The Vanguard Group

Zusammenfassung:Founded in Japan in 2023, the Vanguard Group is an unregulated investment management firm offering trading in Mutual funds, ETFs, stocks, and bonds with no minimum deposit requirement.

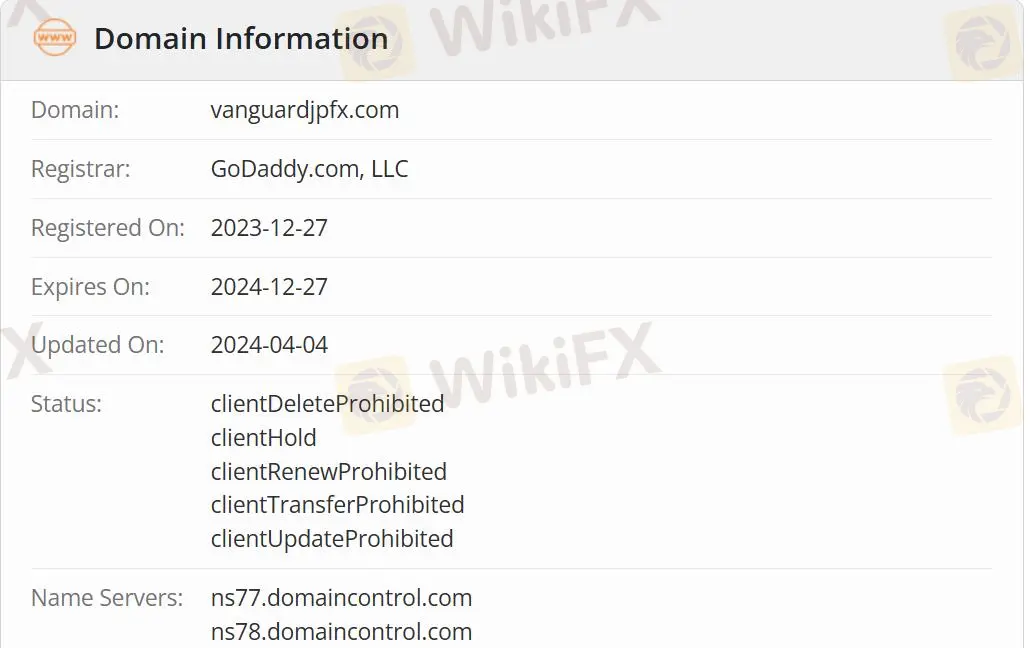

Note: The Vanguard Group' official website - https://vanguardjpfx.com is currently inaccessible normally.

| The Vanguard Group Review Summary | |

| Founded | 2023 |

| Registered Country/Region | Japan |

| Regulation | Unregulated |

| Market Instruments | 7,000+, mutual funds, ETFs, stocks, bonds |

| Demo Account | / |

| Leverage | / |

| Trading Platform | / |

| Min Deposit | $0 |

| Customer Support | Tel: +81 04 2000 2818 |

Founded in Japan in 2023, the Vanguard Group is an unregulated investment management firm offering trading in Mutual funds, ETFs, stocks, and bonds with no minimum deposit requirement.

Pros and Cons

| Pros | Cons |

| Wide range of investment products | Inaccessible website |

| Various account types | Unregulated status |

| $0 commissions on US stock and ETF trades | Lack of transparency |

| No minimum deposit | Limited payment options |

Is The Vanguard Group Legit?

No, The Vanguard Group has no regulations. Besides, its domain is in the form of restriction, due to its unavailable website.

What Can I Trade on The Vanguard Group?

The Vanguard Group provides over 7,000 mutual funds, ETFs, stocks, and bonds.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| Bonds | ✔ |

| ETFs | ✔ |

| Mutual Funds | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

Account Type

The Vanguard Group offers many kinds of live accounts including individual, joint, traditional IRA, Roth IRA, SEP IRA, Coverdell ESA, trust, and custodial accounts withno minimum deposit requirement.

The Vanguard Group Fees

The Vanguard Group charges commissions and fees for various class assets:

| Asset Class | Commission/Fee |

| US Stock and ETF Trades | ❌ |

| Fixed Income Trades (Bonds) | $1 to $25 per bond |

| International Stock and ETF Trades | 0.1% foreign transaction fee |

Deposit and Withdrawal

The Vanguard Group accepts payments via electronic funds transfer (ACH), check deposits, and wire transfers.

WikiFX-Broker

Aktuelle Nachrichten

Ozempic bald 80 Prozent günstiger? Hikma Pharmaceuticals will von auslaufenden Patenten profitieren

Bericht über Megaprojekt in Saudi-Arabien: Neom-Manager sollen Finanzberichte manipulieren, um hohe Kosten zu vertuschen

Porsche nimmt Ziele zurück – wegen schwacher Nachfrage nach E-Autos

Puma muss deutlichen Rückgang beim Gewinn hinnehmen

„Viel zu hohe Risiken – Branchenverband für Volksbanken fordert strengere Regeln für die eigenen Banken

Ford Deutschland in den roten Zahlen – jetzt soll eine Milliarden-Finanzspritze des US-Konzerns helfen

Corona-Überflieger Biontech machte einst Milliardengewinne – mittlerweile aber Verluste und kündigt Stellenabbau an

Ich bin 38 und CEO von Trivago: Diese 6 Skills machen euch zu einer guten Führungskraft

Webasto: Angeschlagener Automobilzulieferer braucht 200-Millionen-Finanzspritze

Trotz sinkendem Absatz: VW-Tochter Traton steigert Rendite und erhöht die Dividenden für Anleger

Wechselkursberechnung