Mohicans markets:Focus on EIA Crude Oil Inventory Data

Zusammenfassung:On Tuesday, spot gold dived sharply in the U.S. market and once fell below the $1700 mark, eventually closing down 1.30% at $1702.08 per ounce; spot silver dived with gold, eventually closing down 2.30% at $19.33 per ounce.

At 14:00 today, IEA will release its monthly oil market report. Investors can pay attention to the IEAs expectations for global oil demand and supply. OPEC currently maintains its forecast for strong global oil demand growth in 2022 and 2023.

At 22:30, the U.S. will release EIA crude oil inventories for the week ending September 9, and the market currently expects them to decrease by 200,000 barrels.

Today, the president of the European Commission von der Leyen will also deliver the State of the EU address in the European Parliament. Earlier she had said that the ECB would continue to raise interest rates and that a 75 basis point rate hike was not the norm.

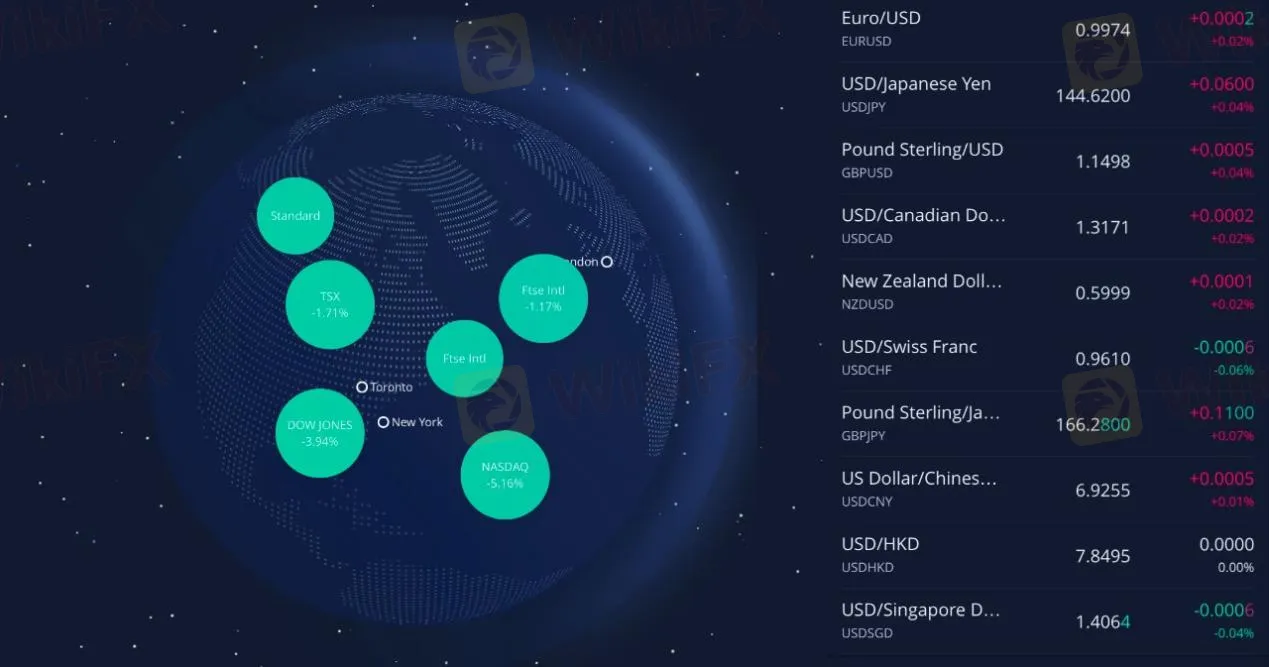

Global Views - List of Major Markets

On Tuesday, spot gold dived sharply in the U.S. market and once fell below the $1700 mark, eventually closing down 1.30% at $1702.08 per ounce; spot silver dived with gold, eventually closing down 2.30% at $19.33 per ounce.

The dollar index pulled up sharply, once approaching the 110 mark during the day, eventually closing up 1.49% at 109.94; 10-year U.S. bond yields fell before rising, eventually closing up 1.91% at 3.41%. The U.S. 5-year and 30-year Treasury yield curve inverted by 9.6 basis points, the largest inversion since June.

In terms of crude oil, the two oils rose and then fell, falling more than 3% during the session. WTI crude oil began to dive in the U.S. session and erased all intra-day gains, once falling to a low of 85.05 per barrel. And then it rebounded, eventually closing down 0.46% at $87.61 per barrel; Brent crude oil eventually closed down 0.77% at $93.47 per barrel.

The U.S. stocks plunged across the board Tuesday, with the Dow closing down 3.94%, the Nasdaq closing down 5.16% and the S&P 500 closing down 4.32%, both the biggest one-day declines since June 2020. Almost all sectors ended lower, with large technology stocks falling, led by chip stocks and pharmaceutical stocks. Nvidia closed down about 9%, Apple closed down about 6%, Alibaba closed down about 5% and Tesla closed down about 4%.

European stocks also closed lower across the board, Germanys DAX index closed down 1.59% at 13188.95 points; the FTSE 100 index closed down 1.17% at 7385.86 points; the European Stoxx 50 index closed down 1.65% at 3586.18 points.

Precious Metals

In early trading hours on Wednesday, September 14, Beijing time, spot gold fell after narrow oscillation, currently trading at $ 1701.50 per ounce near. At 20:30 on Tuesday, September 13, Beijing time, the U.S. released the inflation data in August, with both headline and core inflation higher than expected and the Federal Reserve expected to raise interest rates for the third consecutive time this month by 75 basis points. The dollar jumped after an unexpected rise in consumer prices in August cemented bets on an aggressive Fed rate hike. Gold prices fell more than 1% on Tuesday.

The U.S. consumer prices rose unexpectedly in August, with core inflation accelerating amid climbing rent and health care prices. The market now sees an 81% chance that the Fed will raise rates by 75 basis points at its Sept. 20-21 meeting.

Spot silver fell 1.4% to $19.51 per ounce. It had posted its biggest one-day percentage gain since February 2021 on Monday. Spot platinum fell 2.1% to $887.94 and palladium fell 6.4% to $2,120.16.

On the whole, gold prices fell on higher-than-expected CPI, now that a 75 basis point rate hike has been confirmed. The dollar is surging and will likely continue to put pressure on gold. Gold is likely to stay within the $1690 -1700 range in the short term, and the dollar is unlikely to make new highs unless the Fed announces a very hawkish outcome next week. They are likely to wait and see though, as the meeting after that will be held in November.

Crude Oil

In early trading on Wednesday, September 14, Beijing time, U.S. oil traded around $87.7 a barrel; Oil prices closed down nearly 1 percent on Tuesday, reversing earlier gains in the session, as U.S. inflation data unexpectedly rose in August, providing the case for the Federal Reserve to raise interest rates again sharply next week; Morning data showed U.S. crude inventories soared last week, and the Biden administration is said to be considering buying crude at around $80 to replenish reserves.

Follow the U.S. PPI annual rate and EIA data in August.

Bullish factors affecting oil prices

[OPEC sticks to forecast of strong oil demand growth]

[U.S. small business confidence improved in August]

[Ukraine's counter-offensive to regain all the lost territory, the United States will provide new military assistance]

Bearish factors affecting oil prices

[The three major U.S. stock indexes have the biggest decline in two years]

[U.S. inflation unexpectedly climbs in August, the Fed may not raise interest rates by 75 basis points next week]

[The Biden administration is reported to consider buying crude oil at around $80 to replenish reserves]

[U.S. crude oil api stocks surged by about 6 million barrels last week]

On the whole, although OPEC insisted on the forecast that oil demand will increase sharply, the increase in inventories, coupled with the expectation of aggressive interest rate hikes by the Federal Reserve, helped the strong dollar continue to rise, suppressing oil prices,and the Biden administration is reported to consider buying crude oil at a price of around $80 to replenish reserves, and there may be downside risks for oil prices in the short term.

Foreign Exchange

In early trading on Wednesday,September 14, Beijing time, the US dollar index rose slightly and is currently trading around 109.98. The dollar index rebounded sharply on Tuesday after stronger-than-expected U.S. inflation data boosted investor bets that the Federal Reserve will need to continue aggressive rate hikes.

The U.S. dollar index closed up 1.50% at 109.93 on Tuesday, its biggest one-day percentage gain since March 2020, but still below the 20-year high of 110.80 hit last week. U.S. consumer prices unexpectedly rose in August, with core inflation accelerating amid rising rent and health care prices, according to a Labor Department report. EUR/USD closed down 1.52% at 0.9967 on Tuesday.EUR/USD hit a near one-month high of 1.0197 on Monday. EUR/USD has traded below par on 16 of the past 17 sessions. The economic slowdown in the euro zone continues to be a major negative for the euro.USD/JPY closed up 1.19% at 144.53 on Tuesday. Earlier, the yen found support from comments from officials that suggested the government might take steps to counter the yen's excessive weakness.

Sterling rose to a two-week high on Monday.Britain's unemployment rate fell to its lowest level since 1974, while wages excluding bonuses rose by 5.2%, the highest growth rate in the three months to August 2021, as data showed.Sterling eased slightly against the dollar on Tuesday, closing down 1.62% at 1.1491. A slowdown in the UK economy and a cooling of expectations of a rate hike by the Bank of England weighed on the pound. At 19:00 on September 22, Beijing time, the Bank of England will announce its interest rate decision and meeting minutes.“The MPC is not yet ready to raise rates by 75 basis points at its upcoming meeting, which is an important short-term risk for the pound,” Goldman Sachs said in a weekly update on foreign exchange strategy.They said the MPC was likely to hold on to another 50 basis points of interest rate hikes as they factored in the impact of the UK government's recently announced energy price cap, which is expected to significantly reduce UK inflation peaks.

Institutional Currency Viewpoint

1. ING Bank: Sterling is temporarily supported, focusing on external factors

2. Former IMF economist: The continued appreciation of the dollar may lead to a series of developing countries facing more serious debt problems

3. Commonwealth Bank of Australia: EUR/USD may still be back below parity

4. UOB: Bank of England likely to raise rates by 50 basis points at a later date

Statement | Disclaimer

Disclaimer: The information contained in this material is for general advice only. It does not take into account your investment goals, financial situation or special needs. Mohicans Markets has made every effort to ensure the accuracy of the information as of the date of publication. Mohicans Markets makes no warranties or representations regarding this material. The examples in this material are for illustration only. To the extent permitted by law, Mohicans Markets and its employees shall not be liable for any loss or damage arising in any way, including negligence, from any information provided or omitted from this material.The features of Mohicans Markets products, including applicable fees and charges, are outlined in the product disclosure statements available on the Mohicans Markets website and should be considered before deciding to deal with these products. Derivatives can be risky and losses can exceed your initial payment. Mohicans Markets recommends that you seek independent advice.

Mohicans Markets, (Abbreviation: MHMarkets or MHM, Chinese name: Mai hui), Australian Financial Services License No. 001296777.

WikiFX-Broker

Aktuelle Nachrichten

Bitcoin und Ethereum verzeichnen Kursverluste, nachdem die Fed eine „vorsichtige Zinssenkung” vorgenommen hat

Aave Preis-Prognose: AAVE ist bereit für einen Ausbruch, da sich die bullischen Signale verstärken

Ripple-Preisprognose: XRP konsolidiert über der Unterstützung von 2,00 USD

Oracles Kurssturz ist ein weiteres Warnsignal für KI-Investoren

Solana-Preisprognose: SOL fällt, da die hawkishe Geldpolitik der Fed die Marktstimmung dämpft

Bitcoin-Preisprognose: BTC fällt auf 90.000 USD, da die hawkishe Haltung der Fed den Risiko appetit dämpft

Wechselkursberechnung