APL Markets

Zusammenfassung:APL Markets leads the way in financial technology, delivering sophisticated solutions tailored for astute money managers. With liquidity sourced from 85 global banks, secure, low-latency execution is assured. Services encompass Request for Streams, Algo-trading, Benchmark Trading, Executable Streaming Prices, API connectivity, automated order functionality, and Prime Brokerage with STP integration. Precision is paramount with real-time market depth and strategically-located data centers to minimize latency. The innovative backoffice interface, APLynx™, centralizes comprehensive data, offering specialized reports, VaR & Portfolio analysis, and transparent end-client statistics. APL Markets provides cutting-edge technology for informed financial decision-making.

| Company Name | APL Markets |

| Location | Belize City, Belize, C.A. |

| Regulation | Unregulated |

| Trading Platform | APLynx |

| Services Offered | - APLynx Trading Platform - White Label Solutions - Institutional Account Services |

| Customer Support | - Criticized for slow response times |

| Customer Support | info@apl-markets.com |

| Overall Assessment | Caution advised due to lack of regulation and limited transparency |

Overview

APL Markets leads the way in financial technology, delivering sophisticated solutions tailored for astute money managers. With liquidity sourced from 85 global banks, secure, low-latency execution is assured. Services encompass Request for Streams, Algo-trading, Benchmark Trading, Executable Streaming Prices, API connectivity, automated order functionality, and Prime Brokerage with STP integration. Precision is paramount with real-time market depth and strategically-located data centers to minimize latency. The innovative backoffice interface, APLynx™, centralizes comprehensive data, offering specialized reports, VaR & Portfolio analysis, and transparent end-client statistics. APL Markets provides cutting-edge technology for informed financial decision-making.

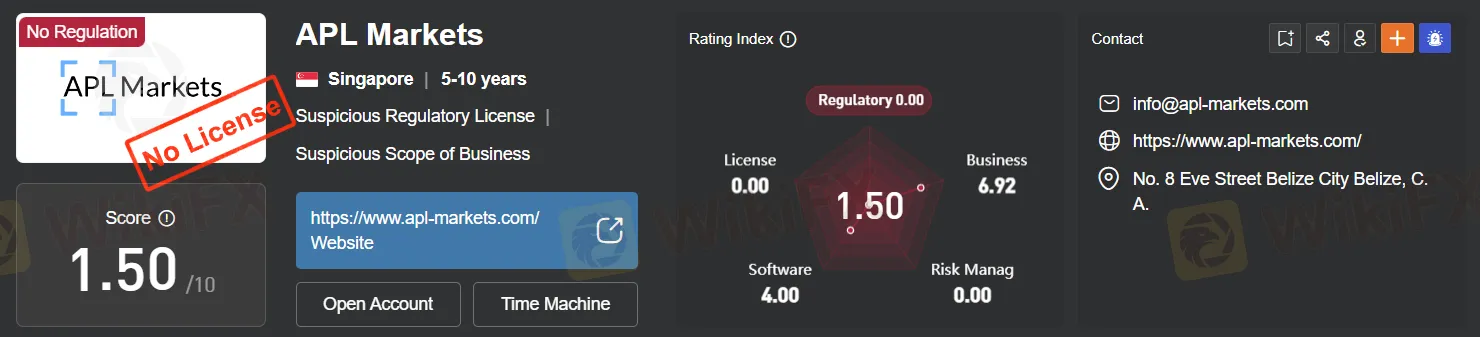

Regulation

APL Markets is an unregulated broker, a designation that raises concerns about its legitimacy and the level of investor protection it provides. Unregulated brokers often operate without the oversight and regulation that established financial authorities impose on their regulated counterparts. This lack of regulation can expose traders and investors to various risks, including potential fraudulent activities and inadequate customer protection measures. When considering investing with APL Markets or any unregulated broker, it is crucial to conduct thorough due diligence and exercise caution, as there may be limited recourse in case of disputes or financial issues. Choosing a regulated broker with a solid track record can offer a higher level of security and accountability for investors in the financial markets.

Pros and Cons

APL Markets offers a range of services, including a sophisticated trading platform, White Label Solutions, and Institutional Account Services. However, it operates as an unregulated broker, which can raise concerns about investor protection. The limited information available on its website and slow customer support response times contribute to a lack of transparency and may pose challenges for clients. While it offers competitive features like advanced order types, real-time market depth, and custom liquidity options, traders and investors should exercise caution and conduct thorough due diligence when considering APL Markets for their financial activities.

| Pros | Cons |

|

|

|

|

|

|

|

Services

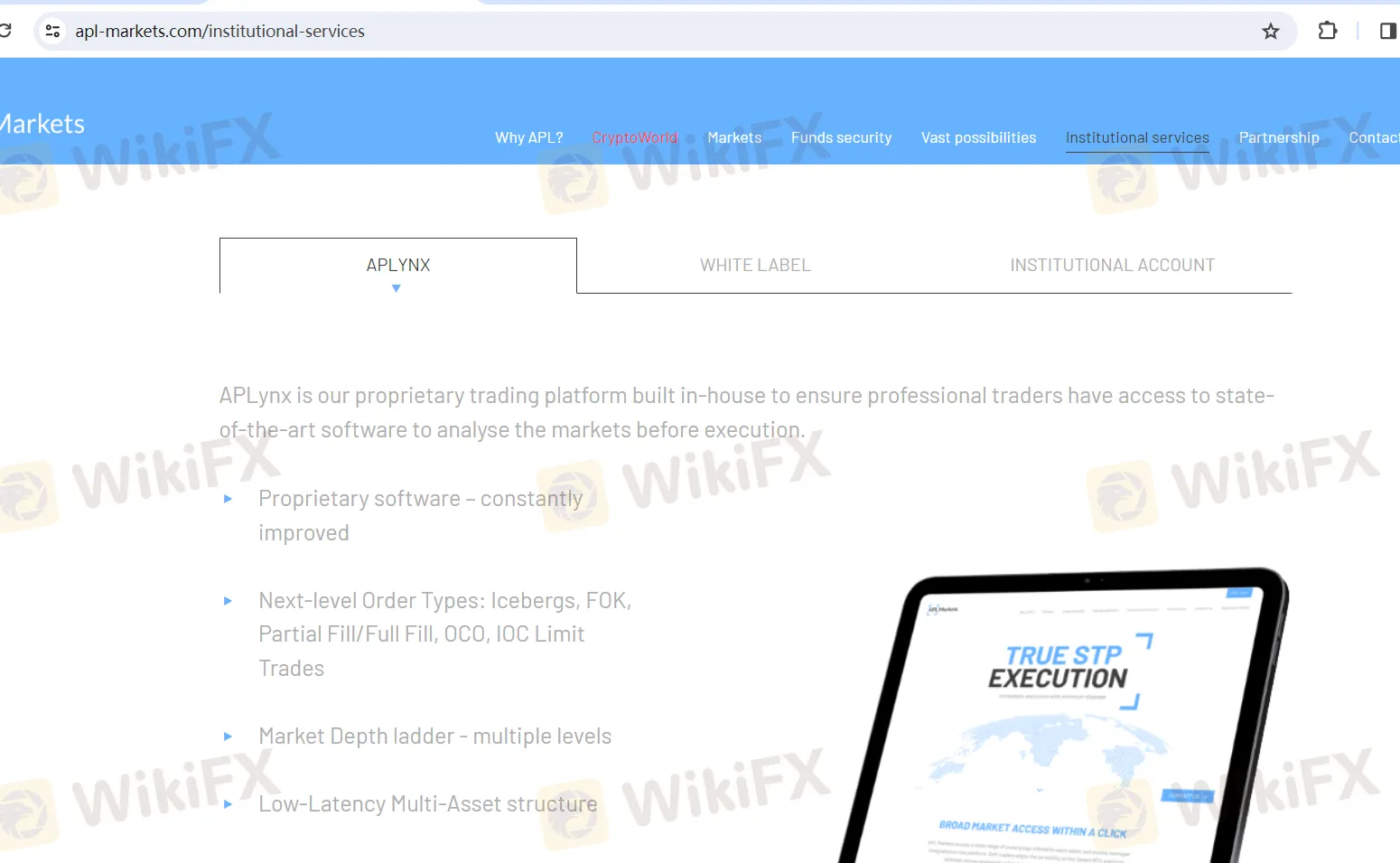

APLynx Trading Platform:

APL Markets offers APLynx, an exclusive proprietary trading platform designed in-house, providing professional traders with state-of-the-art software for comprehensive market analysis and execution. The platform features constantly improved proprietary software, advanced order types (Icebergs, FOK, Partial Fill/Full Fill, OCO, IOC Limit Trades), a detailed Market Depth ladder with multiple levels, low-latency multi-asset capabilities, and an Order Blotter for efficient trade reconciliation. With over 72 chart functions, traders can access charts of various levels of detail, inspect order flow, fill status, ticket sizes, active trades, all exportable into Excel, and enjoy detailed customization options tailored to their needs.

White Label Solutions:

APL Markets extends White Label solutions covering FX, Indices, CFDs, and Precious Metals. The platform offers access to over 90 technical indicators and drawing tools, competitive pricing, diverse plug-ins, custom liquidity options, a Multi Language Platform for global reach, and a customizable Execution Terminal. Additionally, clients benefit from the support of a dedicated Account Manager to facilitate their trading experience.

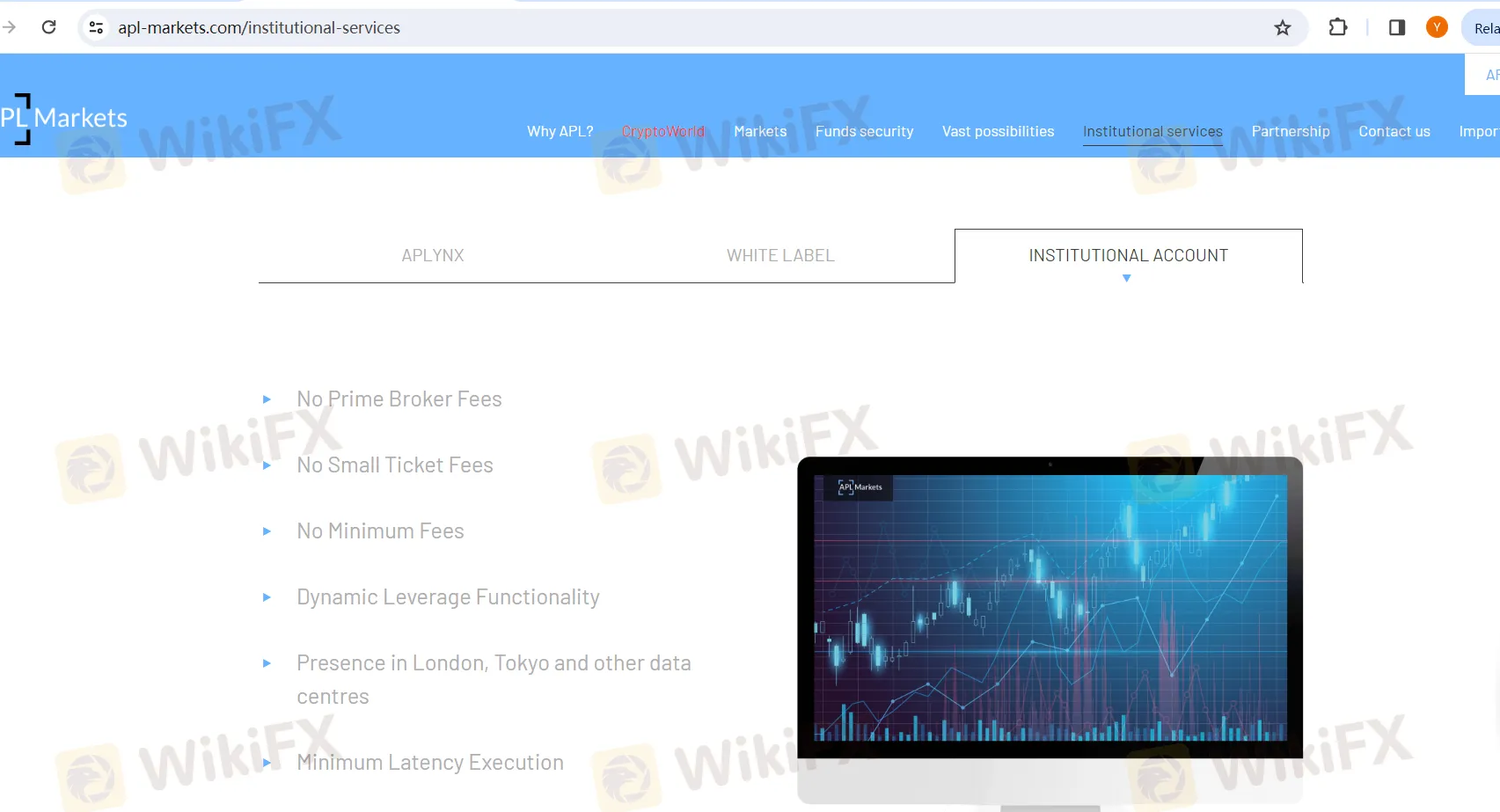

Institutional Account Services:

APL Markets' Institutional Account services cater to the needs of institutional clients with a focus on transparency and cost-efficiency. These services feature no Prime Broker Fees, no Small Ticket Fees, and no Minimum Fees. Traders can take advantage of Dynamic Leverage Functionality, ensuring flexible risk management. APL Markets maintains a global presence with locations in London, Tokyo, and other data centers, ensuring minimum latency execution. Pre-trade risk checking safeguards trading activities, and volume discounts are available for high-volume traders.

Customer Support

APL Markets' customer support has been criticized for its sluggish response times. Despite boasting lightning-fast trade execution, the response from their support team often falls short of expectations. Queries sent to their provided email address, info@apl-markets.com, may not receive prompt attention, leaving customers waiting for answers. This delayed response can be frustrating for clients seeking timely assistance or resolution to their concerns.

Summary

APL Markets, an unregulated broker, raises significant concerns regarding its legitimacy and investor protection. Operating without the oversight and regulation typical of established financial authorities, APL Markets exposes traders and investors to various risks, including potential fraud and inadequate customer protection. The lack of regulatory safeguards means limited recourse in disputes or financial issues, making investment with APL Markets a risky proposition. Furthermore, the limited information available on its website and the criticized sluggish customer support contribute to a lack of transparency and reliability. Traders and investors should exercise caution and thorough due diligence when considering APL Markets for their financial endeavors, as the absence of regulation can result in significant uncertainties and potential pitfalls.

FAQs

Q1: Is APL Markets a regulated broker?

A1: No, APL Markets is an unregulated broker, which may pose concerns about investor protection and legitimacy.

Q2: What services does APL Markets offer?

A2: APL Markets provides a range of services, including the APLynx Trading Platform, White Label Solutions, and Institutional Account Services, catering to various trading needs.

Q3: How can I contact APL Markets' customer support?

A3: You can reach APL Markets' customer support by emailing info@apl-markets.com, although some customers have reported delays in response times.

Q4: Are there any fees associated with APL Markets' Institutional Accounts?

A4: No, APL Markets' Institutional Accounts boast no Prime Broker Fees, Small Ticket Fees, or Minimum Fees, promoting cost-efficiency.

Q5: What should I consider before trading with APL Markets?

A5: Prior to trading with APL Markets, it is crucial to conduct thorough due diligence due to its lack of regulation, limited website information, and reported customer support issues, which can introduce uncertainties and risks.

WikiFX-Broker

Aktuelle Nachrichten

Traum vom Krypto-Staat auf Grönland: Was Tech-Mogule aus den USA mit Trumps Expansionsplänen zu tun haben

Internes Treffen der VW-Bosse: Darüber sprechen die Auto-Manager

Elon Musk sorgt mit Statistik Asylstatistik für Kritik – Experte ordnet die Zahlen ein

Erstmals seit 10 Jahren sind wieder drei Millionen Menschen arbeitslos – warum der Arbeitsmarkt dennoch erstaunlich stabil ist

„An oberster Stelle steht finanzielle Robustheit: Das sind laut internem Papier die neuen Konzern-Prioritäten von VW-Chef Oliver Blume

Schlechte Zahlen bei Audi: Müssen Mitarbeiter auf die versprochene Gehaltserhöhung verzichten?

Porsche will zwei Vorstände rauswerfen

Gemini: Hacker aus China, Iran und Nordkorea nutzen Googles KI, um ihre Produktivität zu steigern

Milliardär Reinhold Würth lobt die CDU unter Friedrich Merz und hofft auf Donald Trumps Vernunft

Intel: Schwache Erlösprognose für das laufende Quartal

Wechselkursberechnung