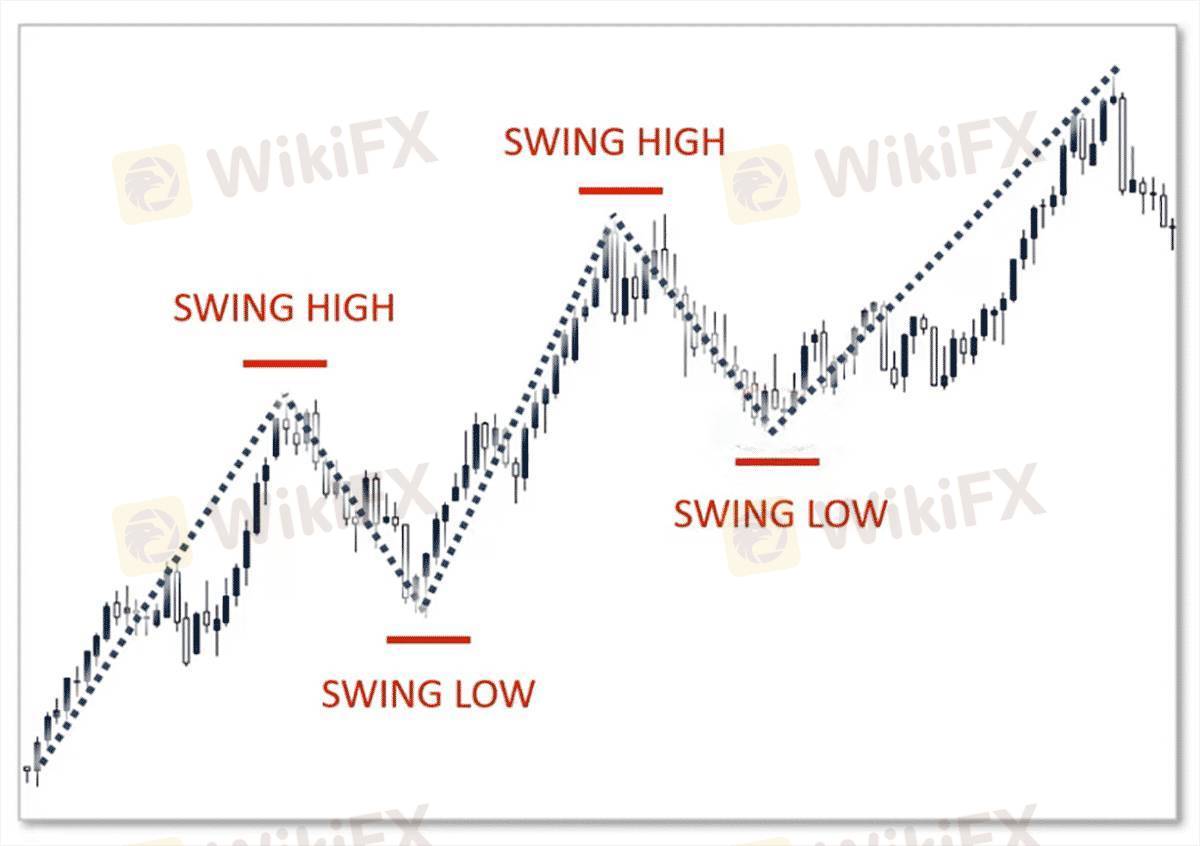

Swing trading strategies aim to capture short- to medium-term price movements within a larger trend. Traders typically hold positions for several days or weeks, taking advantage of price “swings” between support and resistance levels. Key strategies include:

1. Trend-following: This involves identifying the prevailing trend (up or down) and entering trades in the direction of the trend. Traders use technical indicators like moving averages or trendlines to confirm trends.

2. Breakout Trading: Traders enter positions when price breaks key support or resistance levels, expecting strong price movement in the direction of the breakout.

3. Retracement/Correction Trading: This strategy targets price pullbacks within a trend. Traders look for opportunities to buy during an uptrend or sell during a downtrend when the price retraces to a key Fibonacci level or moving average.

4. Divergence Strategy: Traders look for divergences between price and indicators (like RSI or MACD), which can signal potential reversals.

Swing traders use a combination of technical analysis, risk management, and patience to profit from market swings.

贊 0

Veinticinco25

Trader

熱門討論

業內

哎,现在明白不赌就是赢啊

行情分析

美元/加元技术面

技術指標

外汇技术分析之波浪理论

業內

[活動]論交易,贏取200元話費補貼

技術指標

EZ.Fury Kite是基于趋势指标MA进行判断

技術指標

指标派是什么?

市集分類

平臺

展會

代理商

招聘

EA

業內

行情

指標

Swing Trading Strategies

尼日利亞 | 2025-01-29 17:05

尼日利亞 | 2025-01-29 17:05#firstdealofthenewyearFateema

Swing trading strategies aim to capture short- to medium-term price movements within a larger trend. Traders typically hold positions for several days or weeks, taking advantage of price “swings” between support and resistance levels. Key strategies include:

1. Trend-following: This involves identifying the prevailing trend (up or down) and entering trades in the direction of the trend. Traders use technical indicators like moving averages or trendlines to confirm trends.

2. Breakout Trading: Traders enter positions when price breaks key support or resistance levels, expecting strong price movement in the direction of the breakout.

3. Retracement/Correction Trading: This strategy targets price pullbacks within a trend. Traders look for opportunities to buy during an uptrend or sell during a downtrend when the price retraces to a key Fibonacci level or moving average.

4. Divergence Strategy: Traders look for divergences between price and indicators (like RSI or MACD), which can signal potential reversals.

Swing traders use a combination of technical analysis, risk management, and patience to profit from market swings.

贊 0

我也要評論

提問

0條評論

還沒人評論,趕緊搶佔沙發

提問

還沒人評論,趕緊搶佔沙發