June 14, 2023-MHM European Perspective

Zusammenfassung:On Wednesday (June 14), spot gold rebounded slightly during the Asian session and is currently trading at $1947.33 per ounce.

Market Overview

On Wednesday (June 14), spot gold rebounded slightly during the Asian session and is currently trading at $1947.33 per ounce. Because the U.S. CPI data overnight was less than expected, the market is widely expected to suspend the Fed's interest rate hike this week, and the 100-day average to gold prices to provide support. However, because the U.S. core CPI is still more than two times the Fed's target, the market is generally expected to the Fed this week will be “hawkish skip” rate hike, and July rate hike is expected to remain high, which still make gold prices face further downside risk.

In addition to the Fed's interest rate resolution, investors should also pay attention to the Fed's latest quarterly economic forecast, dot plot and Fed Chairman Powell's press conference. In addition, the U.S. May PPI data before the interest rate resolution should also be noted.

U.S. crude oil extended its overnight rally and is currently trading near $69.67 per barrel. The market reinforced expectations that the Federal Reserve will pause its rate hike this week, and U.S. stocks extended their rally to refresh more than one-year highs, providing support to oil prices. The U.S. saw peak summer travel with air travel near may above 2019 levels; OPEC data showed that Saudi Arabia's latest oil production cuts will tighten the global market significantly next month. Although the unexpected increase in API crude inventories has limited oil price gains, the rally overnight has significantly weakened short-term downside risks.

Investors need to pay attention to EIA crude oil inventory series data, U.S. May PPI data, Federal Reserve interest rate resolution and IEA monthly report this trading day.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on June 14, Beijing time.

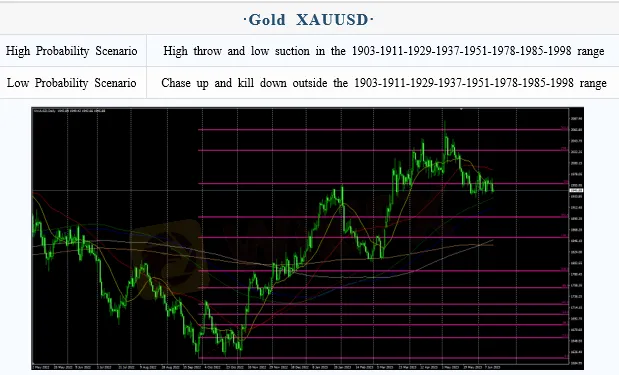

Intraday Oscillation Range: 1903-1911-1929-1937-1951-1978-1985-1998

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1911-1929-1937-1951-1978-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1903-1911-1929-1937-1951-1978-1985-1998 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 14. This policy is a daytime policy. Please pay attention to the policy release time.

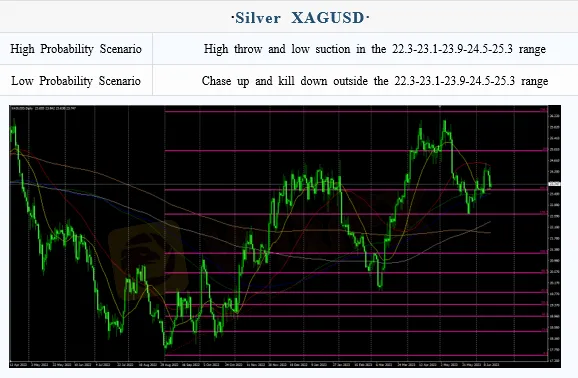

Intraday Oscillation Range: 22.3-23.1-23.9-24.5-25.3

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 22.3-23.1-23.9-24.5-25.3 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 14. This policy is a daytime policy. Please pay attention to the policy release time.

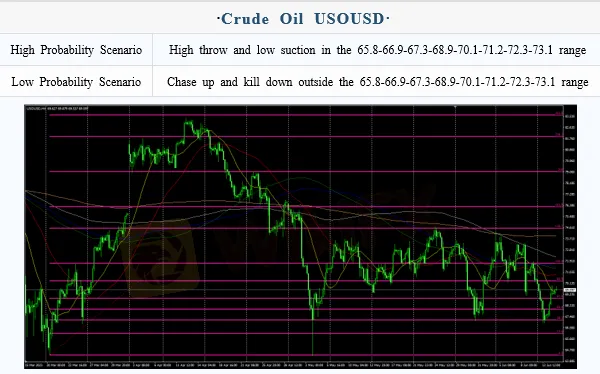

Intraday Oscillation Range: 65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1

In the subsequent period of Crude Oil, 65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 14. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0570-1.0690-1.0755-1.0830-1.0950-1.1157

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303

In the subsequent period of EURUSD, 1.0570-1.0690-1.0755-1.0830-1.0950-1.1157 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 14. This policy is a daytime policy. Please pay attention to the policy release time.

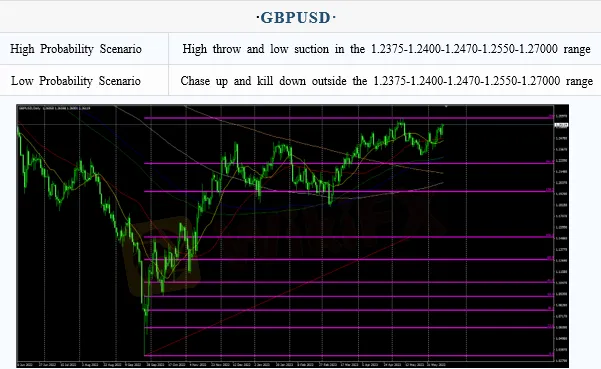

Intraday Oscillation Range: 1.2375-1.2400-1.2470-1.2550-1.27000

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.2550-1.27000

In the subsequent period of GBPUSD, 1.2375-1.2400-1.2470-1.2550-1.27000 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on June 14. This policy is a daytime policy. Please pay attention to the policy release time.

WikiFX-Broker

Aktuelle Nachrichten

Japanischer Konzern kauft Intel-Aktien für zwei Milliarden US-Dollar – und treibt so den Kurs nach oben

Geht der KI-Hype vorbei? US-Technologieaktien schwächeln nach Veröffentlichung von kritischer MIT-Studie

164,5 Millionen US-Dollar: Dieser Top-CEO hat 2024 am meisten verdient. Wetten, dass ihr ihn nicht kennt?

Wechselkursberechnung