DBG Markets: Market Report for Sep 05, 2025

Zusammenfassung:U.S. NFP in Focus: Setting the Stage for the Dollars Next MoveMarkets are treading cautiously ahead of today‘s U.S. nonfarm payrolls report, with investors holding back from major moves. Global bond y

U.S. NFP in Focus: Setting the Stage for the Dollars Next Move

Markets are treading cautiously ahead of today‘s U.S. nonfarm payrolls report, with investors holding back from major moves. Global bond yields remain elevated after this week’s heavy selling, though U.S. Treasuries have been relatively stable as dovish-leaning Fed comments eased rate concerns. Equities are trading sideways, while the dollar consolidates in tight ranges against major peers.

How NFP Could Shape the Market

Today‘s jobs data will be pivotal in shaping expectations for the Fed’s September meeting. The focus is not only on whether the Fed cuts rates, but also on its forward guidance for the rest of the year.

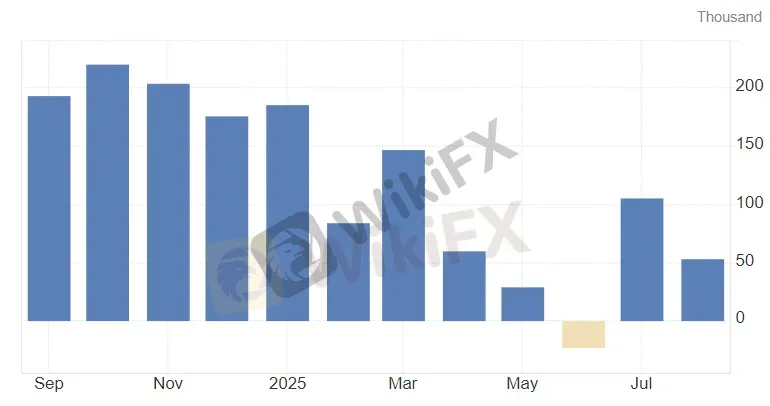

Consensus points to slower job growth, and yesterday‘s ADP report reinforced that view. Private payrolls rose by only 54k in August, sharply lower than July’s upwardly revised 106k and well below the 65k forecast. This trend suggests the official NFP report could also confirm further cooling in the labor market.

US ADP Non-Farm Employment Changes | Source: ADP Inc, Trading Economics

A softer print would strengthen bets on policy easing later this year, pressuring the dollar while supporting risk assets. A stronger result could point the other way, as markets may price in a smaller or slower pace of cuts. Still, the outlook may not be that straightforward, and the dollars current setup shows why.

Dollar Stuck in Indecision

The U.S. dollar index has been trading in a narrow 97.5–98.5 range, with NFP expected to be the main catalyst for a breakout. However, if the report delivers a mixed outcome, this range could easily extend into the Feds September meeting. A still-tight labor market would add uncertainty to policy guidance, keeping the dollar trapped in consolidation.

USDX, H4 Chart

Unless the data clearly shifts expectations with a sharp surprise in key components—such as headline job growth, the unemployment rate, or wage gains—any dollar strength is likely to remain capped, leaving the near-term bias neutral to cautious.

EURUSD & GBPUSD: Bearish Reversal Signals?

While the U.S. dollars next move remains uncertain, both EURUSD and GBPUSD are showing signs of fading momentum, raising the risk of a bearish reversal that would favor dollar strength.

Over the technical outlook of EURUSD, the six-month rally has stalled near 1.1800, with repeated rejections suggesting fading buying pressure.

EURUSD, Daily Chart

This suggests the pair has shifted into a consolidation phase after its prolonged uptrend. Key levels to watch are 1.1730 and 1.1600. A break below 1.1600 would confirm a bearish reversal, while a move back above 1.1730 could reopen the upside.

GBPUSD, Daily Chart

GBPUSD shows a similar setup, with strong resistance at 1.3790 and consolidation zone seen between 1.3600–1.3400 range. A decisive breakout from this range will likely define the next directional trend.

Biggest Tests Still to Come

While both EURUSD and GBPUSD hint at the potential for the dollar to reverse its recent bearish trend, the outlook is not one-sided. Consolidation could just as easily lead to a continuation of dollar weakness, keeping both pairs supported.

The upcoming nonfarm payrolls report is expected to show slower job growth, which would normally weigh on the dollar. However, the bigger catalysts lie ahead, with U.S. inflation data next week and the Feds September decision to follow.

This makes it less likely that NFP alone will establish a clear new trend. Instead, today‘s data may set the stage for the market’s next decisive move in the weeks to come.

WikiFX-Broker

Aktuelle Nachrichten

„Ich hoffe einfach, dass es nach Trumps Amtszeit wieder normal wird: Wie Strafzölle diesem Unternehmer schaden

Wechselkursberechnung