Mohicans markets:11.14-MHM European Perspective

Zusammenfassung:On Monday, November 14, Beijing time, during the Asian European session, spot gold weakened after opening low. At present, it is trading at US $1759.02 per ounce. Therefore, the former gonveror of the Federal Reserve said that the anti inflation stance has not been "softened", helping the yield of the US dollar and US debt rebound, thus putting pressure on the gold price.

Market Overview

On Monday, November 14, Beijing time, during the Asian European session, spot gold weakened after opening low. At present, it is trading at US $1759.02 per ounce. Therefore, the former gonveror of the Federal Reserve said that the anti inflation stance has not been “softened”, helping the yield of the US dollar and US debt rebound, thus putting pressure on the gold price; Although the medium and long term has turned to the long term, considering the large increase of gold price last week, the short-term callback pressure has increased.

“After the Federal Reserve Waller counterattacked the market's response to the weak CPI, gold fell because only one data point does not indicate that inflation has been curbed. There is no doubt that inflation is still the fulcrum of the market.”

There is little economic data this trading day, so investors need to pay attention to the relevant news of the G20 Summit and the market's expectation of the US data to be released this week. At present, the US retail sales in October, which are expected to be released on Wednesday, grew 0.9% month on month, with a previous value of 0, which tends to support the US dollar and bear on gold prices.

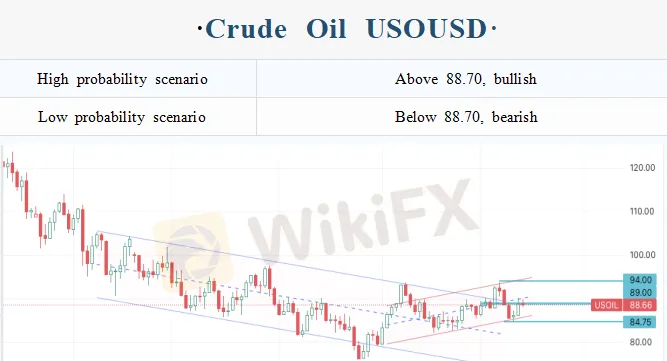

US crude oil fell slightly in shock, and the current trading volume is around 88.45 dollars per barrel. Although the news that Asian powers had optimized epidemic prevention measures at the weekend once provided support for oil prices, the hawkish speech of the Federal Reserve intensified the market's expectation of global economic recession, and Asian stock markets generally weakened, which also weighed on oil prices; In addition, there were more confirmed cases of COVID-19 in Asia over the weekend, which also slightly increased demand concerns, and the downside risks faced by short-term oil prices increased.

It is worth mentioning that the number of oil rigs in the United States increased by 9 to 622 last week, the highest level since March 2020. This data will generally be further fermented on Monday, slightly negative for oil prices. This trading day focuses on the monthly report of OPEC crude oil market and relevant information of G20 Summit.

Mohicans Markets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on November 14, 2022 Beijing time.

Technical Analysis

Change of CME Group's option layout (futures price in December):

1800 Bullish increased significantly, bearish increased slightly, long target

1785 Bullish increased slightly, bearish increased, resistance level

1780 Bullish increased, bearish increased, long short competition, resistance level

1770-1775 Bullish sharply reduced, bearish unchanged, resistance zone

1765 Bullish increased, bearish increased, long short competition

1755 Bullish decreased, bearish sharply increased, short target

1750 Bullish sharply reduced but huge stock, bearish increased, support level

1730-1735 Bullish decreased, bearish sharply increased, short target area

Order flow key point marking (spot price):

1800 Resistance level, long target, near 200 day moving average, call option bet

1782-1785 Resistance zone

1772-1775 The first key resistance zone, the highest point last week

1755 Support position

1747 Important support, breaking position and be alert for further callback risk

1730-1733 Key support of trend

1712 CPI data after lifting point, key support

Note: The above strategy was updated at 15:00 on November 14. This policy is a daytime policy. Please pay attention to the policy release time.

Change of CME Group's option layout (futures price in December):

22.5 Bullish sharply reduced, but the stock was large, bearish slightly increased, long target, resistance level

22.25 Bullish slightly increased, bearish unchanged, long target

22 Bullish decreased but stock was huge, bearish slightly increased, resistance level

21.55 Bullish increased, bearish increased, long short competition, resistance level

21.5 Bullish increased significantly, bearish decreased, and breaking support conversed to resistance

21 Bullish decreased but stocks were large, bearish increased significantly, short target

20.75-20.85 Bullish unchanged, bearish sharply increased, short target area

Order flow key point marking (spot price):

22.9 Strong resistance level

22.5-22.6 Strong resistance area composed of early rebound highs, and bull targets in technical

22 Long target (option bet)

21.5 The first support position turned into resistance after Asian market broke

21.3 The rising point of CPl data, key support

21 Top bottom conversion, key support for this round of bulls

20.38-20.5 Key support of trend

Note: The above strategy was updated at 15:00 on November 14. This policy is a daytime policy. Please pay attention to the policy release time.

CME Group options layout changes (Futures Price in December):

97.5 Bullish increased sharply, bearish unchanged, long target

96 Bullish increased sharply, bearish increased slightly, long target

91 Bullish increased sharply, bearish increased slightly, long target

90 Bullish decreased sharply but the stock was large, bearish decreased sharply, key resistance

86 Bullish increased, bearish increased sharply, short target

85 Bullish decreased slightly but the stock was large, bearish increased sharply, short target and support

80 Bullish unchanged but the stock was large, bearish increased sharply and the stock was large, short target

Order flow key point marking (Spot Price):

92.8-93.5 Strong resistance area

91.6 Resistance level

90.3-90.5 Key resistance

88.7 Resistance turns to support, and focus on the gains and losses first during the day

88 Support level

87.2 key support, the current round of upward trend of the short and long division

84.8-85 Strong support area

83.3 The last defense of the long side

80-82 Short target range

Note: The above strategy was updated at 15:00 on November 14. This policy is a daytime policy. Please pay attention to the policy release time.

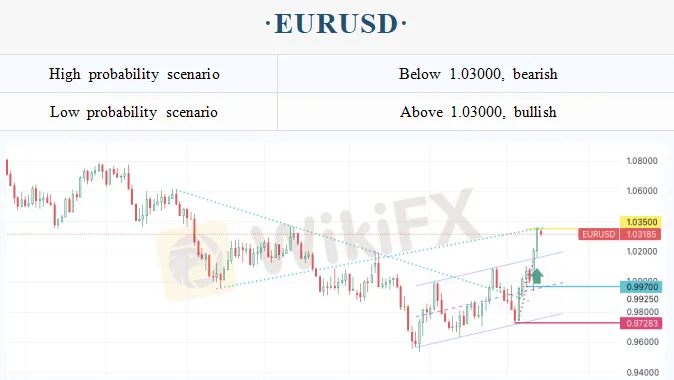

Todays CME Group data:

1.04 Bullish decreased but the stock is large, bearish increased slightly, early long target and resistance

1.035 Bullish decreased sharply, bearish increased, key resistance during the day

1.03 Bullish decreased sharply, bearish increased, support weakened

1.025 Bullish increased slightly, bearish increased, first support

1.02 Bullish decreased sharply, bearish increased sharply, first short target

1.015 Bullish increased and the stock was dominant, bearish increased slightly, Key support for long trend

Note: The above strategy was updated at 15:00 on November 14. This policy is a daytime policy. Please pay attention to the policy release time.

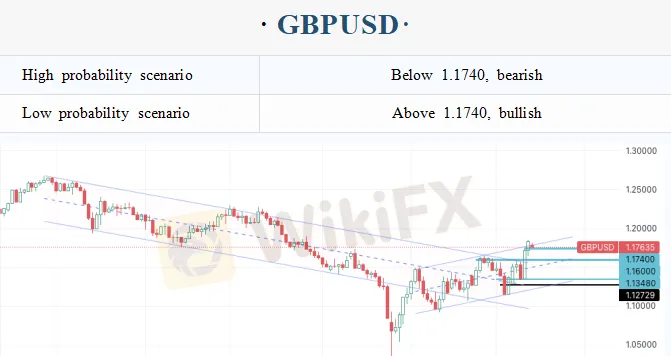

Todays CME Group data:

1.20 Bullish increased and the stock was large, bearish unchanged, long target and strong resistance

1.19 Bullish increased slightly, bearish unchanged, resistance

1.18 Bullish increased sharply, bearish increased, first resistance

1.175 Bullish decreased slightly, bearish unchanged, short-term key level

1.17 Bullish decreased slightly, bearish increased slightly, support weakened

1.165 Bullish decreased slightly, bearish unchanged, support level

1.16 Bullish decreased but the stock was large, bearish increased slightly, key support

Note: The above strategy was updated at 15:00 on November 14. This policy is a daytime policy. Please pay attention to the policy release time.

Statement|Disclaimer

Disclaimer: The information contained in this material is for general advice only. It does not take into account your investment goals, financial situation or special needs. We have made every effort to ensure the accuracy of the information as of the date of publication. MHMarkets makes no warranties or representations about this material. The examples in this material are for illustration only. To the extent permitted by law, MHMarkets and its employees shall not be liable for any loss or damage arising in any way, including negligence, from any information provided or omitted from this material. The features of MHMarkets products, including applicable fees and charges, are outlined in the product disclosure statements available on the MHMarkets website. Derivatives can be risky and losses can exceed your initial payment. MHMarkets recommends that you seek independent advice.

Mohicans Markets, (Abbreviation: MHMarkets or MHM, Chinese name: Maihui), Australian Financial Services License No. 001296777.

WikiFX-Broker

Aktuelle Nachrichten

„Ich hoffe einfach, dass es nach Trumps Amtszeit wieder normal wird: Wie Strafzölle diesem Unternehmer schaden

Wechselkursberechnung