DBG Markets: Market Report for September 30, 2024

Zusammenfassung:Market OverviewIt is rate cuts season and the starter for every major banks have kicked up. Currently, this is the condition of the major banks and market expectation before the year ends:U.S. Dollar:

Market Overview

It is rate cuts season and the starter for every major banks have kicked up. Currently, this is the condition of the major banks and market expectation before the year ends:

U.S. Dollar:

Markets are fully pricing in at least a 25-basis point rate cut at the Fed's November meeting, with expectations for a 50-basis point cut rising to 56.7% from 49.9% after recent data releases. The probability of aggressive monetary easing is increasing.

Yen (BoJ):

The new Prime Minister, Ishiba, has signaled support for the BoJ's intent to normalize monetary policy, though the timing and pace remain uncertain. HSBC economist Jun Takazawa commented that any additional stimulus would likely support rising consumption, potentially accelerating the BoJ's resolve to gradually raise interest rates. This has fueled market expectations of a stronger Yen.

Pound (BoE):

The BoE noted that inflation has eased and the economy is evolving as forecast. A gradual approach to removing policy restraints remains appropriate. The BoE expects inflation to rise to around 2.5% by year-end, as the effects of last years energy price declines fade. Currently, there is a 66% chance of a rate cut in November, down from earlier full expectations of a cut. UK policymakers have emphasized that future decisions will be made on a meeting-by-meeting basis.

Aussie Dollar (RBA):

Investors are waiting for the release of August inflation data. RBA Governor Michele Bullock indicated that even if inflation moves back within target, it doesn't guarantee that inflation is fully under control, signaling that the central bank will not rush into policy easing. Currently, markets are pricing in a 72% chance of a rate cut by the end of the year.

New Zealand Dollar (RBNZ):

The RBNZ is aiming to lower its cash rate to below 4%, with a neutral target between 2.5% and 3%. Analysts expect major 50-basis point rate cuts in both October and November, in response to the Feds anticipated cuts. However, there are arguments that the RBNZ might stay more conservative in 2024, pushing larger cuts into 2025.

Swiss Franc (SNB):

At its September 26 monetary policy decision, outgoing SNB Chairman Thomas Jordan is expected to announce another interest rate cut. Most experts predict a 0.25% reduction, although there is a growing view that a 0.50% cut may be on the table, particularly in light of the Feds recent moves and the Franc's strength against the Euro. Markets currently see a 33% chance of a 50-basis point cut.

Euro (ECB):

Investors have raised their bets on another rate cut on October 17, with the probability increasing to 75% from 25% last week. This sharp shift underscores mounting expectations for further monetary easing in the Eurozone.

GOLD - Gold continues to hover near record highs, with prices consolidating between 2670.882 and 2653.515. Given the ongoing global economic uncertainty and the recent wave of rate cuts, the outlook remains bullish. It is expected that a new high may be established as geopolitical tensions and weakening economies push demand higher.

SILVER - Silver has reached new highs this quarter but remains within the consolidation zone between 32.518 and 31.472. The market structure continues to support further buying as the bullish momentum remains intact.

DXY - The dollar has broken below the 100.443 mark, signaling potential further downside. However, there is a possibility of a market bounce from this level, but we await additional price action for confirmation.

GBPUSD - The Pound has risen to 1.34294 and 1.33593. With current market conditions and impending rate cut announcements, there is a strong possibility of further upward movement in the short term.

AUDUSD - The Aussie dollar is showing renewed strength, with bullish momentum continuing. We expect further upside as the market remains favorable for buying, although inflation data could influence future moves.

NZDUSD - The Kiwi continues its upward trajectory, driven by expectations of further USD rate cuts. There is no clear structure suggesting where the rally may pause, but the current outlook favors continued buying momentum.

EURUSD - The Euro remains in an upward trend, but could face a breakdown if the market fails to rise above the current S&D structure. Additional price action is needed to confirm the next significant move.

USDJPY - The Yen has gained strength as expected, supported by a more positive economic outlook following the new PMs remarks and the BoJ's potential for gradual rate hikes.

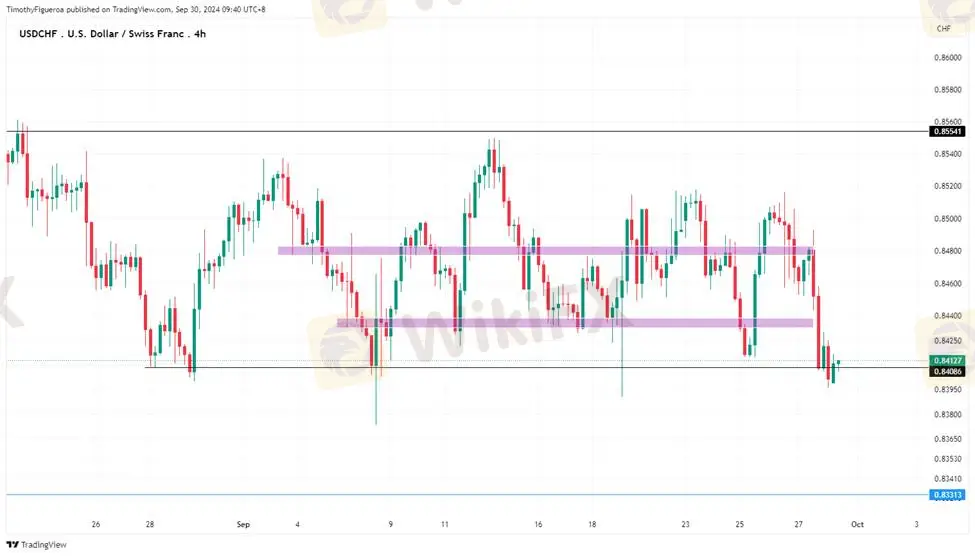

USDCHF - The Franc has been in consolidation since late August, with price action indicating a comfortable trading range. However, there is a strong probability that prices may break lower ahead of the SNBs rate cut announcement.

USDCAD - The Loonie strengthened last week, but has since lost momentum after briefly trading above 1.34803. Continued global tensions and economic uncertainty suggest the potential for further downside pressure.

WikiFX-Broker

Aktuelle Nachrichten

SOL hebt ab! Solana über 137 Dollar – Großanleger pumpen Millionen hinein

DOGE-Hammer zum Jahresstart: Dogecoin explodiert – Anleger greifen zu

Ripple (XRP): Kommt 2026 der Schock-Move auf 10 Dollar?

Cardano zieht an – doch reicht die Kraft für den großen Ausbruch?

ETH-Kaufrausch! Mega-Firma schnappt sich fast 33.000 Ethereum – Kurs vor nächstem Sprung?

Deutsche Unternehmen steigern Gehälter: 77 Prozent der Betriebe planen dieses Jahr mit Lohnerhöhungen

Ripple explodiert: Diese XRP-Zahl entscheidet 2026

Morgan Stanley: Diese sechs Faktoren sorgen für steigende Aktienkurse in 2026

Wechselkursberechnung