WIKIFX REPORT: Big Breakout on Gold & Silver – More to come?

Zusammenfassung:Both gold and silver surged higher again last night amid a continued weakening USD and volatility returning to markets on mixed news around possible peace talks in Ukraine, the possibility of a full Republican congress and the ‘war’ between 2 of the biggest crypto exchanges breaking out and crypto falling accordingly. But there are more structural factors at play as discussed earlier.

Both gold and silver surged higher again last night amid a continued weakening USD and volatility returning to markets on mixed news around possible peace talks in Ukraine, the possibility of a full Republican congress and the ‘war’ between 2 of the biggest crypto exchanges breaking out and crypto falling accordingly. But there are more structural factors at play as discussed earlier.

As drafted earlier this week, that surge in silver is often a precursor to strength in both gold and silver prices and last night added weight to that thesis. It was also an important night for seeing a substantive break out of golds falling channel this year.

Last night USD spot surged $37.10 (2.21%) for gold and $0.53 (2.55%) for silver with gold now firmly back above the $1700 mark at $1712 at the time of writing. Despite that USD weakness seeing a stronger AUD we were still up 1.84% and 2.17% respectively for gold and silver.

The chaos on crypto markets that looks like Binance will rescue FTX and FTX currently suspending withdrawals was a salient reminder of the beauty of physical precious metals that have no such counterpart risk and indeed Ainslies crypto wallets where again there is no counterparty risk to holding crypto. There is a lot of dust to settle on the Binance / FTX situation so a full account on Monday and Tuesday next week with the benefit of some of the FUD settling and and better hindsight could be revealed.

This same appeal of lack of counterparty risk when owning physical gold and silver was evident too in the latest World Gold Council report we detailed on Monday. The last quarter was remarkable for the move from paper (ETFs and futures) to physical gold globally, and in particular central banks covering themselves with the largest quarter of buying ever from them.

The sell off in ETFs has been driven by the so called carry cost of owning gold (non yielding) amid high interest rates. The more astute look at the REAL interest rate but even that can be interpreted differently. Simply, it is the difference between the nominal interest rate and the inflation rate. So for the US that is 3.85% less 8% which puts it in negative territory and hence attractive to gold.

Pure finance manages often use instead the breakeven inflation rate (subtracting the yield of an inflation-protected bond from the yield of a nominal bond) which is currently 2.4%, the highest real rate since the GFC. The former is based on current facts, the latter on expectations. Those whose who believe the spin are selling gold, those who dont are buying, and often in physical form.

Last night Goldman Sachs analyst in a note to paid clients made this observation:

“high inflation tends to be (extremely) bullish for gold when the market questions the central bank‘s ability to fight it, such as during Burns’s tenure in the 1970s. In contrast, high inflation tends to be bearish for gold when the market gives the CB credit in its ability to reduce it, such as during Volckers fight on inflation in the early 1980s.”

We have questioned previously the true motivation of central banks to real inflation all the way back to 2%. It just simply isnt in their interest to do so.

He takes cues then from the huge central bank demand for gold this year noting:

“EM CB demand appears to be a reflection of geopolitical trends that have been years in the making vs a one-off spike.”

“with CB demand rising by 233 tonnes over the past year, the gold price was boosted by 6.5%, all else equal. Going forward, if CB gold purchases were to continue at a 400 tonnes quarterly pace, that could boost equilibrium gold prices by 25%, all else equal. In a less extreme scenario where purchases moderate to 250 tonnes per quarter over the next year, we believe gold could increase by 12.5%, all else equal.”

“there is limited further downside in Spec positioning which is already close to historic lows. The bank also thinks that, while the drawdown in US ETFs can continue, European liquidations should slow after the ECB turned more dovish. Thus, structurally higher CB demand should help absorb further ETF selling which further enhances the gold price return asymmetry in our view.”

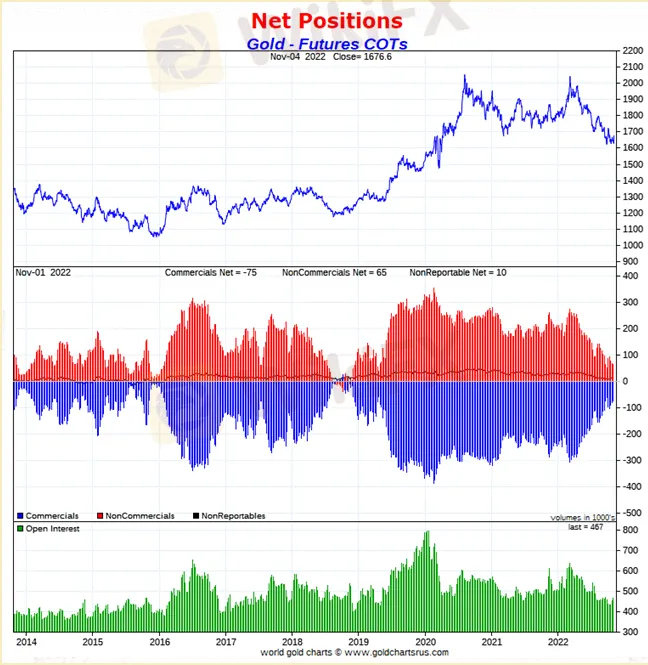

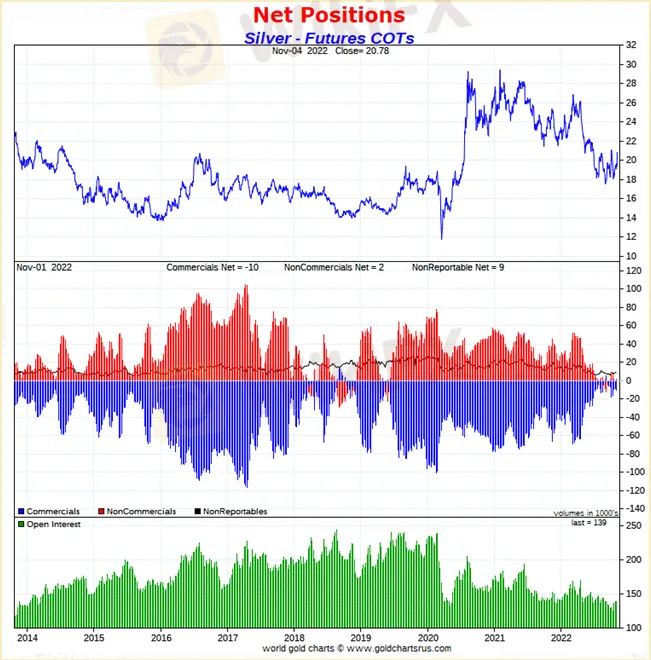

To that latter point on futures spec positioning, the latest Commitment of Traders report from COMEX paints an incredibly bullish picture for both gold and silver:

WikiFX-Broker

Aktuelle Nachrichten

XRP: Was Ripple dir JETZT nicht offen sagt

Oracles Kurssturz ist ein weiteres Warnsignal für KI-Investoren

Solana vor möglichem Ausbruch: ETF-Zuflüsse stützen Kurs über 131 Dollar

Cardano stabilisiert sich über 0,40 Dollar – Indikatoren nähren Hoffnungen auf Ausbruch

Wechselkursberechnung