EnclaveFX

Zusammenfassung:Founded in 2018, EnclaveFX, a trading name of EnclaveFX Limited, is allegedly a broker based and registered in the UK that provides its clients with the industry-standard MetrTrader5 trading platform, leverage up to 1:500, variable spreads on over 120 tradable financial products, as well as a choice of eight different live account types and 24/5 customer support service.

| Registered in | UK |

| Regulated by | ASIC |

| Year(s) of establishment | 2-5 years |

| Trading instruments | Currency pairs, CFDs, metals, cryptocurrencies |

| Minimum Initial Deposit | $10 |

| Maximum Leverage | 1:500 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT5 |

| Deposit and withdrawal method | bitcoin, bank transfer, AED, USDT and Indian cash |

| Customer Service | Email/phone number/address/live chat |

| Fraud Complaints Exposure | Yes |

General Information

Founded in 2018, EnclaveFX, a trading name of EnclaveFX Limited, is allegedly a broker based and registered in the UK that provides its clients with the industry-standard MetrTrader5 trading platform, leverage up to 1:500, variable spreads on over 120 tradable financial products, as well as a choice of eight different live account types and 24/5 customer support service.

EnclaveFX offers a diverse range of tradable assets, including forex currency pairs, metals, cryptocurrencies, and CFD products. Traders can choose from various account types, such as Micro, Standard, Silver, Gold, Platinum, Diamond, ECN, and ECN Pro, catering to different trading preferences and requirements. Additionally, EnclaveFX provides a demo account for traders to practice and familiarize themselves with the platform.

With a minimum deposit requirement of $10, EnclaveFX offers accessibility to traders of different financial capacities. Traders on EnclaveFX can benefit from a maximum leverage of up to 1:500, allowing them to amplify their trading positions. EnclaveFX ensures comprehensive customer support, with service availability 24/5 through email, live chat, phone, and social media platforms.

EnclaveFX understands the importance of education and provides various resources to enhance traders' knowledge. Traders can access news updates, economic calendars, blogs, and educational videos, empowering them with market insights and trading strategies. The availability of copy trading allows traders to follow and replicate the trades of successful traders.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on.

We will also briefly summarize the main advantages and disadvantages so that you can understand the broker's characteristics at a glance.

Is EnclaveFX legit or a scam?

EnclaveFX operates under a regulated framework, holding an AR (Appointed Representative) license authorized by the Australia Securities & Investment Commission (ASIC), with license number 001299124.

Pros and Cons

EnclaveFX offers several advantages for traders, including a comprehensive MT5 trading platform available on multiple devices. With this broker, there are also multiple tiered trading accounts available to statisfy different traders' trading preference and strategies. The user-friendly interface and advanced trading tools enhance the trading experience, while the platform's compatibility across various operating systems ensures convenience. Traders can also benefit from access to the latest news, blogs, and educational videos, providing valuable market insights.

However, it is important to note that EnclaveFX has a limited range of tradable instruments and payment methods. The absence of 24/7 customer support can cause some inconvenience for traders who have to address their problems during weekends. Lastly, this broker asks for high minimum deposits for most brokers, which is unfriendly to most brokers.

| Pros | Cons |

| Low minimum deposit requirement for Micro account | No 7/24 customer support |

| MT5 trading platform supported (Availability on desktop, Android, iPhone, and web terminal) | Limited range of tradable instruments |

| Tiered trading accounts available | Limited payment methods |

| User-friendly interface and advanced trading tools | Only MT5 trading platform offered |

| Compatibility with different operating systems | High minimum deposit for most trading accounts |

| Access to latest news, blogs, and educational videos | |

| Copy trading available | |

| Demo accounts available | |

| Online chat supported |

Market instruments

Currency pairs, CFDs, metals, cryptocurrencies.....EnclaveFX allows clients to access a wide range of trading markets. Therefore, both beginners and experienced traders can find what they want to trade on EnclaveFX.

One of their prominent offerings is forex, granting traders the opportunity to engage in the global foreign exchange market.

In addition to forex, EnclaveFX presents Contracts for Difference (CFDs) as a versatile trading instrument. CFDs empower traders to speculate on the price movements of various financial assets, including stocks, indices, commodities, and more.

EnclaveFX also provides access to trading precious metals, such as gold and silver. These metals are known for their value and serve as a hedge against inflation and market uncertainties.

Moreover, EnclaveFX recognizes the growing popularity of cryptocurrencies and offers them as tradable instruments.

EnclaveFX, while offering a range of market instruments, may have a relatively limited selection compared to some other brokers. While they provide opportunities for forex trading, CFDs, precious metals, and cryptocurrencies, it's important to note that some brokers may offer a more extensive variety of tradable assets, including additional commodities, stocks, indices, and more.

| Pros | Cons |

| forex, CFDs, metals, cryptocurrencies available | Limited trading assets offered |

| Opportunity to trade in the forex market with numerous currency pairs | Limited cryptocurrecies available |

| CFDs offer flexibility to trade various financial assets without ownership | No enery products offered |

| Access to trading precious metals for portfolio diversification | No stock or share products offered |

| Inclusion of popular cryptocurrencies for trading | No ETFs available |

Spreads and Commissions

EnclaveFX offers a range of trading accounts with varying spreads and commission structures. Starting with the Micro account, traders can expect spreads from 2.2 pips and zero commissions. The Standard account provides spreads from 1.8 pips, also with zero commissions. Moving up the ladder, the Silver account offers spreads from 1.5 pips without any commissions. For those looking for even lower spreads, the Gold account features spreads from 1.2 pips and zero commissions. The Platinum account takes it a step further, offering spreads from 1.0 pips with zero commissions. For traders seeking the tightest spreads, the Diamond account presents spreads from 0.7 pips and zero commissions. On the other hand, the ECN account, while providing spreads from 0 pips, carries a commission of $10 per trade. Lastly, the ECN Pro account offers spreads from 0 pips with a reduced commission of $7 per trade.

EnclaveFX's account options cater to traders with varying preferences and trading strategies. From the more accessible Micro and Standard accounts to the premium-tier Diamond and Platinum accounts, traders can choose the account type that aligns with their needs. The offering of zero commissions across several account types is an attractive feature, allowing traders to focus solely on spreads and trade execution. The introduction of the ECN accounts provides an alternative for traders seeking direct market access with the lowest possible spreads, albeit with a commission structure.

Non-Trading Fees

EnclaveFX may encompass various non-trading fees. Firstly, account inactivity fees may apply if a trader fails to engage in any trading activity for an extended period. It is important to review the specific terms and conditions to understand the duration and charges associated with inactivity fees.

Additionally, EnclaveFX may impose deposit and withdrawal fees, which can vary depending on the payment method utilized. Traders should consider these fees and choose the most cost-effective payment option accordingly.

Furthermore, currency conversion fees may be applicable when depositing or withdrawing funds in a currency different from the account base currency. EnclaveFX typically provides information regarding the applicable conversion fees.

Account Types

Demo Account: EnclaveFX provides a demo account that allows you to try out the financial markets without the risk of losing money.

Live Account: EnclaveFX offers a total of 8 account types: micro, standard, silver, gold, platinum, diamond, ECN and ECN Pro.

. The Micro account requires a minimum deposit of $10 and provides spreads starting from 2.2 pips. This account type operates with zero commissions and offers leverage up to 1:500. Traders can opt for a swap-free option and choose between regular and Islamic account types.

For those looking for a Standard account, a minimum deposit of $500 is required. Spreads start from 1.8 pips, and like the Micro account, there are no commissions charged. The leverage offered is also up to 1:500, and traders can select either a regular or Islamic account.

The Silver account requires a minimum deposit of $1000 and offers spreads starting from 1.5 pips. It operates without commissions and provides leverage up to 1:500. Traders can choose between regular and Islamic account types, and a swap-free option is available.

Moving up, the Gold account requires a minimum deposit of $1500 and features spreads starting from 1.2 pips. Like the previous accounts, there are no commissions, and leverage up to 1:500 is provided. Traders have the flexibility to select either a regular or Islamic account, and a swap-free option is available.

For higher-tier accounts, the Platinum account requires a minimum deposit of $2500 and offers spreads starting from 1.0 pips. Zero commissions are charged, and leverage up to 1:500 is provided. Traders can choose between regular and Islamic account types and opt for a swap-free option.

The Diamond account, with a minimum deposit of $5000, boasts spreads starting from 0.7 pips. There are no commissions, and leverage up to 1:500 is available. Traders can select either a regular or Islamic account type, and a swap-free option is offered.

EnclaveFX also provides two ECN account options: the ECN and ECN Pro accounts. The ECN account requires a minimum deposit of $2500 and offers spreads from 0 pips. A commission fee of $10 is charged, and leverage up to 1:500 is available. Traders can choose between regular and Islamic account types and opt for a swap-free option.

The ECN Pro account, with a minimum deposit of $5000, provides spreads starting from 0 pips. Commissions are set at $7, and leverage up to 1:500 is offered. Similar to other account types, traders can select either a regular or Islamic account, and a swap-free option is available.

By structuring the account types based on the minimum deposit, EnclaveFX allows traders to select an account that suits their individual needs and risk appetite.

How to open an account?

To open an account with EnclaveFX, follow these steps:

Firstly, visit the EnclaveFX website and navigate to the account opening section. Look for the “OPEN ACCOUNT” button, usually located prominently on the homepage.

2. Once you click on the registration button, you'll be directed to the account opening page. Here, you'll need to provide your personal information, such as your full name, date of birth, your residence of country, and contact details. Make sure to enter accurate and up-to-date information.

3. Next, you will be prompted to choose the type of account you wish to open. EnclaveFX typically offers different account options tailored to different trading preferences, such as standard, mini, or Islamic accounts. Select the account type that suits your needs.

4. After selecting the account type, you will be required to provide additional details, including your country of residence, preferred base currency for trading, and any relevant financial information. This may include questions about your employment status or investment experience.

5. Once you have completed the necessary information, carefully review the terms and conditions presented by EnclaveFX. It is crucial to understand the risks involved in trading and any contractual obligations before proceeding.

6. If you agree with the terms and conditions, you can submit your application. EnclaveFX may require you to verify your identity by providing scanned copies or photos of identification documents, such as your passport or driver's license, and proof of address, like a utility bill or bank statement.

7. After submitting your application and completing the necessary verification process, EnclaveFX will review your information. Once approved, you will receive your account login credentials, typically via email. You can then log in to your account and proceed with funding it to start trading.

Trading platforms offered by EnclaveFX

EnclaveFX boasts a comprehensive and versatile trading platform, offering traders access to the popular MetaTrader 5 (MT5) platform. Available for desktop, Android, iPhone, and web terminal, the platform ensures convenience and flexibility for traders across various devices.

The MT5 trading platform provided by EnclaveFX is well-regarded within the industry, known for its robust features and advanced trading capabilities. With a user-friendly interface, it caters to both beginner and experienced traders alike. The platform offers a wide range of analytical tools, including interactive charts, technical indicators, and drawing tools, enabling traders to conduct thorough market analysis and make informed trading decisions.

One notable advantage of the EnclaveFX MT5 platform is its compatibility with different operating systems, allowing traders to access their accounts seamlessly from desktop computers or on-the-go through their smartphones. The mobile apps for Android and iPhone offer a similar experience to the desktop version, ensuring traders can stay connected to the markets and manage their trades anytime, anywhere.

The web terminal option provided by EnclaveFX is particularly useful for traders who prefer not to download or install any software. It allows for direct access to the platform via a web browser, making it convenient and accessible across various devices without compromising on functionality or trading features.

Additionally, EnclaveFX's MT5 platform supports various order types, including market orders, limit orders, stop orders, and more, providing flexibility in executing trades according to individual strategies and preferences. The platform also offers a wide range of tradable instruments, including forex currency pairs, commodities, indices, and cryptocurrencies, enabling traders to diversify their portfolios and capitalize on market opportunities.

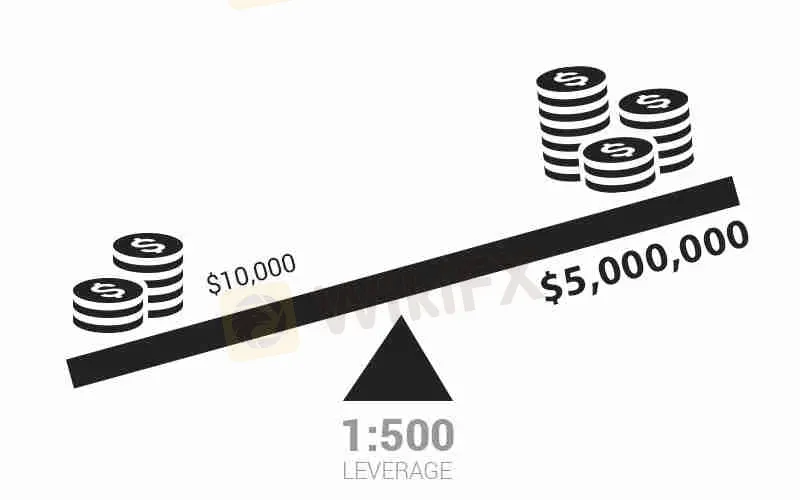

Leverage

EnclaveFX offers a maximum trading leverage of up to 1:500, which can have both positive and negative implications for traders. On the positive side, high leverage allows traders to amplify their positions and potentially increase their profits. With a leverage ratio of 1:500, traders can control larger positions with a smaller amount of capital. This can be advantageous for those seeking higher returns and capitalizing on small market movements.

However, it is important to consider the potential risks associated with high leverage. While it offers the opportunity for greater profits, it also amplifies losses. Trading with high leverage means that even small adverse market movements can lead to substantial losses. Therefore, it is crucial for traders to exercise caution and implement risk management strategies when utilizing such high leverage ratios. Furthermore, high leverage can attract inexperienced traders who may be enticed by the prospect of making quick profits. This can lead to overtrading and increased risk-taking, potentially resulting in significant financial losses.

Deposit and Withdrawal Methods and Fees

EnclaveFX offers a diverse range of deposit and withdrawal options, ensuring traders have convenient methods to manage their funds. These options include Bitcoin, local bank transfers, Indian Cash, USDT (TRC20), and AED. Each method is accompanied by specific details regarding commissions, fixed rates, execution times, and minimum amounts.

For Bitcoin transactions, both deposits and withdrawals are conducted free of charge. Deposits are typically processed within 1-3 hours, with a minimum amount requirement of 50.00 USD. Similarly, withdrawals are also free and usually completed within 1-3 hours.

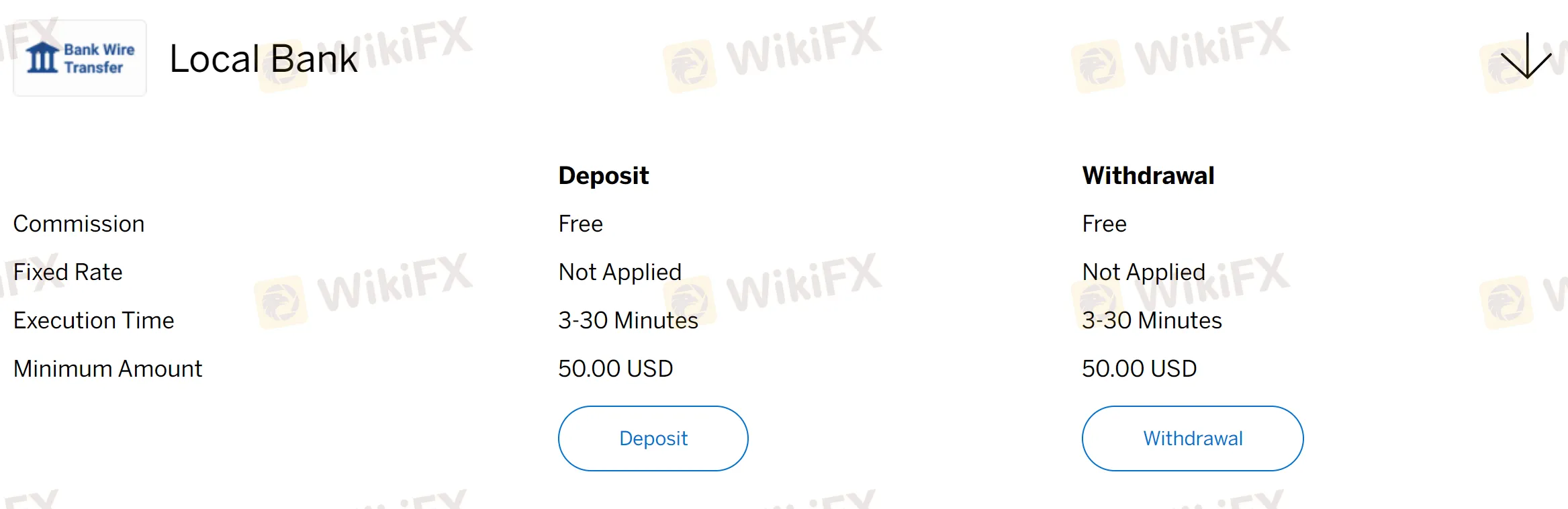

Deposits and withdrawals through local banks incur no commission fees. Deposits are swiftly executed within 3-30 minutes, while the minimum deposit amount is set at 50.00 USD. Withdrawals, likewise free of charge, are processed within the same time frame.

Indian Cash deposits are also free, with an approximate execution time of 15 minutes. Traders are required to deposit a minimum amount of 10.00 USD. Withdrawals, also free, generally take approximately 4-5 hours to process. However, in rare conditions, this processing time may extend up to 24 hours.

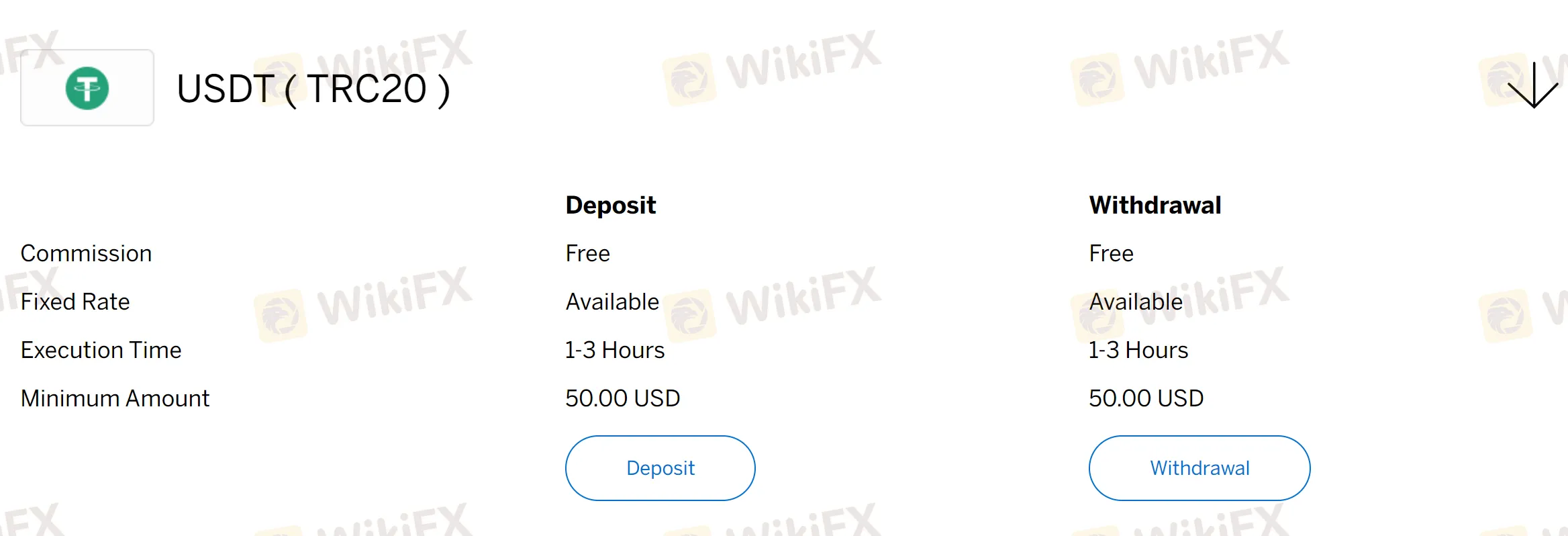

USDT (TRC20) deposits and withdrawals are facilitated without any associated fees. The execution time for these transactions typically falls within the range of 1-3 hours, with a minimum amount threshold of 50.00 USD.

Lastly, AED deposits and withdrawals can be conducted free of charge. The estimated execution time for these transactions is 1-3 hours, and a minimum amount of 50.00 USD is required.

Copy Trading

EnclaveFX offers copy trading feature, which allows traders to benefit from the expertise and strategies of successful traders in the market. Copy trading provides an opportunity for less experienced or time-constrained traders to automatically replicate the trades of experienced traders, known as signal providers, in their own trading accounts.

Through EnclaveFX's copy trading feature, traders can browse and select from a wide range of signal providers based on their performance, trading style, risk tolerance, and other relevant factors. The platform provides detailed information about each signal provider, including their trading history, average returns, risk levels, and number of followers.

Customer Support

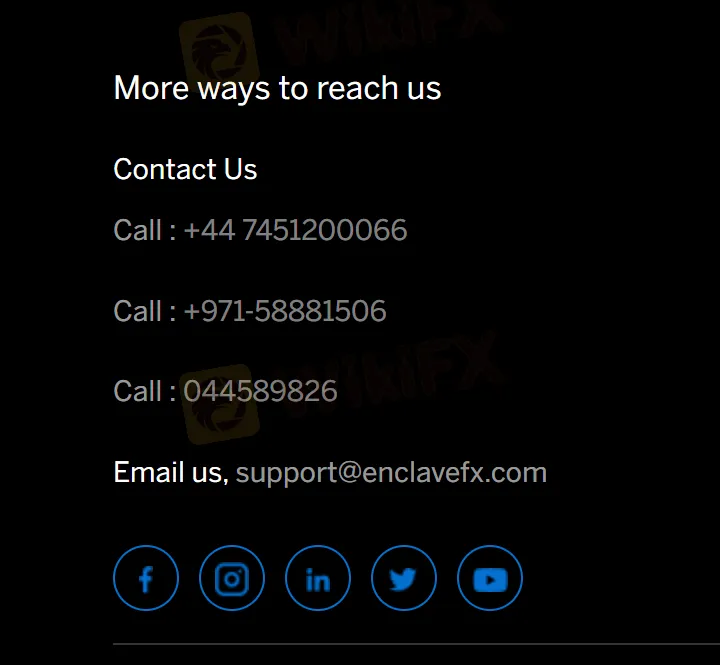

EnclaveFX offers several customer support options to assist traders in their journey. The broker can be easily reached through various communication channels, including telephone, email and online chat. Moreover, EnclaveFX maintains an active presence on popular social media platforms, such as Facebook, Instagram, Linkedin, Twitter, and Youtube, allowing traders to connect and engage with the broker through their preferred channels.

However, it is worth noting that EnclaveFX does not have a dedicated FAQ section displayed on their platform. While this absence may limit immediate access to a centralized repository of frequently asked questions, traders can still reach out to the customer support team for any inquiries they may have.

Educational Resources

EnclaveFX offers a range of educational resources to support traders in their journey towards financial proficiency. Traders can access the latest news and blogs, which serve as valuable sources of information and market insights. These resources provide up-to-date analysis and commentary on significant market events, helping traders stay informed about the latest trends and developments impacting the financial markets.

In addition to written content, EnclaveFX offers educational videos that cater to different learning styles. These videos cover various topics, including trading strategies, technical analysis, risk management, and more. Presented in a clear and concise manner, the videos provide visual demonstrations and explanations, making complex concepts more accessible to traders of all levels of expertise.

Users exposures on WikiFX

On our website, you can see that some users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Conclusion

In conclusion, EnclaveFX presents a mixed picture based on the provided pros and cons. On the positive side, the broker offers a user-friendly interface and advanced trading tools through the MT5 trading platform, accessible on various devices, including desktop, Android, iPhone, and web terminals. Additionally, traders have access to the latest news, blogs, and educational videos, which can enhance their market knowledge and trading skills.

However, there are some limitations to consider. The broker has a limited range of tradable instruments available, which may restrict traders' diversification options. Furthermore, there is a lack of 24/7 customer support, which could be a disadvantage for traders requiring immediate assistance. Additionally, the broker offers limited payment methods, potentially limiting flexibility for depositing and withdrawing funds. Another notable aspect is that only the MT5 trading platform is offered, with no alternative options like MT4 available.

Overall, traders considering this broker should weigh the pros and cons carefully. While there are notable advantages, it also has some undeniable disadvantages to consider.

FAQs

Q: What is the minimum deposit requirement for opening an account with EnclaveFX?

A: EnclaveFX offers a range of account types with varying minimum deposit requirements. The exact amount depends on the account type chosen. $10 is required to open a Micro account.

Q: What trading platforms does EnclaveFX support?

A: EnclaveFX supports the MetaTrader 5 (MT5) trading platform, which is available for desktop, Android, iPhone, and web terminals. The MT5 platform is renowned for its advanced features and intuitive interface.

Q: Does EnclaveFX provide customer support around the clock?

A: Unfortunately, EnclaveFX does not offer 24/7 customer support. However, they do provide customer support during regular trading hours. Traders can reach out to them via various communication channels such as email, phone, or online chat.

Q: Are demo accounts available for practice?

A: Yes, EnclaveFX offers demo accounts to traders.

Q: Does EnclaveFX offer copy trading services?

A: Yes, EnclaveFX provides copy trading services.

WikiFX-Broker

Aktuelle Nachrichten

Ripple XRP vor einem möglichen Ausbruch: Was der jüngste Anstieg des Open Interest bedeutet

Solana: Korrektur nach starker Rally – Geht der Anstieg weiter?

Die ersten Umfragen zur Bundestagswahl aus diesem Jahr sind da: AfD legt deutlich zu, Grüne mit Rückenwind, BSW rutscht ab

Ihr seid Jurist und wollt KI nutzen? Diese AI-Tools nutzt eine Linklaters-Partnerin

Bitcoin über 100.000-Dollar-Marke: Was Krypto-Experten für 2025 erwarten und welche Tipps sie Anlegern geben

Ripple stärkt RLUSD-Stablecoin mit Chainlink – Neuer Meilenstein für DeFi-Adoption

Rolex, Häuser und finanzielle Sicherheit: Anleger verraten, wie viel sie mit der jüngsten Bitcoin-Rallye verdient haben

Fitnessstudio-Feeling für Zuhause: Die besten Geräte fürs Home Gym

Trade Republic gibt Einblick in Geschäftszahlen: höherer Gewinn, Kundenzahl verdoppelt – Fokus auf Europa

BNB-Preisprognose: Sinkende Preise aufgrund des negativen Refinanzierungssatzes

Wechselkursberechnung