2025-02-06 15:11

業內The role of market makers in trading

#firstdealofthenewyearFateema

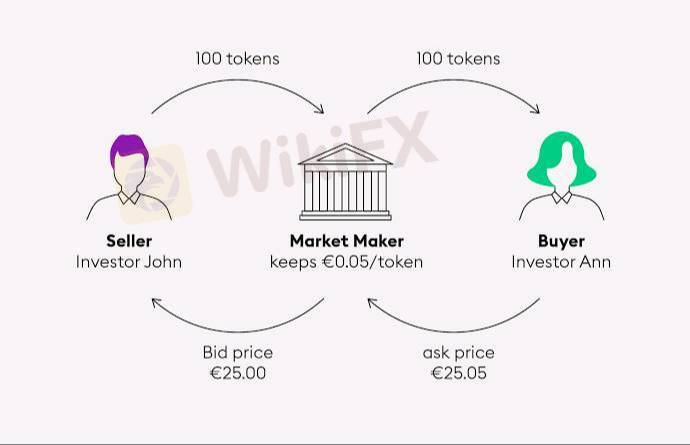

Market makers play a crucial role in trading by providing liquidity and ensuring smooth price discovery. Their main responsibilities include:

1. Providing Liquidity – Market makers continuously place buy and sell orders in the order book, ensuring traders can execute trades without significant delays.

2. Reducing Bid-Ask Spreads – By actively quoting both buy (bid) and sell (ask) prices, they narrow the spread, making it cheaper for traders to buy or sell assets.

3. Enhancing Market Efficiency – By maintaining active order books, market makers help prevent drastic price swings and contribute to a fair valuation of assets.

4. Risk Management – Market makers balance their inventory by adjusting their orders based on market conditions to minimize potential losses.

5. Facilitating Large Trades – In traditional finance and crypto, market makers help institutions execute large trades without causing excessive price impact.

In crypto, market makers operate on centralized exchanges (CEXs) and decentralized exchanges (DEXs). On DEXs like Uniswap, liquidity providers (LPs) perform a similar function by supplying assets to automated market maker (AMM) pools.

Would you like a deeper dive into market-making strategies or its role in DeFi?

贊 0

murphy

交易者

熱門討論

業內

哎,现在明白不赌就是赢啊

行情分析

美元/加元技术面

技術指標

外汇技术分析之波浪理论

業內

[活動]論交易,贏取200元話費補貼

技術指標

EZ.Fury Kite是基于趋势指标MA进行判断

技術指標

指标派是什么?

市集分類

平臺

展會

代理商

招聘

EA

業內

行情

指標

The role of market makers in trading

尼日利亞 | 2025-02-06 15:11

尼日利亞 | 2025-02-06 15:11#firstdealofthenewyearFateema

Market makers play a crucial role in trading by providing liquidity and ensuring smooth price discovery. Their main responsibilities include:

1. Providing Liquidity – Market makers continuously place buy and sell orders in the order book, ensuring traders can execute trades without significant delays.

2. Reducing Bid-Ask Spreads – By actively quoting both buy (bid) and sell (ask) prices, they narrow the spread, making it cheaper for traders to buy or sell assets.

3. Enhancing Market Efficiency – By maintaining active order books, market makers help prevent drastic price swings and contribute to a fair valuation of assets.

4. Risk Management – Market makers balance their inventory by adjusting their orders based on market conditions to minimize potential losses.

5. Facilitating Large Trades – In traditional finance and crypto, market makers help institutions execute large trades without causing excessive price impact.

In crypto, market makers operate on centralized exchanges (CEXs) and decentralized exchanges (DEXs). On DEXs like Uniswap, liquidity providers (LPs) perform a similar function by supplying assets to automated market maker (AMM) pools.

Would you like a deeper dive into market-making strategies or its role in DeFi?

贊 0

我也要評論

提問

0條評論

還沒人評論,趕緊搶佔沙發

提問

還沒人評論,趕緊搶佔沙發