What Asia FX is Saying About the Dollar - Week 29 | Technical Analysis by Jasper Lawler

Zusammenfassung:Weekly thoughtsWe rarely trade the FX minors. But we might be about to.This week we‘ve been focused on Asian currencies, but there are some interesting setups developing in Eastern Europe and South Am

Weekly thoughts

We rarely trade the FX minors. But we might be about to.

This week we‘ve been focused on Asian currencies, but there are some interesting setups developing in Eastern Europe and South America too. These aren’t pairs we trade every day — but right now, they might be offering some of the clearest signals in FX.

Even if you don‘t plan on trading minor pairs like USD/PLN or USD/BRL, it’s worth watching what theyre doing. They can give you important clues — not just about dollar strength, but about the broader market regime.

As we all know, the dollar is the world‘s reserve currency — and when it’s part of a pair, it‘s usually the dominant force. That means what happens in USD/JPY or USD/PLN isn’t just a story about the yen or the zloty — its a story about the dollar.

And for most of this year, that story has been one of broad-based dollar weakness. We've seen the dollar trade lower against most of the G10, and its been the same story in the minors too.

But now, theres a twist.

Over the past two weeks, the dollar has started to rebound. We‘ve seen pullbacks in major pairs like EUR/USD and GBP/USD but so far, there’s been no evidence of a proper top.

Where things get more interesting is in some of the less-followed crosses, particularly in Asia.

Pairs like USD/SGD and USD/THB have dropped to multi-year lows. In other words, those local currencies are at their strongest levels versus the dollar in years. Thats where we could see a turning point.

If the dollar does form a bottom here, it could be the first sign of a pause or reversal in dollar weakness across the board. And that could mean were heading into a different kind of environment for the majors too.

But if the dollar doesnt bounce — if it breaks down through these levels in the minors — then we have a powerful confirmation: dollar weakness is still the dominant trend, and likely has more room to run.

In short:

The majors are in pullback mode, but theres no confirmed top in EUR/USD or GBP/USD.

The minors are trading at extremes — and could offer a first clue about what happens next.

Whether or not you trade them, the signals from the minors could help shape your view on the majors.

This is one of those times where watching the edges of the map might help you understand the centre.

Setups & signals

We look at hundreds of charts each week and present you with three of our favourite setups and signals.

USD/SGDSetup

The price just dropped to a decade-low and rebounded back over local support formed from the 2024 low in what could be a false breakdown - a bullish signal. The MACD indicator is oversold but yet to show a crossover.

Signal

A downtrend on the daily chart is being defined by a downtrend line. RSI bullish divergence and a break back over the 50 level suggest a possible bullish trend reversal.

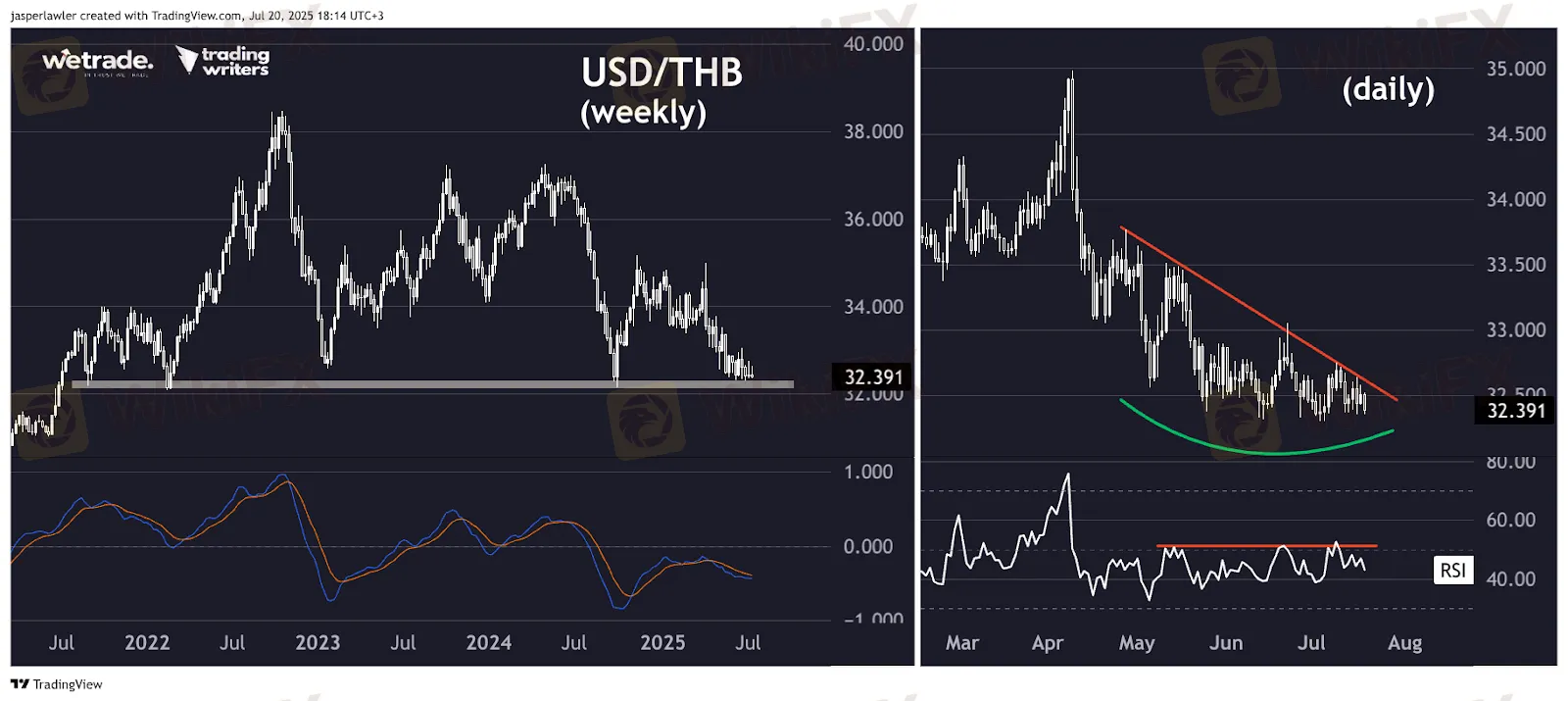

USD/THBSetup

Price is sitting at long term support at the 32.0 handle after a double top earlier this year up at 35.

Signal

There is a downtrend on the daily chart, which has stalled recently at the multi-year low. A break below 32 would indicate a trend continuation. A move over the trendline and 50 RSI level could indicate a bullish reversal.

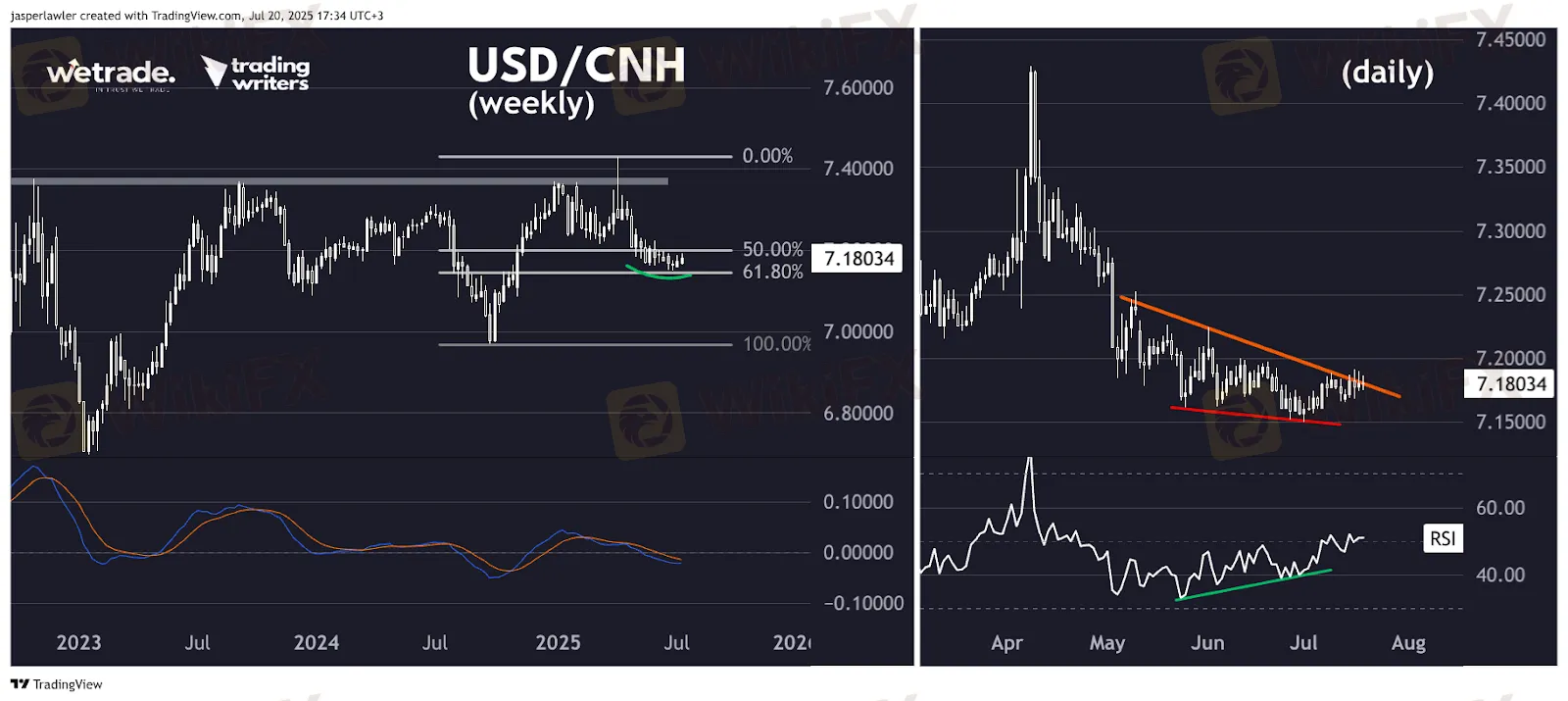

USD/CNHSetup

The price has pulled back to the 61.8% Fibonacci level after touching multi-year highs in April - an area from which the price could rebound.

Signal

Downtrend momentum has stalled in recent weeks and there is a bullish RSI divergence, indicating a possible bullish reversal.

But - as always - thats just how the team and I are seeing things, what do you think?

Share your ideas with us OR send us a request!

WikiFX-Broker

Aktuelle Nachrichten

Henkel performt nicht gut an der Börse – so will der CEO das ändern

Solana-Preisprognose: SOL rutscht unter die Unterstützung, da der Verkaufsdruck zunimmt

US-Börsenaufsichtsbehörde SEC genehmigt Sachausgaben und Rücknahmen für Bitcoin- und Ethereum-ETPs

XRP vor Big Move? Ripple sorgt für Spekulation am Kryptomarkt

Ethena-Preisprognose: ENA-Rückgang um 15% spiegelt Finanzierungskosten und Einbruch des Open Interest wider

Top 3: Bitcoin, Ethereum, Ripple – BTC, ETH und XRP bereiten sich nach Fed-Entscheidung auf Volatilität vor

Bahn macht im ersten Halbjahr „nur 760 Millionen Euro Verlust

Bitcoin-Preisprognose: BTC konsolidiert sich weiter, da die Zinsentscheidung der Fed bevorsteht

Wechselkursberechnung