MFP Trading

Zusammenfassung:MFP Trading claims to be a forex execution specialist focused on delivering premium trading solutions for professional clients. MFP provides customized execution services and value-added offerings, such as market sentiment indices and treasury solutions. MFP claims to adhere to the FX Global Code of Conduct for competitive pricing and robust infrastructure.

| MFP Trading Review Summary | |

| Founded | 2019 |

| Registered Country/Region | United Kingdom |

| Regulation | No regulation |

| Products & Services | Trade execution |

| EUR/USD Spread | 0.03-0.1 pips for the retail market makers; around 1 pip for institutions |

| Customer Support | Address: Unit 8, 74 Back Church Lane, London, E1 1LX, United Kingdom |

| Tel: +44 203 769 9884 | |

| Email: sales@mfptrading.com | |

| Contact form | |

MFP Trading Information

MFP Trading claims to be a forex execution specialist focused on delivering premium trading solutions for professional clients. MFP provides customized execution services and value-added offerings, such as market sentiment indices and treasury solutions. MFP claims to adhere to the FX Global Code of Conduct for competitive pricing and robust infrastructure.

Pros and Cons

| Pros | Cons |

| Tight spreads for retail market maker | Lack of regulation |

| Multiple contact channels | Lack of transparency |

Is MFP Trading Legit?

Regulation is of great importance to evaluate the legitimacy and reliability of a brokerage firm, but in the case of MFP Trading, the company operates without any valid regulatory oversight, indicating less compliance to industry standards, financial transparency, and the protection of client interests

Products & Services

MFP Trading is a company specializes in forex execution, offering premium services tailored to meet the sophisticated needs of professional clients by partnership with TraderTools. Utilizing advanced technology and broad access to top-tier Prime Brokers, MFP Trading provides customized execution solutions, value-added services like market sentiment indices and treasury services, and robust support for asset management firms.

Spread

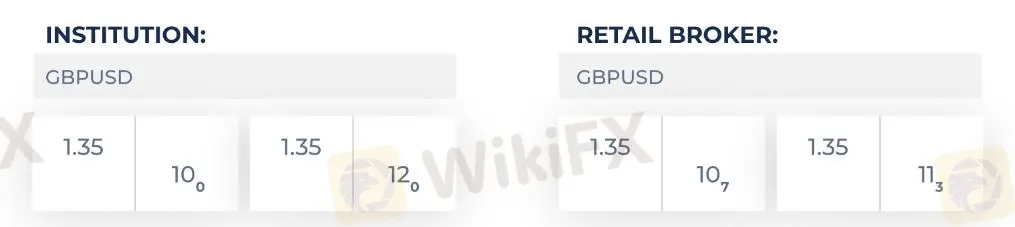

MFP Trading offers different spread levels for different client profiles, with institutional clients get more attractive pricing compared to traditional retail market makers.

For instance, while institutional spreads for EUR/USD is around 1 pip and GBP/USD around 2 pips, retail market makers might display tighter spreads of 0.1/03 and 0.5/08, respectively.

WikiFX-Broker

Aktuelle Nachrichten

Frauen verdienen im Laufe ihrer Karriere 500.000 Euro weniger als Männer – der Grund überrascht

Führung fest in Männerhand: Neue Zahlen zeigen, wie besorgniserregend der Frauenanteil in deutschen Chefetagen ist

Apple: Einige KI-Verbesserungen an Siri wurden überraschend auf 2026 verschoben

Wechselkursberechnung