BitPro

Zusammenfassung:BitPro, established in 2022 and headquartered in Saint Vincent and the Grenadines, operates as an unregulated trading platform. Catering to various traders' needs, BitPro offers multiple account types: Standard, Premium, and VIP, each tailored to different investment capacities. With a minimum deposit requirement of $120 and a maximum leverage of 1:500, the platform aims to provide accessibility to traders of diverse backgrounds. BitPro presents a web-based platform for trading convenience, offering a range of tradable assets, including cryptocurrencies, forex pairs, commodities, and indices. Despite its wide asset selection, BitPro's educational resources remain limited, potentially posing challenges for users seeking comprehensive learning materials. However, the platform ensures 24/7 customer support through various channels like live chat, email, and phone, prioritizing user assistance. For deposits and withdrawals, BitPro supports bank transfers, credit/debit cards, and reputable

| Aspect | Information |

| Company Name | BitPro |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2022 |

| Regulation | Not regulated |

| Minimum Deposit | $120 |

| Maximum Leverage | 1:500 |

| Spreads | As low as 0.0 pips |

| Trading Platforms | Web-based platform |

| Tradable Assets | Cryptocurrencies, Forex pairs, Commodities, Indices |

| Account Types | Standard, Premium, VIP |

| Customer Support | 24/7 support via live chat, email, phone |

| Deposit & Withdrawal | Bank transfers, credit/debit cards, and reputable e-wallets |

| Educational Resources | Limited educational materials |

Overview of BitPro

BitPro, established in 2022 and headquartered in Saint Vincent and the Grenadines, operates as an unregulated trading platform. Catering to various traders' needs, BitPro offers multiple account types: Standard, Premium, and VIP, each tailored to different investment capacities. With a minimum deposit requirement of $120 and a maximum leverage of 1:500, the platform aims to provide accessibility to traders of diverse backgrounds. BitPro presents a web-based platform for trading convenience, offering a range of tradable assets, including cryptocurrencies, forex pairs, commodities, and indices. Despite its wide asset selection, BitPro's educational resources remain limited, potentially posing challenges for users seeking comprehensive learning materials. However, the platform ensures 24/7 customer support through various channels like live chat, email, and phone, prioritizing user assistance. For deposits and withdrawals, BitPro supports bank transfers, credit/debit cards, and reputable e-wallets, facilitating transactional flexibility for its users.

Is BitPro legit or a scam?

BitPro's lack of regulation could raise concerns about transparency and oversight within the exchange. Unregulated platforms miss out on the crucial legal safeguards and oversight provided by regulatory bodies, potentially increasing the risks of fraudulent activities, market manipulations, and security vulnerabilities. The absence of regulatory checks might also pose challenges for users in resolving disputes or seeking recourse in case of issues. Moreover, the absence of oversight can create a less transparent trading environment, making it challenging for users to gauge the credibility and reliability of the exchange.

Pros and Cons

| Pros | Cons |

| Wide range of trading assets available | Not regulated |

| Multiple account types available | Limited payment methods |

| Different leverage options | Lack of comprehensive educational resources |

| Web-based platform for convenience | ot available in some countries or regions |

| 24/7 customer support available |

Pros:

1.Wide Range of Trading Assets Available: BitPro offers a diverse selection of trading assets, allowing traders to explore and invest in various markets, potentially providing more opportunities for portfolio diversification.

2. Multiple Account Types Available: With different account tiers (Standard, Premium, VIP), BitPro caters to various trader needs, offering flexibility in trading conditions and services based on individual preferences and investment capacities.

3. Different Leverage Options: BitPro provides varying leverage options across its account types, granting traders the ability to adjust their exposure and risk levels according to their trading strategies and risk management preferences.

4. Web-Based Platform for Convenience: The web-based platform ensures ease of access without requiring software downloads. This convenience allows traders to access the platform from different devices with internet connectivity.

5. 24/7 Customer Support Available: BitPro offers around-the-clock customer support via various channels like live chat, email, and phone, ensuring traders can seek assistance or resolve issues at any time, promoting convenience and responsiveness.

Cons:

1.Not Regulated: BitPro's lack of regulation might raise concerns about the platform's adherence to industry standards and oversight, potentially impacting user trust and the platform's reliability.

2. Limited Payment Methods: The platform might have fewer payment options compared to established brokers, potentially limiting users' choices and convenience in depositing and withdrawing funds.

3. Lack of Comprehensive Educational Resources: BitPro's educational resources might be limited, potentially affecting new users' learning curve in understanding the platform and trading cryptocurrencies, increasing the risk of errors and losses.

4. Not Available in Some Countries or Regions: BitPro's availability might be restricted in certain geographical areas, limiting access for users residing in those regions.

Market Instruments

BitPro provides an extensive array of trading assets across various categories. This includes Forex pairs encompassing major, minor, and exotic currency pairs. Additionally, the platform offers a diverse range of cryptocurrencies, allowing users to trade popular digital currencies like Bitcoin (BTC), Ethereum (ETH), and numerous altcoins. In the commodities segment, users can access trading options involving precious metals, energies, agricultural products, and more. Furthermore, BitPro extends its offerings to indices, enabling traders to invest in and trade indices representing various markets or sectors. Lastly, the platform provides access to a selection of stocks from prominent companies, broadening the scope of investment opportunities for its users.

Account Types

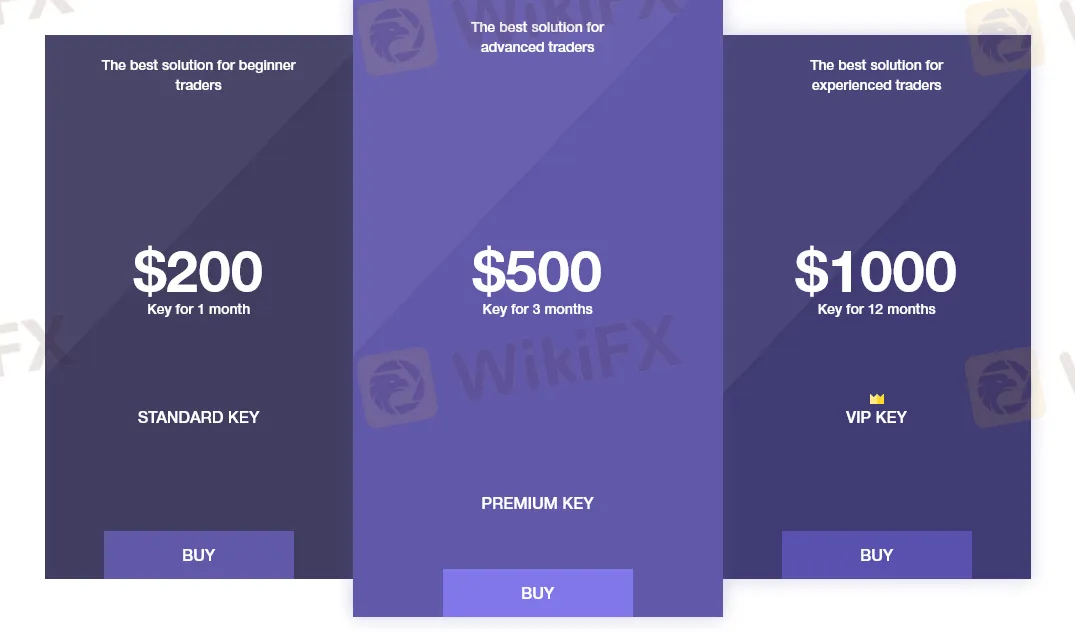

BitPro's diverse account offerings cater to traders with varying experience levels and preferences.:

Standard Account:

The Standard account at BitPro offers traders a starting point with a minimum deposit requirement of $120. With leverage of up to 1:500, traders can access the market with relatively higher leverage compared to other account types. The spread starts as low as 0.2 pips, enabling competitive pricing for trades. There are no commissions charged per trade, making it an attractive option for those who prefer fee-free trading.

Premium Account:

For more seasoned traders or those seeking advanced features, BitPro's Premium account requires a higher minimum deposit of $5,000. This account type offers increased leverage of up to 1:500 and tighter spreads starting as low as 0.1 pips, potentially providing better trading conditions. Traders pay a nominal commission of $5 per trade but benefit from free withdrawals, access to demo accounts, and usage of MetaTrader 4 and MetaTrader 5.

VIP Account:

At BitPro, the VIP account stands as the highest tier, demanding a substantial minimum deposit of $10,000. Despite a minimum deposit requirement, VIP account holders gain access to leverage of up to 1:500 and enjoy the most competitive spreads starting from as low as 0.0 pips. However, a commission of $10 per trade is applied.

| Feature | Standard | Premium | VIP |

| Account type | Standard | Premium | VIP |

| Leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 |

| Spread | As low as 0.2 pips | As low as 0.1 pips | As low as 0.0 pips |

| Commission | $0 per trade | $5 per trade | $10 per trade |

| Minimum deposit | $120 | $5,000 | $10,000 |

| Withdrawals | Free | Free | Free |

How to Open an Account?

Here's a step-by-step guide on how to open an account with BitPro:

Visit BitPro's Website:

Go to BitPro's official website using a web browser on your computer or mobile device.

2. Account Registration:

Click on the “Sign Up” or “Register” button prominently displayed on the website's homepage. Fill in the required information, including your name, email address, country of residence, and a secure password.

3. Account Verification:

Once you've filled in the registration form, you'll likely need to verify your email address. Check your inbox for a verification email from BitPro and follow the instructions provided to confirm your account.

4. Complete Personal Details:

Log in to your newly created BitPro account. You'll be prompted to complete your profile by providing additional personal details, such as your date of birth, address, and possibly some identification documents for verification purposes. Follow the on-screen instructions to complete this step.

5. Choose Account Type and Fund Your Account:

After your profile setup, choose the type of account you wish to open based on your trading preferences and financial capacity (Standard, Premium, or VIP). Then, proceed to fund your account by selecting a payment method and depositing the required initial amount. Ensure you meet the minimum deposit criteria for your chosen account type.

6. Start Trading:

Once your account is funded and verified, you're ready to start trading. Access the trading platform provided by BitPro (such as MetaTrader 4 or MetaTrader 5) and explore the available financial instruments, tools, and resources to begin your trading journey.

Leverage

At BitPro, the maximum leverage provided to traders varies based on the chosen account type:

Standard Account: Offers a maximum leverage of up to 1:500.

Premium Account: Provides a higher maximum leverage, allowing traders to access up to 1:500 leverage.

VIP Account: Despite being a premium account type, the maximum leverage for the VIP account remains at up to 1:500.

Leverage enables traders to control larger positions in the market with a relatively smaller amount of capital. For instance, a leverage ratio of 1:500 means that for every unit of the trader's capital, they can potentially control up to 500 units in a trade.

Higher leverage amplifies both potential profits and losses. While it can enhance potential gains, it also heightens the risk of significant losses if the market moves unfavorably. Traders should carefully assess their risk tolerance and use leverage judiciously, considering its impact on their trading strategy and risk management.

Spreads & Commissions

Spreads: Spreads refer to the difference between the buying (ask) and selling (bid) prices of an asset. They indicate the cost incurred when entering a trade. At BitPro:

Standard Account: Offers spreads starting as low as 0.2 pips.

Premium Account: Provides tighter spreads, starting as low as 0.1 pips.

VIP Account: Presents the most competitive spreads, potentially starting from as low as 0.0 pips.

Lower spreads generally benefit traders by reducing the cost of entering a trade, potentially resulting in quicker profitability as the market moves in their favor.

Commissions: Some accounts may have commissions charged per trade, which is an additional fee apart from the spread. At BitPro:

Standard Account: Generally doesn't charge commissions per trade, offering fee-free trading.

Premium Account: Incurs a commission of $5 per trade.

VIP Account: Imposes a higher commission of $10 per trade.

While the Standard Account doesn't have trade commissions, it may have slightly higher spreads compared to the Premium and VIP accounts. The commission structure can impact overall trading costs, influencing traders' decisions based on their trading frequency and strategy.

Trading Platform

BitPro's trading platform is a basic web-based system primarily focused on binary options trading. The platform offers accessibility through a web browser, eliminating the need for software downloads. Available in both Russian and English, the platform provides convenience for users comfortable with either language.

The platform's simplicity caters to users seeking a straightforward approach to binary options trading. While it may lack the complexity and depth of more advanced trading platforms, its user-friendly interface allows for easy navigation and execution of binary options trades.

Despite potential language inconsistencies, users can access essential trading functionalities such as placing trades, monitoring positions, and possibly accessing basic analytical tools. However, for users requiring more advanced features or a more comprehensive trading experience, they might find limitations within BitPro's basic web-based platform.

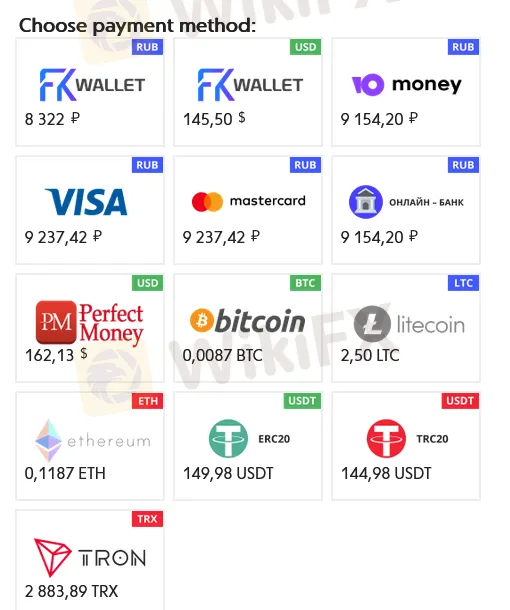

Deposit & Withdrawal

BitPro offers deposit methods that include less conventional Russia-based payment processors and cryptocurrencies, which might be viewed as less transparent compared to established payment options commonly provided by legitimate brokers. These methods might cater to specific user preferences but could potentially lack the clarity and security features found in widely accepted options like bank transfers, credit/debit cards, and reputable e-wallets such as PayPal, Skrill, Neteller, or Sofort.

Moreover, BitPro's withdrawal policy includes one free withdrawal per month; subsequent withdrawals incur a 10 USD fee. This stands in contrast to legitimate brokers who generally do not impose such limitations or transaction fees on withdrawals, fostering a more flexible and cost-effective withdrawal process for traders.

Additionally, for clients availing bonuses, BitPro necessitates meeting stringent trading volume requirements before permitting withdrawals. The turnover requirement involves trading at least 30 times the bonus amount plus the initial deposit, representing a relatively high threshold compared to industry standards. This high turnover requirement might limit clients' flexibility in withdrawing bonuses and associated profits, making it essential for traders to carefully consider these conditions before opting for bonuses.

Customer Support

BitPro's customer support aims to provide assistance and guidance to traders through various channels and potentially around-the-clock service. Typically, BitPro offers customer support via live chat, email, and phone, ensuring accessibility for users seeking assistance with trading-related queries or technical issues. The 24/7 availability of these support channels ensures that traders can reach out for help at any time, which is beneficial, especially in a fast-paced trading environment where timely assistance matters.

Moreover, some account types, such as the Premium and VIP accounts, might offer additional personalized support in the form of dedicated account managers. These managers could provide more tailored assistance, advice, or support beyond the general customer service scope, potentially catering to the specific needs of these account holders.

Educational Resources

BitPro faces a notable gap in its educational resources, creating challenges for new users endeavoring to navigate the platform and delve into cryptocurrency trading. Absent from BitPro are essential educational materials such as a comprehensive user guide, instructive video tutorials, live webinars, insightful blogs, among others. This dearth of educational content significantly hampers the learning curve for newcomers, potentially resulting in missteps and financial losses. Such an obstacle not only impedes users' abilities to grasp the platform's functionalities but also increases the likelihood of errors, fostering discouragement among novice traders and dissuading them from further engagement in trading activities.

Conclusion

BitPro, while offering a diverse range of trading assets, multiple account types, and different leverage options, faces notable limitations. The platform's lack of regulation and limited payment methods might deter some users concerned about oversight and transactional flexibility.

Moreover, the absence of comprehensive educational resources could pose challenges for newcomers, potentially impacting their learning curve and increasing the risk of errors. Despite these drawbacks, BitPro stands out with its web-based convenience, 24/7 customer support, and availability of various account types, catering to different trader preferences. Traders should weigh these advantages against the platform's limitations to make informed decisions aligning with their trading needs and risk tolerance.

FAQs

Q: What trading assets are available on BitPro?

A: BitPro offers a diverse range of trading assets including cryptocurrencies, forex pairs, commodities, and indices, providing options for diversified trading strategies.

Q: How many account types does BitPro offer?

A: BitPro provides multiple account types catering to different trader needs, typically offering Standard, Premium, and VIP accounts, each with varying features and benefits.

Q: What leverage options are available on BitPro?

A: BitPro offers different leverage options across its account types, allowing traders to access leverage ratios up to 1:500, or other variations based on the chosen account type.

Q: Does BitPro provide educational resources for traders?

A: BitPro might have limited educational resources, potentially lacking comprehensive guides, video tutorials, or webinars, which could impact new users' learning curve.

Q: What payment methods can I use on BitPro?

A: BitPro might offer limited payment methods, potentially supporting obscure Russia-based processors and cryptocurrencies alongside traditional methods like bank transfers and credit/debit cards.

Q: Are there withdrawal fees on BitPro?

A: BitPro typically offers one free withdrawal per month; subsequent withdrawals might incur a fee, usually around 10 USD, potentially impacting the cost-effectiveness of frequent withdrawals.

WikiFX-Broker

Aktuelle Nachrichten

Frauen verdienen im Laufe ihrer Karriere 500.000 Euro weniger als Männer – der Grund überrascht

Führung fest in Männerhand: Neue Zahlen zeigen, wie besorgniserregend der Frauenanteil in deutschen Chefetagen ist

Apple: Einige KI-Verbesserungen an Siri wurden überraschend auf 2026 verschoben

Wechselkursberechnung