2025-02-12 20:28

業內The impact of central bank policy on forex market

#firstdealofthenewyearastylz

The Impact of Central Bank Policy on Forex Market

Introduction

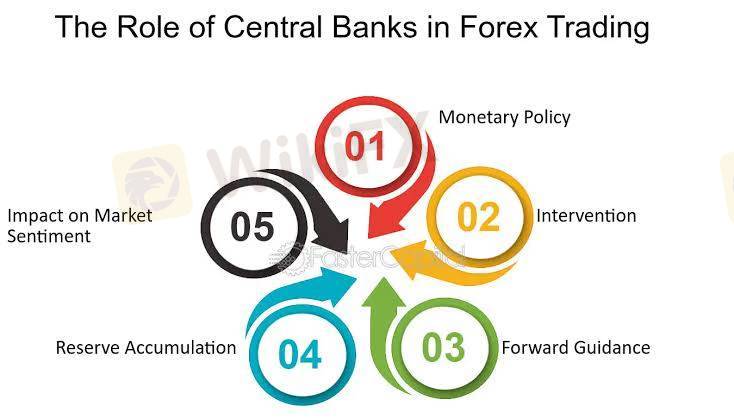

The foreign exchange (forex) market is a dynamic and highly volatile environment, influenced by a multitude of factors. Among these, central bank policy plays a crucial role in shaping the market's trajectory. Central banks, responsible for managing a nation's monetary policy, implement decisions that significantly impact currency values, trading volumes, and market sentiment.

Monetary Policy Tools

Central banks employ various monetary policy tools to achieve their objectives, including:

1. *Interest Rates*: Adjusting interest rates influences borrowing costs, consumption, and investment, ultimately affecting currency demand and value.

2. *Quantitative Easing (QE)*: Central banks create new money to purchase assets, injecting liquidity into the economy and influencing currency values.

3. *Forward Guidance*: Communicating future policy intentions helps shape market expectations, influencing currency prices.

Impact on Forex Market

Central bank policy decisions have far-reaching consequences for the forex market:

1. *Currency Volatility*: Changes in interest rates, QE, or forward guidance can lead to significant currency fluctuations, creating opportunities and challenges for traders.

2. *Currency Strength*: A central bank's decision to raise interest rates or implement hawkish policies can strengthen its currency, while dovish policies can weaken it.

3. *Trade Volumes*: Central bank policy announcements can increase trading volumes, as market participants react to new information and adjust their positions.

4. *Market Sentiment*: Central bank communication can influence market sentiment, with hawkish or dovish tones impacting investor confidence and risk appetite.

Examples and Case Studies

1. *Federal Reserve (Fed)*: The Fed's decision to raise interest rates in 2015 strengthened the US dollar, while its subsequent rate cuts in 2020 weakened the currency.

2. *European Central Bank (ECB)*: The ECB's implementation of QE in 2015 boosted the eurozone economy but weakened the euro currency.

3. *Bank of Japan (BoJ)*: The BoJ's adoption of negative interest rates in 2016 aimed to stimulate the Japanese economy but had limited impact on the yen currency.

Conclusion

Central bank policy has a profound impact on the forex market, influencing currency values, trading volumes, and market sentiment. Understanding central bank decisions and communication is crucial for traders, investors, and policymakers to navigate the complex and dynamic forex market. By analyzing central bank policy, market participants can make informed decisions, manage risk, and capitalize on opportunities in the ever-changing forex landscape.

贊 0

Vic.d

Брокеры

熱門討論

業內

哎,现在明白不赌就是赢啊

行情分析

美元/加元技术面

技術指標

外汇技术分析之波浪理论

業內

[活動]論交易,贏取200元話費補貼

技術指標

EZ.Fury Kite是基于趋势指标MA进行判断

技術指標

指标派是什么?

市集分類

平臺

展會

代理商

招聘

EA

業內

行情

指標

The impact of central bank policy on forex market

香港 | 2025-02-12 20:28

香港 | 2025-02-12 20:28#firstdealofthenewyearastylz

The Impact of Central Bank Policy on Forex Market

Introduction

The foreign exchange (forex) market is a dynamic and highly volatile environment, influenced by a multitude of factors. Among these, central bank policy plays a crucial role in shaping the market's trajectory. Central banks, responsible for managing a nation's monetary policy, implement decisions that significantly impact currency values, trading volumes, and market sentiment.

Monetary Policy Tools

Central banks employ various monetary policy tools to achieve their objectives, including:

1. *Interest Rates*: Adjusting interest rates influences borrowing costs, consumption, and investment, ultimately affecting currency demand and value.

2. *Quantitative Easing (QE)*: Central banks create new money to purchase assets, injecting liquidity into the economy and influencing currency values.

3. *Forward Guidance*: Communicating future policy intentions helps shape market expectations, influencing currency prices.

Impact on Forex Market

Central bank policy decisions have far-reaching consequences for the forex market:

1. *Currency Volatility*: Changes in interest rates, QE, or forward guidance can lead to significant currency fluctuations, creating opportunities and challenges for traders.

2. *Currency Strength*: A central bank's decision to raise interest rates or implement hawkish policies can strengthen its currency, while dovish policies can weaken it.

3. *Trade Volumes*: Central bank policy announcements can increase trading volumes, as market participants react to new information and adjust their positions.

4. *Market Sentiment*: Central bank communication can influence market sentiment, with hawkish or dovish tones impacting investor confidence and risk appetite.

Examples and Case Studies

1. *Federal Reserve (Fed)*: The Fed's decision to raise interest rates in 2015 strengthened the US dollar, while its subsequent rate cuts in 2020 weakened the currency.

2. *European Central Bank (ECB)*: The ECB's implementation of QE in 2015 boosted the eurozone economy but weakened the euro currency.

3. *Bank of Japan (BoJ)*: The BoJ's adoption of negative interest rates in 2016 aimed to stimulate the Japanese economy but had limited impact on the yen currency.

Conclusion

Central bank policy has a profound impact on the forex market, influencing currency values, trading volumes, and market sentiment. Understanding central bank decisions and communication is crucial for traders, investors, and policymakers to navigate the complex and dynamic forex market. By analyzing central bank policy, market participants can make informed decisions, manage risk, and capitalize on opportunities in the ever-changing forex landscape.

贊 0

我也要評論

提問

0條評論

還沒人評論,趕緊搶佔沙發

提問

還沒人評論,趕緊搶佔沙發