2025-02-21 18:44

業內How forex traders respond to a Fed rate cut

#FedRateCutAffectsDollarTrend

How Forex Traders Respond to a Fed Rate Cut

Forex traders closely monitor Federal Reserve (Fed) decisions, as interest rate changes have a significant impact on currency values. A rate cut by the Fed often signals a shift in the economic landscape, and forex traders will adjust their strategies based on how the market interprets these changes.

The response of forex traders to a Fed rate cut can vary based on market expectations, the economic context, and the magnitude of the rate cut, but there are some common patterns and strategies traders typically follow.

1. Immediate Market Reaction: Short-Term Movements

When the Fed announces a rate cut, forex markets react quickly due to the immediate impact on interest rate differentials between the U.S. dollar (USD) and other currencies. Traders often respond in real-time to adjust their positions. The response can be categorized as follows:

a. USD Weakness

• Expectations vs. Actual Cut: In most cases, the U.S. dollar weakens after a rate cut because the lower interest rates make the currency less attractive to foreign investors. A lower yield on U.S. assets reduces their appeal, leading traders to sell the USD in favor of higher-yielding currencies (e.g., the euro or the Australian dollar).

• Example: If the Fed cuts rates by 0.25% when the market expected a bigger cut, the USD may weaken, as the market perceives the cut as insufficient to stimulate the economy or is concerned about economic slowdown.

b. USD Strength (Occasionally)

• Rate Cuts in the Context of Economic Growth: Sometimes, a rate cut might strengthen the USD due to market expectations of future economic stability or growth. If the market believes the Fed is cutting rates to support a recovering economy, it could interpret the action as a positive signal, driving traders to buy the USD.

• Risk Sentiment: In certain scenarios, a rate cut can signal to traders that the Fed is acting proactively, which can reduce concerns about economic slowdown or even a recession, strengthening the dollar as a safe-haven currency.

2. Medium to Long-Term Forex Response

The market’s longer-term response to a Fed rate cut can depend on several factors, including the economic backdrop, future rate cut expectations, and the Fed’s forward guidance. Forex traders take these elements into account when positioning themselves for longer-term trends.

a. Changing Expectations About Future Rate Cuts

• Forex traders often adjust their expectations of future rate cuts based on the Fed’s actions. For example, if the rate cut is seen as a sign that the Fed will continue to ease policy, the USD may continue to weaken over time. Conversely, if the rate cut is seen as a one-time event and there are no additional rate cuts expected, the USD might stabilize or even strengthen.

• Example: If the Fed signals that the rate cut is a part of a series of cuts, traders may short the USD in favor of other currencies, anticipating a prolonged period of lower rates in the U.S.

b. Economic Data and Fed Forward Guidance

• Follow-up Economic Data: Traders will also focus on economic data, such as GDP growth, inflation, and unemployment, to gauge the effectiveness of the Fed’s rate cuts. If the data improves following the rate cut, traders may shift their expectations about the USD.

• Fed’s Forward Guidance: The Fed’s comments after a rate cut are crucial. If the Fed suggests that it has no immediate plans for further cuts, traders may consider this as a signal to buy USD, expecting a pause or tightening later on. If the Fed continues to emphasize a dovish outlook, traders may position for a weaker USD.

3. Strategic Approaches to Forex Trading After a Fed Rate Cut

a. Trend Following (Post-Rate Cut Trends)

• Immediate Trend: After a Fed rate cut, forex traders who follow trends often go long on currencies that benefit from the weaker USD (e.g., the euro, Australian dollar, or Japanese yen). The logic is that the USD will likely depreciate in the short term, so traders look to buy the currencies with the strongest potential for appreciation.

• Example: If the Fed cuts rates by 0.5%, and traders expect further cuts, they may continue buying EUR/USD, betting on further USD weakness over the weeks or months following the rate cut.

b. Carry Trade Opportunities

• Carry Trade Strategy: Carry traders may also respond to Fed rate cuts by adjusting their positions. The carry trade involves borrowing money in a currency with low interest rates and investing in a currency with higher interest rates. If the Fed cuts rates, traders may unwind USD-based carry trades or increase positions in currencies of countries with higher interest rates.

• Example: If a Fed rate cut causes the USD to weaken, traders may borrow USD to fund positions in higher-yielding currencies like the Australian dollar (AUD) or the New Zealand dollar (NZD).

c. Risk Management and Hedging

• Risk-Off Sentiment: Sometimes, a rate cut can ind

贊 0

Sriniwas

중개인

熱門討論

業內

哎,现在明白不赌就是赢啊

行情分析

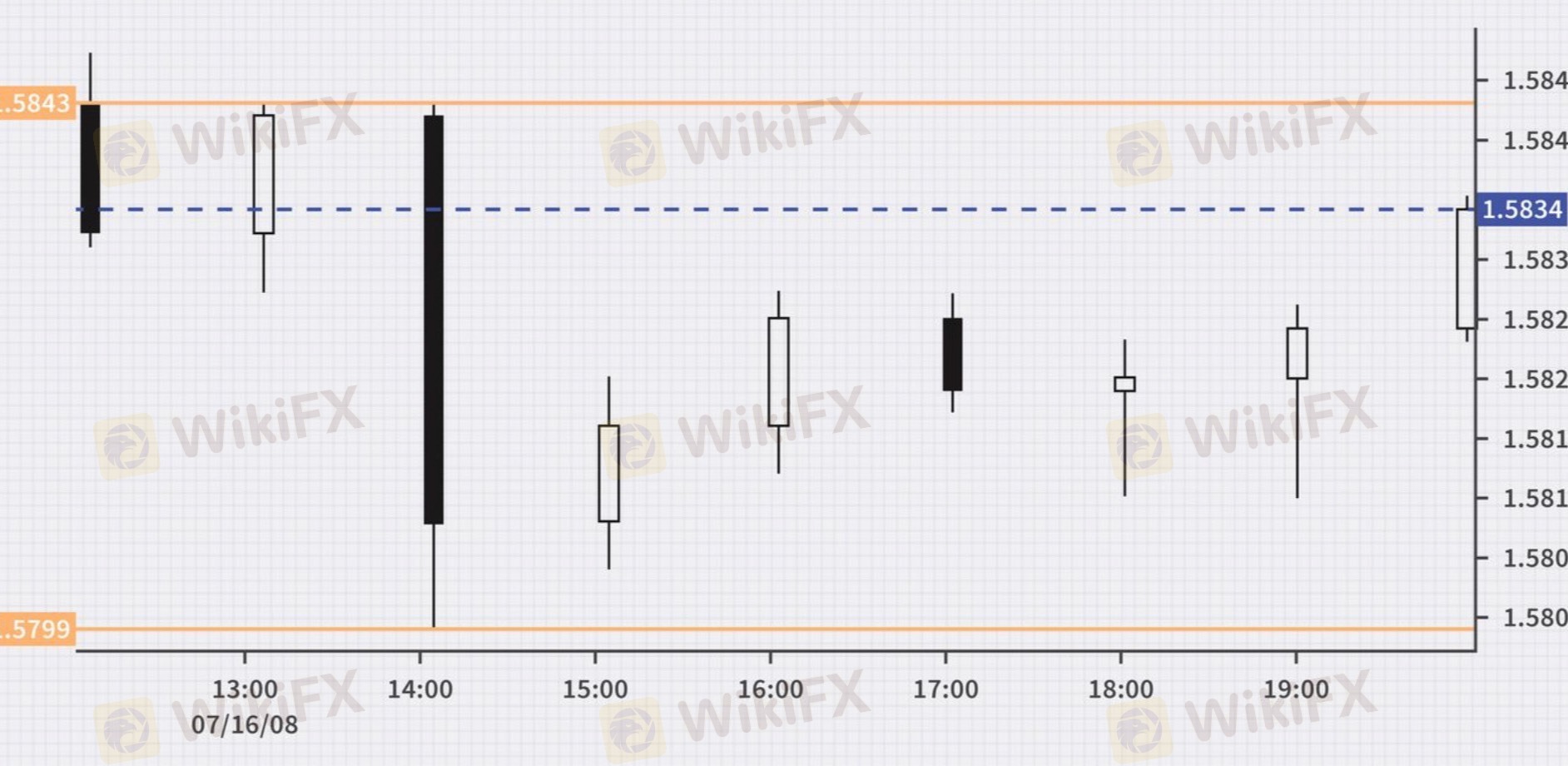

美元/加元技术面

技術指標

外汇技术分析之波浪理论

業內

[活動]論交易,贏取200元話費補貼

技術指標

EZ.Fury Kite是基于趋势指标MA进行判断

技術指標

指标派是什么?

市集分類

平臺

展會

代理商

招聘

EA

業內

行情

指標

How forex traders respond to a Fed rate cut

印度 | 2025-02-21 18:44

印度 | 2025-02-21 18:44#FedRateCutAffectsDollarTrend

How Forex Traders Respond to a Fed Rate Cut

Forex traders closely monitor Federal Reserve (Fed) decisions, as interest rate changes have a significant impact on currency values. A rate cut by the Fed often signals a shift in the economic landscape, and forex traders will adjust their strategies based on how the market interprets these changes.

The response of forex traders to a Fed rate cut can vary based on market expectations, the economic context, and the magnitude of the rate cut, but there are some common patterns and strategies traders typically follow.

1. Immediate Market Reaction: Short-Term Movements

When the Fed announces a rate cut, forex markets react quickly due to the immediate impact on interest rate differentials between the U.S. dollar (USD) and other currencies. Traders often respond in real-time to adjust their positions. The response can be categorized as follows:

a. USD Weakness

• Expectations vs. Actual Cut: In most cases, the U.S. dollar weakens after a rate cut because the lower interest rates make the currency less attractive to foreign investors. A lower yield on U.S. assets reduces their appeal, leading traders to sell the USD in favor of higher-yielding currencies (e.g., the euro or the Australian dollar).

• Example: If the Fed cuts rates by 0.25% when the market expected a bigger cut, the USD may weaken, as the market perceives the cut as insufficient to stimulate the economy or is concerned about economic slowdown.

b. USD Strength (Occasionally)

• Rate Cuts in the Context of Economic Growth: Sometimes, a rate cut might strengthen the USD due to market expectations of future economic stability or growth. If the market believes the Fed is cutting rates to support a recovering economy, it could interpret the action as a positive signal, driving traders to buy the USD.

• Risk Sentiment: In certain scenarios, a rate cut can signal to traders that the Fed is acting proactively, which can reduce concerns about economic slowdown or even a recession, strengthening the dollar as a safe-haven currency.

2. Medium to Long-Term Forex Response

The market’s longer-term response to a Fed rate cut can depend on several factors, including the economic backdrop, future rate cut expectations, and the Fed’s forward guidance. Forex traders take these elements into account when positioning themselves for longer-term trends.

a. Changing Expectations About Future Rate Cuts

• Forex traders often adjust their expectations of future rate cuts based on the Fed’s actions. For example, if the rate cut is seen as a sign that the Fed will continue to ease policy, the USD may continue to weaken over time. Conversely, if the rate cut is seen as a one-time event and there are no additional rate cuts expected, the USD might stabilize or even strengthen.

• Example: If the Fed signals that the rate cut is a part of a series of cuts, traders may short the USD in favor of other currencies, anticipating a prolonged period of lower rates in the U.S.

b. Economic Data and Fed Forward Guidance

• Follow-up Economic Data: Traders will also focus on economic data, such as GDP growth, inflation, and unemployment, to gauge the effectiveness of the Fed’s rate cuts. If the data improves following the rate cut, traders may shift their expectations about the USD.

• Fed’s Forward Guidance: The Fed’s comments after a rate cut are crucial. If the Fed suggests that it has no immediate plans for further cuts, traders may consider this as a signal to buy USD, expecting a pause or tightening later on. If the Fed continues to emphasize a dovish outlook, traders may position for a weaker USD.

3. Strategic Approaches to Forex Trading After a Fed Rate Cut

a. Trend Following (Post-Rate Cut Trends)

• Immediate Trend: After a Fed rate cut, forex traders who follow trends often go long on currencies that benefit from the weaker USD (e.g., the euro, Australian dollar, or Japanese yen). The logic is that the USD will likely depreciate in the short term, so traders look to buy the currencies with the strongest potential for appreciation.

• Example: If the Fed cuts rates by 0.5%, and traders expect further cuts, they may continue buying EUR/USD, betting on further USD weakness over the weeks or months following the rate cut.

b. Carry Trade Opportunities

• Carry Trade Strategy: Carry traders may also respond to Fed rate cuts by adjusting their positions. The carry trade involves borrowing money in a currency with low interest rates and investing in a currency with higher interest rates. If the Fed cuts rates, traders may unwind USD-based carry trades or increase positions in currencies of countries with higher interest rates.

• Example: If a Fed rate cut causes the USD to weaken, traders may borrow USD to fund positions in higher-yielding currencies like the Australian dollar (AUD) or the New Zealand dollar (NZD).

c. Risk Management and Hedging

• Risk-Off Sentiment: Sometimes, a rate cut can ind

贊 0

我也要評論

提問

0條評論

還沒人評論,趕緊搶佔沙發

提問

還沒人評論,趕緊搶佔沙發