Euro Plunge Sets the Stage for U.S. Dollar Index to Challenge the 100 Mark

Zusammenfassung:The euro fell sharply by 1.40% yesterday, helping the U.S. Dollar Index hold above the 98 level. In the global FX market, other non-dollar currencies also saw moderate depreciation. Risk assets, meanw

The euro fell sharply by 1.40% yesterday, helping the U.S. Dollar Index hold above the 98 level. In the global FX market, other non-dollar currencies also saw moderate depreciation. Risk assets, meanwhile, were mixed. In the U.S., tech stocks—our primary indicator for risk sentiment—rose 0.33%, while European equities mostly closed slightly lower.

From an intermarket perspective, we believe the current environment reflects a rotation out of Eurozone assets and back into U.S. holdings.

Given the current backdrop, we suggest investors focus on currency movements, as capital flows will dictate the trajectory of risk assets in the months ahead. Our base case for Q3 calls for high-level consolidation in risk assets, with global equities likely turning weaker in sequence—first European stocks, then Japanese equities, followed by other Asian markets, and finally the U.S.

1. Why Are U.S. Assets Seeing Renewed Demand?

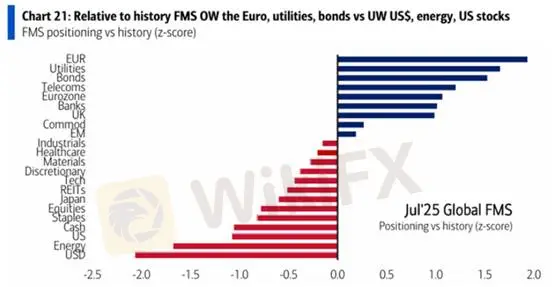

The July Bank of America Merrill Lynch FMS Fund Manager Survey shows allocation to U.S. dollar assets remains more than two standard deviations below the 20-year Z-score. This indicates significant room for reallocation.

Meanwhile, allocations to U.S. equities have risen from 1% to 14% in just one month. This repositioning has fueled the Nasdaqs continued push to fresh highs.

(Chart 1: 20-Year FMS Positioning Z-score; Source: Bank of America)

In addition to structurally low allocations, another key driver for U.S. equity inflows is corporate earnings performance.

FactSet data shows that of the 34% of S&P 500 companies that have reported Q2 results so far, 80% have beaten consensus estimates. The projected Q2 earnings growth rate stands at 6.4%. Valuation-wise, the S&P 500s current P/E is 22.4x—above both its 5-year and 10-year averages. While valuations are elevated, earnings growth is keeping pace, making a significant valuation correction less likely for now.

2. Asian Currency Selloff—Watch the Japanese Yen

The current wave of systemic selling is not just benefiting the U.S. dollar—the Japanese yen, the worlds third most-traded currency, also deserves attention.

According to the BIS 2022 Triennial Survey, the yen accounted for 16.7% of all OTC FX transactions by daily volume. If Asian equity markets come under pressure in the second half of the year, capital outflows could support the yen. Our assessment continues to view the yen as relatively undervalued.

The combined strength of the dollar and yen could create a liquidity squeeze effect, with implications for various asset classes, including precious metals, which may face downside risks.

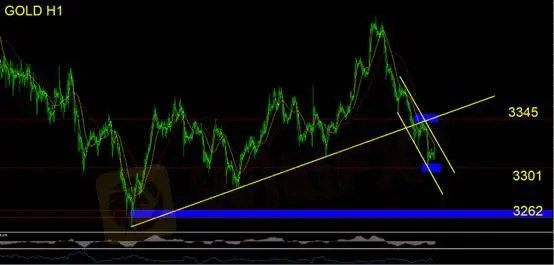

Gold Technical Analysis

On the hourly chart, gold remains in a steep downtrend with lower highs and lower lows, making it unsuitable for Fibonacci-based projections at this stage. Horizontal support and resistance remain the best reference levels.

As long as prices remain below 3345, the preferred strategy is to sell into rallies. The next downside target is the neckline area around 3362.

Support: 3301 / 3262

Resistance: 3345

Recommendation: Avoid adopting a bullish bias in the current setup. Suggested stop-loss: $20.

Risk Disclaimer: The views, analyses, research, prices, and other information herein are provided solely as general market commentary and do not represent the views of the platform. All users should bear full responsibility for their own trading decisions. Exercise caution.

WikiFX-Broker

Aktuelle Nachrichten

Tech-Aktien weiter unter Druck: Warum auch Nvidias Erfolg die Rally gerade nicht wiederbeleben

Wechselkursberechnung