2025-02-06 20:00

業內Creating a Legacy Through Annual Investment Strate

#firstdealofthenewyearchewbacca

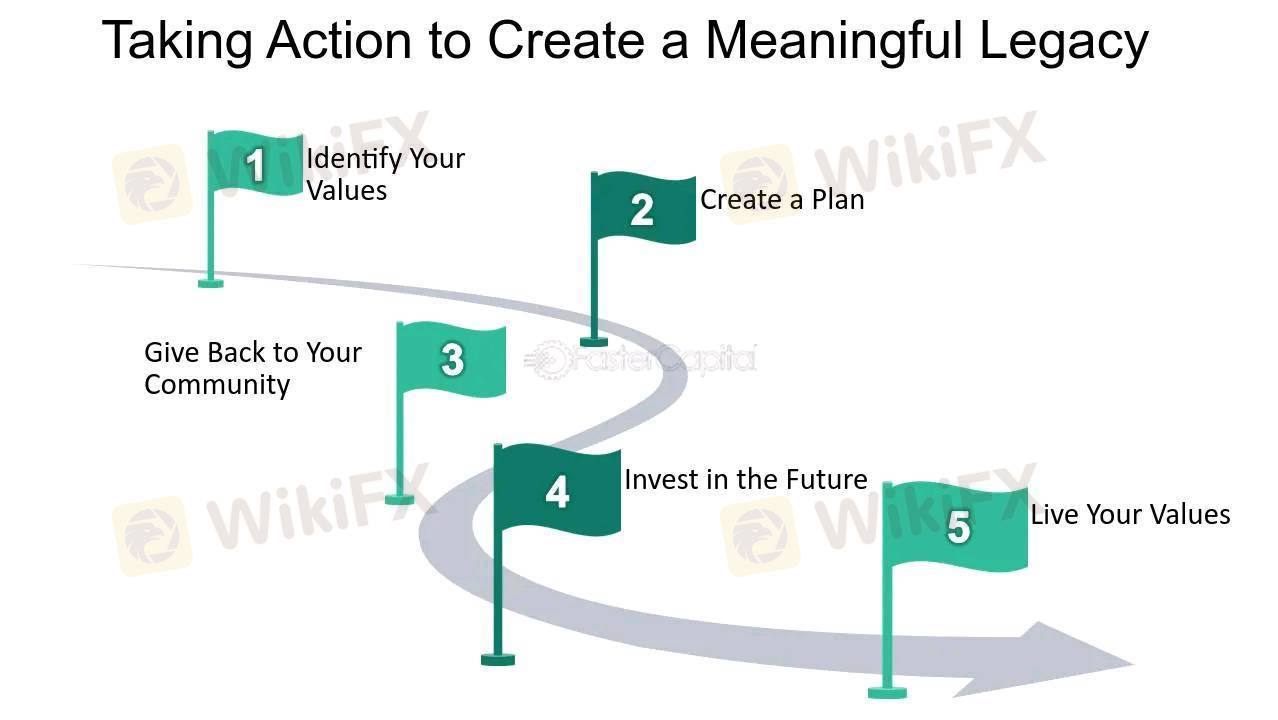

Creating a legacy through annual investment strategies requires a long-term vision, disciplined financial planning, and strategic asset allocation. Here’s a structured approach to building and sustaining a lasting financial legacy:

1. Define Your Legacy Goals

Determine whether your legacy is for family wealth, philanthropy, or business continuity.

Set clear financial and non-financial objectives.

2. Establish a Sustainable Investment Plan

Asset Allocation: Diversify across stocks, bonds, real estate, and alternative investments.

Risk Management: Balance high-risk and stable investments to ensure long-term growth.

Tax Efficiency: Utilize tax-advantaged accounts, trusts, and estate planning to preserve wealth.

3. Commit to Annual Investments

Consistently invest a fixed amount each year, leveraging compound interest.

Increase contributions over time to outpace inflation.

4. Utilize Compounding and Reinvestment

Reinvest dividends, interest, and capital gains for exponential growth.

Choose growth-oriented investments for long-term wealth accumulation.

5. Implement Estate and Succession Planning

Set up wills, trusts, and foundations to ensure smooth wealth transfer.

Involve heirs or beneficiaries in financial education.

6. Review and Adjust Annually

Evaluate investment performance and market conditions.

Adjust asset allocations and contributions based on economic changes.

贊 0

bossbaby6527

Nhà đầu tư

熱門討論

業內

哎,现在明白不赌就是赢啊

行情分析

美元/加元技术面

技術指標

外汇技术分析之波浪理论

業內

[活動]論交易,贏取200元話費補貼

技術指標

EZ.Fury Kite是基于趋势指标MA进行判断

技術指標

指标派是什么?

市集分類

平臺

展會

代理商

招聘

EA

業內

行情

指標

Creating a Legacy Through Annual Investment Strate

尼日利亞 | 2025-02-06 20:00

尼日利亞 | 2025-02-06 20:00#firstdealofthenewyearchewbacca

Creating a legacy through annual investment strategies requires a long-term vision, disciplined financial planning, and strategic asset allocation. Here’s a structured approach to building and sustaining a lasting financial legacy:

1. Define Your Legacy Goals

Determine whether your legacy is for family wealth, philanthropy, or business continuity.

Set clear financial and non-financial objectives.

2. Establish a Sustainable Investment Plan

Asset Allocation: Diversify across stocks, bonds, real estate, and alternative investments.

Risk Management: Balance high-risk and stable investments to ensure long-term growth.

Tax Efficiency: Utilize tax-advantaged accounts, trusts, and estate planning to preserve wealth.

3. Commit to Annual Investments

Consistently invest a fixed amount each year, leveraging compound interest.

Increase contributions over time to outpace inflation.

4. Utilize Compounding and Reinvestment

Reinvest dividends, interest, and capital gains for exponential growth.

Choose growth-oriented investments for long-term wealth accumulation.

5. Implement Estate and Succession Planning

Set up wills, trusts, and foundations to ensure smooth wealth transfer.

Involve heirs or beneficiaries in financial education.

6. Review and Adjust Annually

Evaluate investment performance and market conditions.

Adjust asset allocations and contributions based on economic changes.

贊 0

我也要評論

提問

0條評論

還沒人評論,趕緊搶佔沙發

提問

還沒人評論,趕緊搶佔沙發