IC Markets

摘要:IC Markets is an online forex and CFD brokerage firm that offers a wide range of financial instruments across different asset classes, including forex, indices, commodities, stocks, bonds, cryptocurrencies, and futures. IC Markets aims to provide a comprehensive trading experience to its clients, offering multiple account types such as cTrader accounts, Raw Spread accounts, and Standard accounts, each catering to various trading preferences. The broker also offers access to popular trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, along with a free demo account for traders to practice and improve their skills.

Risk Warning

Online trading is dangerous, and you could potentially lose all of your investment funds. Not all investors and traders are suitable for it. Please understand that the information on this website is designed to serve as general guidance, and that you should be aware of the risks.

General Information

| IC Markets Review Summary | |

| Registered Country/Region | Seychelles |

| Regulation | FSA (Offshore Regulated), ASIC & CYSEC (Suspicious Clone) |

| Market Instruments | Forex, indices, commodities, stocks, bonds, cryptocurrencies, futures |

| Demo Account | Available |

| Leverage | 1:500 |

| EUR/USD Spread | 0.0 pips |

| Trading Platforms | MT4/MT5, cTrader |

| Minimum Deposit | $200 |

| Customer Support | 24/7 live chat, phone, email, social media |

What is IC Markets?

IC Markets is an online forex and CFD brokerage firm that offers a wide range of financial instruments across different asset classes, including forex, indices, commodities, stocks, bonds, cryptocurrencies, and futures. IC Markets aims to provide a comprehensive trading experience to its clients, offering multiple account types such as cTrader accounts, Raw Spread accounts, and Standard accounts, each catering to various trading preferences. The broker also offers access to popular trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, along with a free demo account for traders to practice and improve their skills.

Pros & Cons

| Pros | Cons |

| • Diverse range of trading instruments | • Reports of severe slippage and scam |

| • Access to popular trading platforms like MT4, MT5, and cTrader | • High minimum deposit |

| • Offers a free demo account | • No valid regulation |

| • 24/7 live chat supported | • Regional restrictions |

IC Markets Alternative Brokers

There are many alternative brokers to IC Markets depending on the specific needs and preferences of the trader. Some popular options include:

AvaTrade - With over 200 financial instruments, AvaTrade caters to various trading styles and offers a user-friendly interface with both fixed and variable spreads. It supports multiple platforms, including MT4 and MT5.

XM - XM is known for its low minimum deposit requirements, generous leverage options, and a wide range of educational resources. It provides MT4 and MT5 platforms and is regulated by multiple financial authorities.

IG - As a well-established broker, IG offers access to a diverse range of markets, including stocks, forex, indices, and commodities. It provides a user-friendly trading platform and is regulated by top-tier authorities.

Is IC Markets Safe or Scam?

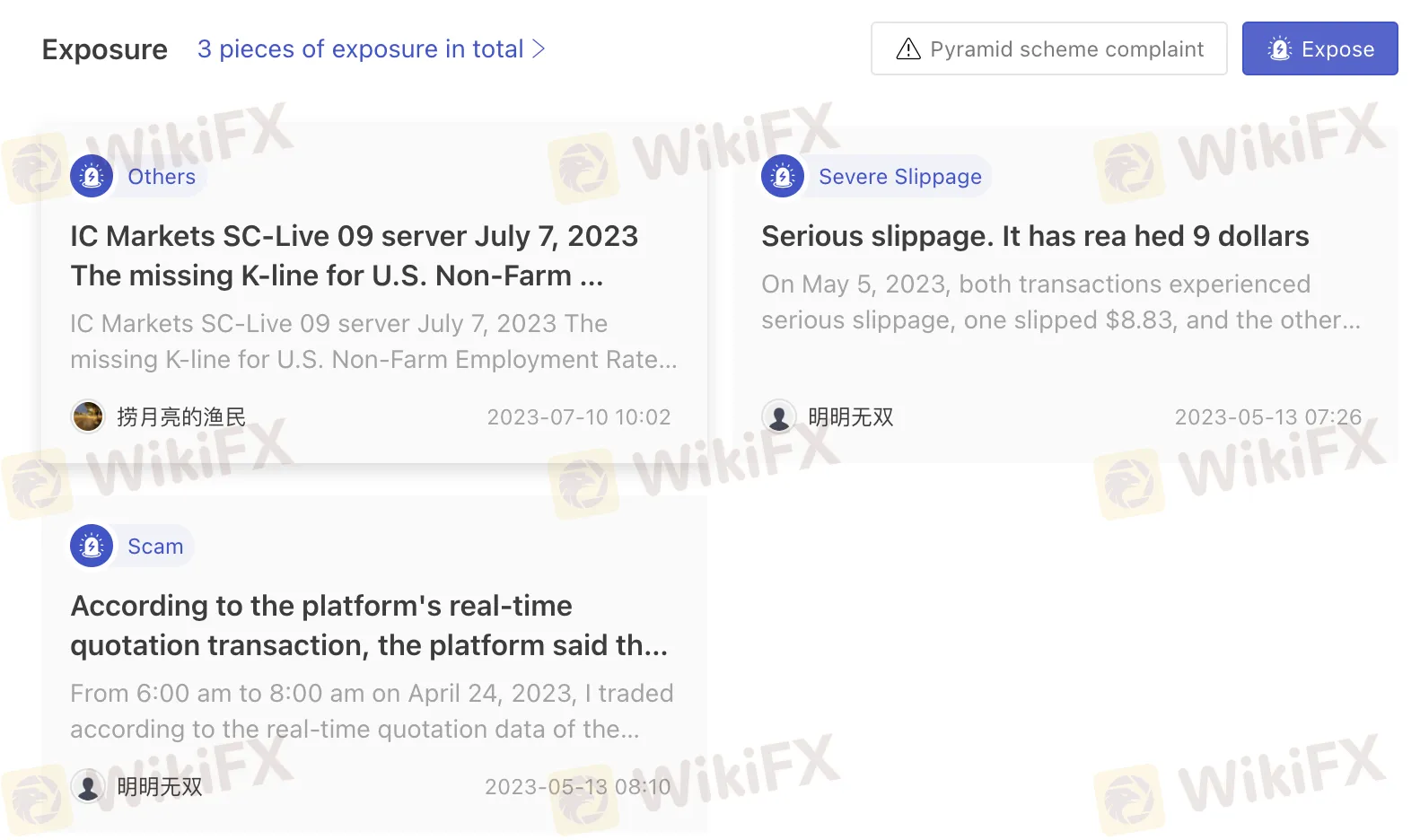

IC Markets holds three regulatory licenses, however, none of them is valid. The Seychelles Financial Services Authority (FSA, No. SD018) license is offshore regulated, Australia Securities & Investment Commission (ASIC, No. 335692) and Cyprus Securities and Exchange Commission (CYSEC, No. 362/18) are both suspicious clones. Regulation is an essential factor in assessing the safety of a brokerage firm as it provides oversight and helps ensure compliance with industry standards and client protection measures.

Regarding the reports of severe slippage and scams, it is crucial to consider the safe of this broker. It's essential to approach any financial service provider with caution and conduct due diligence before entrusting them with your funds. If you have concerns or doubts about a broker's legitimacy, consider seeking advice from financial experts and authorities. Additionally, be wary of making decisions solely based on unverified reports or rumors.

Market Instruments

IC Markets is a well-known brokerage firm that offers a diverse range of trading instruments across various asset classes, providing traders with a wide array of opportunities to participate in financial markets. Here's a brief summary of the market instruments available on IC Markets:

Forex: IC Markets offers access to the foreign exchange market, allowing traders to buy and sell currency pairs. Forex is one of the largest and most liquid markets globally, providing opportunities for both speculative trading and hedging.

Indices: Traders can trade on global stock market indices, such as the S&P 500, NASDAQ, FTSE 100, and others. Index trading allows investors to speculate on the overall performance of a group of stocks representing a specific market or industry.

Commodities: IC Markets provides access to commodity trading, allowing investors to trade popular commodities like gold, silver, oil, natural gas, and agricultural products. Commodity trading can serve as a hedge against inflation or geopolitical uncertainties.

Stocks: Through IC Markets, traders can invest in individual company stocks listed on various stock exchanges worldwide. This provides an opportunity to participate in the growth and performance of specific companies.

Bonds: The platform may offer trading opportunities in government and corporate bonds. Bonds are debt securities issued by governments or companies, and trading them allows investors to speculate on interest rates and credit risks.

Cryptocurrencies: IC Markets allows trading of cryptocurrencies like Bitcoin, Ethereum, Litecoin, and others. Cryptocurrencies have gained popularity as a volatile and innovative asset class.

Futures: Traders can access futures contracts, which are agreements to buy or sell assets at a predetermined price on a specific date in the future. Futures can be based on commodities, indices, or other financial instruments.

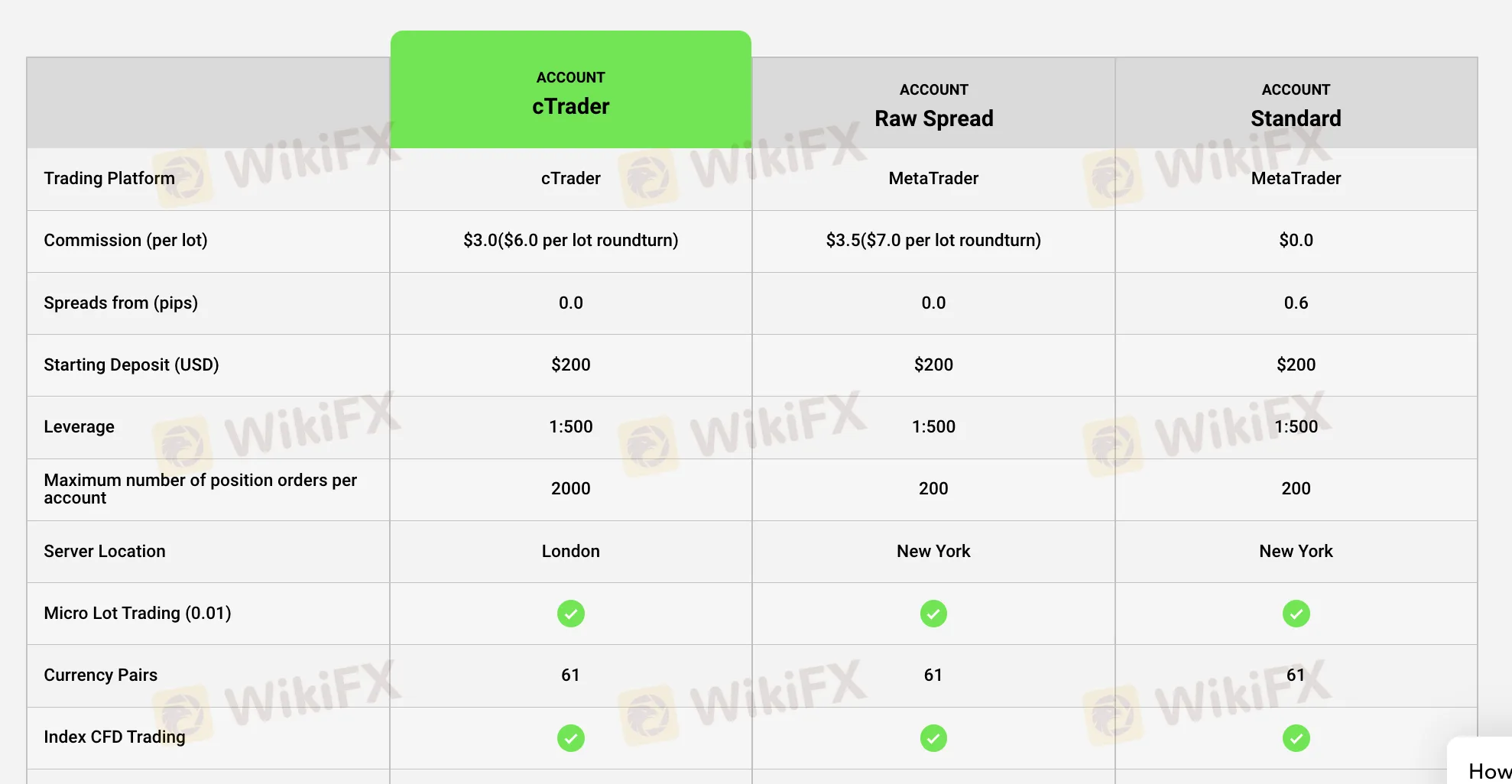

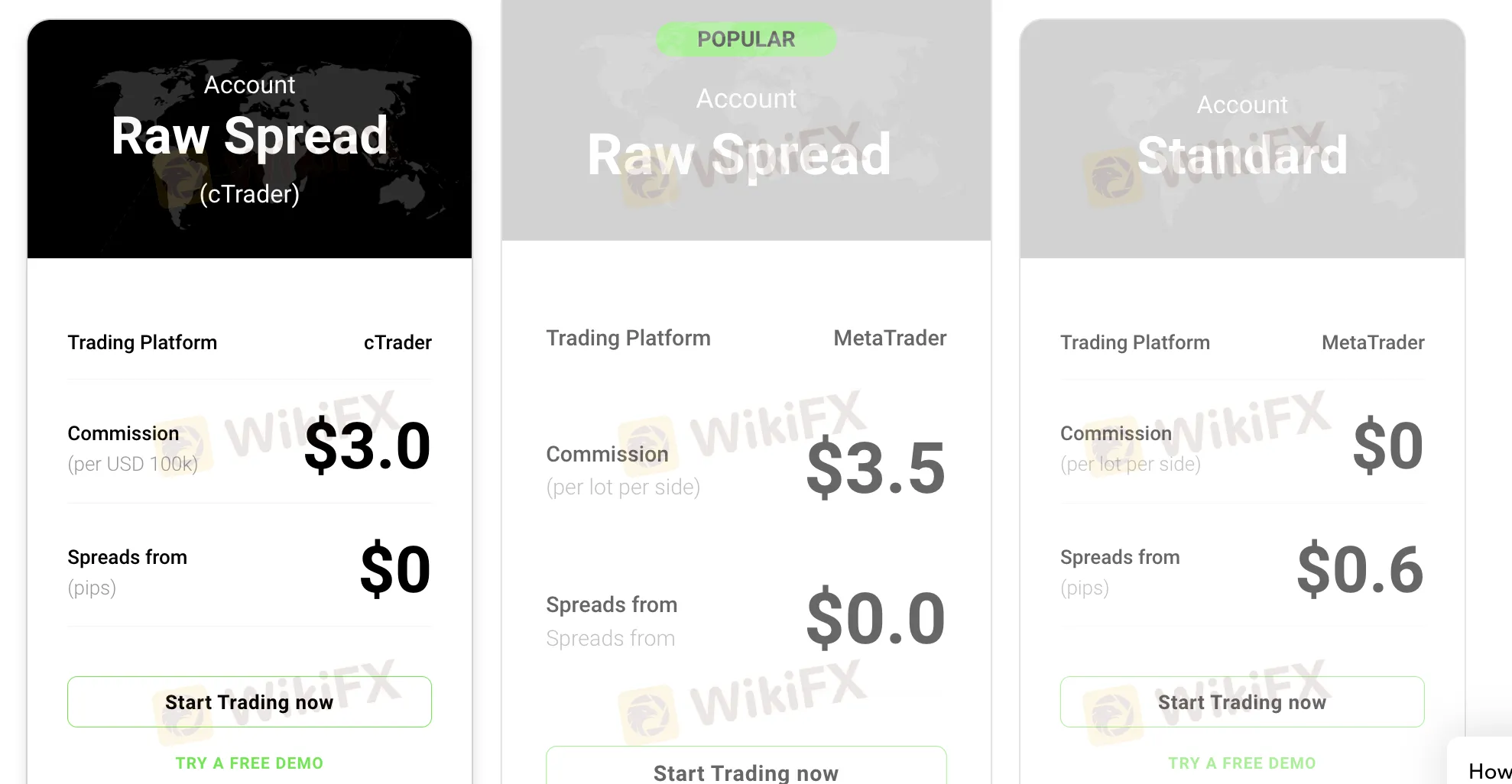

Accounts

IC Markets understands the diverse needs of its clients and offers a range of trading accounts to cater to different trading styles and preferences. Traders have the flexibility to choose from various account types, including cTrader accounts, Raw Spread accounts, and Standard accounts, all with a reasonable minimum deposit requirement of $200. Each account type comes with its own unique features and trading conditions to accommodate traders with varying strategies and risk appetites.

Furthermore, IC Markets understands the importance of practice and skill development, which is why they offer a Demo Account for clients. This free account allows traders to engage in simulated trading with virtual funds, providing an authentic market experience without risking real money.

Leverage

IC Markets provides a maximum leverage of 1:500 for all types of trading accounts. Leverage allows traders to control larger positions in the market with a smaller amount of capital. For instance, with a 1:500 leverage, traders can control $500 in the market for every $1 of their own capital. While high leverage can amplify potential profits, it also increases the risk of significant losses. Traders should exercise caution and use leverage responsibly, considering their risk tolerance and trading strategies, as higher leverage can magnify both gains and losses in their trading activities.

Spreads & Commissions

IC Markets caters to traders seeking competitive pricing and transparent fee structures across its different account types. For Raw Spread accounts and cTrader accounts, the broker offers spreads starting from $0, providing direct market access to ultra-tight pricing directly from liquidity providers. This pricing model appeals to traders who value minimal spreads and prefer to pay a small commission per trade rather than having the costs built into the spread.

On the other hand, for Standard accounts, traders enjoy the convenience of fixed spreads with rates starting at $0.6. The absence of commissions makes this account type suitable for traders who prefer a more straightforward fee structure and do not wish to pay additional charges per trade.

For cTrader accounts, IC Markets charges a competitive commission of $3 per trade, while Raw Spread account holders are subject to a slightly higher commission of $3.5 per trade. And for Standard account, the commission is $0.0. These commissions, in combination with the tight spreads, create a transparent pricing environment for traders who value low-cost trading and appreciate knowing the precise costs of their transactions.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commissions (per lot) |

| IC Markets | 0.6 (Std) | $0 (Std) |

| AvaTrade | 0.9 | N/A |

| XM | 0.6 | N/A |

| IG | 0.6 | N/A |

Trading Platforms

IC Markets' diverse selection of trading platforms reflects their commitment to accommodating traders with varying levels of experience and different trading preferences.

For those who value a straightforward and familiar interface, MetaTrader 4 (MT4) offers a highly accessible platform. With its user-friendly design and extensive library of technical indicators, MT4 is a popular choice for both novice and experienced traders.

For traders seeking more advanced capabilities and a broader range of financial instruments, MetaTrader 5 (MT5) presents an appealing option. Building on the foundation of MT4, MT5 introduces additional features, including more charting tools, timeframes, and support for trading stocks and futures alongside forex and CFDs.

For a unique trading experience, IC Markets offers cTrader, a platform renowned for its transparency and efficiency. With its Level II pricing, traders gain access to market depth, allowing for a deeper understanding of price movements and potential liquidity.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| IC Markets | MT4/MT5, cTrader |

| AvaTrade | AvaTradeGO, MT4, MT5, WebTrader, AvaOptions, DupliTrade |

| XM | MT4/MT5, Trading software |

| IG | MT4 |

Trading Tools

IC Markets provides a range of trading tools to enhance the trading experience for its clients. Here's a brief description of some of the key trading tools offered by IC Markets:

Virtual Private Server (VPS):

This service is particularly beneficial for traders who employ automated trading strategies (EAs) and want to ensure optimal trade execution and minimal downtime.

Using a VPS ensures that trading platforms run 24/7 without interruptions, even if the trader's computer is turned off or experiencing connectivity issues.

IC Markets offers a Virtual Private Server service to traders, allowing them to host their trading platforms and Expert Advisors (EAs) in a dedicated virtual environment.

Trading Servers:

Low latency is crucial for traders who execute high-frequency or time-sensitive trades.

These trading servers are strategically located in data centers around the world, aiming to reduce latency and provide traders with fast and seamless access to the financial markets.

IC Markets maintains robust and reliable trading servers to facilitate quick and efficient order execution.

Advanced Trading Tools

IC Markets offers advanced trading tools and features that assist traders in making well-informed decisions and managing their trades effectively.

Traders can utilize these tools to conduct thorough market analysis, identify trading opportunities, and implement their trading strategies with greater precision.

These tools may include various technical indicators, charting tools, economic calendars, and market analysis resources.

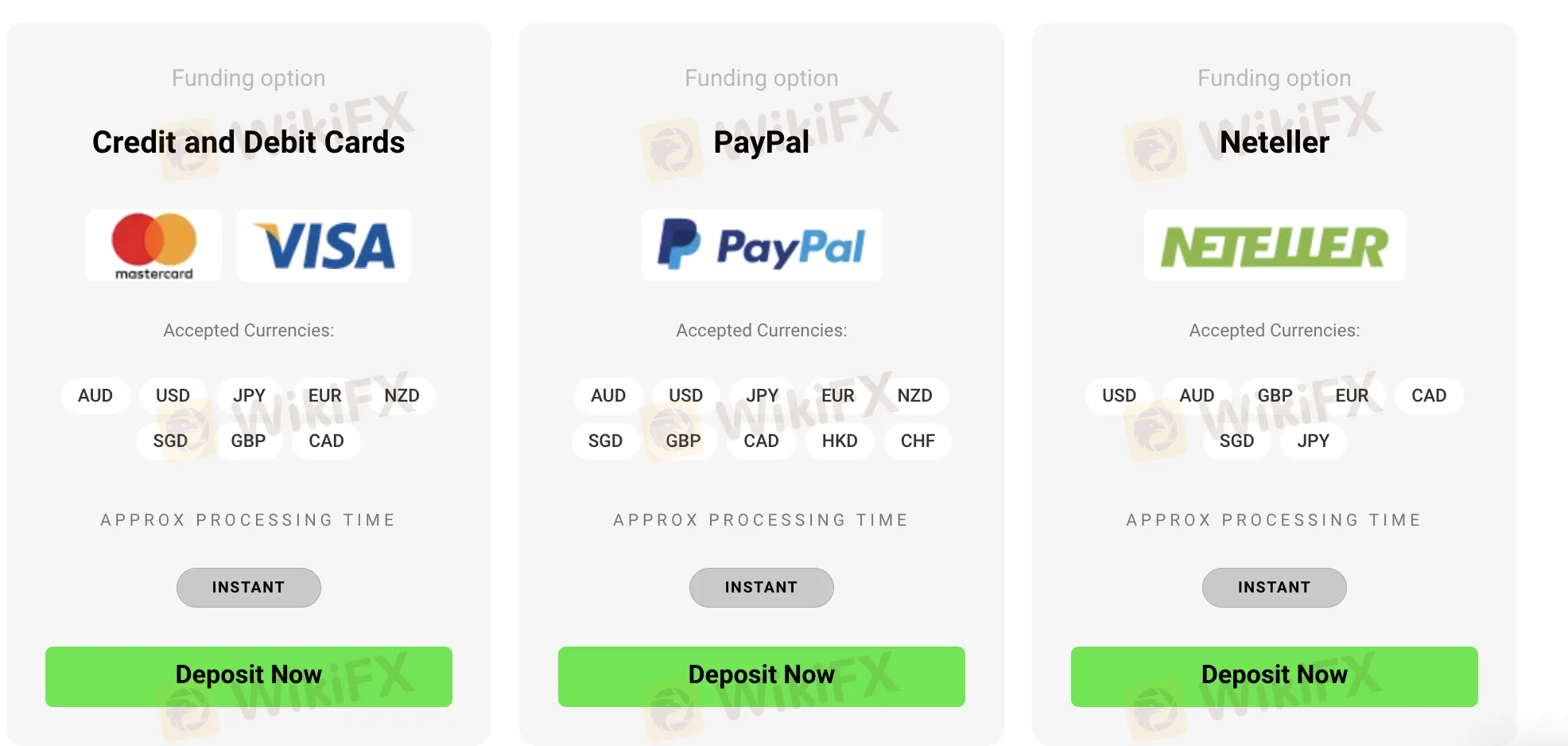

Deposits & Withdrawals

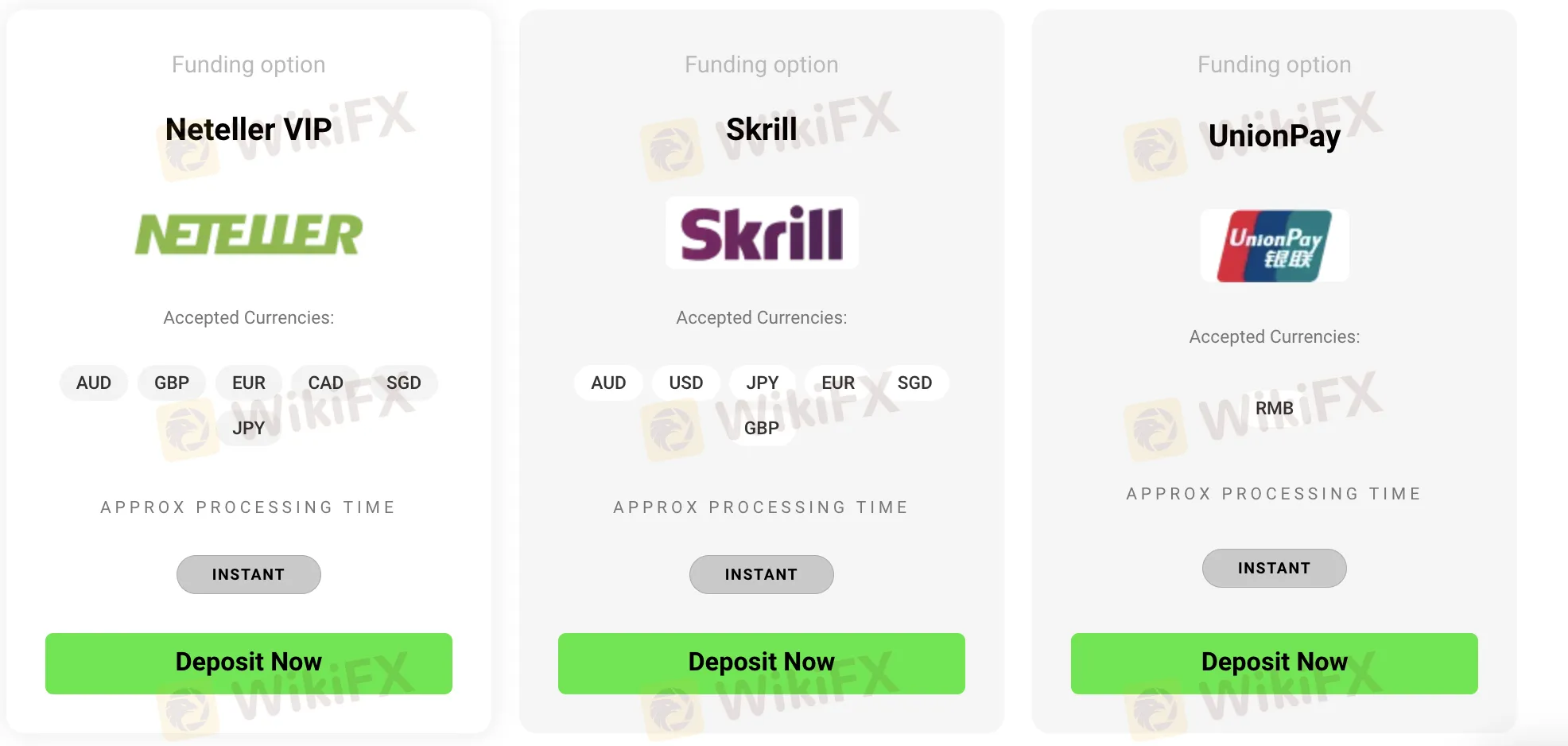

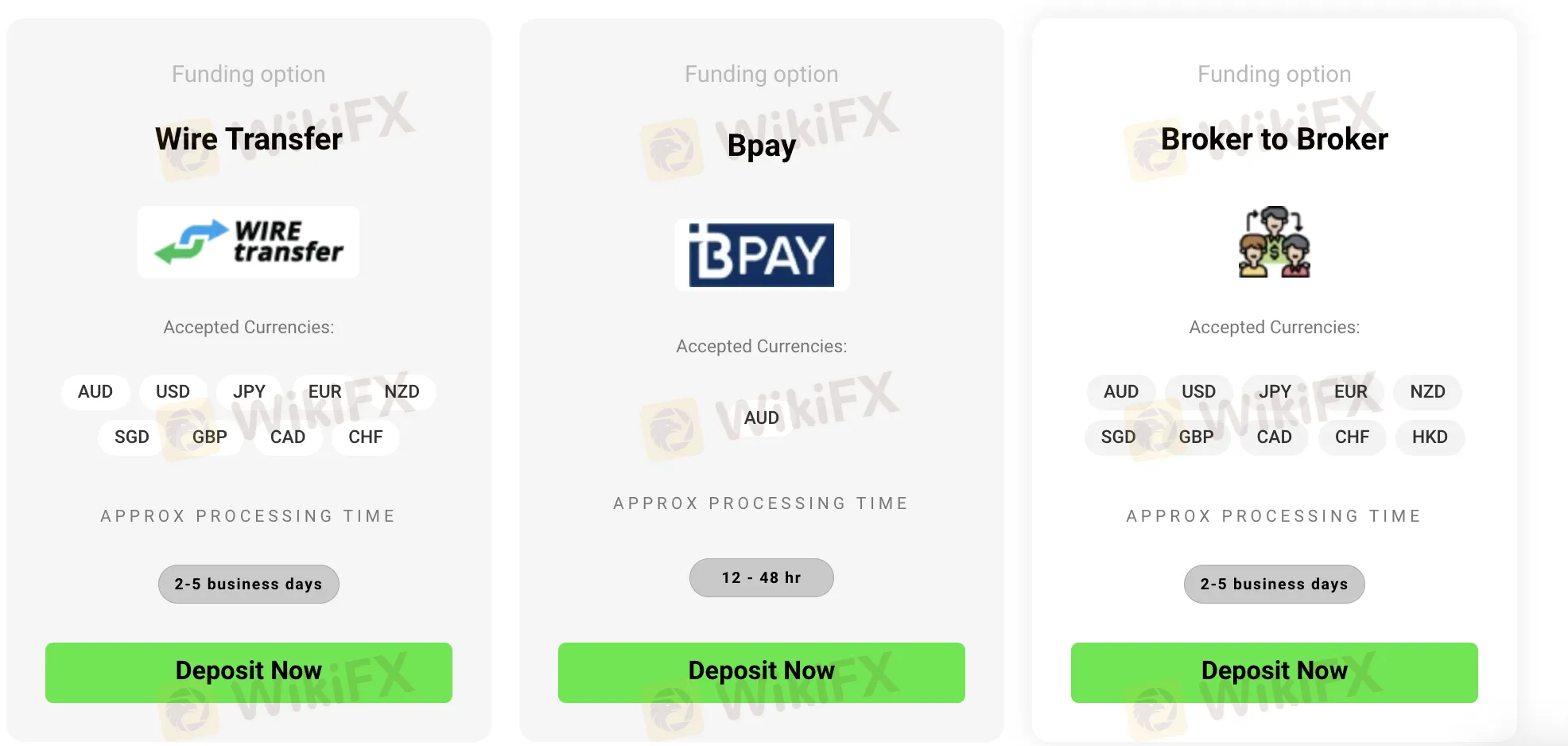

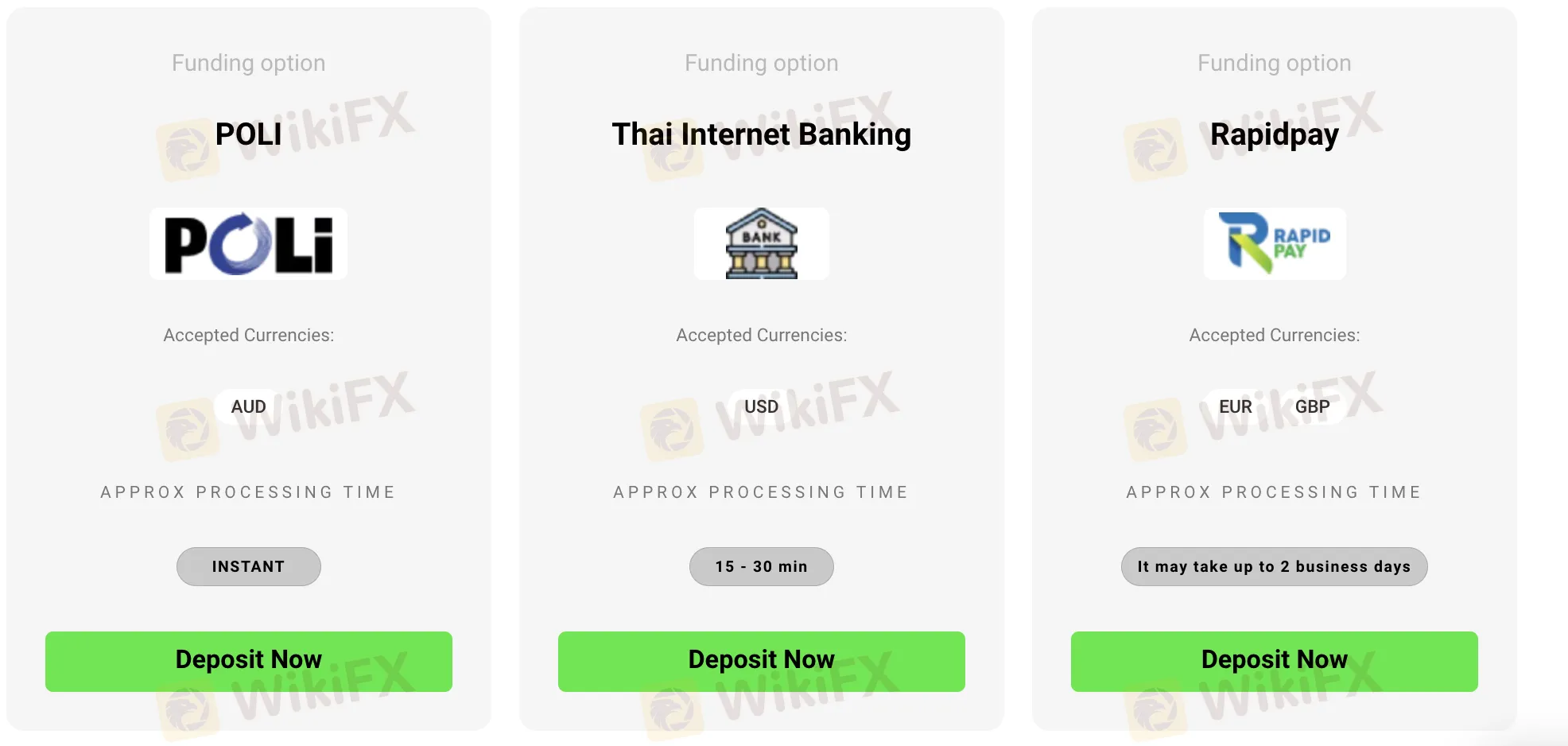

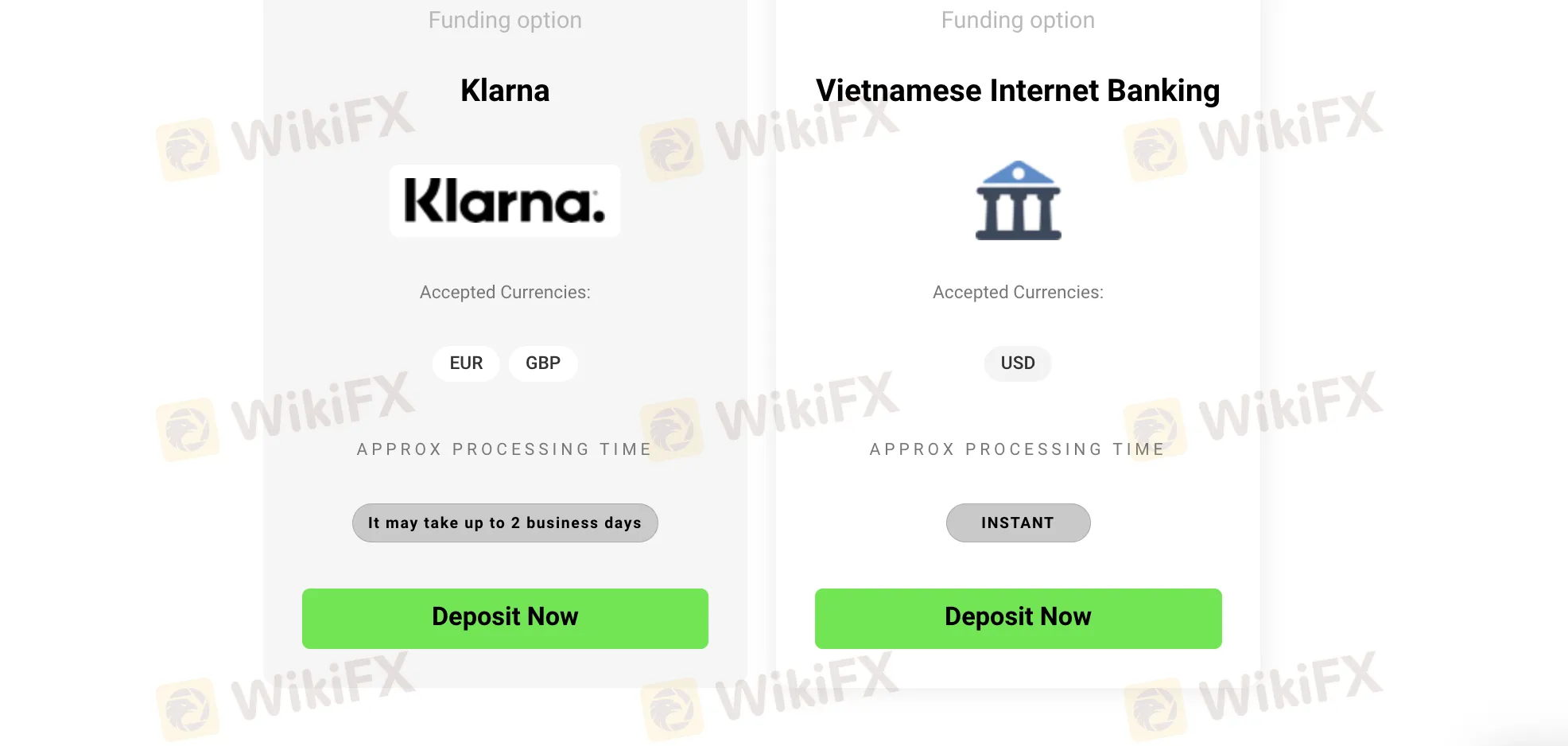

IC Markets is a brokerage firm that offers a variety of deposit and withdrawal methods to cater to the needs of its clients. The broker accepts a range of popular payment options, including VISA, PayPal, NETELLER, Skrill, UnionPay, Wire Transfer, Bpay, Broker to Broker, POLI, Thai Internet Banking, Rapidpay, Klarna, and Vietnamese Internet Banking.

The minimum deposit requirement is $200, allowing traders with different budget levels to access their services.

IC Markets Minimum deposit vs other brokers

| IC Markets | Most other | |

| Minimum Deposit | $200 | $100 |

However, detailed information regarding fees and processing times for deposits and withdrawals is not readily available, which may be a concern for some traders.

User Exposure on WikiFX

On our website, you can see reports of severe slippage and scam. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section. We would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

IC Markets offers comprehensive customer service options to address the needs and inquiries of its clients. The 24/7 live chat feature enables real-time communication with the support team, allowing traders to receive immediate responses to their queries at any time of the day or night.

Additionally, customers can contact the broker's customer service team through phone support (+248 467 19 76), offering direct and personal assistance.

For less urgent matters, traders can reach out via email (clientrelations@icmarkets.com), providing a convenient way to communicate and receive detailed responses to more complex issues.

IC Markets also engages with its clients on social media platforms, including Facebook, Twitter, Instagram, and LinkedIn, fostering a more interactive and accessible approach to customer support.

Education

IC Markets is dedicated to empowering its clients with valuable educational resources to enhance their trading knowledge and skills. The educational platform offered by IC Markets encompasses a variety of topics, catering to both beginner and experienced traders. Here's a brief description of some of the educational offerings:

Advantages of Forex:

This section educates traders about the benefits and opportunities presented by the forex market.

Traders can learn about the 24/5 trading schedule, high liquidity, and the ability to profit from both rising and falling markets.

It highlights the significance of leveraging and risk management in forex trading.

Advantages of CFDs:

The section on CFDs (Contracts for Difference) introduces traders to the benefits of trading these derivative instruments.

It explains how CFDs allow traders to speculate on the price movements of various assets without owning the underlying asset.

The educational material emphasizes the flexibility of trading CFDs on a diverse range of financial instruments.

Video Tutorials:

IC Markets provides video tutorials covering various aspects of trading, suitable for traders of all levels.

These tutorials cover topics such as platform navigation, placing trades, using technical analysis tools, and understanding trading strategies.

The video format makes it easier for traders to grasp complex concepts visually, enhancing the learning experience.

Conclusion

IC Markets is an unregulated brokerage firm that offers a diverse range of trading instruments and trading platforms, providing traders with ample opportunities to engage in the financial markets. The broker's array of account types and leverage options caters to traders of different experience levels and risk appetites. Additionally, IC Markets extends its commitment to customer support, offering 24/7 live chat, phone, email, and social media channels for efficient assistance. The educational platform empowers clients with valuable resources to enhance their trading knowledge and strategies. However, as with any broker, it is essential for traders to conduct thorough research and exercise caution, considering factors such as recent regulatory status, customer reviews, and reported issues before making a decision about the safety and reliability of IC Markets.

Frequently Asked Questions (FAQs)

Q1: Is IC Markets a regulated brokerage firm?

A1: No, IC Markets claims to be regulated by FSA (Offshore Regulated), ASIC & CYSEC (Suspicious Clone).

Q2: What types of trading instruments does IC Markets offer?

A2: IC Markets offers a diverse range of trading instruments across various asset classes, including forex, indices, commodities, stocks, bonds, cryptocurrencies, and futures.

Q3: What are the minimum deposit requirements for opening an account with IC Markets?

A3: The minimum deposit requirement for all account types at IC Markets is $200.

Q4: What trading platforms are available for clients at IC Markets?

A4: IC Markets provides access to popular trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

Q5: Does IC Markets have any regional restrictions?

A5: Yes. It does not provide services for residents of certain countries such as the United States of America, Canada, Israel, New Zealand, Iran and North Korea (Democratic People's Republic of Korea) or a country where such distribution or use would be contrary to local law or regulation.

天眼交易商

熱點資訊

WikiEXPO成為利伯蘭官方合作夥伴,共同推動全球金融交易領域創新與健康發展

Admiral Markets艾迪麥深度評測:一文了解平台監管情形、交易環境、用戶評價、潛在風險

外匯市場槓桿效應全解析:小資金如何撬動大收益

外匯投資陷阱?TGC TRADE網站消失,交易安全堪憂!

eToro為8個歐洲國家新增本地貨幣存款功能

「點差」詐騙手法完全揭露:選擇交易平台之前必須知道的5件事

越南破獲史上最大投資理財詐騙案!知名網紅竟是詐騙頭目!

匯率計算