10/24 Market report

Zusammenfassung:【Dow Jones】 【Euro】 【Gold】 【Crude Oil】

【Dow Jones】

The four major U.S. stock indexes rallied yesterday (21) as news indicated that the U.S. FEDeral Reserve will hold discussions on slowing interest rate hikes in December, which means that the policies implemented by the Fed may not be too strong and will encourage the four major indexes to rise across the board, with Dow Jones up 748.97 points and Nasdaq up 244.87 points; The Wall Street Journal reported that some Federal Reserve officials have begun to throw out the idea of slowing down the rate hike, and the president of the Federal Reserve Bank of San Francisco has echoed this view, saying it is time to discuss slowing down the rate of increase in borrowing costs.

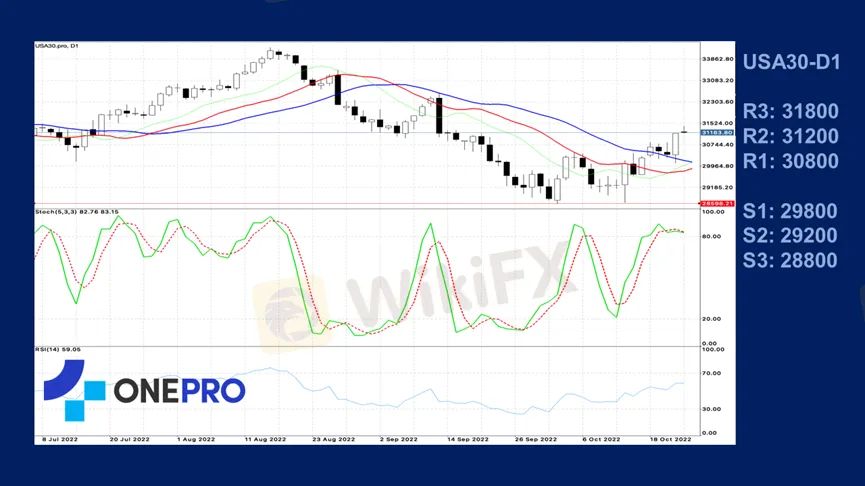

In the daily technical indicators of the Dow Jones industrial average, Alligator is tangled, indicating that the direction of the long-term Dow Jones industrial average is beginning to be chaotic, and the short-term KD indicator is showing high-grade passivation, indicating that the short-term buying strength has emerged, and the strength of the long-term is stronger after breaking through the previous high point.

USA30-D1:Uptrend

Price point: 28598

Current transactions: multiple orders held with targets at 31200 and 31500

Alternative:Set 28500 and 28200 after the price hit 28598

Comment: The RSI value of 59.05% is too high.

【Euro】

The European Central Bank will hold an interest rate decision-making meeting on the 27th. Economists point out that the European Central Bank is expected to focus on the persistently high inflation rate and maintain the pace of interest rate increase even if the economy is weak. The meeting is expected to raise interest rates by another 3 yards. The main refinancing rate will be raised to 2%, the deposit rate to 1.5% and the marginal lending rate to 2.25%.

In the euro zone's Japanese technical line, the long-term Alligator is tangled, indicating that in the long run, the euro is easy to be chaotic, and the short-term KD index is high-grade and passive, indicating that the short-term buying trend appears and the short-term challenges the consolidation range.

EURUSD-D1: Downtrend

Price point: 1.00000

Current transactions: hold empty orders with targets at 0.98200 and 0.98000

Alternative: Set 1.00200 and 1.00500 after the price hit 1.00000

Comment: The RSI value of 51.14% is on the short side.

【Gold】

According to the data released on October 20 by the Swiss Customs, the largest gold exporter, in September 2022, the export volume of Swiss gold was 174.2 metric tons, up 43% from 121.8 metric tons in the previous month, and up 48% from 117.4 metric tons in the same period of last year. From January to September 2022, Swiss gold exports increased by 14% a year to 1,125.5 tonnes, mainly driven by the doubling of exports to Chinese mainland.

In the technical line of gold's daily line, the long-term Alligator shows a dead cross, indicating that the long-term trend of gold is beginning to go empty, the short-term KD indicator shows a gold cross, and there is a buy-in on the short-term, so the next step is to observe whether the upward pressure is broken.

XAUUSD-D1: Downtrend

Price point: 1642

Current Transaction: Hold Empty Orders, Target at 1650.8 and 1648.2

Alternative: Set 1683.5 and 1684.8 after the price hit 1682

Comment: The RSI value of 45.03% is on the short side.

【Crude Oil】

December crude oil futures on the New York Mercantile Exchange (NYMEX) closed up $0.54, or 0.6 percent, to $85.05 a barrel on October 21 as expectations of a possible slowdown in the Fed's interest rate hike bolstered the market, as well as the effects of tighter supply in the oil market.

Mary Daly, president of federal reserve bank of san francisco, said on Friday whether the Fed would keep raising interest rates by three yards, saying that the tightening of monetary policy would enter the second phase and would be more deliberate and based on economic data to ensure that the policy would not be tightened too much. Daley said that although the time has not yet come to slow down the pace of interest rate hikes, the Federal Reserve could begin discussions and planning.

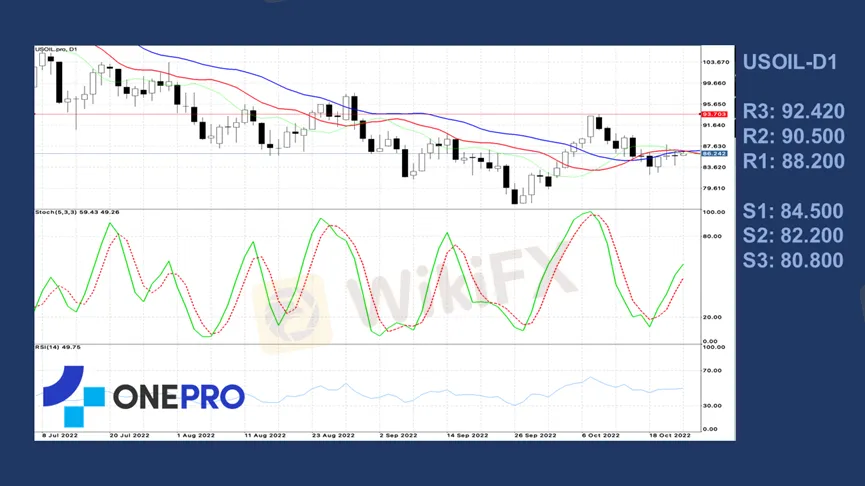

In the technical line of crude oil, the long-term Alligator is tangled, indicating that crude oil has begun to be chaotic in the long-term trend, and the short-term KD index is a golden cross, indicating that oil prices are beginning to show support in the process of falling back.

USOIL-D1: Downtrend

Price point: 93.70

Current transactions: hold empty orders with targets at 84.80 and 84.20

Alternative: Set 93.8 and 94.2 after the price hit 93.70

Comment: 49.75% of RSI is on the short side.

OnePro Special Analyst

Buy or sell or copy trade crypto CFDs at www.oneproglobal.com

This is a personal opinion and does not represent anyopinion of OnePro Global, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

WikiFX-Broker

Aktuelle Nachrichten

Eine Gruppe von rund 20 US-Investoren plant, im März nach Venezuela zu reisen

SOL hebt ab! Solana über 137 Dollar – Großanleger pumpen Millionen hinein

Krypto-Rally geht weiter: Bitcoin über 92.000 Dollar – XRP hebt ab

ADA auf Angriff! Cardano hält wichtige Marke – aber geopolitische Risiken bremsen

ETH-Kaufrausch! Mega-Firma schnappt sich fast 33.000 Ethereum – Kurs vor nächstem Sprung?

Ripple explodiert: Diese XRP-Zahl entscheidet 2026

Ripple: XRP explodiert – was jetzt wirklich hinter dem Kurssprung steckt

Wechselkursberechnung