2025-02-06 15:30

業內Trading with Elliott Wave Theory

#firstdealofthenewyearFateema

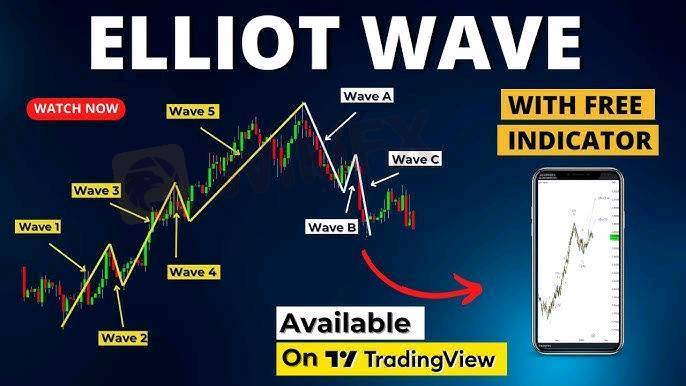

Elliott Wave Theory (EWT) is a powerful technical analysis tool used in trading to predict market movements by identifying repeating wave patterns. Developed by Ralph Nelson Elliott in the 1930s, the theory suggests that financial markets move in fractal patterns based on investor psychology.

Basic Structure of Elliott Wave Theory

Elliott Wave Theory divides price movements into two main phases:

1. Impulse Waves (5-Wave Pattern)

These waves move in the direction of the main trend.

Consists of five waves:

Wave 1: Initial move in the direction of the trend.

Wave 2: Retracement but not beyond the start of Wave 1.

Wave 3: Strongest and longest wave (often extends).

Wave 4: Shallow correction, often sideways.

Wave 5: Final wave in the trend, completing the move.

2. Corrective Waves (3-Wave Pattern)

These waves move against the main trend.

Consists of three waves:

Wave A: Initial move against the trend.

Wave B: Temporary retracement.

Wave C: Final move completing the correction.

Elliott Wave Trading Strategies

1. Identifying the Trend (Impulse Wave Trading)

Enter during Wave 2 pullback or Wave 4 correction.

Ride Wave 3 (strongest move) for maximum profit.

Use Fibonacci retracements to identify entry points.

2. Trading the Correction (Counter-Trend Trading)

Identify corrective patterns (Zigzag, Flat, Triangle).

Short-sell at the end of Wave B or enter long at the end of Wave C.

3. Using Fibonacci for Confirmation

Wave 2 often retraces 50%-61.8% of Wave 1.

Wave 3 often extends 161.8% of Wave 1.

Wave 4 retraces 23.6%-38.2% of Wave 3.

Wave 5 can extend 61.8%-100% of Wave 1-3.

Best Indicators to Use with Elliott Wave

Fibonacci Retracement/Extension (for price targets)

RSI (Relative Strength Index) (divergence at Wave 5)

MACD (Moving Average Convergence Divergence) (momentum confirmation)

Volume (higher in Wave 3, lower in Wave 4)

Challenges in Elliott Wave Trading

Requires experience in wave counting.

Market structure can be subjective.

Works best in trending markets.

Would you like me to analyze a specific chart or asset using Elliott Wave Theory?

贊 0

Aniema30

المتداول

熱門討論

業內

哎,现在明白不赌就是赢啊

行情分析

美元/加元技术面

技術指標

外汇技术分析之波浪理论

業內

[活動]論交易,贏取200元話費補貼

技術指標

EZ.Fury Kite是基于趋势指标MA进行判断

技術指標

指标派是什么?

市集分類

平臺

展會

代理商

招聘

EA

業內

行情

指標

Trading with Elliott Wave Theory

尼日利亞 | 2025-02-06 15:30

尼日利亞 | 2025-02-06 15:30#firstdealofthenewyearFateema

Elliott Wave Theory (EWT) is a powerful technical analysis tool used in trading to predict market movements by identifying repeating wave patterns. Developed by Ralph Nelson Elliott in the 1930s, the theory suggests that financial markets move in fractal patterns based on investor psychology.

Basic Structure of Elliott Wave Theory

Elliott Wave Theory divides price movements into two main phases:

1. Impulse Waves (5-Wave Pattern)

These waves move in the direction of the main trend.

Consists of five waves:

Wave 1: Initial move in the direction of the trend.

Wave 2: Retracement but not beyond the start of Wave 1.

Wave 3: Strongest and longest wave (often extends).

Wave 4: Shallow correction, often sideways.

Wave 5: Final wave in the trend, completing the move.

2. Corrective Waves (3-Wave Pattern)

These waves move against the main trend.

Consists of three waves:

Wave A: Initial move against the trend.

Wave B: Temporary retracement.

Wave C: Final move completing the correction.

Elliott Wave Trading Strategies

1. Identifying the Trend (Impulse Wave Trading)

Enter during Wave 2 pullback or Wave 4 correction.

Ride Wave 3 (strongest move) for maximum profit.

Use Fibonacci retracements to identify entry points.

2. Trading the Correction (Counter-Trend Trading)

Identify corrective patterns (Zigzag, Flat, Triangle).

Short-sell at the end of Wave B or enter long at the end of Wave C.

3. Using Fibonacci for Confirmation

Wave 2 often retraces 50%-61.8% of Wave 1.

Wave 3 often extends 161.8% of Wave 1.

Wave 4 retraces 23.6%-38.2% of Wave 3.

Wave 5 can extend 61.8%-100% of Wave 1-3.

Best Indicators to Use with Elliott Wave

Fibonacci Retracement/Extension (for price targets)

RSI (Relative Strength Index) (divergence at Wave 5)

MACD (Moving Average Convergence Divergence) (momentum confirmation)

Volume (higher in Wave 3, lower in Wave 4)

Challenges in Elliott Wave Trading

Requires experience in wave counting.

Market structure can be subjective.

Works best in trending markets.

Would you like me to analyze a specific chart or asset using Elliott Wave Theory?

贊 0

我也要評論

提問

0條評論

還沒人評論,趕緊搶佔沙發

提問

還沒人評論,趕緊搶佔沙發