MHMarkets :MHM European Market

Zusammenfassung:In the Asian session on Tuesday (May 9), spot gold rose slightly. At present, it is trading near 2026.40 dollars/ounce. Worries about the US debt default crisis provide safe haven support for gold prices.

Market Overview

In the Asian session on Tuesday (May 9), spot gold rose slightly. At present, it is trading near 2026.40 dollars/ounce. Worries about the US debt default crisis provide safe haven support for gold prices.

US President Biden reportedly held a meeting with four leaders of the US Congress at the White House on the debt ceiling issue. US Treasury Secretary Yellen stated on Monday that if Congress fails to raise the federal debt ceiling of $31.4 trillion, it will have a huge impact on the US economy and weaken the US dollar's position as the world reserve currency.

US crude oil fluctuated narrowly and is currently trading around $72.60 per barrel. The market remains cautious ahead of the release of US April inflation data. This inflation data will be the key to the Federal Reserve's next interest rate decision.

The Federal Reserve raised interest rates last week, which may be the last rate hike in its tightening cycle. As inflationary pressures began to ease, it abandoned guidance on the necessity of future interest rate hikes.

In a report, the New York Federal Reserve stated that American consumers stated in April that they expect inflation to slightly decrease in one year.

In addition, this trading day also needs to pay attention to the speeches of Federal Reserve Director Jefferson and New York Fed Chairman Williams (Federal Reserve Number Three, Permanent Voting Committee).

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text.

The following strategy will be updated at 15:00 on May 9, Beijing time.

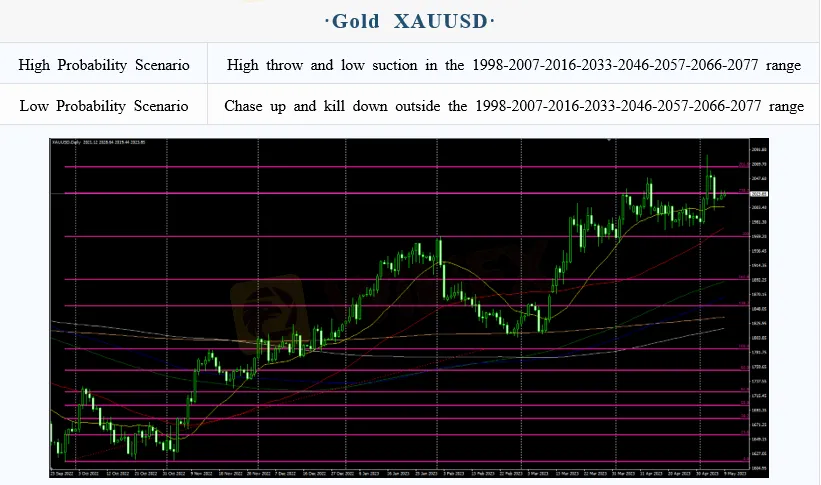

Intraday Oscillation Range: 1998-2007-2016-2033-2046-2057-2066-2077

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1911-1929-1937-1951-1978-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1998-2007-2016-2033-2046-2057-2066-2077 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 9. This policy is a daytime policy. Please pay attention to the policy release time.

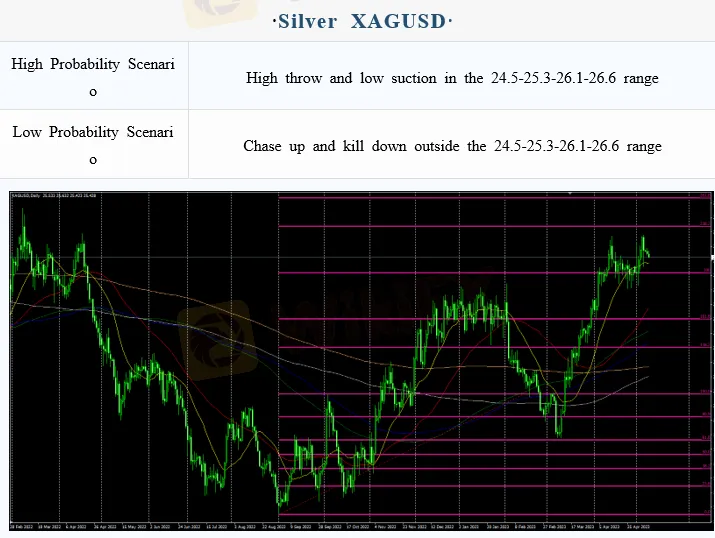

Intraday Oscillation Range: 24.5-25.3-26.1-26.6

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 24.5-25.3-26.1-26.6 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 9. This policy is a daytime policy. Please pay attention to the policy release time.

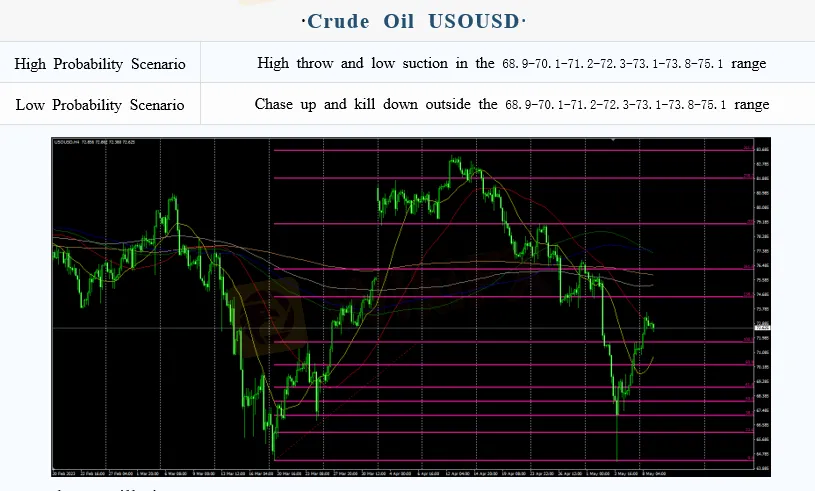

Intraday Oscillation Range:68.9-70.1-71.2-72.3-73.1-73.8-75.1

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1

In the subsequent period of Crude Oil, 68.9-70.1-71.2-72.3-73.1-73.8-75.1 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 9. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0690-1.0755-1.0830-1.0950-1.1157

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303

In the subsequent period of EURUSD, 1.0690-1.0755-1.0830-1.0950-1.1157 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 9. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.2375-1.2400-1.2470-1.2550-1.27000

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.2550-1.27000

In the subsequent period of GBPUSD, 1.2375-1.2400-1.2470-1.2550-1.27000 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 9. This policy is a daytime policy. Please pay attention to the policy release time.

WikiFX-Broker

Aktuelle Nachrichten

Die Top 3 am besten regulierten Forex-Broker weltweit

Krypto-Schock: Ethereum rutscht zweistellig ab – Anleger ziehen Milliarden ab

Die Top 3 am besten regulierten Forex-Broker weltweit

Wenn du ein FX-Trader bist, könnten diese Broker genau das sein, wonach du gesucht hast.

Die besten Plattformen für Forex-Trader, die auch investieren wollen

Die Top 3 am besten regulierten Forex-Broker weltweit

Cardano rutscht weiter ab – droht jetzt der nächste Absturz?

DNeue FX-Trader: Sucht nicht weiter – hier sind die 3 besten Broker für Anfänger

Ripple unter Druck: XRP rutscht ab – Privatanleger ziehen sich zurück

Wechselkursberechnung