Euro Faces Headwind as France Political Crisis Arises

Zusammenfassung:Market SummaryThe euro traded largely unchanged after the French government was ousted in a no-confidence vote led by far-right leader Marine Le Pen. The anticipated outcome saw Prime Minister Élisabe

Market Summary

The euro traded largely unchanged after the French government was ousted in a no-confidence vote led by far-right leader Marine Le Pen. The anticipated outcome saw Prime Minister Élisabeth Borne lose parliamentary support, casting uncertainty over the next chapter of French politics, which may weigh further on the euro.

Meanwhile, the U.S. dollar experienced a volatile session. Initially pressured by weaker-than-expected ADP Nonfarm Employment Change data and disappointing PMI readings, the greenback rebounded as Fed Chair Jerome Powell struck a confident tone, asserting that the U.S. economy remains more resilient than previously forecasted, even after recent rate cuts. His comments buoyed both the dollar and Wall Street sentiment. In the Japanese Yen market, downside pressure mounted as expectations for a Bank of Japan rate hike in December fell from 66% to 44%, diminishing the currency's appeal.

In the commodity market, The precious metal traded in a narrow range as traders awaited Friday‘s Nonfarm Payrolls report, a key indicator for the Fed’s monetary policy trajectory. On the other hand, Crude prices plunged over 2% amid bearish sentiment. U.S. crude stockpiles saw a larger-than-expected build, adding to pressure ahead of the OPEC+ meeting, where the market anticipates discussions on extending production cuts.

Current rate hike bets on 18th December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (40.4%) VS -25 bps (59.6%)

Market Movements

DOLLAR_INDX, H4

The Dollar Index remained flat as market participants digested statements from Fed Chair Jerome Powell and awaited Fridays critical US jobs report. Powell highlighted the need for a cautious approach to rate cuts, emphasizing that the resilient US economy does not warrant aggressive monetary easing. The outlook for dollar trends hinges on upcoming economic data, leaving investors on edge for more clues.

The Dollar Index is trading flat while consolidating between support and resistance levels. MACD has illustrated diminishing bullish momentum, while RSI is at 50, suggesting the index might still struggle to seek direction since the RSI stays near the midline.

Resistance level: 106.85, 108.05

Support level: 105.80, 104.45

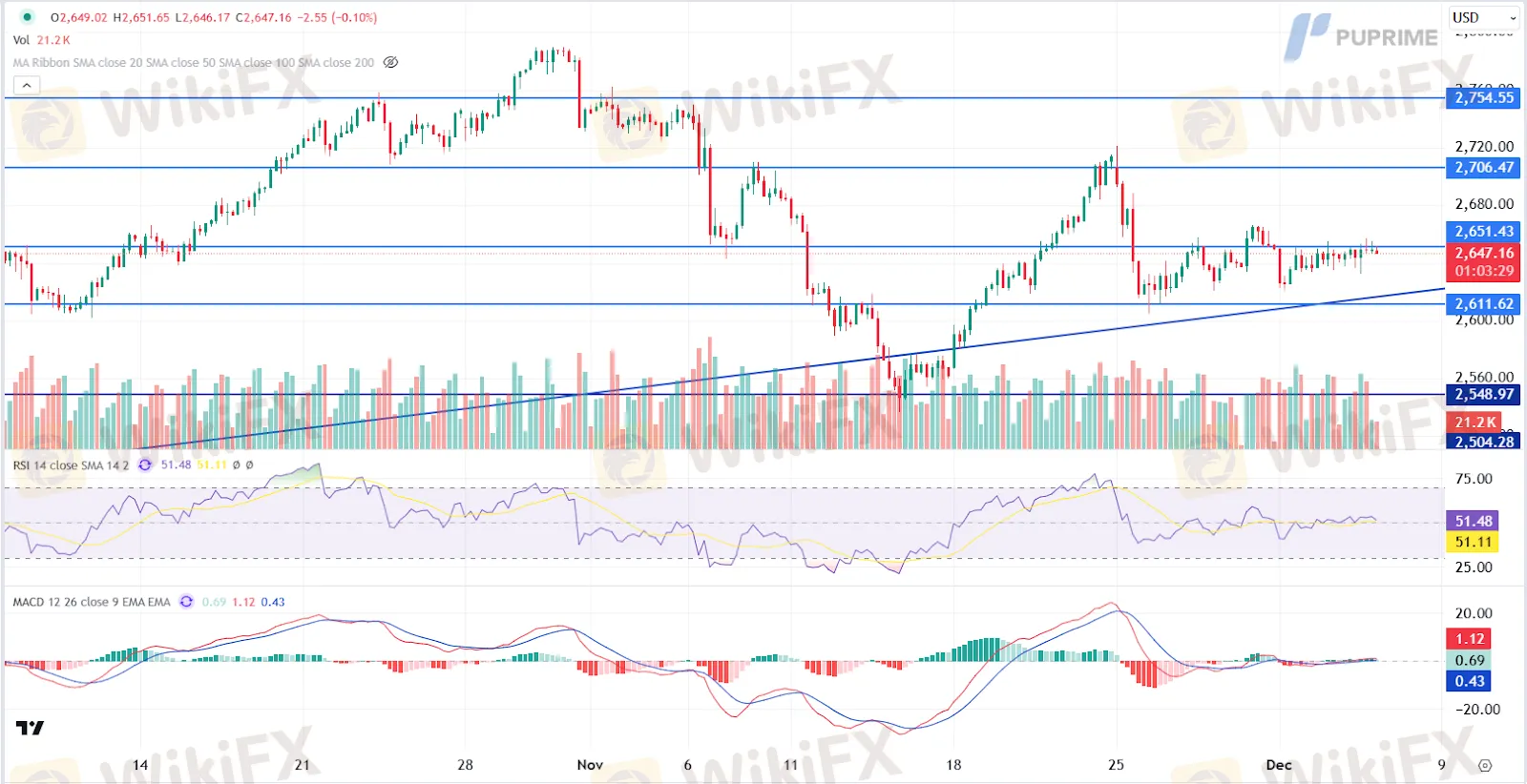

XAU/USD, H4

Gold prices remained flat, consolidating within a narrow range as investors maintained a cautious outlook amid mixed market sentiment. Renewed tensions in the Middle East, particularly Israel's ongoing strikes against Hezbollah despite the ceasefire agreement, have fueled safe-haven demand for gold. However, this bullish momentum was capped by the stronger-than-expected US job openings data, which bolstered the dollar and curbed gold's appeal.

Gold prices are trading flat while currently testing the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 48, suggesting the commodity might edge lower since the RSI stays below the midline.

Resistance level: 2650.00, 2705.00

Support level: 2610.00, 2550.00

BTC/USD H4:

Bitcoin prices erased some losses after reports that President-elect Donald Trump plans to appoint Paul Atkins as SEC Chair. Known for his pro-business stance, Atkins‘ potential appointment has fueled speculation about crypto-friendly regulations under the Trump administration. Promises of making the U.S. a global crypto hub and even creating a Bitcoin national reserve have added to market anticipation. Traders remain cautious, however, as they await more clarity on Trump’s policies for cryptocurrencies.

BTC is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 62, suggesting the crypto might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 98725.00, 101990.00

Support level: 91780.00, 87645.00

CL OIL, H4

Oil prices edged lower as investors booked profits ahead of OPEC+‘s decision on production cuts. A larger-than-expected draw in US crude stockpiles provided some support, with the Energy Information Administration reporting a significant drop in inventories as refiners ramped up operations. Nonetheless, gains were muted amid uncertainty over OPEC+’s policy direction.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 70.40, 72.55

Support level: 68.05, 65.65

WikiFX-Broker

Aktuelle Nachrichten

Oracles Kurssturz ist ein weiteres Warnsignal für KI-Investoren

XRP: Was Ripple dir JETZT nicht offen sagt

Solana vor möglichem Ausbruch: ETF-Zuflüsse stützen Kurs über 131 Dollar

Cardano stabilisiert sich über 0,40 Dollar – Indikatoren nähren Hoffnungen auf Ausbruch

Wechselkursberechnung