Another Firm Collapses

Zusammenfassung:Today, BlockFi filed voluntary cases under Chapter 11 of the U.S. Bankruptcy Code, becoming the latest domino to fall following the demise of the FTX. Let’s (once again) discuss secure asset storage and look to the data to see how the market is reacting.

Yesterday, BlockFi filed voluntary cases under Chapter 11 of the U.S. Bankruptcy Code, becoming the latest domino to fall following the demise of the FTX. Lets (once again) discuss secure asset storage and look to the data to see how the market is reacting.

BlockFi said in a bankruptcy filing that its substantial exposure to FTX created a liquidity crisis. Crypto lenders are not required to hold capital or liquidity buffers like traditional lenders and some found themselves exposed when a shortage of collateral forced them, and their customers, to shoulder large losses.

Once again, we have learned the importance of trustworthy asset custody and the K.I.S.S strategy – keep it simple, stupid. At the very least, you MUST do your due diligence on who you choose to conduct your trading with. Wallets that are stored online by a third party, often an exchange, can be the most convenient for short-term traders looking to make quick buys/sells. This is potentially the least secure method of storage, however, as your assets are not under your control. Most large hacking incidents where significant funds have been stolen have occurred on exchanges.

We advocate self-custody via an Ainslie Cold Wallet or our Secure Custody.

The Ainslie Cold Wallet is a cold/offline paper wallet provided free of charge with any purchase. The computers and printers used to create the wallets have never been online. Random number generators are also used to add another level of security around the key generation. Ainslie wallets are only produced while you watch so you can oversee the security around each stage of the process.

Ainslie Secure Custody allows you to store your cryptocurrency with us. Ainslie Secure Custody has minute-by-minute internal audits to further guarantee the safety of your assets.

Using an Ainslie Secure Custody account, you let us manage your purchases and cold storage. This also makes it easier for you to buy, sell and swap between cryptocurrencies and precious metals. When you set up your account, you get access to our Storage App Dashboard where you can view the current value of your bullion and crypto holdings. Additionally, you can see your transaction history and export a statement of holdings for your EOFY tax obligations.

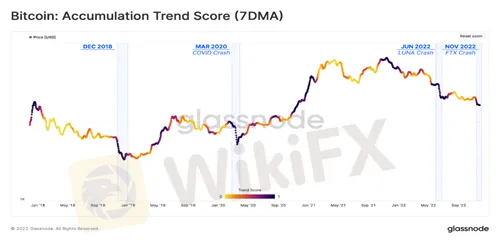

Looking towards the market data, the price of BTC has been trading below the Realised Price (the cost-basis of the wider market) for over 4.5 months. This has historically correlated with the bottom discovery phase, which can often be visualised and assessed using the Accumulation Trend Score metric.

This tool indicates the relative balance change of entities over the last 30 days, with the scale representing both the size of the balance change and its direction (accumulation to distribution).

Values approaching 1 signify that a large portion of the Bitcoin network has been accumulating coins and meaningfully increasing their balance. Values approaching 0 signify that a large portion of the Bitcoin network has been distributing coins and meaningfully decreasing their balance.

From a comparative point of view, the recent strong accumulation score following the recent sell-off resembles that of late 2018. This behavioural shift can be seen immediately following many major sell-off events, including:

• November -December 2018 50% sell-off

• March 2020 COVID Crash

• May 2022 LUNA collapse

• June 2022, when the price first fell below $20k

The FTX fallout has triggered one of the largest capitulation events in Bitcoin history, flushing billions of USD value out of underwater investors.

The characteristics of this capitulation bear several similarities to the darkest points during the 2018 bear market. This sell-off saw significant statistical deviations outside the mean on investor losses. The current unrealised loss held by the actively traded coin supply is effectively at an all-time low, rivalling only the very deep bottoms of the 2015 and 2018 bear cycles.

With such a chaotic year to date, the resilience of Bitcoin holders has been firmly tested to a historic degree throughout 2022. No previous cycle compares. Historically periods of such high capitulation have turned out to be the points of absolute seller exhaustion, thus the pivot point from a bear market to bull market. Accumulate at the lows. Keep your assets safe. K.I.S.S.

WikiFX-Broker

Aktuelle Nachrichten

Die Top 3 am besten regulierten Forex-Broker weltweit

Krypto-Schock: Ethereum rutscht zweistellig ab – Anleger ziehen Milliarden ab

Die Top 3 am besten regulierten Forex-Broker weltweit

Wenn du ein FX-Trader bist, könnten diese Broker genau das sein, wonach du gesucht hast.

Die besten Plattformen für Forex-Trader, die auch investieren wollen

Die Top 3 am besten regulierten Forex-Broker weltweit

Cardano rutscht weiter ab – droht jetzt der nächste Absturz?

DNeue FX-Trader: Sucht nicht weiter – hier sind die 3 besten Broker für Anfänger

Ripple unter Druck: XRP rutscht ab – Privatanleger ziehen sich zurück

Wechselkursberechnung