Excite One

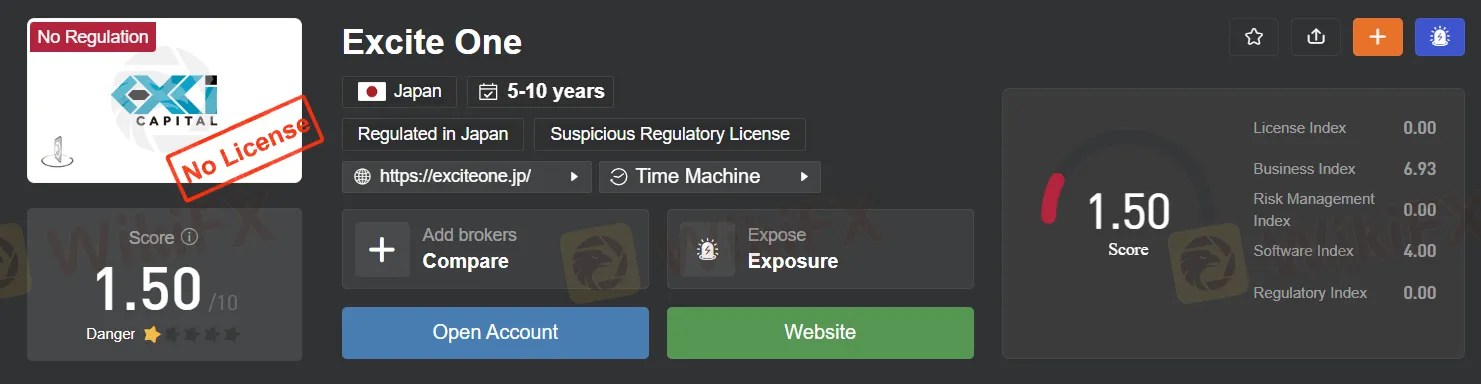

Zusammenfassung:Excite One, a company supposedly registered in Japan, operated in a suspicious and unregulated manner. It claimed to offer forex trading services but was widely regarded as a suspicious clone. The broker provided a maximum leverage of up to 1:100 for most asset classes but offered only 1:3 for cryptocurrencies. Spreads varied across different asset classes, and the broker's trading platform was limited to MetaTrader 4 (MT4). While it boasted a range of tradable assets, including forex, commodities, indices, stocks, and bonds, Excite One's credibility came under question due to its dubious practices. The broker offered both live and demo trading accounts, but its educational tools were notably absent. This, coupled with its dubious reputation, led to significant skepticism within the trading community. Furthermore, it's important to note that Excite One had reportedly ceased providing forex trading services, further adding to concerns surrounding its operations. Traders were advised to

| Aspect | Information |

| Registered Country/Area | Japan |

| Company Name | Excite One |

| Regulation | Suspicious Clone |

| Maximum Leverage | Up to 1:100 (most asset classes), 1:3 (Cryptocurrencies) |

| Spreads | Varies by asset class |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Forex, Commodities, Indices, Stocks, Bonds |

| Account Types | Live Trading Account, Demo Trading Account |

| Demo Account | Available |

| Customer Support | Help Center, Live Chat, Email, Phone |

| Payment Methods | Credit & Debit Cards, Bank Wire |

| Educational Tools | No |

Overview

Excite One, a company supposedly registered in Japan, operated in a suspicious and unregulated manner. It claimed to offer forex trading services but was widely regarded as a suspicious clone. The broker provided a maximum leverage of up to 1:100 for most asset classes but offered only 1:3 for cryptocurrencies. Spreads varied across different asset classes, and the broker's trading platform was limited to MetaTrader 4 (MT4). While it boasted a range of tradable assets, including forex, commodities, indices, stocks, and bonds, Excite One's credibility came under question due to its dubious practices. The broker offered both live and demo trading accounts, but its educational tools were notably absent. This, coupled with its dubious reputation, led to significant skepticism within the trading community. Furthermore, it's important to note that Excite One had reportedly ceased providing forex trading services, further adding to concerns surrounding its operations. Traders were advised to exercise extreme caution and conduct thorough due diligence when considering any involvement with this broker.

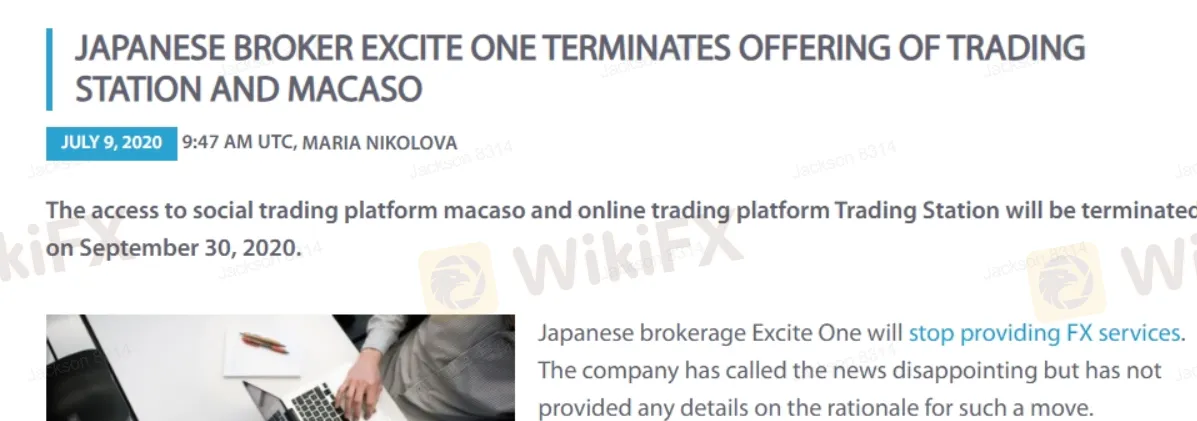

Regulation

Excite One, an unregulated forex broker, garnered notoriety for its unethical practices and lack of regulatory oversight. It operated without the strict supervision imposed on legitimate forex brokers, enabling it to make enticing but false promises to investors. Investors faced a high risk of financial loss due to its aggressive marketing tactics and lack of transparency. Many individuals lost significant amounts of money, and the absence of regulatory protection made it challenging for them to seek recourse. Eventually, Excite One faced legal action and investigations from various financial authorities, highlighting the perils of dealing with unregulated brokers and the need for thorough due diligence in the financial sector.

Pros and Cons

Excite One offered a diverse array of trading instruments, competitive leverage, and various payment methods. However, its lack of regulation and legal issues raised significant concerns. Additionally, limited fee information and unclear details about customer support and education posed challenges for traders. The choice between pros and cons depended on an individual's risk tolerance and priorities, emphasizing the importance of thorough research and due diligence when considering this broker.

| Pros | Cons |

| Diverse Range of Trading Instruments | Lack of Regulation |

| Competitive Leverage | Legal Issues |

| Multiple Payment Methods | Limited Fee Information |

| MetaTrader 4 (MT4) Platform | Unclear Customer Support and Education |

| Demo and Live Accounts | Risk of Loss with Leverage |

Market Instruments

Excite One was a versatile brokerage firm that offered a diverse range of trading instruments to meet the unique requirements of its clients. These instruments encompassed a wide array of financial assets, providing traders with opportunities for diversification and potential profit across various market conditions.

Forex (Foreign Exchange): Excite One facilitated Forex trading, allowing clients to participate in the vast and highly liquid foreign exchange market. This involved the buying and selling of currency pairs, including major ones like EUR/USD and GBP/JPY, allowing traders to speculate on currency price movements.

Commodities: Clients at Excite One could engage in commodity trading, which included precious metals like gold and silver, energy resources such as crude oil, and agricultural products like wheat and corn. Commodity markets were influenced by global supply and demand dynamics, making them appealing for diversifying investment portfolios.

Indices: Excite One offered index trading, granting clients access to invest in stock market indices. This allowed traders to track the performance of entire markets or specific sectors, with popular indices like the S&P 500, FTSE 100, and Nikkei 225 available for trading.

Stocks: Excite One provided access to equity markets, allowing clients to buy and sell shares of publicly traded companies. This comprehensive offering encompassed a wide range of stocks from various sectors and regions, providing traders with ample opportunities to invest in individual companies.

Bonds: For income-focused investors, Excite One offered bond trading. Bonds were fixed-income securities issued by governments and corporations, delivering regular interest payments to bondholders. Bond trading was an attractive option for those seeking a more stable income stream.

In summary, Excite One's diverse range of trading instruments catered to traders with various goals and risk appetites. Whether traders were interested in forex, commodities, indices, stocks, or bonds, the platform provided the tools and opportunities needed to explore and engage in the global financial markets.

Account Types

Excite One provides two primary types of trading accounts:

Demo Trading Account: Tailored for newcomers to the world of trading, this account offers the opportunity to practice without risk using virtual funds. It replicates genuine market conditions, allowing users to become acquainted with the platform's functionalities and gain confidence in their trading strategies.

Live Trading Account: Crafted for traders prepared to commit actual capital in live markets, this account opens the door to profit potential but also carries the risk of financial loss. Holders of live accounts gain access to real financial markets and receive enhanced support and services to aid them in their trading endeavors.

Leverage

This broker once offered a maximum trading leverage of up to 1:100 for most asset classes, including Forex, Metals, Indices, and Commodities. This allowed traders to put up just 1% of their trade's total value as margin to open a position, while controlling a position size up to 100 times the margin invested.

Shares had a maximum leverage of up to 1:20, and Bonds offered leverage up to 1:100. Leverage could amplify both profits and losses, emphasizing the importance of using it wisely in trading strategies.

Excite One's diverse range of market instruments allowed traders to build well-rounded portfolios, manage risk, and explore various market opportunities. Whether clients were interested in forex, commodities, indices, stocks, or bonds, they could access these instruments through the brokerage's platform.

Spreads & Commissions:

The broker's fee structure varies across different asset classes. For Forex and metals trading, spread values are variable and depend on the specific currency pairs or metals traded, while commissions range from 5.4 EUR to 9 USD. Indices and commodities trading do not incur any commission costs. Shares trading carries a commission of 0.02 USD per share per side, and bonds trading does not involve any commission fees. These cost details are critical for traders to consider when planning their trading strategies and assessing the overall expenses associated with different asset classes.

| Asset Class | Spreads | Commissions |

| Forex | Variable (Currency pair dependent) | Ranging from 5.4 EUR to 9 USD |

| Metals | Variable (Metal dependent) | Ranging from 5.4 EUR to 9 USD |

| Indices and Commodities | Not applicable (No commissions) | No commissions |

| Shares | Not specified | 0.02 USD per share per side |

| Bonds | Not applicable (No commissions) | No commissions |

Deposit & Withdrawal

Payment Methods at Excite One:

Credit and Debit Cards:

Advantages: Offered quick access to funds, making it ideal for prompt trading.

Use Cases: Were well-suited for traders looking to start trading immediately and capitalize on market opportunities.

Bank Wire Transfers:

Advantages: Were reliable, secure, and suitable for larger transactions.

Use Cases: Were ideal for clients who prioritized safety and intended to execute substantial transfers.

Excite One was committed to accommodating a diverse range of client preferences and transaction requirements by offering these payment methods. Whether clients prioritized the speed and convenience of card payments or the security and suitability of Bank Wire transfers, the platform aimed to provide a seamless and efficient experience for all financial transactions related to trading accounts.

Trading Platform

Excite One delivered a comprehensive array of trading platforms, ensuring that traders, whether novice or professional, had access to a versatile and seamless trading experience. These platforms included:

MetaTrader 4 (MT4) for Professionals: At Excite One, traders could harness the power of MetaTrader 4, a platform revered by professionals worldwide. MT4 offered competitive spreads starting from 0.0 Pips, enabling cost-effective trading across an extensive selection of over 300 markets. This platform excelled in execution speed, with orders processed in less than 1 millisecond (< 1ms). With 24/7 availability, traders could seize opportunities in global markets while benefiting from the best fills and low costs, even in challenging market conditions.

Customer Support

Certainly, here's a more organized description of Excite One's past customer support:

Customer Support at Excite One (Past Tense):

Help Center: Traders had access to an extensive online Help Center filled with FAQs, video tutorials, user guides, and articles. It served as a valuable self-help resource for finding answers to common questions and gaining insights into trading-related matters.

Live Chat: Excite One offered real-time live chat support, enabling traders to engage with customer support representatives directly for immediate assistance with urgent inquiries or technical issues while trading.

Email: Traders could reach out to the customer support team via email for less time-sensitive inquiries or those requiring detailed explanations. Responses were typically received within a specified timeframe.

Phone: Phone support allowed traders to speak directly with customer support representatives, making it ideal for resolving complex issues, account-related matters, or receiving personalized assistance. This channel operated during designated working hours.

These customer support channels were designed to cater to the diverse needs of traders, enhancing their overall trading experience with timely and relevant assistance.

Educational Resources

Details about Excite One's educational resources were not provided. These resources typically encompass tutorials, webinars, articles, videos, and guides designed to enhance traders' skills and market knowledge. For more information regarding Excite One's educational offerings, it is recommended to visit their official website or get in touch with their customer support team for comprehensive details.

Summary

Excite One, an unregulated forex broker, operated without regulatory oversight, leading to unethical practices and financial risks for investors. Despite its diverse range of trading instruments, including forex, commodities, indices, stocks, and bonds, it faced legal action due to its lack of transparency. The broker offered various account types, leverage options, and a fee structure that varied across asset classes, impacting traders' strategies and expenses. Additionally, Excite One provided multiple payment methods and a versatile trading platform, MetaTrader 4 (MT4). However, details about its customer support and educational resources were not available. Traders should exercise caution when dealing with unregulated brokers and prioritize due diligence in the financial sector.

FAQs

Q1: What is Excite One's regulatory status?

A1: Excite One was an unregulated forex broker, operating without oversight from financial authorities.

Q2: What trading instruments did Excite One offer?

A2: Excite One provided a wide range of instruments, including forex, commodities, indices, stocks, and bonds.

Q3: What were Excite One's leverage options?

A3: The broker offered leverage up to 1:100 for most asset classes, varying for shares and bonds.

Q4: What were the commission and spread structures at Excite One?

A4: Commissions ranged from 5.4 EUR to 9 USD for forex and metals trading, while indices and commodities had no commission costs. Spread values varied.

Q5: What was the primary trading platform offered by Excite One?

A5: Excite One's main trading platform was MetaTrader 4 (MT4), known for its speed and versatility in executing trades across various markets.

WikiFX-Broker

Aktuelle Nachrichten

PEPE legt 25 % zu: Wird der Widerstand bei $0,000025 jetzt geknackt?

Gold erlebte 2024 einen Boom: Jetzt machen viele Anleger Kasse mit dem Edelmetall

Lilium soll 200 Millionen Euro bekommen – aber es bleiben viele Unsicherheiten

Top 3 Cryptos: BTC, ETH und XRP im Aufwind

Frank Gotthardts CompuGroup Medical hält 22-Euro-Angebot pro Aktie von Investor CVC für „fair und angemessen

Grünen-Kanzlerkandidat Habeck will deutsche Verteidigungsausgaben deutlich steigern

Deutsche Bahn so unpünktlich wie seit 21 Jahren nicht mehr: Fast jeder dritte Fernzug 2024 verspätet

Warren Buffett empfiehlt den Kauf eines S&P 500 Indexfonds: Ein prominenter Tech-Investor warnt vor einer „bösen Überraschung

Interiorarchitektin verrät: Für diese 4 Produkte von Ikea würde ich 2025 kein Geld ausgeben

Volkswagen, Mitsubishi, Volvo: Wie dieser mächtige Banker russische Gesellschaften internationaler Unternehmen in Putins Reich aufkauft

Wechselkursberechnung