2025-01-31 17:56

業內How to Determine your forex trading lot sizes.

#firstdealofthenewyearAKEEL

Determining the correct lot size in forex trading is crucial for risk management and account sustainability. Here’s how to do it:

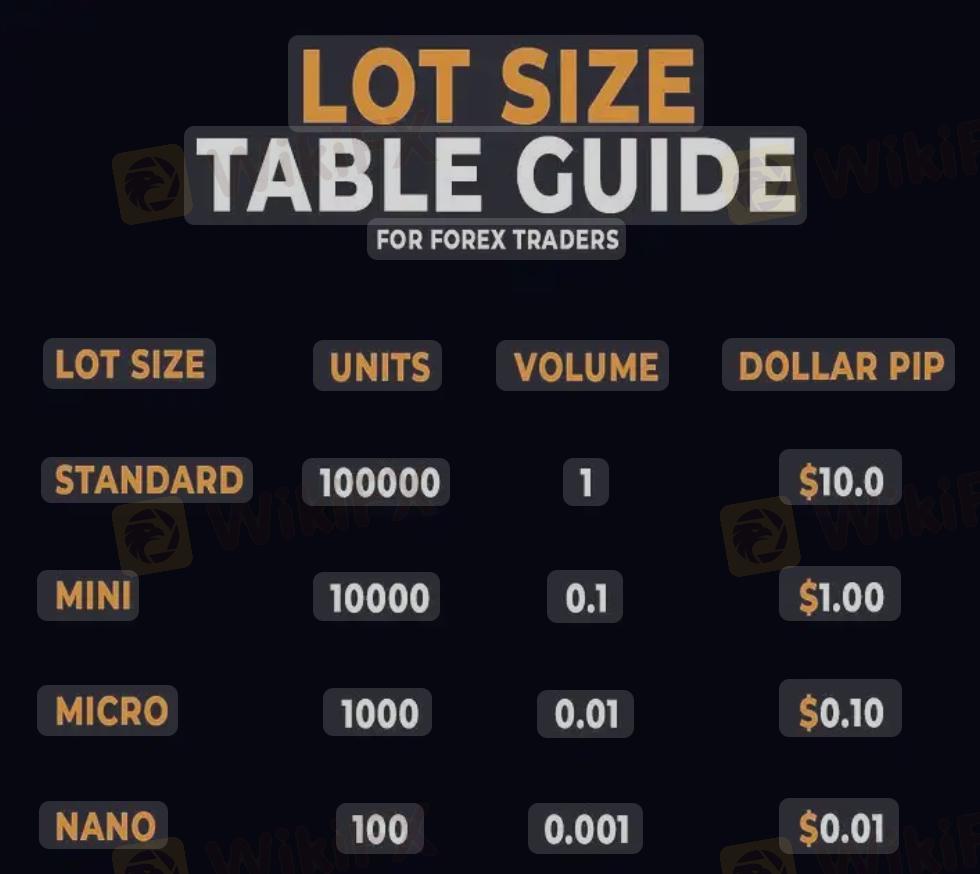

1. Understand Lot Sizes in Forex

Standard Lot = 100,000 units (1 lot)

Mini Lot = 10,000 units (0.1 lot)

Micro Lot = 1,000 units (0.01 lot)

Nano Lot = 100 units (0.001 lot) (not offered by all brokers)

2. Define Your Risk Per Trade

Risk should be 1-2% of your account balance per trade.

Example: If your account is $10,000, a 2% risk = $200 per trade.

3. Determine Stop Loss in Pips

Choose a logical stop-loss level based on market structure.

Example: If your stop loss is 50 pips, this helps determine position size.

4. Calculate the Lot Size Using This Formula

\text{Lot Size} = \frac{\text{Risk Amount}}{\text{Stop Loss (pips)} \times \text{Pip Value}}

For USD pairs (e.g., EUR/USD, GBP/USD):

1 standard lot = $10 per pip

1 mini lot = $1 per pip

1 micro lot = $0.10 per pip

5. Example Calculation

Scenario:

Account Balance = $10,000

Risk = 2% ($200)

Stop Loss = 50 pips

Trading EUR/USD (1 pip = $10 per standard lot)

\text{Lot Size} = \frac{200}{50 \times 10} = \frac{200}{500} = 0.4 \text{ lots}

6. Adjust for Leverage & Margin

Ensure you have enough free margin to open the trade.

Higher leverage allows larger positions but increases risk exposure.

Would you like a lot size calculator or help setting up a risk management plan?

#firstdealofthenewyearAKEEL

贊 0

Boss8889

Trader

熱門討論

業內

哎,现在明白不赌就是赢啊

行情分析

美元/加元技术面

技術指標

外汇技术分析之波浪理论

業內

[活動]論交易,贏取200元話費補貼

技術指標

EZ.Fury Kite是基于趋势指标MA进行判断

技術指標

指标派是什么?

市集分類

平臺

展會

代理商

招聘

EA

業內

行情

指標

How to Determine your forex trading lot sizes.

尼日利亞 | 2025-01-31 17:56

尼日利亞 | 2025-01-31 17:56#firstdealofthenewyearAKEEL

Determining the correct lot size in forex trading is crucial for risk management and account sustainability. Here’s how to do it:

1. Understand Lot Sizes in Forex

Standard Lot = 100,000 units (1 lot)

Mini Lot = 10,000 units (0.1 lot)

Micro Lot = 1,000 units (0.01 lot)

Nano Lot = 100 units (0.001 lot) (not offered by all brokers)

2. Define Your Risk Per Trade

Risk should be 1-2% of your account balance per trade.

Example: If your account is $10,000, a 2% risk = $200 per trade.

3. Determine Stop Loss in Pips

Choose a logical stop-loss level based on market structure.

Example: If your stop loss is 50 pips, this helps determine position size.

4. Calculate the Lot Size Using This Formula

\text{Lot Size} = \frac{\text{Risk Amount}}{\text{Stop Loss (pips)} \times \text{Pip Value}}

For USD pairs (e.g., EUR/USD, GBP/USD):

1 standard lot = $10 per pip

1 mini lot = $1 per pip

1 micro lot = $0.10 per pip

5. Example Calculation

Scenario:

Account Balance = $10,000

Risk = 2% ($200)

Stop Loss = 50 pips

Trading EUR/USD (1 pip = $10 per standard lot)

\text{Lot Size} = \frac{200}{50 \times 10} = \frac{200}{500} = 0.4 \text{ lots}

6. Adjust for Leverage & Margin

Ensure you have enough free margin to open the trade.

Higher leverage allows larger positions but increases risk exposure.

Would you like a lot size calculator or help setting up a risk management plan?

#firstdealofthenewyearAKEEL

贊 0

我也要評論

提問

0條評論

還沒人評論,趕緊搶佔沙發

提問

還沒人評論,趕緊搶佔沙發