May 30, 2023-MHM European Perspective

Zusammenfassung:Spot gold shocked lower during the Asian session on Tuesday (May 30), once hitting a new low of more than two months to $1,932.52 per ounce. Optimism over the U.S. debt ceiling deal and reduced market bets on the Federal Reserve to suspend interest rate hikes in June weakened gold's appeal.

Market Overview

Spot gold shocked lower during the Asian session on Tuesday (May 30), once hitting a new low of more than two months to $1,932.52 per ounce. Optimism over the U.S. debt ceiling deal and reduced market bets on the Federal Reserve to suspend interest rate hikes in June weakened gold's appeal.

U.S. President Joe Biden said Monday he was optimistic about the prospects of Congress passing the debt-ceiling deal he reached with House Speaker John McCarthy.

Michael Langford, director of corporate advisory firm AirGuide, said high volatility events such as the U.S. regional banking crisis and the U.S. debt limit impasse are now passing, reducing market interest in gold as investors seek risk appetite.

On the other hand, speeches by Fed officials in recent days have heightened the hawkish outlook for interest rates, which has also somewhat offset safe-haven flows around the U.S. debt ceiling situation, as higher interest rates will weaken the appeal of non-yielding gold.

The market currently expects the Fed to raise interest rates at its June meeting with a 60% probability.

U.S. crude oil is shaking and weakening, currently trading near $72.39 per barrel. A number of Fed officials made hawkish speeches last week and market expectations for a Fed rate hike in June have risen, with the dollar continuing to move higher, weighing on oil prices. In addition, concerns that OPEC+ will keep production quotas unchanged also put pressure on oil prices. However, the market expects the debt ceiling agreement in the world's largest oil consumer, the United States, to stimulate more demand, still providing some support to oil prices.

The market is in a wait-and-see mood as major oil producers are set to meet on June 4.

Comments from Russian oil officials and sources, including Deputy Prime Minister Novak, suggest the world's third-largest producer is inclined to keep production unchanged.

Because Monday is Memorial Day in the U.S., the API crude oil inventory series, which was scheduled to be released early Wednesday morning BST, was pushed back a day this week to Thursday.

With less economic data this trading day, investors need to focus on news related to the U.S. debt ceiling deal and pay attention to speeches from Federal Reserve officials.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on May 30, Beijing time.

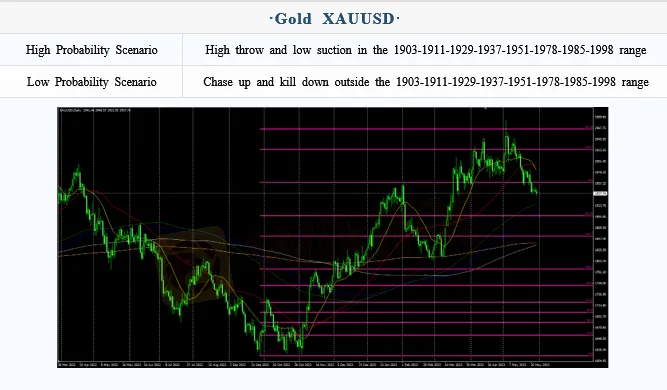

Intraday Oscillation Range: 1903-1911-1929-1937-1951-1978-1985-1998

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1911-1929-1937-1951-1978-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1903-1911-1929-1937-1951-1978-1985-1998 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 30. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 22.3-23.1-23.9-24.5-25.3

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 22.3-23.1-23.9-24.5-25.3 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 30. This policy is a daytime policy. Please pay attention to the policy release time.

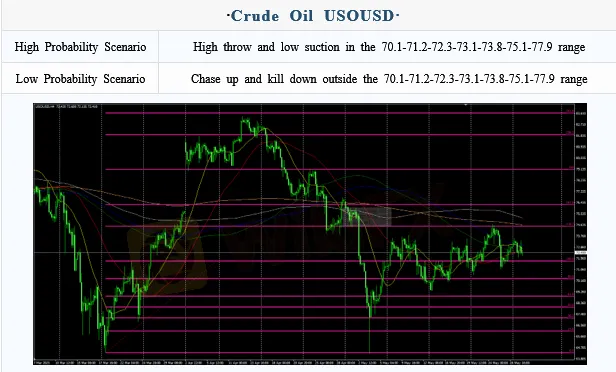

Intraday Oscillation Range: 70.1-71.2-72.3-73.1-73.8-75.1-77.9

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1

In the subsequent period of Crude Oil, 70.1-71.2-72.3-73.1-73.8-75.1-77.9 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 30. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0460-1.0570-1.0690-1.0755-1.0830

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303

In the subsequent period of EURUSD, 1.0460-1.0570-1.0690-1.0755-1.0830 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 30. This policy is a daytime policy. Please pay attention to the policy release time.

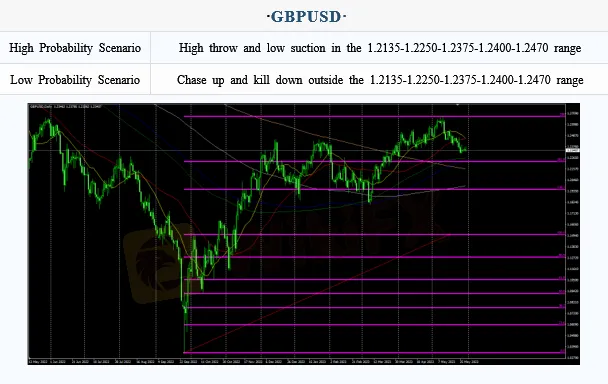

Intraday Oscillation Range: 1.2135-1.2250-1.2375-1.2400-1.2470

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.2550-1.27000

In the subsequent period of GBPUSD, 1.2135-1.2250-1.2375-1.2400-1.2470 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on May 30. This policy is a daytime policy. Please pay attention to the policy release time.

WikiFX-Broker

Aktuelle Nachrichten

Die Top 3 am besten regulierten Forex-Broker weltweit

Krypto-Schock: Ethereum rutscht zweistellig ab – Anleger ziehen Milliarden ab

Die Top 3 am besten regulierten Forex-Broker weltweit

Wenn du ein FX-Trader bist, könnten diese Broker genau das sein, wonach du gesucht hast.

Die besten Plattformen für Forex-Trader, die auch investieren wollen

Die Top 3 am besten regulierten Forex-Broker weltweit

Cardano rutscht weiter ab – droht jetzt der nächste Absturz?

DNeue FX-Trader: Sucht nicht weiter – hier sind die 3 besten Broker für Anfänger

Ripple unter Druck: XRP rutscht ab – Privatanleger ziehen sich zurück

Wechselkursberechnung