MHMarkets:The US dollar index accelerated its decline during the Asian market, and the Bank of Japan intervened in the market.

Zusammenfassung:On Tuesday (October 24), the US dollar index accelerated its decline to 105.45 during the Asian market, which was hindered, and the current price is around 105.49.

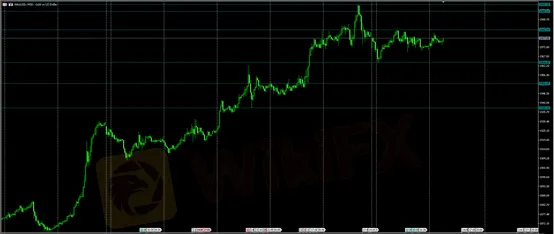

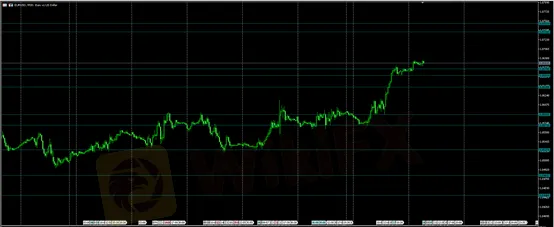

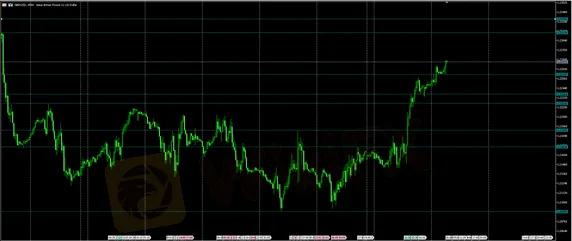

On Tuesday (October 24), the US dollar index accelerated its decline to 105.45 during the Asian market, which was hindered, and the current price is around 105.49. After breaking through the previous support yesterday, the US dollar index continued to decline, and there is a short-term downward demand. Gold was hindered from rising to around 1980.82 at the opening of the Asian market. Today, there is not much volatility in gold, and the resistance around 1992 above is still working. In the future market, we are waiting for further guidance from the fundamentals. US crude oil fell sharply to 85.13 in the market yesterday, supported by the current price around 85.46. Today, the Asian market continued to decline at the opening, and the future market is likely to continue yesterday's decline. EURUSD rose strongly yesterday and continuously broke through the resistance above. The Asian market continued to rise at the opening today, and it is likely to continue yesterday's rise in the future market. The current price is around 1.0680. USDJPY was affected by the Bank of Japan's unplanned bond purchase operation, and the market as a whole fell yesterday. The upper policy red line still exists, and there is a high probability that USDJPY will continue to fall in the future market. The current price of USDJPY is around 149.60.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on October 24, Beijing time.

· Gold XAUUSD· | |

Resistance | 1982.73 – 1997.25 |

Support | 1964.10 – 1952.15 |

Gold was hindered from rising to 1980.82 at the opening of the Asian market, and there has been a long-standing resistance at the upper high point. Currently, gold is waiting for further guidance from fundamentals. Based on the current fundamentals, it is likely that gold will continue its previous upward trend in the future market. Intraday attention to the support of 1964.10-1952.15 below and the resistance of 1982.73-1997.25 above. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on October 24. This policy is a daytime policy. Please pay attention to the policy release time. | |

· Crude Oil USOUSD· | |

Resistance | 87.30 – 87.77 – 87.97 |

Support | 85.11 – 84.37 |

The US crude oil market plummeted to 85.13 yesterday and ultimately closed near the intraday low. It is likely that US crude oil will continue its previous downward trend in the future market. Intraday attention to the support of 85.11-84.37 below and the resistance of 87.30-87.77-87.97 above. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on October 24. This policy is a daytime policy. Please pay attention to the policy release time. | |

· EURUSD· | |

Resistance | 1.0594 - 1.0615 |

Support | 1.0555 - 1.0522 |

EURUSD rose sharply in today's market and continuously broke through upper resistance, ultimately closing near the intraday high. At the opening of the Asian market today, the market continued to rise, and it is likely that EURUSD will continue its previous upward trend in the future market. Intraday attention to the support of 1.0555-1.0522 below and the resistance of 1.0594-1.0615 above. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on October 24. This policy is a daytime policy. Please pay attention to the policy release time. | |

· GBPUSD· | |

Resistance | 1.2313– 1.2331 |

Support | 1.2261 - 1.2236 – 1.2224 |

GBPUSD rose sharply in the market yesterday, and savings rose during the Asian session today, breaking through previous highs. It is likely that GBPUSD will continue its previous upward trend in the future market. Intraday attention to the support of 1.2261-1.2236-1.2224 below and the resistance of 1.2313-1.2331above. The market will be judged by whether to break through the upper and lower support and resistance. Note: The above strategy was updated at 15:00 on October 24. This policy is a daytime policy. Please pay attention to the policy release time. | |

WikiFX-Broker

Aktuelle Nachrichten

Tech-Aktien weiter unter Druck: Warum auch Nvidias Erfolg die Rally gerade nicht wiederbeleben

Wechselkursberechnung