2025 Brokerage Tech Landscape: The Great Balancing Act Between Legacy and Innovation

الملخص:A deep dive into the 2025 trading infrastructure. Comprehensive market data reveals how the industry is navigating the dominance of legacy platforms while embracing a new era of diversification.

In 2025, the architecture of the retail trading industry presents a fascinating contradiction. On the surface, the sector appears heavily consolidated around established legacy systems, yet beneath this stability, a significant strategic shift is underway. Broad-scale market data provides a granular look at how brokerage firms are constructing their technology stacks to meet the demands of a modern, fragmented market.

The Persistence of the “Dual-Core” Standard

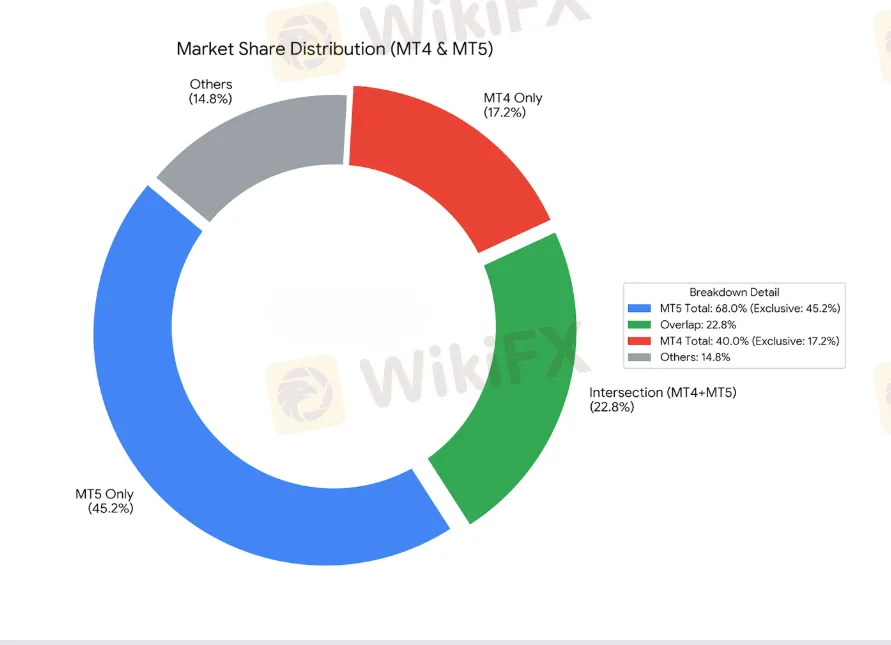

Despite years of predictions regarding the obsolescence of older technology, recent statistics confirm that the industrys reliance on the MetaTrader ecosystem has not just endured—it has deepened. MetaTrader 5 (MT5) has unequivocally secured its position as the market standard, now serving as the backbone for approximately 68% of the analyzed brokers. Its broad adoption speaks to the industry's need for multi-asset capabilities, accommodating everything from traditional forex to futures and commodities.

However, the ascent of MT5 has not resulted in the immediate extinction of its predecessor. MetaTrader 4 (MT4)remains a stubborn fixture, present in the portfolios of roughly 40% of firms. This resilience suggests that brokers are prioritizing “stickiness” over pure modernization; they are retaining the older platform to appease a massive, loyal community of algorithmic traders while simultaneously pushing new clients toward the more robust architecture of MT5. Consequently, the combined footprint is staggering: 85.2% of all brokers utilize at least one of these two giants, making them the undisputed gravity center of the sector.

The Erosion of the Single-Platform Model

While the giants dominate, the most telling trend lies in how they are deployed. The era of the “one-size-fits-all” broker appears to be slowly fading. While a majority of firms (approximately 60%) still adhere to a simplified, single-platform operational model to control costs, a growing segment of the market is moving toward diversification.

Nearly 23% of brokers have now integrated a second platform into their offering, and a small but agile tier of firms (under 5%) is managing complex ecosystems with three or more interfaces. This shift toward a multi-platform infrastructure is not merely a technical decision; it is a strategic hedge. By moving away from a single point of failure, brokers are building resilience into their operations and widening their net to capture different demographics of traders—from the “old school” scalper to the modern, visual-first investor.

The Rise of Specialized Alternatives

As brokers expand their stacks, they are increasingly looking outside the traditional ecosystem to fill specific gaps in user experience. Alternative platforms such as cTrader, TradingView, DXtrade, and Match Trader are gaining ground, not necessarily as total replacements, but as specialized complements.

The data highlights interesting strategic pairings. While the combination of MT4 and MT5 remains the default “safe bet,” we are seeing a rise in hybrid setups. For instance, roughly 6% of brokers now pair MT5 with cTrader, and others are integrating charting-heavy solutions like TradingView alongside their execution engines. These combinations suggest that brokers are trying to curate a more holistic environment—offering the raw power of legacy systems alongside the superior UI/UX and analytical tools of the challengers.

Verdict

The 2025 data paints a picture of an industry in transition. The market is not discarding the past; it is building a bridge to the future. For the foreseeable future, the successful broker will likely be defined by their ability to manage this hybridity—offering the rock-solid reliability of the old guard while integrating the flexibility and innovation of the new contenders.

وسيط WikiFX

أحدث الأخبار

2025 Brokerage Tech Landscape: The Great Balancing Act Between Legacy and Innovation

【داخل لجنة النخبة】حوار مع محمد لواء

مشهد تكنولوجيا الوساطة في 2025: عملية التوازن الكبرى بين الأنظمة القديمة والابتكار

أصوات لجنة تحكيم جائزة Golden Insight | دينيس يِه، رئيس منطقة آسيا والمحيط الهادئ في Taurex

حساب النسبة