Nixse-Overview of Minimum Deposit, Spreads & Leverage

Zusammenfassung:Nixse is an online trading platform founded in 2020 and headquartered in Saint Vincent and the Grenadines. The broker offers a wide range of tradable assets, including currencies, commodities, stocks, indices, and digital currencies. It provides multiple account types, starting with a minimum deposit of $250, and offers leverage of up to 1:400. Nixse operates with variable spreads and does not specify commission rates on its website. Traders can fund their accounts using Mastercard, Visa, or Bitcoin, and the platform of choice is the NX Trader Platform. Customer support is available via phone, email, and live chat. Nixse also offers various educational resources, including technical market signals and analyst price targets, with more extensive tools available for higher-tier account holders. However, it's essential to note that Nixse is not regulated by any recognized financial regulatory authority, which may raise concerns about the safety and security of funds.

| Nixse | Basic Information |

| Company Name | Nixse |

| Founded | 2020 |

| Headquarters | Saint Vincent and the Grenadines |

| Regulations | Not regulated |

| Tradable Assets | Currencies, commodities, stocks, indices, and digital currencies |

| Account Types | Silver, Gold, Platinum, VIP, Black |

| Minimum Deposit | $250 |

| Maximum Leverage | 1:400 |

| Spreads | Variable spreads |

| Commission | Not specified |

| Deposit Methods | Mastercard, Visa, Bitcoin |

| Trading Platforms | NX Trader Platform |

| Customer Support | Phone, email, live chat |

| Education Resources | Technical market signals, analyst price targets, advanced education tools, depending on account type |

| Bonus Offerings | Not specified |

Overview of Nixse

Nixse is a relatively new online trading platform that was established in 2020 and is headquartered in Saint Vincent and the Grenadines. The platform offers a diverse range of trading instruments, including currencies, commodities, stocks, indices, and digital currencies, providing traders with ample opportunities to access global markets. Nixse caters to traders with varying experience levels by offering multiple account types, starting with a minimum deposit of $250.

One notable aspect of Nixse is its proprietary trading platform, the NX Trader Platform, known for its versatility and accessibility. Traders can access this platform via desktop installations or directly through a web browser, providing flexibility and convenience. Additionally, Nixse recognizes the importance of mobile trading and offers dedicated apps for both Android and iOS devices, allowing traders to stay connected and execute trades on the go.

However, it's crucial to highlight that Nixse operates without regulation from any recognized financial regulatory authority. This lack of oversight may raise concerns about fund safety and transparency. Traders considering Nixse should exercise caution and conduct thorough research before engaging in trading activities on the platform to ensure it aligns with their risk tolerance and objectives.

Is Nixse Legit?

Nixse is not regulated by any recognized financial regulatory authority. As an unregulated broker, it operates without oversight from regulatory bodies that are responsible for ensuring compliance with industry standards and protecting the interests of traders. This lack of regulation raises concerns about the safety and security of funds, as well as the transparency of the broker's business practices.

Trading with an unregulated broker like Nixse carries inherent risks. Without regulatory supervision, there may be limited avenues for dispute resolution, and traders may face challenges in seeking recourse in case of any issues or disputes. Additionally, unregulated brokers may not be subject to stringent financial and operational standards, potentially leading to inadequate client fund protection and unfair trading practices.

Pros and Cons

Nixse offers a diverse range of trading instruments, including currencies, commodities, stocks, indices, and digital currencies, providing traders with ample opportunities to diversify their portfolios. The availability of multiple account types caters to traders with varying needs and preferences. The NX Trader Platform, with its versatile charting and automation tools, enhances the trading experience. Additionally, the inclusion of mobile trading apps ensures traders can stay connected and execute trades on the go. However, it's important to note that Nixse operates without regulatory oversight, which raises concerns about fund safety and transparency. Detailed fee information, including spreads and commissions, is not readily available on the website, and educational resources vary by account type. Additionally, non-trading fees are not clearly outlined, creating uncertainty for potential traders.

| Pros | Cons |

| 1. Diverse Range of Trading Instruments | 1. Lack of Regulation |

| 2. Multiple Account Types | 2. Limited Information on Fees |

| 3. Versatile Trading Platform | 3. Educational Resources Vary by Account Type |

| 4. Mobile Trading Apps | 4. Uncertainty Regarding Non-Trading Fees |

Trading Instruments

Nixse offers a diverse range of trading instruments, providing traders with deep access to global markets. On the NX Trader platform, traders can choose from over 1,500 instruments, including currencies, commodities, stocks, indices, and digital currencies.

1. Currency Pairs: Trade over 90 currency pairs 24/5 with leverage up to 1:400.

2. Stock Indices: Speculate on the performance of top companies in indices like FTSE 100, NASDAQ, and S&P 500 without owning the shares.

3. Energies: Trade the price movements of energies like Natural Gas and Crude Oil without physical transactions.

4. Metals: Invest in precious metals such as Gold, Silver, and Platinum with favorable trading conditions.

5. Digital Currencies: Buy and sell popular digital currencies like Bitcoin and Litecoin with 24/7 market access.

6. Global Shares: Take positions on global corporations like Google, Microsoft, Netflix, and Tesla, going either long or short on their stocks.

Nixse's trading platform offers convenience and flexibility across these asset classes, making it accessible for traders to diversify their portfolios.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Metals | Crypto | CFD | Indexes | Stocks | ETFs |

| Nixse | Yes | Yes | Yes | No | Yes | Yes | No |

| RoboForex | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Pocket Option | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Tickmill | Yes | Yes | Yes | Yes | Yes | Yes | No |

Account Types

Nixse offers a range of account types tailored to meet the varying needs of traders:

Silver Account: With a minimum deposit of $10,000, this account provides a personal account manager, mobile trading, access to mini trading events, weekly technical market signals, analyst price targets, and a 15% Silver Credit.

Gold Account: Starting with a minimum deposit of $25,000, the Gold Account offers a dedicated account manager, mobile trading, participation in Gold Event Trading, daily technical signals (twice daily), analyst price targets, advanced educational tools, and Gold Credit benefits.

Platinum Account: This account, requiring a minimum deposit of $100,000, includes full educational resources, a dedicated account manager, mobile trading, access to Platinum Event Trading, Earning Season Trading (each quarter of the year), daily technical signals (five times daily), analyst price targets, advanced education tools, one month of swap-free trading, and Platinum Credit.

VIP Account: With a minimum deposit of $250,000, the VIP Account offers comprehensive education, a dedicated account manager, mobile trading, VIP Event Trading access, Earning Season Trading (each quarter of the year), daily technical signals (ten times daily), analyst price targets, an advanced education package, two months of swap-free trading, and VIP Credit.

Black Account: Designed for experienced traders and requiring a minimum deposit of $1,000,000, the Black Account includes an annual business strategy, a coordinated team covering every market, distinct market insights, fundamental analysis sources, and an extended research account. It also offers three months of swap-free trading.

These account options allow traders to choose the one that best aligns with their experience level and trading goals.

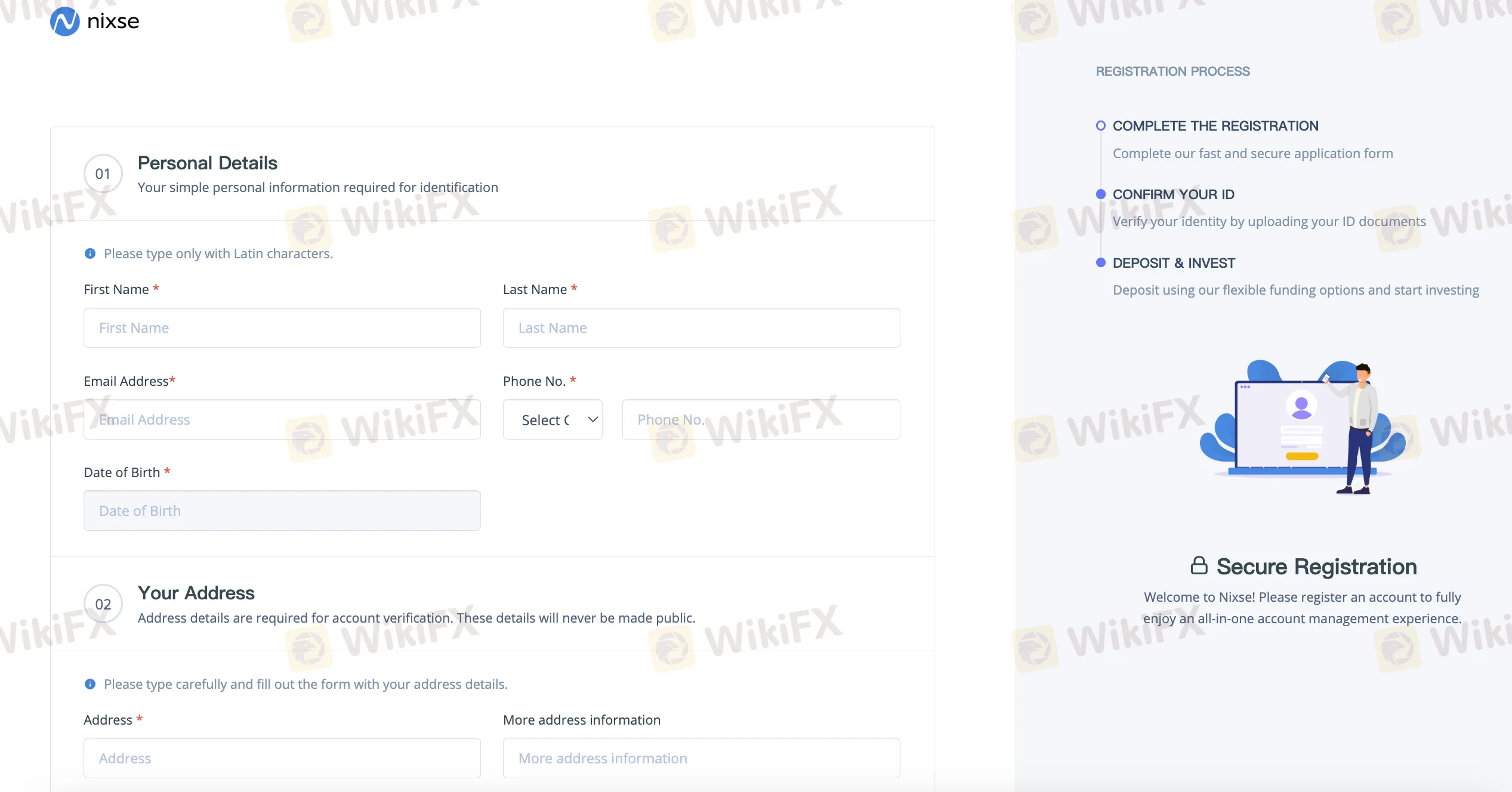

How to Open an Account?

To open an account with Nixse, follow these steps.

Visit the Nixse website. Look for the “CREATE ACCOUNT” button on the homepage and click on it.

Sign up on websites registration page.

Verify your identity by uploading your ID documents

Proceed to deposit funds to your account

Download the platform and start trading

Leverage

Nixse provides different leverage levels depending on the type of account you choose and the specific assets you're trading. Leverage ratios can range from as low as 1:1 to as high as 1:400 or more, depending on your account type and the asset class. For example, the highest leverage is often available for forex trading, while other asset classes like stocks or commodities may have lower leverage limits.

While leverage can amplify potential profits, it also significantly increases the risk of losses. This means that even a small adverse price movement in the market can result in substantial losses when trading with high leverage. Traders should exercise caution and ensure they have a solid risk management strategy in place when using leverage to mitigate potential losses.

It's crucial to choose an appropriate leverage level that aligns with your trading experience, risk tolerance, and overall trading strategy. Nixse offers various account types with different leverage options, allowing traders to select the one that best suits their needs and comfort level. Additionally, traders should always be aware of the specific leverage and margin requirements associated with each asset they trade to make informed decisions.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | Nixse | Libertex | IC Markets | RoboForex |

| Maximum Leverage | 1:400 | 1:30 | 1:500 | 1:2000 |

Spreads and Commissions(Trading Fees)

Nixse provides traders with variable spreads across its range of tradable instruments, but specific spread details for individual instruments are not specified on the website. Traders should contact Nixse directly or access their trading platform for comprehensive spread information.

Non-Trading Fees

Nixse offers swap-free trading for certain account types, such as the Platinum, VIP, and Black accounts. Swap fees, also known as overnight financing fees, are typically associated with positions held overnight. It means that these specific account types may not incur swap fees for holding positions overnight.

However, the specific details regarding the amount of swap fees or any other non-trading fees are not provided on the website. To get precise and comprehensive information about these fees, including whether other non-trading fees may apply, individuals should reach out to Nixse directly or refer to their official terms and conditions. This will help ensure a clear understanding of all potential fees associated with trading on the platform.

Deposit & Withdraw Methods

Nixse offers its clients a few convenient and widely used deposit and withdrawal methods. Traders can fund their accounts using Mastercard, Visa, or Bitcoin. The minimum deposit amount to get started with Nixse is 250 USD.

One notable feature highlighted by Nixse is that it offers fee-free transactions. This means that clients can deposit and withdraw funds without incurring additional hidden fees, enhancing the transparency of financial transactions with the broker. Additionally, the broker emphasizes that all withdrawal requests are processed within hours, ensuring that traders have fast and easy access to their funds when needed.

Trading Platforms

Nixse provides traders with access to its proprietary trading platform called the NX Trader Platform. This platform is known for its versatility, as it allows investors to trade a wide range of asset classes, including Currencies, Commodities, Stocks, and Indices.

The NX Trader Platform offers traders advanced charting and trading tools, making it suitable for both beginners and experienced traders. One notable feature is the platform's support for automated ordering, allowing traders to implement trading strategies with ease.

Traders can access the NX Trader Platform through various means, including downloading the platform for use on their desktop or accessing it directly via a web browser. This web-based option provides traders with the flexibility to trade from anywhere without the need for installations.

Additionally, Nixse offers mobile trading apps for both Android and iOS devices, ensuring that traders can stay connected and execute trades on the move. These apps provide access to various asset classes, technical analysis tools, financial news, and a full set of order types.

Customer Support

Nixse offers customer support through various channels to assist traders:

1. Phone: Traders can contact the support team directly at +18778977939 for immediate assistance.

2. Email: For non-urgent matters, traders can send inquiries or concerns to information@nixse.com, and the support team will respond via email.

3. Live Chat: The live chat feature on Nixse's website enables real-time communication with support representatives, making it a quick option for immediate assistance.

Nixse's customer support aims to provide traders with accessible and reliable ways to address their trading-related questions and concerns.

Educational Resources

Nixse offers a range of educational resources to assist traders in enhancing their trading knowledge and skills. While the specific educational offerings may vary depending on the chosen account type, here is an overview of the types of resources available:

Technical Market Signals: These signals are provided once a week for Silver Account holders and up to ten times daily for VIP Account holders. They offer insights into market trends and potential trading opportunities based on technical analysis.

Analyst Price Targets: Traders can access price targets set by analysts, helping them make informed decisions about their trades. These targets are available for Silver Account holders and above.

Advanced Education Tools: Gold Account holders and above can benefit from advanced education tools, which may include additional educational materials, webinars, or tutorials designed to enhance trading skills.

Full Education: The Platinum and VIP Accounts offer full education resources, providing traders with comprehensive training and knowledge about financial markets, trading strategies, and risk management.

Advanced Education Package: VIP Account holders receive an advanced education package, which likely includes in-depth educational resources and support for traders looking to further develop their skills.

Trading Tools

Nixse offers a selection of trading tools to assist traders in their decision-making processes and market analysis. Here's a brief overview of some of the trading tools available:

1. Fibonacci Calculation: Fibonacci retracement and extension levels are essential tools for technical analysis. Traders can use Fibonacci calculations to identify potential support and resistance levels, helping them make informed decisions about entry and exit points for their trades.

2. Pivot Calculation: Pivot points are critical indicators for determining potential price reversals and market trends. These calculations provide traders with key levels to watch, including support, resistance, and pivot points. Pivot calculations can be valuable for devising trading strategies and managing risk.

3. Economic Calendar: Staying informed about economic events and announcements is crucial for traders. Nixse provides access to an economic calendar that highlights important economic indicators, news releases, and events that can impact the financial markets. Traders can use this calendar to plan their trading activities around significant market-moving events.

Conclusion

In conclusion, Nixse presents traders with a wide array of tradable assets and account types, along with a user-friendly NX Trader Platform and mobile trading options. However, its lack of regulatory oversight poses significant risks to traders, potentially compromising fund security and transparency. The absence of clear and detailed fee information, both in terms of spreads and commissions, raises concerns about hidden costs. While Nixse offers educational resources, their availability varies depending on the chosen account type, limiting access for some traders. Despite its strengths, the unregulated nature of Nixse and its limited transparency should prompt traders to exercise caution and thoroughly evaluate their risk tolerance before considering this broker for their trading needs.

FAQs

Q: Is Nixse a regulated broker?

A: No, Nixse is not regulated by any recognized financial regulatory authority, which means it operates without oversight from regulatory bodies responsible for ensuring industry compliance.

Q: What types of assets can I trade on Nixse?

A: Nixse offers a diverse range of tradable assets, including currencies, commodities, stocks, indices, and digital currencies, providing traders with options to diversify their portfolios.

Q: What are the minimum deposit requirements for Nixse accounts?

A: The minimum deposit for Nixse accounts starts at $250, with varying amounts required for different account types, such as Silver, Gold, Platinum, VIP, and Black accounts.

Q: What deposit methods are available on Nixse?

A: Nixse accepts deposits through Mastercard, Visa, and Bitcoin, offering some flexibility in funding options for traders.

Q: How can I contact customer support at Nixse?

A: Nixse offers multiple customer support channels, including phone support at +18778977939, email at information@nixse.com, and a live chat feature on its website for real-time assistance.

WikiFX-Broker

Wechselkursberechnung